Mastering market predictions with W.D. Gann Theory involves a blend of angles, mathematics, astrology, and time cycles to predict asset price changes with over 90% accuracy. Gann Theory fundamentals include identifying price levels that reveal support, resistance, and trend reversals, aided by Gann Fan angles and mathematical divisions. Gann Square Analysis utilizes mathematical precision to determine critical price levels. Connecting market trends with Gann tools enhances decision-making. Time analysis anticipates turning points, while Gann Angles strategy aids in identifying support and resistance levels. Explore how technical analysis integration enhances precision. Discover the key strategies of Gann Theory for market analysis.

Gann Theory Fundamentals

In delving into the foundational principles of Gann Theory, a sophisticated framework blending angles, geometric shapes, mathematics, astrology, and time cycles, one discovers a formidable tool for precise and insightful market forecasting.

Gann Theory, developed by the legendary trader W.D. Gann, is renowned for its high accuracy rate of over 90% in predicting asset price changes. The utilization of angles within Gann Theory plays an important role in identifying support and resistance levels in stock prices. These angles provide traders with valuable insights into potential price movements and areas of price consolidation.

Additionally, mathematical calculations and geometric shapes are instrumental in pinpointing key turning points and trend reversals in the market. By incorporating astrology and time cycles, Gann Theory deepens the understanding of natural rhythms influencing stock price fluctuations. This holistic approach enables traders to make more informed decisions based on a thorough analysis of price movements and market dynamics.

Identifying Price Levels

Gann price levels offer important insights into key support levels, resistance breakout points, and trend reversal indicators in stock trading.

By utilizing mathematical divisions and Gann Fan Angles, traders can pinpoint significant price levels for making informed trading decisions.

These price levels serve as essential markers for setting profit targets and maneuvering market complexities with precision.

Key Support Levels

Deriving key support levels through precise mathematical divisions is a fundamental aspect of identifying important price points in stock trading according to the principles of W.D. Gann Theory.

Gann Angles, which are based on geometric angles, assist in determining these support and resistance levels essential for market analysis. By utilizing mathematical calculations and Gann principles, traders can pinpoint key support levels that indicate potential price reversals or areas of increased buying interest.

Understanding these levels helps in setting profit targets and managing risk effectively. Gann Theory provides a structured approach for traders to navigate market complexities and make informed decisions based on the analysis of support and resistance levels.

Resistance Breakout Points

Utilizing precise analysis techniques within W.D. Gann Theory, traders focus on identifying key resistance breakout points as critical price levels that signify potential trend shifts or significant market movements. When it comes to Gann Theory in stocks, understanding resistance breakout points is essential for making informed trading decisions. Here are three key aspects to keep in mind:

- Importance of Resistance Levels: Resistance breakout points indicate areas where buying interest may increase, leading to potential upward price movements.

- Utilization of Gann Tools: Traders employ tools like Gann Fans and angles to pinpoint precise resistance breakout levels accurately.

- Integration with Technical Analysis: Combining resistance breakout points with other technical indicators enhances the overall analysis for better trading strategies.

These elements play a vital role in navigating the complexities of stock market trends using Gann Theory.

Trend Reversal Indicators

Identifying key price levels through trend reversal indicators is essential for traders seeking to make informed decisions in the dynamic stock market environment. Gann Price Levels, derived from mathematical divisions, provide critical points for spotting potential trend reversals. Gann Fan Angles aid in pinpointing support and resistance levels, essential for predicting market shifts. Mathematical calculations are integral in determining these price levels, enhancing the accuracy of trend reversal indicators. Profit Targets indicators further assist traders in setting specific price levels for profit-taking during trend reversals. Understanding and utilizing Gann price levels are fundamental in effectively identifying and capitalizing on trend reversal indicators in trading.

