Calculating stock standard deviation involves determining variability in returns for risk evaluation. Begin by finding the mean return to establish a baseline. Square the deviations from the mean to quantitatively measure stock return discrepancies. Calculate the average of squared deviations for data dispersion indication. Take the square root of this value to determine standard deviation, providing a single representation of variability. Understanding volatility measurement aids in risk evaluation. Higher deviation indicates increased price fluctuations, while lower values suggest stability. This step-by-step process is essential for informed investment decisions concerning risk. Learn in detail about each calculation in evaluating stock risk and performance.

Mean Calculation

When determining the mean for stock returns, investors sum all the individual returns and then divide this total by the number of data points. The average return provides a baseline indicator for evaluating deviations from the mean, enabling investors to gauge the level of risk associated with a particular stock.

By understanding the average return, investors can better comprehend the fluctuations in stock performance and evaluate the standard deviation, which quantifies the extent of these fluctuations. The mean calculation is fundamental in finance as it serves as a central point of reference for analyzing stock returns.

It aids in measuring the variability of returns around this average, thereby assisting investors in evaluating the level of risk inherent in a stock investment. Ultimately, the mean plays an important role in determining the standard deviation of a stock, which is essential for comprehending the potential risks and rewards associated with a particular investment.

Return Deviation Squaring

Building upon the calculation of the mean for stock returns, the process of squaring deviations from this average is a pivotal step in determining the stock standard deviation. By squaring the differences from the mean, we quantitatively measure how far each stock return deviates from the average, aiding in evaluating risk management through understanding the variance of data points. This step is essential in stock analysis as it treats negative and positive deviations equally, helping to determine the spread and dispersion of historical stock returns.

| Keywords | Description |

|---|---|

| Standard deviation | Measures the dispersion of data points from the mean. |

| Data points | Values representing stock returns in the dataset. |

| Square | Process of multiplying deviations from the mean by themselves. |

| Variance | Quantifies the average squared differences from the mean. |

Understanding and applying the concept of squaring deviations is vital in grasping the variability and potential risks associated with stock investments. By calculating the variance through squaring deviations, investors gain insights into the degree of fluctuation in stock returns, aiding in informed decision-making for effective risk management strategies.

Average of Squared Deviations

Have you ever considered the significance of the average of squared deviations in the calculation of stock standard deviation?

The average of squared deviations is a fundamental concept when determining the standard deviation of stock performance. It entails squaring the variances between individual returns and the mean return, then summing these squared differences to gauge the variability in stock returns.

By calculating the average of squared deviations, you obtain a quantitative measure of the dispersion of data points within the stock's performance. This step is vital in evaluating the level of risk or volatility associated with the stock, as it provides insight into how widely the stock's returns deviate from the mean return.

Understanding the average of squared deviations is essential for accurately determining the standard deviation, which is a key metric in evaluating and comparing the performance and risk of different stocks in a portfolio.

Square Root Calculation

The culmination of the average of squared deviations leads to the next critical step in determining stock standard deviation – the square root calculation. This calculation is essential in quantifying the dispersion of data points, providing a measure of variability within the dataset.

By taking the square root of the average of the squared variances from the mean, analysts can obtain a single value that represents the standard deviation. Rounding the result to two or three decimal places is a common practice to maintain precision in the calculation. Professionals often opt for three decimal places to enhance accuracy in interpreting the standard deviation.

This final step in the standard deviation process offers a clear and concise metric for evaluating the variability of the data, enabling investors and analysts to better understand the level of uncertainty or risk associated with a particular stock.

Understanding Volatility Measurement

Volatility measurement plays an essential role in evaluating the fluctuation and risk levels associated with a stock's returns over a specific timeframe. Stock standard deviation, a key metric in this evaluation, quantifies the variability of a stock's returns.

Investors rely on standard deviation to gauge the risk associated with a particular stock; a higher standard deviation indicates greater price fluctuations and therefore higher risk, while a lower standard deviation suggests more stable and predictable returns.

