Embarking on the journey of mastering the MACD indicator is akin to navigating the intricate pathways of a financial maze.

As you start unraveling the 10 simple steps to harness the power of MACD, you'll discover a world where momentum and trends converge to guide your trading decisions.

Each step holds a key to unlocking the potential of this versatile tool, equipping you with the skills needed to navigate the complexities of the market with confidence.

A mastery of these steps can lead you to a realm where informed choices pave the way to successful trading outcomes.

Understanding MACD Indicator Basics

When delving into the realm of technical analysis, grasping the fundamental aspects of the MACD Indicator serves as a crucial foundation for making informed trading decisions.

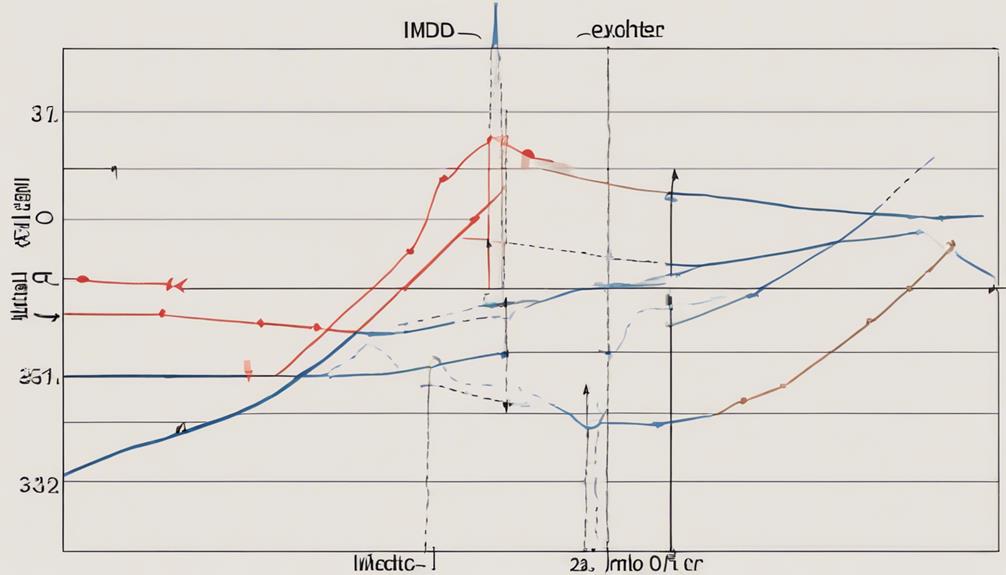

The MACD, short for Moving Average Convergence Divergence, comprises the MACD Line, Signal Line, and Histogram. The MACD Line represents the variance between the 12-period and 26-period Exponential Moving Averages (EMAs).

Meanwhile, the Signal Line, a 9-period EMA of the MACD Line, aids in generating buy or sell signals. Traders utilize the MACD through interpreting crossovers, divergences, and the Histogram to gauge potential market trends accurately.

Understanding these basics of the MACD Indicator is pivotal for discerning when to enter or exit trades effectively, enhancing your overall trading strategy.

Interpreting MACD Line and Signal Line

To gain a deeper understanding of the MACD Indicator, it's essential to interpret the relationship between the MACD Line and Signal Line for effective trading analysis. Here's how to interpret them:

- MACD Line: Calculated by subtracting the 26-period EMA from the 12-period EMA.

- Signal Line: Represents a 9-period EMA of the MACD Line, used to generate buy or sell signals.

- Bullish Trend: Crossing above zero on the MACD Line signifies a bullish trend.

- Bearish Trend: Crossing below zero on the MACD Line indicates a bearish trend.

Understanding the crossovers and interactions between the MACD Line and Signal Line is crucial for identifying potential buy or sell signals and determining the prevailing market trend.

Identifying MACD Crossovers

Identifying MACD crossovers involves analyzing the points at which the MACD line crosses above or below the signal line. A bullish crossover occurs when the MACD line surpasses the signal line, indicating a potential uptrend and offering a buy signal.

Conversely, a bearish crossover happens when the MACD line falls below the signal line, suggesting a possible downtrend and providing a sell signal. Traders utilize these crossovers to identify potential changes in trend direction.

Analyzing MACD Histogram

Analyzing the MACD Histogram provides valuable insights into market momentum and potential trend reversals based on the relationship between the MACD line and the signal line. When interpreting the histogram, consider the following:

- Peaks and troughs in the histogram signal shifts in momentum.

- Convergence towards the zero line suggests a possible trend reversal.

- Bullish divergence, where prices rise while the histogram falls, indicates potential buying opportunities.

- Bearish divergence, where prices fall while the histogram rises, may signify upcoming selling opportunities.

Understanding these dynamics can help you identify shifts in momentum and potential trend reversals effectively.

Recognizing Bullish and Bearish Divergences

When observing the MACD indicator, a crucial aspect to note is the recognition of Bullish and Bearish Divergences, which serve as key signals for potential trend reversals.

