The Williams %R indicator, a key tool in technical analysis, holds significance in the assessment of market conditions. As traders navigate the complexities of financial markets, the insights provided by this indicator play a crucial role in decision-making processes.

By understanding how the Williams %R indicator works and its implications for trading strategies, traders can gain a competitive edge in their approach to market analysis. The nuances of this indicator offer a unique perspective on market dynamics, shedding light on potential opportunities and risks that traders need to consider.

Williams %R Indicator Overview

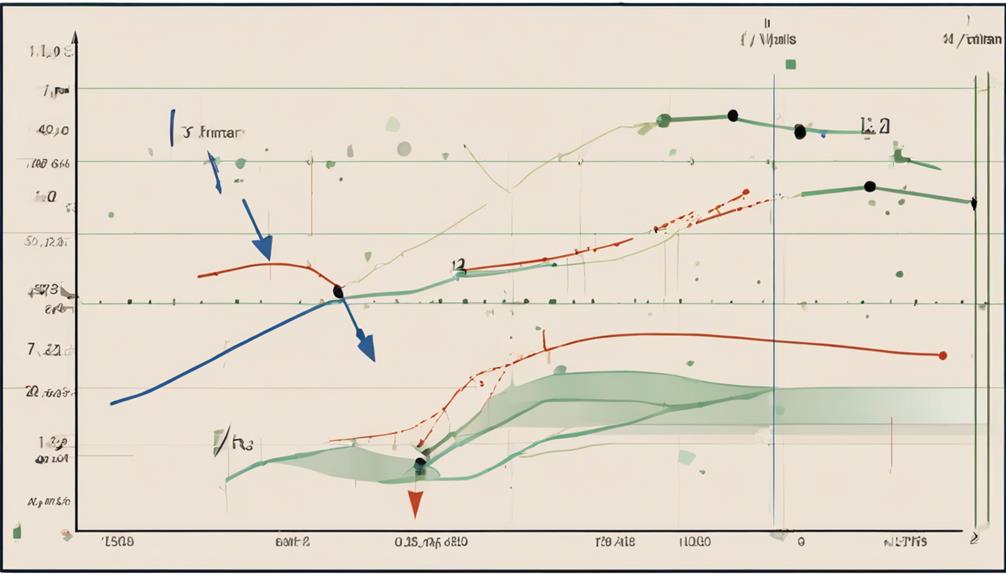

In the realm of technical analysis, the Williams %R indicator, developed by Larry Williams, stands as a pivotal tool for assessing market momentum. This technical indicator, similar to the Stochastic oscillator, measures where the closing price is in relation to the high-low range over a specific period, typically 14 days.

Traders utilize Williams %R to determine overbought and oversold conditions in the market. Readings above -20 are considered overbought, suggesting a potential downward reversal, while readings below -80 indicate oversold conditions, signaling a possible upward reversal.

By comparing the current closing price to the highest high within the observation period, the Williams %R indicator helps traders identify potential shifts in market momentum. This insight enables traders to make informed decisions regarding entry and exit points, thereby enhancing the effectiveness of their trading strategies.

Understanding the nuances of this indicator is crucial for traders seeking to navigate market trends successfully.

Understanding the Calculation Process

Utilizing historical price data, the calculation process for the Williams %R indicator involves comparing the current close price to the highest high and lowest low over a specified period. This comparison is crucial in determining the current market momentum and potential reversal points.

To understand the calculation process better, consider the following:

- Calculation Formula: The formula for Williams %R is (Highest High – Close) / (Highest High – Lowest Low). This calculation yields a value that oscillates between 0 and -100, indicating the momentum's strength and direction.

- Identification of Extremes: Traders use the Williams %R indicator to identify overbought or oversold conditions. When the indicator shows values close to 0, it suggests an overbought condition, whereas readings approaching -100 indicate an oversold market situation.

