The Parabolic SAR indicator is a widely utilized tool in intraday trading, offering traders valuable insights into short-term market dynamics and potential trend changes. As one of the key indicators developed by J. Welles Wilder, Jr., its graphical representation of trend direction through distinct dots on price charts is instrumental in guiding traders on stop-loss placement, entry and exit signals, and trailing stop strategies.

However, the true power of this indicator lies in its versatility and adaptability to various market conditions, making it a must-have for traders seeking to navigate the complexities of intraday trading effectively.

Identifying Trend Reversals

The identification of trend reversals using the Parabolic SAR indicator is a critical aspect of effective decision-making in intraday trading.

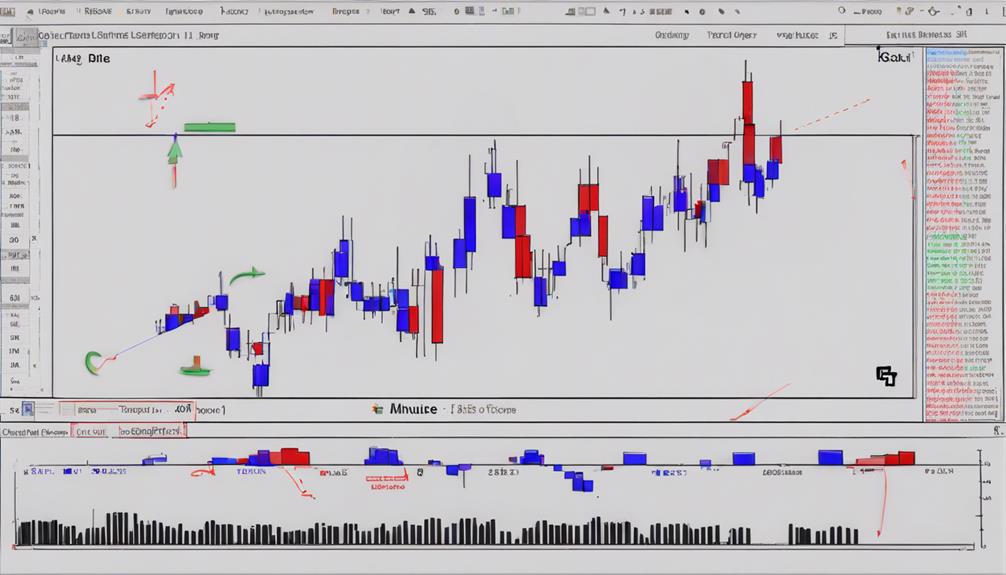

Intraday traders heavily rely on the Parabolic SAR to pinpoint potential trend reversals during the trading day. This technical indicator plots dots above or below the price candles, and a switch in the position of these dots indicates a possible reversal in the ongoing trend.

Traders interpret these reversal signals as cues to adjust their current positions, set stop losses, or even initiate new trades in the opposite direction.

Being able to accurately identify trend reversals using the Parabolic SAR is essential for intraday traders as it allows them to swiftly adapt to changing market conditions, maximize profits, and effectively manage risks.

Setting Stop Loss Orders

Enhancing risk management and trade efficiency in intraday strategies, intraday traders utilize the Parabolic SAR indicator for setting dynamic stop-loss orders based on price movements. The Parabolic SAR indicator offers a visual representation by placing dots above or below the price, indicating potential stop levels. By adjusting the Acceleration Factor (AF), traders can fine-tune the sensitivity of these stop-loss orders to align with their risk tolerance and market conditions.

Intraday trading demands a nimble approach to risk management, and the Parabolic SAR excels in this aspect by trailing the stop-loss levels as the price moves. This dynamic feature allows traders to protect their capital while capturing potential profits during intraday price fluctuations. By incorporating the Parabolic SAR for setting stop-loss orders, traders can enhance their risk management practices and optimize trade efficiency in intraday strategies. This tool acts as a valuable guide in determining appropriate stop levels and adapting to changing market dynamics swiftly.

