The Ultimate Oscillator stands as a pivotal tool in stock analysis, offering a nuanced perspective by amalgamating various timeframes to gauge market dynamics. Its unique approach to weighting longer-term trends for stability sets it apart from conventional indicators, furnishing traders with more dependable insights into market movements.

The integration of buying pressure and true range calculations equips investors with a strategic edge, aiding in the identification of potential shifts in stock trends. As we explore further, the significance of the Ultimate Oscillator in refining trading strategies and decision-making processes becomes increasingly apparent, making it an indispensable asset in the realm of stock analysis.

Understanding Ultimate Oscillator Basics

In exploring the fundamentals of the Ultimate Oscillator, one delves into a sophisticated tool that amalgamates three distinct timeframes to provide a nuanced assessment of stock momentum.

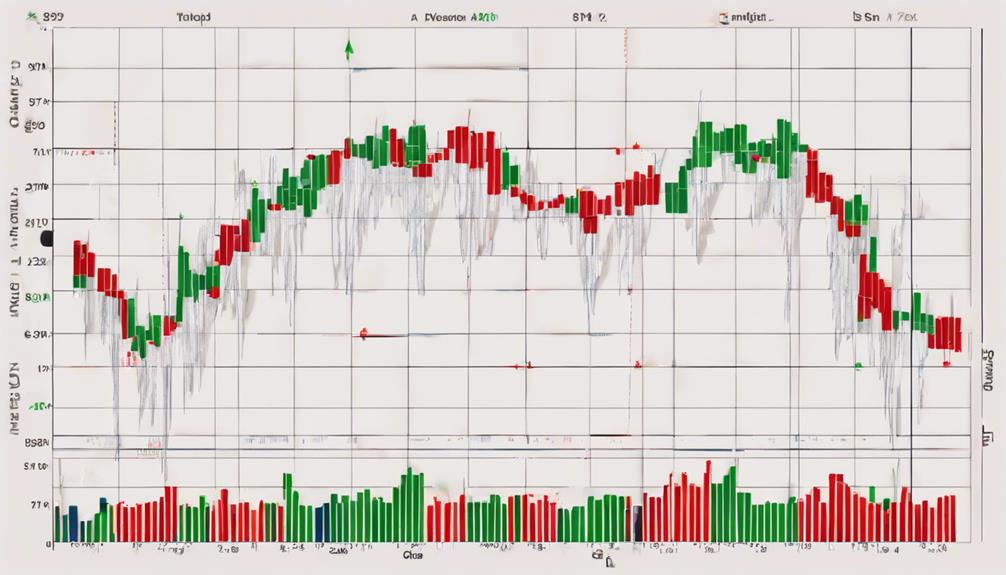

The Ultimate Oscillator (UO) functions as a powerful price indicator, utilizing periods of 7, 14, and 28 to calculate buying pressure, true range, and selling pressure. This comprehensive approach enables traders to receive a holistic view of market dynamics and potential price movements.

By encompassing multiple timeframes, the Ultimate Oscillator offers a more accurate representation of momentum compared to single-frame oscillators. Traders can effectively utilize the UO to identify overbought and oversold conditions, with readings above 70 signaling overbought levels and readings below 30 indicating oversold levels.

Furthermore, divergences within the Ultimate Oscillator can serve as early signals for potential trend reversals in stock prices, providing traders with valuable insights for informed decision-making in their trading strategies.

Importance of Ultimate Oscillator in Analysis

A cornerstone in technical analysis, the Ultimate Oscillator stands out as a pivotal tool for evaluating stock price momentum across various timeframes. It is valued for its ability to combine short, medium, and long-term trends, providing a comprehensive understanding of market conditions.

By incorporating True Range (TR) and Buying Pressure (BP) in its calculations, this momentum oscillator effectively identifies buying and selling opportunities. Traders rely on the Ultimate Oscillator to spot trend changes and potential reversals in the market, enhancing their decision-making process.

Its unique feature of weighting averages helps reduce volatility, offering more reliable signals for entry and exit points. When used in conjunction with other technical indicators, the Ultimate Oscillator strengthens the accuracy of stock analysis, enabling traders to make informed decisions.