| Trend Reversal Indicators | Importance |

|---|---|

| Gann Price Levels | Critical for spotting potential reversals |

| Gann Fan Angles | Aid in identifying key support/resistance levels |

| Mathematical Calculations | Enhance accuracy of trend reversal indicators |

Gann Square Analysis

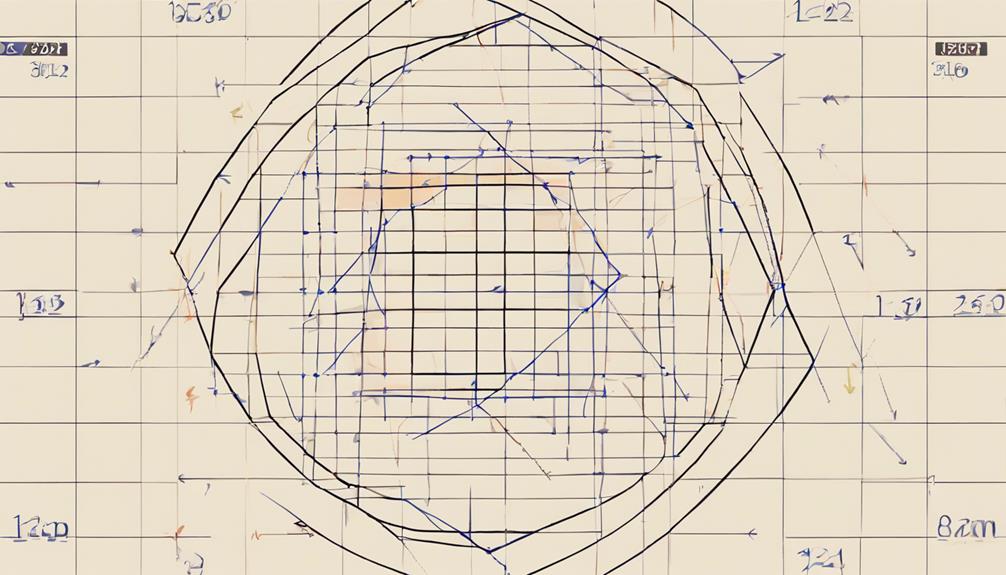

Gann Square Analysis, a strategic method based on geometric calculations, plays a pivotal role in identifying critical price levels within the market. This technique, rooted in Gann's theory, offers traders valuable insights into potential support, resistance levels, and target levels through a spiral pattern around a central number. Here are three key aspects of Gann Square Analysis:

- Mathematical Precision: Gann Square Analysis utilizes mathematical principles to determine price levels accurately, aiding traders in making well-informed decisions within their trading strategies.

- Turning Points Identification: The methodical approach of Gann Square Analysis assists in pinpointing key turning points and trend reversals, vital for anticipating market movements effectively.

- Complexity Navigation: By incorporating Gann Square Analysis into their trading arsenal, traders can navigate the complexities of the market landscape with more confidence, setting precise profit targets and enhancing overall trading strategies.

Market Trend Connections

Effective market trend connections rely on utilizing trend analysis tools like Gann Fan support and resistance lines to identify key price levels. By interpreting price movements through Gann angles and intervals, traders can develop strategic approaches for forecasting future trends.

The correlation of major market trends with diagonal support and resistance levels is essential for pinpointing breakout points and trend reversals.

Trend Analysis Tools

In the domain of market trend analysis, the utilization of sophisticated tools for recognizing and interpreting price levels is vital for strategic decision-making. Utilizing Gann Fan support and resistance lines aids in identifying important price levels, while analyzing Gann angles and price intervals assists in developing effective trading strategies.

Diagonal support and resistance levels also play a significant role in pinpointing breakout points and trend reversals. Correlating major market trends with Gann Fan lines provides valuable insights into key price levels, enhancing informed decision-making. Integrating time analysis with price analysis further enriches strategic approaches by anticipating market turning points.

Through the utilization of these trend analysis tools, traders can gain a deeper understanding of market dynamics and make well-informed decisions.