Confirming Entry Points

Confirming entry points is crucial in intraday trading as it validates the timing of trade entries based on market conditions.

Parabolic SAR indicator helps traders by providing visual cues through its dots' positioning relative to price action.

Entry Signal Confirmation

Validating entry points in intraday trading involves analyzing the alignment between price movement and the Parabolic SAR indicator dots. The Parabolic SAR indicator can confirm entry signals when the dots switch positions relative to price, signaling a potential trend change.

Traders rely on this alignment between price direction and SAR dots to validate entry points in intraday trading. Entry signal confirmation occurs when the price crosses the SAR dots, indicating a shift in momentum.

Timing Trade Entries

When considering the timing of trade entries in intraday trading, the alignment between price movement and the Parabolic SAR indicator dots plays a crucial role in determining optimal entry points.

- Utilize Parabolic SAR to confirm entry points by observing dot switches relative to price.

- Time trade entries based on the alignment of Parabolic SAR dots with price movements.

- Pay attention to crossovers of price with Parabolic SAR dots for precise entry timing.

- Enhance decision-making in intraday trading by using Parabolic SAR to provide clear signals for trade entry confirmation.

Trailing Stop Loss Strategy

When utilizing the trailing stop-loss strategy with the Parabolic SAR indicator, traders can benefit from dynamic stop levels that adjust with price movements. This approach offers a flexible way to manage risk.

By implementing this strategy, traders can secure profits by allowing positions to run in a favorable trend while protecting against potential market reversals.

Understanding the nuances of setting up and fine-tuning the trailing stop with Parabolic SAR can significantly enhance intraday trading performance.

SAR for Dynamic Stops

Implementing Parabolic SAR for dynamic stops in intraday trading offers traders a systematic approach to risk management, enhancing their overall performance by adjusting stop-loss levels to trail price movements. This dynamic approach to stop placement can be a game-changer for intraday traders looking to maximize profits and minimize losses.

Here are some key benefits of using SAR for dynamic stops:

- Locking in Profits: By trailing stop-loss levels based on price movements, traders can secure profits as the trade moves in their favor.

- Protecting Against Reversals: Dynamic stops help protect gains by adjusting to sudden price reversals, minimizing potential losses.

- Staying in Winning Trades: Traders can ride winning trades longer by letting profits run with the help of dynamic stop levels.

- Enhanced Risk-Reward Ratios: Implementing SAR for dynamic stops can improve risk-reward ratios, leading to better trading outcomes.

Implementation Tips

For optimal risk management in intraday trading, employing a trailing stop loss strategy with Parabolic SAR can be a strategic approach to safeguard profits. By setting stop loss orders based on the SAR dots positioned above or below the price, traders can effectively capture trend movements and protect their gains.

It is crucial to adjust the Acceleration Factor (AF) and Step settings to suit the specific dynamics of intraday trades, ensuring that the trailing stop adapts to market conditions. Utilizing Parabolic SAR in this manner allows for dynamic adjustments of stop loss levels as prices fluctuate throughout the trading session.

For enhanced risk management and decision-making, consider combining Parabolic SAR with other indicators to refine trading strategies further.

Filtering Trade Signals

By effectively utilizing the Parabolic SAR indicator, traders can enhance their intraday decision-making process by accurately filtering trade signals to identify potential trend reversals. The Parabolic SAR is a valuable tool for intraday traders looking to improve their trading strategies.

Here are some ways in which traders can use the Parabolic SAR to filter trade signals effectively:

- Identifying Trend Reversals: The Parabolic SAR helps traders differentiate between noise and actual trend changes, allowing them to spot potential reversals early on.

- Focus on High-Probability Setups: By using the Parabolic SAR, intraday traders can concentrate on trade setups with higher probabilities of success, increasing their overall profitability.

