Have you ever wondered why moving averages analysis is crucial for novices in the trading world?

Understanding the significance of this analytical tool can significantly impact your decision-making process and overall trading success.

By grasping the fundamentals of moving averages, novices can unlock a wealth of insights into market behavior and trends.

Stay tuned to uncover how this simple yet powerful technique can empower you to navigate the complex landscape of financial markets with more confidence and precision.

Importance of Moving Averages for Beginners

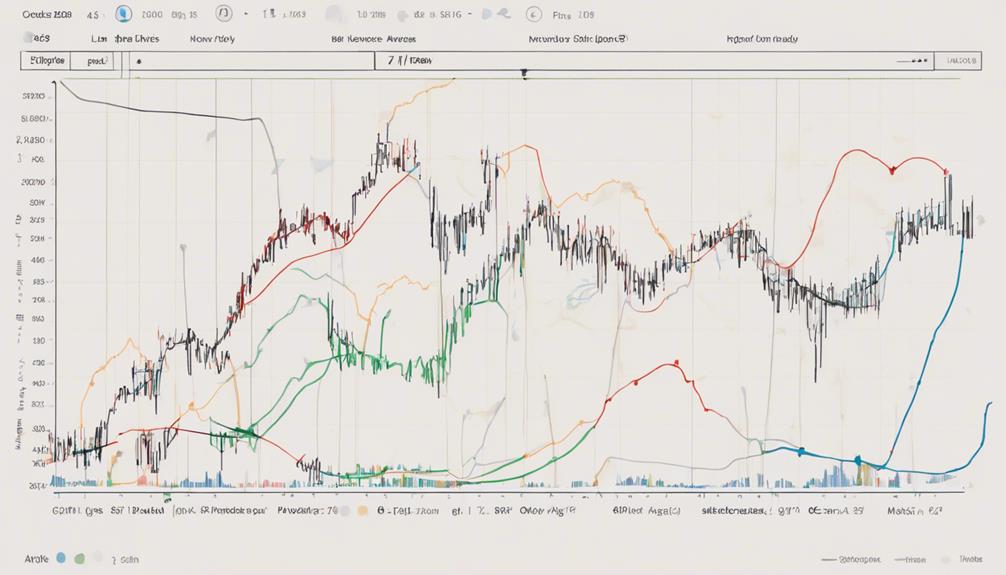

Moving averages play a crucial role for beginners in grasping market trends effectively and making informed trading decisions. By calculating the average price of a security over a specific number of trading days, the simple moving average helps novices identify trends in the stock market.

This technical analysis tool focuses on the price action, smoothing out fluctuations to reveal the current trend. Novices can utilize moving averages to determine potential entry or exit points based on the signals provided.

Understanding the significance of moving averages empowers beginners to interpret price movements more confidently and set realistic profit targets and stop-loss levels, ultimately enhancing their decision-making process in the stock market.

Advantages of Using Moving Averages

Utilizing moving averages in your analysis offers novice traders a strategic advantage in identifying and interpreting market trends effectively. Simple moving averages help smooth out price fluctuations, allowing you to focus on the overall trend rather than short-term noise.

By analyzing different time frames using moving averages, you can identify potential entry and exit points based on the closing price trends. Exponential moving averages provide a more responsive view of price movements, aiding in understanding the dynamic nature of stock prices.

Additionally, combining moving averages with other technical indicators enhances the comprehensiveness of your analysis, enabling you to better anticipate market trends and potential reversals in stock prices.

Common Mistakes in Moving Averages Analysis

To fully grasp the intricacies of moving averages analysis, novice traders must be cautious of several common mistakes that can impede accurate trend identification and decision-making in the market.

Using too short of a time frame, such as a set number of days, can introduce more noise and false signals into the analysis, potentially leading to incorrect conclusions.

Solely relying on moving averages without considering other technical indicators or fundamental analysis may overlook important aspects influencing the market.

Misinterpreting crossovers, where two moving averages intersect, can result in misguided trading decisions if not contextualized within market conditions.

Failing to adjust moving average parameters based on market volatility can delay or distort trend signals.

Neglecting volume analysis alongside moving averages may lead to incomplete assessments of market trends and potential reversals.