Bullish divergence occurs when the price forms a lower low, while the MACD indicator forms a higher low. On the other hand, Bearish divergence occurs when the price makes a higher high, but the MACD indicator forms a lower high.

These divergences between price action and the MACD indicator can indicate potential price movement in the opposite direction. Recognizing these divergences is essential as Bullish divergence suggests potential upward price movement, while Bearish divergence indicates potential downward price movement, assisting traders in anticipating changes in market direction.

Applying MACD for Trend Confirmation

To effectively confirm trends using the MACD indicator, traders analyze crossovers between the MACD line and the signal line. When the MACD line crosses above the signal line, it indicates a bullish trend confirmation. Conversely, a bearish trend confirmation is signaled by the MACD line crossing below the signal line.

MACD assists traders in identifying the strength and direction of trends, enabling informed decision-making. Understanding MACD crossovers is essential for confirming trend changes in the market.

Using MACD for Entry and Exit Points

Utilize MACD crossovers and histogram changes to strategically pinpoint entry and exit positions in your trading endeavors.

Entry points are signaled when the MACD line crosses above the signal line, indicating a potential uptrend. Conversely, exit signals are generated when the MACD line crosses below the signal line, suggesting a possible downtrend. Traders rely on MACD crossovers to determine optimal entry and exit positions, enhancing their decision-making process.

Additionally, monitoring the MACD histogram for changes, such as bars shrinking, can help identify potential trend reversals and serve as exit signals. By incorporating these techniques into your trading strategy, you can effectively implement entry and exit strategies based on MACD analysis.

Incorporating MACD With Other Indicators

Consider integrating MACD with other indicators to enhance the depth of your technical analysis and improve trading decisions. When combining Moving Average Convergence Divergence with other indicators, such as RSI, volume indicators, trendlines, and support and resistance levels, you can create a comprehensive analysis strategy.

Here's how you can do it:

- Use MACD with RSI for comprehensive technical analysis.

- Validate trading decisions by combining MACD with volume indicators.

- Enhance trend identification by incorporating trendlines with MACD.

- Improve entry and exit points by integrating support and resistance levels with MACD.

Setting Stop Loss and Take Profit Levels

Implementing strategically placed stop loss and take profit levels is crucial for effectively managing risk and securing profits in trading scenarios. When using the Moving Average Convergence/Divergence (MACD) indicator, it's important to consider setting stop loss and take profit levels based on support/resistance levels or other technical indicators to enhance trading discipline.

By defining these predetermined price levels, you can better control risk and protect your trading profits. Automated features on trading platforms allow for efficient execution of stop loss and take profit orders. Properly incorporating these risk management tools not only safeguards your capital but also plays a significant role in maximizing your overall trading profits.

Practicing MACD Indicator Strategies

To enhance your trading skills with the MACD indicator, it's essential to practice various strategies that involve analyzing historical price data and experimenting with different settings. Here are some steps to help you practice MACD indicator strategies effectively:

- Adjust the EMA periods in the MACD settings to see how it impacts signal accuracy.

- Explore different MACD strategies like crossover signals, divergence analysis, and histogram interpretation.

- Backtest your MACD trading strategies on historical price charts to assess their performance.

- Utilize paper trading or demo accounts to apply MACD strategies in real-time and refine your skills without financial risk. Joining online trading communities can also provide valuable insights into successful MACD indicator strategies.

Are the Steps to Navigate the MACD Indicator the Same in Both Lists?

Yes, the steps for navigating the MACD indicator are the same in both lists. Whether you are using a bullish or bearish list, the process for navigating the MACD indicator steps remains consistent. This uniformity allows for greater ease and efficiency when using the indicator to inform trading decisions.

Frequently Asked Questions

How Do You Use MACD for Beginners?

To use MACD for beginners, you can identify trends with moving averages, interpret crossovers for entry/exit signals, analyze the histogram for momentum shifts, spot divergences for trend reversals, and simplify analysis with default settings.

What Is the MACD Indicator Simplified?

The MACD indicator simplifies trend analysis by comparing two moving averages. It consists of the MACD line (faster) and signal line (slower), showing trend direction and momentum. Crossovers signal buy or sell opportunities based on trend changes.

What Is the Best Strategy for Macd?

When trading with MACD, focus on crossovers between the MACD line and signal line for trend changes. Buy when MACD line crosses above signal line, sell when it crosses below. Use histogram bars for trend strength assessment.

What Are the 3 Components of MACD Indicator?

To understand the MACD indicator, note its three components – MACD Line, Signal Line, and Histogram. The MACD Line tracks the difference between 12 and 26 EMA, while the Signal Line is a 9 EMA of the MACD Line.

Conclusion

In conclusion, mastering the MACD indicator can greatly enhance your trading skills. Remember, 'the trend is your friend' when using MACD to navigate the markets.

By following the 10 simple steps outlined in this article, you can effectively utilize this powerful tool to make informed trading decisions. Keep practicing and refining your strategies to maximize your success in the ever-changing world of trading.

Happy trading!