- Reducing False Signals: Filtering trade signals with the Parabolic SAR leads to better decision-making and helps traders avoid false entry and exit points.

- Clarity in Trading Opportunities: The clarity provided by the Parabolic SAR in identifying valid trading opportunities is invaluable for intraday traders seeking to optimize their trading performance.

Scalping Opportunities

In scalping opportunities, traders aim to capitalize on quick profits by executing short trades based on Parabolic SAR signals.

The fast-paced nature of intraday price fluctuations creates ideal conditions for scalpers to enter and exit positions swiftly, leveraging the indicator's guidance.

Timing is crucial for scalp traders utilizing Parabolic SAR to navigate the rapid movements of the market and secure profits efficiently.

Quick Scalp Profits

Utilizing the Parabolic SAR indicator in intraday trading for quick scalp profits demands acute market awareness and swift decision-making. Scalping opportunities with Parabolic SAR can be lucrative for traders looking to capitalize on short-term price movements.

Here are key points to consider when aiming for quick scalp profits:

- Identify Short-Term Trends: Use Parabolic SAR dots to spot short-term market trends.

- Quick Entry and Exit: Make rapid trading decisions based on the changing SAR positions.

- Tight Stop-Loss Orders: Implement tight stop-loss levels to manage risk effectively in fast-paced trading.

- Stay Focused and Disciplined: Maintain a high level of concentration and discipline to seize small price fluctuations efficiently.

Timing Short Trades

When considering the timing of short trades in intraday trading for scalping opportunities, the strategic use of the Parabolic SAR indicator can be instrumental in pinpointing optimal entry and exit points.

By utilizing the sell signals generated by the indicator's dots, traders can identify potential entry points for short positions. In intraday trading, the dots appearing above the price action serve as a cue for potential downtrends, signaling advantageous moments to enter short trades.

Adjusting the Parabolic SAR settings for different timeframes enables traders to fine-tune their entry points, maximizing the effectiveness of short trade opportunities.

Ultimately, the precise timing of short trades with the Parabolic SAR can help traders capitalize on intraday price fluctuations while effectively managing risk through strategic stop-loss placement.

Intraday Price Fluctuations

Efficiently navigating intraday price fluctuations presents lucrative opportunities for scalping in the fast-paced realm of trading. Traders leveraging the Parabolic SAR indicator can capitalize on short-term price fluctuations, enhancing their scalping strategies.

Here are key points to consider:

- Parabolic SAR aids in identifying short-term price movements ideal for scalping.

- Scalping entails profiting from small intraday price shifts within a single trading day.

- Utilizing Parabolic SAR allows for precise entry and exit points, crucial for quick trades.

- Traders focusing on scalping opportunities with Parabolic SAR must remain agile, making swift decisions to capture small profits throughout the day.

Avoiding False Signals

To effectively navigate the challenges posed by false signals in Parabolic SAR, traders often employ complementary indicators such as moving averages or RSI. False signals commonly arise in choppy markets when the Parabolic SAR dots flip frequently, leading to inaccurate trading cues.

By utilizing filtering techniques like combining Parabolic SAR with other indicators, traders can enhance signal accuracy and reduce the impact of market noise. Filtering out these false signals is crucial for maintaining trading accuracy and avoiding unnecessary losses, especially in intraday trading where quick decisions are made based on timely information.

Intraday traders frequently adjust the Parabolic SAR settings to minimize false signals and align with the shorter timeframes typical of intraday trading. Understanding market conditions and volatility levels is essential for traders to effectively distinguish between valid signals and false ones when utilizing the Parabolic SAR indicator in their trading strategies.

Enhancing Risk Management

Given the significance of risk management in intraday trading and the pivotal role of the Parabolic SAR indicator in setting stop-loss levels, enhancing risk control strategies becomes paramount for traders seeking to navigate volatile markets effectively. When it comes to intraday trading, managing risk is crucial for long-term success.

