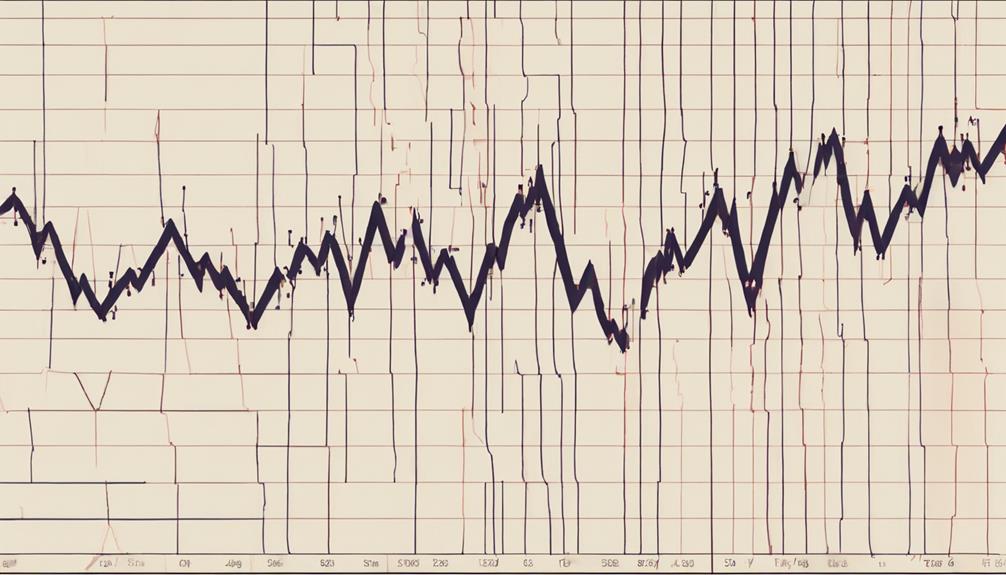

The Zig Zag indicator has garnered recognition as a reliable market predictor for its adeptness at discerning significant price movements and highlighting pivotal market shifts. Its unique ability to filter out noise and focus on essential price reversals offers traders a clear perspective on market dynamics.

However, what truly sets the Zig Zag indicator apart is its capacity to identify key turning points that might otherwise go unnoticed, providing traders with valuable insights for decision-making.

As we explore the intricacies of this indicator further, we unveil the layers of its predictive power and the nuances that make it a valuable tool in the realm of market analysis.

Definition and Purpose of Zig Zag Indicator

The Zig Zag indicator, a fundamental tool in technical analysis, serves the purpose of meticulously discerning significant trends and reversals amidst the noise inherent in price movements. By filtering out minor price movements, the Zig Zag indicator helps traders identify key turning points where a trend may be forming or reversing. This tool is particularly useful in spotting potential support and resistance levels by connecting major highs and lows on price charts.

In essence, the Zig Zag indicator simplifies price analysis by focusing on substantial price movements above a predetermined percentage threshold. This aids traders in confirming trends and making informed decisions based on the identified patterns. By highlighting important price levels and changes in trend direction, the Zig Zag indicator enhances the overall technical analysis process. Traders often rely on this indicator in conjunction with other tools to gain a comprehensive understanding of market dynamics and to improve the accuracy of their predictions.

How Zig Zag Indicator Predicts Trends

Utilizing a sophisticated algorithm, the Zig Zag indicator efficiently anticipates market trends by sifting through price fluctuations and emphasizing significant movements. By connecting swing highs and lows on a price chart, it can identify potential trend reversals and significant changes in price trends.

The Zig Zag lines adjust dynamically to capture new data, aiding traders in recognizing support and resistance levels crucial for trend analysis. This indicator plays a pivotal role in pinpointing turning points, offering insights into possible trend shifts and optimal entry/exit points.

Its ability to filter out noise and focus on essential price movements makes it a valuable tool for traders seeking to navigate market trends with precision. In essence, the Zig Zag indicator serves as a reliable ally in trend prediction, enhancing traders' abilities to interpret market dynamics and make informed decisions based on concrete data.

Factors Influencing Zig Zag Accuracy

Considering the pivotal role played by the chosen percentage threshold in filtering price movements, the accuracy of the Zig Zag indicator is significantly influenced by this parameter. By adjusting this percentage threshold, traders can effectively filter out noise in the market, allowing them to focus on significant price reversals. This fine-tuning not only enhances the indicator's ability to identify crucial turning points but also improves its overall reliability as a market predictor.

When combined with other technical analysis tools, such as moving averages or support and resistance levels, the Zig Zag indicator becomes even more powerful in forecasting market trends. Traders must also take into account factors like market volatility and historical price data when calibrating the indicator to ensure optimal performance.

Proper interpretation of Zig Zag patterns and seeking confirmation from multiple indicators can further boost the accuracy and reliability of market predictions, making the Zig Zag indicator a valuable tool in technical analysis.