- Historical Data Analysis: Traders set a specific lookback period to analyze historical price data. By examining past highs and lows, traders can interpret the indicator's values and make informed trading decisions based on the data provided by the indicator.

Interpreting Williams %R Readings

How can investors effectively interpret Williams %R readings to make informed trading decisions based on market sentiment and momentum?

Williams %R, also known as the Williams Percent Range, serves as a momentum indicator that helps gauge market sentiment. When Williams %R readings surpass -20, it signifies overbought conditions, indicating potential price highs and suggesting a moment to consider selling. Conversely, readings below -80 signal oversold conditions, hinting at potential price lows and signaling a potential buying opportunity.

Comparing Williams %R With Other Indicators

Comparing Williams %R with other technical indicators reveals nuances in momentum analysis and can provide traders with additional insights into market conditions.

- Difference Between Williams %R and Stochastic Indicator:

- While both are momentum indicators, Williams %R compares the closing price to the highest high over a specific period, whereas the Stochastic oscillator compares it to the lowest low.

- Using the Williams %R Indicator in Price Analysis:

- Williams %R tells traders how the current price is near the highest high over a specific period, helping identify potential overbought or oversold conditions.

- Calculation Variation for Consistency:

- The Williams %R indicator ranges from 0 to -100, with overbought conditions above -20 and oversold conditions below -80. Unlike the Stochastic oscillator, which ranges from 0 to 100, the Williams %R is corrected by multiplying by -100 for consistency.

Comparing these indicators can enhance traders' understanding of momentum and improve decision-making in the dynamic financial markets.

Practical Applications of Williams %R

Drawing on the insights gained from comparing Williams %R with other technical indicators, understanding the practical applications of the Williams %R indicator can provide traders with valuable tools for analyzing market dynamics and making informed decisions. Traders use Williams %R to identify overbought and oversold conditions in stocks, indicating potential entry and exit points.

When the indicator reaches above -20, it suggests overbought levels, while readings below -80 signal oversold conditions. By comparing the stock's closing price to the highest high and lowest low over a specific lookback period, traders can anticipate trend reversals and momentum shifts.

Williams %R is particularly useful when a stock is near the highs of its recent range or has experienced a bigger price decline, as it helps assess whether the price is relative to the recent price action. This information assists traders in making timely and strategic decisions based on market trends.

How Can I Use the Williams %R Indicator in Technical Analysis?

The Williams %R indicator, an important tool in technical analysis, can be used to identify overbought or oversold conditions in the financial markets. Traders can use this indicator to make informed decisions about when to buy or sell assets. Understanding the Williams %R indicator analysis is crucial for successful trading.

Frequently Asked Questions

What Is the Optimal Configuration for the Williams %R Indicator?

The optimal configuration for the Williams %R indicator involves a 14-day lookback period. Traders often classify readings below -80 as oversold and above -20 as overbought. Adjusting default levels and experimenting with settings can enhance indicator performance.

What Is the Difference Between RSI and Williams R Indicator?

The Relative Strength Index (RSI) and Williams %R are both momentum oscillators, but their key difference lies in how they measure price movements. RSI gauges speed and change, while Williams %R compares the close to the high-low range.

What Is R in Technical Analysis?

R in technical analysis refers to various indicators like the Williams %R, a tool by Larry Williams. It gauges the closing price in relation to a defined period's highest high. Traders use it to spot overbought and oversold conditions for potential trading opportunities.

Is Williams %R Leading or Lagging?

In technical analysis, the Williams %R indicator is considered a leading indicator. It provides traders with early signals of potential trend reversals by identifying overbought and oversold conditions, allowing for proactive decision-making based on momentum shifts in the market.

Conclusion

In conclusion, the Williams %R indicator is a valuable tool in technical analysis for identifying overbought and oversold market conditions. By understanding its calculation process and interpreting its readings, traders can make informed decisions about potential entry and exit points in the market.

While some may argue that no indicator is foolproof, combining Williams %R with other indicators can provide a more comprehensive analysis of market trends.