Here are some ways to enhance risk management using the Parabolic SAR indicator:

- Utilize the clear signals provided by Parabolic SAR for setting stop-loss levels.

- Pay close attention to the stop and reverse points indicated by the Parabolic SAR during intraday trading.

- Minimize losses and protect profits by adjusting stop-loss levels based on Parabolic SAR signals.

- Tailor risk management strategies to different intraday trading styles by adjusting the settings of the Parabolic SAR indicator.

Incorporating the Parabolic SAR indicator into intraday trading plans can significantly enhance risk control and improve decision-making processes, ultimately leading to more effective navigation of the challenges presented by volatile intraday markets.

Combining With Other Indicators

When combining the Parabolic SAR indicator with other technical indicators, traders can enhance their analysis and decision-making process in intraday trading.

One effective way to complement Parabolic SAR is by incorporating it with Moving Averages (MA). This combination can help confirm trend directions and generate stronger buy or sell signals.

Additionally, integrating Parabolic SAR with indicators like the Relative Strength Index (RSI) or Bollinger Bands can further improve trading decisions and enhance overall accuracy.

The use of Parabolic SAR alongside Bollinger Bands, for instance, can assist in identifying potential price breakouts and trend reversals, providing valuable insights for intraday traders.

Optimizing Timeframes

By selecting shorter periods such as 15 or 30 minutes, traders can optimize timeframes effectively when using the Parabolic SAR indicator in intraday trading. When optimizing timeframes, consider the following:

- Capture Quick Price Movements: Shorter timeframes enable traders to swiftly capture price fluctuations, essential for intraday trading where speed is crucial.

- Enhance Entry and Exit Points: Choosing the right timeframe on the Parabolic SAR can significantly improve the accuracy of entry and exit points, aiding in maximizing profits.

- Improve Trading Strategies: Optimal timeframes, like 5-minute charts with adjusted Parabolic SAR settings, can enhance trading strategies specifically tailored for intraday traders.

- Maximize Effectiveness: Adjusting timeframes based on market volatility and individual trading goals can maximize the effectiveness of the Parabolic SAR indicator in intraday trading, providing traders with a competitive edge in fast-paced markets.

How Can I Use the Parabolic SAR Indicator for Intraday Trading?

When using the parabolic SAR stock trading strategy for intraday trading, it is essential to identify the trend direction before making decisions. By analyzing the SAR dots on the price chart, traders can determine potential entry and exit points, helping to maximize profits and minimize losses during intraday trading.

Frequently Asked Questions

What Is the Best Parabolic SAR Setting for Intraday?

For intraday trading, the optimal Parabolic SAR setting typically includes a Step value of 0.02 and a Maximum value of 0.2. These settings strike a balance between responsiveness to price movements and minimizing false signals.

What Is the Best Combination With Parabolic Sar?

Combining Parabolic SAR with the Moving Average Convergence Divergence (MACD) indicator can provide valuable insights into trend direction, momentum, and potential reversals. This strategic pairing enhances trading signals and aids in making informed decisions in intraday trading.

Is Parabolic SAR Indicator Profitable?

Yes, the Parabolic SAR indicator can be profitable, with correct usage and risk management. Its ability to identify trends and reversals can lead to profitable trades. Combining it with other indicators can enhance its effectiveness further.

Is Parabolic SAR Good for Scalping?

Parabolic SAR is beneficial for scalping due to its ability to provide quick entry and exit signals in volatile markets. It helps scalpers set tight stop-loss levels, manage risk, and capture short-term price movements effectively during intraday trading.

Conclusion

In conclusion, the Parabolic SAR indicator serves as a versatile tool in intraday trading, offering insights into short-term momentum and trend reversals.

By effectively identifying trend reversals, setting stop-loss orders, confirming entry points, and implementing trailing stop strategies, traders can optimize their risk management and enhance their overall trading performance.

Like a guiding light in the stormy sea of markets, the Parabolic SAR indicator illuminates the path to successful intraday trading.