Its effectiveness in capturing bullish divergence and confirming price movements makes it a valuable asset for investors looking to capitalize on market trends and fluctuations.

Calculating Ultimate Oscillator for Stocks

The process of calculating the Ultimate Oscillator for stocks involves intricately combining three distinct timeframes to provide a comprehensive assessment of stock momentum.

- True Range and Average True Range (ATR) are calculated for each of the three timeframes (7, 14, and 28 periods) to gauge the buying pressure accurately.

- A weighted average of the buying pressure across these timeframes is then determined. This weighted average helps smooth out price movements and reduces volatility, facilitating more precise analysis of stock momentum.

- The Ultimate Oscillator generates buy/sell signals by identifying divergences, which offer insights into potential trend reversals in stock prices. By utilizing this information, traders can make informed decisions and recognize overbought and oversold conditions, enhancing their trading strategies.

Advantages of Using Ultimate Oscillator

Utilizing the Ultimate Oscillator in stock analysis offers a strategic advantage by integrating multiple timeframes to enhance the accuracy of trade signals and identify critical market trends. By considering three different timeframes (7, 14, 28 periods), the oscillator effectively captures market momentum and reduces volatility through a weighted average approach that gives more weight to longer-term frames.

This weighting mechanism results in fewer but more reliable buy and sell signals compared to single-timeframe indicators, making it a valuable tool for traders. Furthermore, the Ultimate Oscillator's ability to detect divergences enables traders to identify potential trend changes or reversals promptly. It is particularly useful for pinpointing overbought and oversold conditions, aiding in the development of effective trading strategies.

Implementing Ultimate Oscillator in Trading

To effectively apply the Ultimate Oscillator in trading strategies, traders can leverage its multi-timeframe analysis to enhance market insights and optimize decision-making processes for improved trading performance.

Key Points:

- Utilizing Three Different Time Periods:

The Ultimate Oscillator combines three timeframes (7, 14, and 28 periods) to provide a comprehensive analysis of market dynamics, offering valuable insights into market trends and potential reversals.

- Identifying Overbought and Oversold Conditions:

This technical analysis indicator helps traders identify overbought and oversold conditions, with levels above 70 indicating overbought and below 30 indicating oversold conditions. This information can guide traders in making informed decisions about entry and exit points.

- Generating Trading Signals:

How Does the Ultimate Oscillator Help in Stock Analysis and Maximizing Profits?

The ultimate oscillator is a powerful tool for maximizing profits with oscillator. By analyzing the momentum of a stock, it helps investors make informed decisions on when to buy or sell. This can lead to higher profits by timing trades more effectively and capitalizing on market trends.

Frequently Asked Questions

What Is the Ultimate Oscillator in Stocks?

The Ultimate Oscillator in stocks is a momentum oscillator that combines three timeframes for analysis. It measures buying pressure, generates buy/sell signals, and indicates overbought/oversold conditions. Developed by Larry Williams, it aids in identifying trend reversals and reducing volatility.

What Is the Difference Between MACD and Ultimate Oscillator?

The Ultimate Oscillator differs from MACD by aggregating signals from three timeframes to gauge momentum, providing a more comprehensive view of buying pressure. While MACD relies on moving average crossovers, the Ultimate Oscillator detects trend changes through divergences.

What Is the Difference Between RSI and Ultimate Oscillator?

The Ultimate Oscillator and RSI differ in their approach to momentum analysis. RSI focuses on a single timeframe for overbought/oversold conditions, while the Ultimate Oscillator's weighted averages across multiple periods provide a broader view of market momentum.

What Is the Use of Oscillator in Stock Market?

Oscillators in the stock market gauge price momentum, aiding in identifying overbought or oversold conditions. They assist traders in making informed decisions by generating signals indicating potential trend changes. Integration with other tools enhances analysis accuracy.

Conclusion

In conclusion, the Ultimate Oscillator serves as a powerful tool in stock analysis, combining multiple timeframes to provide a comprehensive view of market momentum.

Like a compass guiding a ship through turbulent waters, the Ultimate Oscillator helps traders navigate the complexities of the stock market by identifying potential trend changes and offering reliable buy/sell signals.

Its integration with other technical indicators enhances trading strategies, making it an invaluable asset for informed decision-making in the financial markets.