Interpreting Price Movements

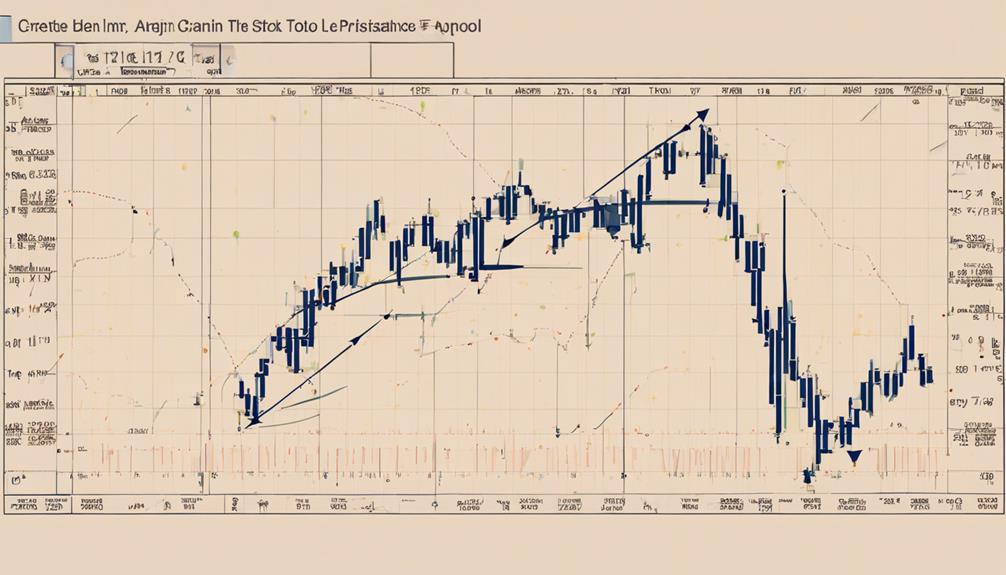

Connecting price movements to market trends is a fundamental aspect of understanding the dynamics of financial markets. In Gann Theory, the analysis of price movements in relation to time is vital. Gann Time focuses on the cyclical nature of markets, suggesting that certain time intervals influence price movements.

By studying price and time relationships, traders can identify potential trend reversals or continuation points. Gann Theory enables the interpretation of market trends through geometric angles and patterns formed by price movements over time. Traders utilize Gann angles to determine key support and resistance levels, aiding in decision-making processes.

Understanding the interconnectedness of price and time is essential for accurate market predictions and effective risk management strategies in trading.

Forecasting Future Trends

Correlating major market trends with support and resistance points is a pivotal aspect facilitated by Gann Theory, aiding in the forecasting of future trends in financial markets.

Utilizing Gann Fan support and resistance lines helps pinpoint key price levels for trend analysis. Analyzing Gann angles and price intervals plays an essential role in developing effective trading methods for forecasting future price movements.

Diagonal support and resistance levels are instrumental in identifying breakout points and potential trend reversals within market trends. Integrating time analysis with price analysis enhances the strategic forecasting of future market trends, providing traders with a holistic approach to making informed decisions based on historical price movements and projected market trends.

Utilizing Time Analysis

Exploring the temporal dimensions of market behavior through Gann Time Analysis illuminates strategic insights into anticipating market turning points and trend reversals. By studying time cycles and intervals in Gann Time Analysis, traders can gain a deeper understanding of when key market turning points are likely to occur. These time intervals serve as valuable guides for traders, allowing them to make informed decisions about entering or exiting positions at opportune times. Integrating time analysis with price analysis provides a more detailed view of market dynamics, enhancing trading strategies.

Understanding the cyclical nature of time is important in predicting market movements accurately. By recognizing recurring patterns and cycles in market behavior, traders can anticipate potential shifts in trends with greater precision. Time analysis in Gann Theory complements price analysis, leading to a more thorough and reliable market forecasts. Incorporating time analysis into trading approaches can greatly improve the effectiveness of decision-making processes, ultimately leading to more successful trading outcomes.

Applying Gann Fan Tool

The Gann Fan tool offers a structured approach to identifying potential market movements by establishing key support and resistance levels.

By utilizing multiple trend lines emanating from a pivotal point, traders can gain insight into the potential direction of price movements.

Understanding the angles of the Gann Fan lines aids in visualizing potential trend changes and assists traders in making well-informed decisions based on these projections.

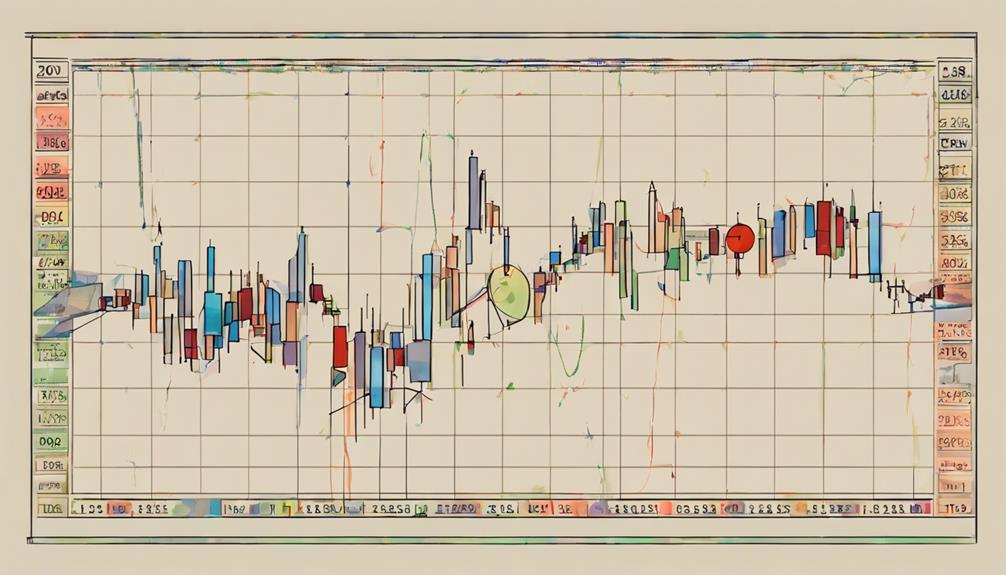

Gann Fan Basics

Utilizing the Gann Fan tool enables traders to analyze market price movements through geometric angles, aiding in the identification of potential support and resistance levels. Here are three key points to understand about Gann Fan basics:

- Geometric Angles: The Gann Fan tool is constructed by drawing trend lines from a significant price point at various angles, forming a fan-like structure based on geometric shapes.

- Forecasting Future Movements: Traders use Gann Fans to predict potential support and resistance levels, assisting in anticipating future price movements based on the angles of the trend lines.

- Enhanced Technical Analysis: By applying Gann Fan angles, traders can improve their technical analysis skills, identifying trend directions and essential price levels for making informed trading decisions.

Gann Fan Strategies

Applying the Gann Fan tool in trading strategies involves precisely positioning trendlines at calculated angles to identify key support and resistance levels for informed decision-making.

By utilizing the angles of the Gann Fan lines, traders can anticipate potential entry and exit points in the market. These trend lines are instrumental in forecasting price movements and recognizing pivotal turning points.

The Gann Fan strategies aid traders in determining ideal entry and exit positions based on the slope and positioning of the lines. This method enhances technical analysis precision, providing a structured approach to identifying market trends and making well-informed trading decisions.

Ultimately, incorporating Gann Fan strategies in trading practices can contribute to more effective and strategic trading outcomes.

Gann Angles Strategy

When implementing the Gann Angles Strategy in market analysis, traders leverage geometric principles to anticipate price movements and pinpoint critical levels of support and resistance. Gann Angles play a vital role in technical analysis by providing traders with a visual representation of stock price movements and key turning points.

Here are three key aspects of the Gann Angles Strategy:

- Unique Insights: Gann Angles such as 1×1, 1×4, and 1×8 offer distinct perspectives on price action, helping traders identify trends and potential reversal points more effectively.

- Reversal Signals: A significant signal occurs when the price crosses below the 1×1 trend line, indicating a potential trend reversal or a shift in market sentiment.

- Enhanced Analysis: By combining Gann Angles with horizontal lines, traders can improve their analysis of support and resistance levels, enabling more informed decision-making in asset trading scenarios. This integration provides a holistic view of price dynamics, aiding in the identification of optimal entry and exit points for trades.

Implementing Square of Nine

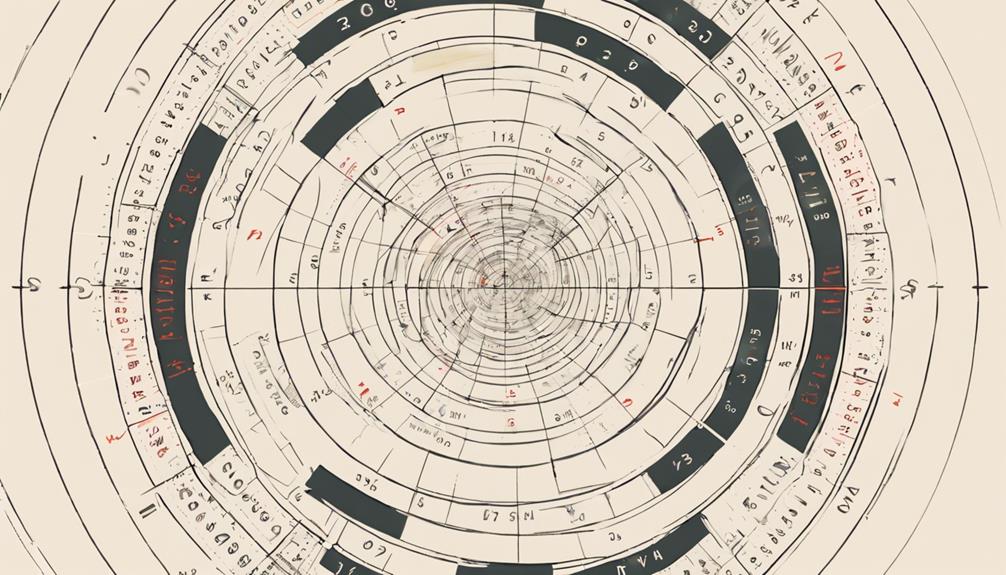

Incorporating the Square of Nine into market analysis further enhances the application of Gann Theory by providing traders with a structured method to identify key price levels and targets for informed decision-making.