Practical Tips for Novices in Moving Averages

For novice traders delving into moving averages analysis, starting with simple moving averages can provide a foundational understanding of basic trend signals. When using moving averages, consider the following practical tips:

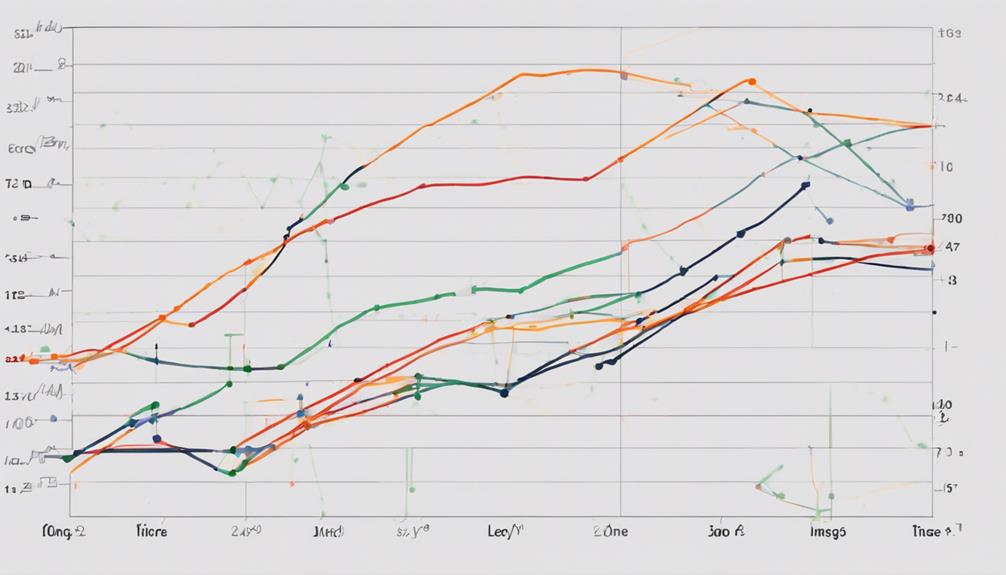

- Experiment with different types of moving averages, like the 20-day or 50-day, to observe their impact on trend identification.

- Watch for the crossover of moving averages, where short-term averages crossing above long-term averages can signal potential trend changes.

- Utilize moving averages as dynamic support or resistance levels to help determine entry and exit points based on price movements.

- Combine moving averages with other technical indicators to validate signals and enhance your trading decisions effectively.

What are the Benefits of Using Moving Averages for Novice Traders?

Novice traders can benefit from using forex trading moving averages to identify trends and make informed decisions. By smoothing out price fluctuations, moving averages provide a clear picture of market direction. This helps traders enter and exit positions at optimal times, ultimately increasing the likelihood of profitable trades.

Key Takeaways for Beginners

When starting out in moving averages analysis, beginners should focus on grasping the fundamental concepts to effectively interpret trends in stock prices.

Utilizing moving averages to identify trends over a specific time frame can provide insight into the strength of market movements.

By observing the relationship between past prices and moving average lines, novices can determine potential entry and exit points.

Traders focus on the crossover of different moving averages to pinpoint buying or selling opportunities.

Setting stop-loss levels and making trade decisions based on trend signals derived from moving averages are essential for beginners.

Filtering out market noise and honing in on significant price movements through moving averages can enhance decision-making processes in stock trading.

What Are the Benefits of Using Moving Averages Analysis for Novices in Technical Analysis?

Novices in technical analysis can benefit from using moving averages in technical analysis. By analyzing the average price of a security over a specific period, novices can spot market trends and make informed trading decisions. This simple yet effective tool provides valuable insights into potential entry and exit points.

Frequently Asked Questions

Why Is It Important to Have a Moving Average?

Having a moving average is important because it offers a clear visual representation of price trends over a specific period. It helps you identify market direction, spot potential trend changes, and set entry/exit points for trades effectively.

What Is the Advantage of Using Moving Average Method?

Using moving averages provides you with a clear visual representation of trend directions and key support/resistance levels. This method aids in identifying potential entry/exit points based on trend shifts, enhancing your ability to make informed trading decisions.

What Is the Purpose of the Simple Moving Average?

To grasp the concept of the simple moving average (SMA), you must understand its purpose. SMA smooths out price data to reveal trends over time. Novices rely on SMA for spotting potential support and resistance levels.

How Is the Moving Average Used in Real Life?

In real life, you use moving averages to identify trends in stock prices. They help you understand short-term and long-term market trends by filtering out noise and focusing on significant price movements for better decisions.

Conclusion

In conclusion, for novice traders, mastering moving averages analysis is crucial for navigating the complex world of trading.

By utilizing moving averages, you can gain valuable insights into market trends, identify potential reversals, and make informed decisions.

Remember, Rome wasn't built in a day, so take your time to understand the nuances of moving averages to improve your trading skills.

Happy trading!