Real-World Applications of Zig Zag Indicator

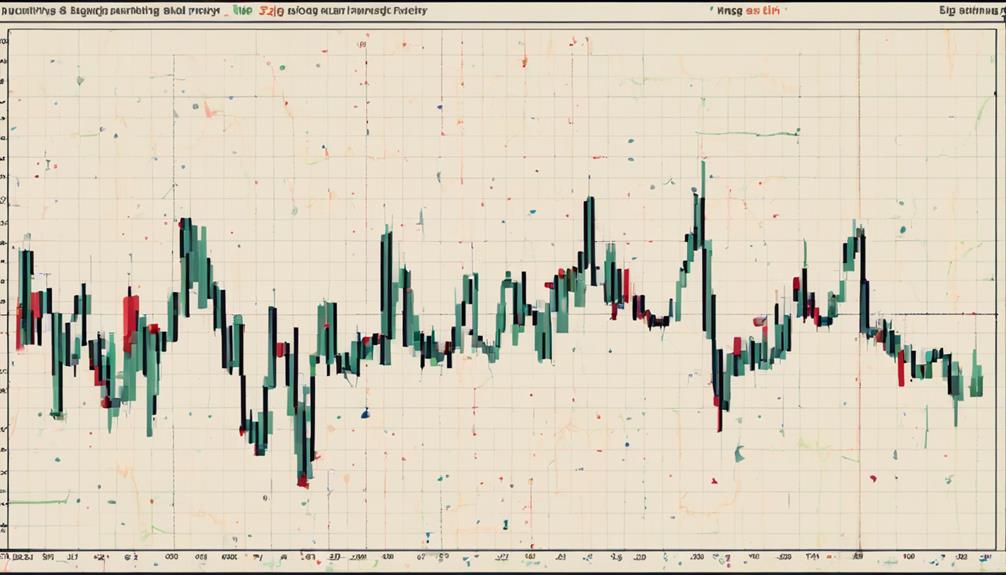

In practical trading scenarios, the application of the Zig Zag Indicator provides traders with a reliable method to pinpoint significant price changes and filter out market noise efficiently. By utilizing this technical tool in real-world trading, traders can identify potential reversal zones and analyze historical highs and lows to anticipate trend changes.

The Zig Zag Indicator aids in recognizing support and resistance areas, crucial for identifying key price levels like $450 for specific stocks such as Costco. Integrating this indicator with moving averages enhances the analysis of price movements, providing additional insight into trend confirmations.

Moreover, when combined with other technical tools, the Zig Zag Indicator adds precision and confirmation to market analysis, contributing to more informed decision-making processes.

Enhancing Trading Strategies With Zig Zag Indicator

The strategic integration of the Zig Zag Indicator in trading methodologies enhances the precision of market analysis and decision-making processes. When used effectively, this tool can significantly improve trading strategies by:

- Filtering out Noise:

The Zig Zag indicator helps traders focus on significant price movements by filtering out market noise, allowing for clearer analysis.

- Enhancing Analysis:

By combining the Zig Zag indicator with Elliott Wave Theory, traders can better understand market trends and potential reversal points.

- Confirming Decisions:

Complementing Fibonacci retracements, the Zig Zag indicator offers additional validation for trading decisions, increasing confidence in entries and exits.

- Spotting Patterns:

Identifying reversal patterns like double bottoms becomes more precise with the Zig Zag indicator, contributing to the overall reliability of trading strategies.

Integrating the Zig Zag indicator into trading strategies not only aids in determining trend direction but also refines the timing of entries and exits, ultimately leading to more informed and strategic trading decisions.

How Does the Zig Zag Indicator Help Predict Market Trends?

The zig zag indicator for day trading helps traders identify potential trend reversals and significant price movements in the market. By highlighting the most crucial price changes, it allows traders to make more informed decisions and predict future market trends with greater accuracy.

Frequently Asked Questions

Is the Zigzag Indicator Reliable?

The reliability of the Zig Zag indicator varies based on market conditions, asset analyzed, and indicator settings. While it can confirm trends and reversals, it should be used cautiously alongside other technical tools for more accurate trading decisions.

What Is the Zigzag Indicator Strategy?

The Zig Zag indicator strategy serves to identify market trends by connecting swing highs and lows, filtering price noise. Traders use specific parameters for precise entry and exit points, often integrating it with tools like Fibonacci retracements for comprehensive analysis.

What Is the Zigzag Pattern in the Stock Market?

The zigzag pattern in the stock market is a series of trend reversals that highlight significant highs and lows. It aids traders in identifying potential support and resistance levels by filtering out short-term price fluctuations.

What Is the Most Accurate Indicator?

In the realm of technical analysis, the Relative Strength Index (RSI) stands out as a robust indicator. Its ability to identify overbought and oversold conditions with precision contributes to its reputation as one of the most reliable tools for market analysis.

Conclusion

In conclusion, the Zig Zag indicator stands out as a reliable market predictor due to its ability to filter out noise, identify trends, and pinpoint key turning points in the market.

By effectively visualizing price reversals and trend changes, this indicator offers valuable insights for traders seeking to make informed decisions. Its accuracy and versatility make it a valuable tool for enhancing trading strategies and staying ahead of market trends.