By calculating standard deviation, analysts can analyze historical data points to measure the dispersion of returns from the mean. This statistical method provides valuable insights into the potential ups and downs a stock may experience, aiding investors in making informed decisions.

Understanding the concept of standard deviation in the context of stock returns is important for evaluating and managing investment risks effectively.

Importance of Stock Standard Deviation

Stock standard deviation plays a critical role in evaluating the risk associated with individual stocks and the impact of volatility on investment performance.

By providing insights into market trends and risk levels, stock standard deviation assists investors in making informed decisions and setting realistic investment objectives.

Understanding the importance of stock standard deviation is essential for effectively managing and optimizing investment portfolios.

Risk Assessment in Stocks

An essential component in evaluating risk within the domain of stock investments lies in the calculation of standard deviation. Standard deviation in stocks serves as a pivotal metric for risk assessment, as it quantifies the dispersion of stock returns from their average, reflecting the stock's volatility.

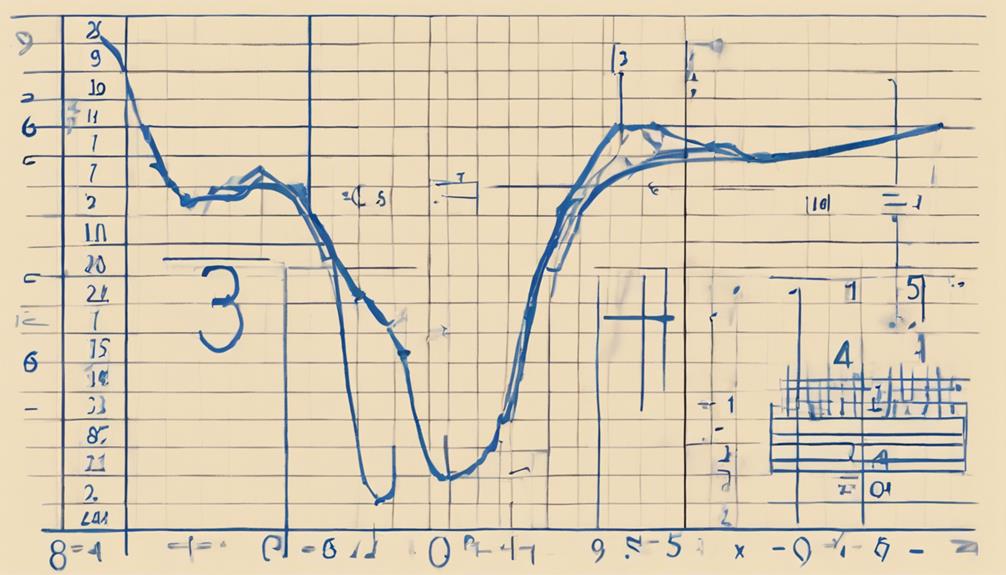

By presenting a bell-shaped curve of potential returns, standard deviation enables investors to gauge the level of uncertainty and assess the potential risks associated with a particular stock. High stock standard deviation signifies greater unpredictability in returns, indicating a riskier investment.

Investors rely on this measure to make informed decisions, manage their portfolio's risk exposure, and anticipate potential price fluctuations. Through the analysis of historical returns, calculating stock standard deviation aids in evaluating the volatility and risk profile of investments.

Volatility Impact Analysis

In evaluating the impact of volatility, understanding the significance of stock standard deviation proves vital for investors seeking to navigate the domain of stock investments effectively. Stock standard deviation serves as an important metric in risk evaluation within the stock market, providing insights into the level of volatility and the extent to which returns deviate from the average return.

By analyzing standard deviation, investors can make informed decisions, set realistic investment goals, and effectively manage portfolio risk. Factors such as historical stock price volatility, market conditions, and investor sentiment influence stock standard deviation, highlighting its importance in evaluating and mitigating risks associated with stock investments.

- Stock standard deviation aids in risk evaluation

- Provides insights into volatility levels

- Helps in setting realistic investment goals

- Vital for effective portfolio risk management

Application in Investment Analysis

Stock standard deviation plays a pivotal role in investment analysis by facilitating risk assessment and evaluating portfolio performance.