The Square of Nine, a fundamental tool in Gann Theory, offers a unique approach to market prediction through its spiral arrangement of numbers. W.D. Gann extensively used this methodology to forecast price movements and reversals, emphasizing its significance in technical analysis.

By utilizing the Square of Nine, traders can pinpoint potential support and resistance levels with precision, aiding in the identification of critical price points for strategic trading decisions. This tool enables traders to establish a roadmap of price levels based on numerical relationships, offering a systematic framework for market analysis.

Combining With Technical Analysis

Utilizing a combination of Gann Theory with technical analysis tools such as moving averages enhances the precision and effectiveness of market analysis strategies. This integration provides traders with a more thorough view of stock price movements and aids in making well-informed trading decisions.

Here are three key ways in which combining Gann Theory with technical analysis can benefit your trading strategy:

- Insightful Trend Analysis: Gann Fans and angles, when used in conjunction with moving averages, offer valuable insights into trend directions and help identify important support and resistance levels. This combination can assist traders in determining ideal entry and exit points.

- Enhanced Price Prediction: By incorporating Fibonacci retracement levels with Gann Theory, traders can improve the accuracy of price predictions. This approach enables a more precise analysis of potential price reversals and continuation patterns in the market.

- Effective Trend Reversal Recognition: Analyzing candlestick patterns alongside Gann Theory enhances the ability to recognize potential trend reversals. This combined approach empowers traders to react swiftly to changing market conditions and adjust their trading strategies accordingly.

Key Gann Theory Strategies

Key Gann Theory strategies encompass a holistic approach that integrates angles, geometric shapes, mathematical principles, astrology, and time cycles to make precise market predictions. Traders use these strategies to anticipate stock market movements and make informed decisions. Key strategies include identifying Gann Price Levels, utilizing Gann Fan Angles, and applying Mathematical Calculations for price analysis. Gann Tools such as Square Analysis and Market Trend Analysis aid in determining critical price levels and trend reversals. Time Analysis in trading helps anticipate market turning points by studying cyclical time patterns. Integration with technical analysis tools enhances market analysis precision by combining Gann Theory with moving averages, Fibonacci retracement, candlestick patterns, and volume analysis.

| Gann Theory Strategies | Description | Benefits |

|---|---|---|

| Gann Price Levels | Identifying key price levels | Helps in setting profit targets and stop-loss levels |

| Gann Fan Angles | Using angles to predict price movements | Provides visual representation of potential price trends |

| Mathematical Calculations | Applying mathematical principles | Aids in determining support and resistance levels |

Frequently Asked Questions

What Is the 9 5 Gann Rule?

The 9-5 Gann Rule is a trading principle attributed to W.D. Gann that advises traders to limit their trading hours to 9 hours a day, 5 days a week. This rule emphasizes discipline and aims to prevent overtrading, promoting a balanced and structured approach to trading.

How to Learn Gann Theory?

To learn Gann Theory, one must understand its techniques through resources like books, online courses, and seminars. Application examples help grasp concepts better.

Practical strategies involve studying Gann Angles, time cycles, and price factors for market analysis. Combining angles and horizontal lines aids in identifying support and resistance levels.

Mastering Gann Theory requires dedication to learning and practice to enhance trading skills effectively.

How Accurate Is the Gann Theory?

The accuracy assessment of Gann Theory relies on historical data and backtesting techniques to evaluate its predictive capabilities.

While Gann Theory boasts a high accuracy rate in forecasting asset price changes, practical application pitfalls exist due to its reliance on complex angles, geometric shapes, astrology, and time cycles.

What Is the Golden Ratio of Gann?

The Golden Ratio of Gann, also known as the 1.618 Fibonacci level, is a crucial mathematical concept in market analysis. It is derived by dividing a number by its preceding number to approximate this ratio.

Traders utilize this ratio to identify potential price levels and market reversals, often in conjunction with Gann's angles for precise predictions.

Understanding and applying the Golden Ratio of Gann can greatly enhance trading strategies and decision-making processes.

Conclusion

To sum up, mastering market predictions with W.D. Gann theory requires a deep understanding of key principles such as price levels, Gann squares, market trends, time analysis, angles strategy, and Square of Nine.

By combining Gann theory with technical analysis, traders can develop effective strategies for forecasting market movements. The application of these advanced techniques can provide valuable insights and enhance trading decisions.

However, the true power of Gann theory lies in its ability to uncover hidden patterns and predict future market trends with precision.