By quantifying the volatility and dispersion of historical stock returns, investors can make more informed decisions and effectively manage risk.

Understanding the application of stock standard deviation is essential for setting realistic investment goals and maximizing returns in the financial market.

Investment Risk Assessment

When evaluating investment opportunities, it is essential to conduct a thorough risk assessment to make informed decisions based on market conditions and historical data analysis.

Understanding standard deviation aids in evaluating investment risk effectively. It provides insights into the dispersion of historical stock returns for better risk evaluation. Calculating stock standard deviation involves quantifying volatility to set realistic investment goals. Utilizing standard deviation analysis helps investors in managing potential returns and gauging risk levels accurately.

Portfolio Performance Evaluation

Analyzing the performance of a portfolio of investments offers valuable insights into the overall risk and returns of the investment strategy. Portfolio performance evaluation involves gauging the volatility and variability of returns using metrics like standard deviation. This analysis helps investors measure the level of risk associated with their investments and understand the potential returns.

By evaluating portfolio performance, investors can make informed decisions to optimize their investment strategies and enhance their overall returns. Comparing the performance of a portfolio over time enables investors to identify trends, assess the effectiveness of their investment decisions, and make adjustments as necessary to achieve their financial goals.

Portfolio performance evaluation is essential in the world of investment analysis for managing risk and maximizing returns.

Interpretation for Decision Making

Evaluating the variability and risk associated with a stock's historical returns through standard deviation is essential for making informed investment decisions. Standard deviation, a key metric in financial analysis, helps investors assess risk by quantifying the dispersion of a stock's returns around its average.

When interpreting standard deviation for decision-making purposes, consider the following emotional impact on investors:

- Confidence: Understanding stock standard deviation instills confidence in decision-making, allowing investors to gauge potential risks effectively.

- Caution: High standard deviation indicates greater volatility, prompting cautious investment decisions to mitigate potential losses.

- Optimism: Low standard deviation can evoke optimism, signaling stability and predictability in returns.

- Realism: Using the formula for standard deviation provides a realistic view of historical volatility, aiding in setting achievable investment objectives.

Limitations of Standard Deviation

Standard deviation, while a valuable measure of dispersion, has limitations when used as the sole indicator of investment quality due to its focus on volatility rather than overall performance.

It is essential to recognize that extreme values can skew standard deviation, potentially leading to misinterpretation of risk.

Additionally, standard deviation may overlook certain types of uncertainty that are important in investment decision-making.

Standard Deviation Drawbacks

While standard deviation provides insight into the volatility of an investment, its limitations must be acknowledged in evaluating overall risk and quality.

- Standard deviation does not evaluate the quality of an investment, only its volatility.

- Extreme values impact standard deviation, but not all uncertainty equates to risk.

- A mutual fund with consistent monthly gains will have a standard deviation of zero.

- Volatile investments exhibit higher standard deviations.

Challenges in Using

When considering the application of standard deviation in investment analysis, it is essential to recognize the inherent challenges that arise in its utilization. Standard deviation, commonly used to measure volatility, has limitations in evaluating risk thoroughly. It does not differentiate between upside and downside volatility, potentially leading to an incomplete understanding of investment risk.

Extreme values can disproportionately impact standard deviation, potentially skewing its interpretation. Also, standard deviation may not capture all forms of uncertainty, meaning that not all fluctuations signify risk. In finance, especially when calculating risk in investments, relying solely on standard deviation without considering its drawbacks can result in inadequate risk assessment and decision-making.

Hence, while standard deviation is a valuable metric, its limitations must be acknowledged in financial analysis.

Practical Example of Calculation

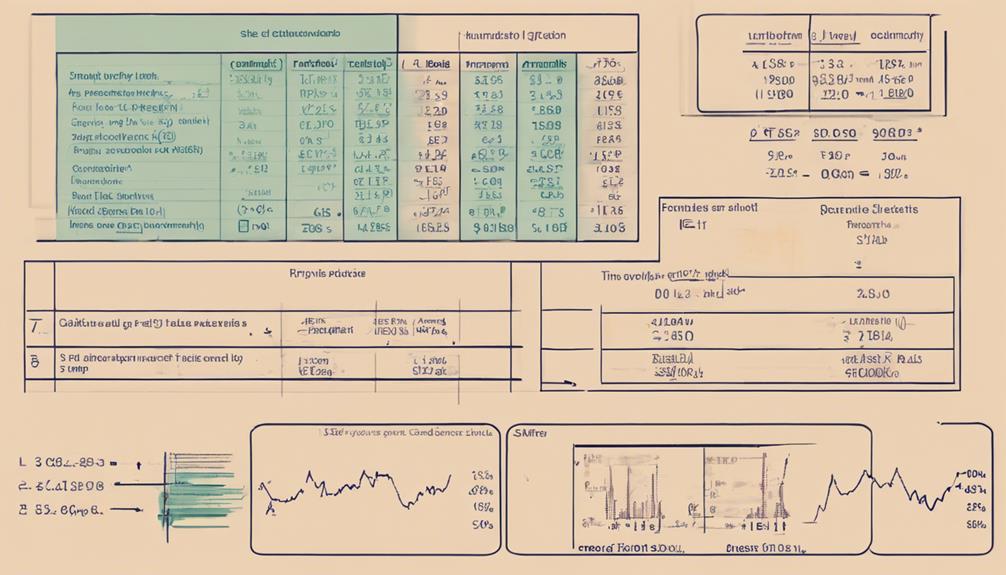

To demonstrate the practical application of calculating stock standard deviation, we will utilize a real-world example illustrating the step-by-step process. When analyzing stock returns, the standard deviation is an important metric for evaluating volatility and risk.

Here is a breakdown of how to calculate standard deviation for stock returns:

- Calculate the average return: Sum all returns and divide by the number of data points to find the mean.

- Quantify deviations: Square the differences between each return and the mean to quantify the disparities in stock performance.

- Assess volatility: Find the variance of stock returns relative to the mean to evaluate the level of volatility and risk.

- Determine standard deviation: Take the square root of the variance to numerically determine the stock standard deviation.

Understanding stock standard deviation is essential for investors to make informed decisions based on the level of risk associated with a particular investment. By following these steps, investors can gain valuable insights into the variability of stock returns, aiding in their investment strategies.

Frequently Asked Questions

How to Calculate Standard Deviation for a Stock?

In historical data analysis, calculating standard deviation for a stock is vital for volatility measurement and risk assessment. It aids in portfolio diversification and informs statistical modeling for investment decisions.

How to Calculate Standard Deviation Step by Step?

Data interpretation and statistical analysis are essential in calculating standard deviation for risk assessment. To determine variance, follow steps such as finding the mean return, quantifying deviations, and summing squared differences. This leads to a better understanding of dispersion in historical returns.

Visualizing a bell curve helps grasp the data spread. By applying these techniques, investors can make informed decisions based on the stock's volatility and risk.

How to Calculate Stock Standard Deviation in Excel?

To calculate stock standard deviation in Excel, utilize the STDEV.S function.

Input stock returns data into a column, then apply the STDEV.S function on the range of cells containing the data.

Excel's efficient handling of calculations provides accurate standard deviation for effective investment analysis.

Utilizing Excel functions for data analysis and statistical tools enables investors to assess market volatility and make informed decisions based on calculated stock standard deviation.

What Is the Standard Deviation of 5 5 9 9 9 10 5 10 10?

The standard deviation of the numbers 5, 5, 9, 9, 9, 10, 5, 10, 10 can be calculated to understand variability in stock prices.

A high standard deviation in stock values indicates greater dispersion from the mean, suggesting higher risk.

Comparing standard deviations of different stock portfolios allows investors to evaluate risk exposure.

Conclusion

In summary, calculating stock standard deviation is an essential step in evaluating the volatility and risk associated with an investment.

By following the step-by-step guide outlined above, investors can make more informed decisions based on statistical analysis rather than gut feelings.

Standard deviation is like a compass in the world of finance, guiding investors through the turbulent waters of market fluctuations.