Navigating the intricacies of the Ichimoku Cloud indicator is akin to deciphering the patterns in a well-crafted tapestry. As you explore its elements, you'll notice a simplicity that belies its profound impact on trading strategies.

The elegance of the Ichimoku Cloud lies in its ability to offer a comprehensive view of the market dynamics through a few key components. Understanding why mastering this indicator is straightforward requires a closer look at how its various elements interact seamlessly to provide traders with a holistic approach to analyzing price movements and trends.

Key Takeaways on Ichimoku Cloud

When delving into the realm of the Ichimoku Cloud indicator, clarity on its key takeaways emerges as a foundational step for mastering this powerful tool.

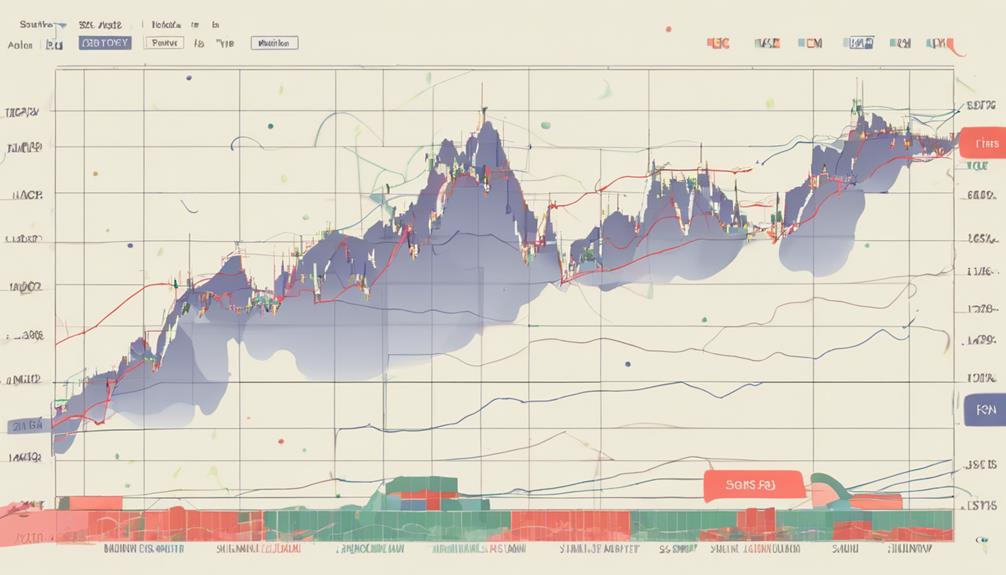

The Ichimoku Cloud provides a visual representation of support and resistance levels, aiding in trend analysis and decision-making for entry and exit points. Its clear trading signals offer traders a holistic view of the market, simplifying the process of identifying potential trading opportunities.

Understanding the calculations behind each component is crucial for developing effective trading strategies using this indicator. By grasping the Ichimoku Cloud's comprehensive analysis of price movements and trend directions, traders can confidently navigate the market with a tool that streamlines the process of making informed trading decisions.

Understanding Ichimoku Cloud Formulas

To comprehend the Ichimoku Cloud fully, understanding the formulas behind its components is essential for effective utilization in trading strategies. When diving into the calculations of the Ichimoku Cloud, it's crucial to grasp the following key points:

- The Tenkan-sen formula averages the highest high and lowest low over the last 9 periods.

- The Kijun-sen formula averages the highest high and lowest low over the last 26 periods for mid-term trend analysis.

- Senkou Span B is a component of the Ichimoku Cloud that involves averaging the highest high and lowest low over the last 52 periods, plotted 26 periods ahead.

These formulas assist in identifying potential support and resistance levels and can help traders interpret crosses between Senkou Span A and B effectively in their Ichimoku Cloud trading strategy.

Interpreting Ichimoku Cloud Signals

Interpreting Ichimoku Cloud signals provides traders with valuable insights into potential market trends and entry/exit points for strategic decision-making. The crossing of Tenkan-Sen and Kijun-Sen lines serves as a signal for potential trend changes, guiding traders on buy or sell opportunities.

Additionally, observing the Cloud's color change from red to green or vice versa can indicate shifts in market direction, aiding in identifying optimal entry and exit points. Chikou Span crossing above or below price action confirms trend strength, assisting traders in making informed trading decisions.

Practical Application of Ichimoku Cloud

Utilizing the Ichimoku Cloud indicator in your trading strategy can provide a practical and effective way to identify trends and make informed decisions in the market. The indicator simplifies trend identification, offering clear signals for entry and exit points through crossovers and cloud breakouts.

Traders can easily determine support and resistance levels with the cloud, aiding in decision-making processes. Ichimoku Cloud's visual representation allows for a straightforward analysis of price movements and trends at a glance.

Advantages of Mastering Ichimoku Cloud

Mastering the Ichimoku Cloud indicator empowers traders with a comprehensive understanding of market trends and potential price movements. This powerful tool simplifies trend identification and support/resistance levels, providing clear entry and exit signals. By mastering the Ichimoku Cloud, traders gain insights into market conditions, allowing them to predict price reversals and trend continuations.

The indicator's user-friendly nature, with its visual representation and straightforward signals, makes it a valuable asset in trading. With its ability to offer a holistic view of the market, the Ichimoku Cloud enhances decision-making processes and aids in crafting effective trading strategies. Start mastering Ichimoku Cloud today to take advantage of its benefits in navigating the complexities of trading.

What Makes Mastering the Ichimoku Cloud Indicator Simple and Effective?

Mastering the Ichimoku cloud indicator effectiveness can be simple and effective due to its comprehensive nature. By analyzing multiple aspects of an asset’s price movement, such as support and resistance levels, trend direction, and momentum, the Ichimoku cloud indicator provides traders with clear signals for making informed trading decisions.

Frequently Asked Questions

What Is the Best Indicator to Use With Ichimoku Cloud?

When using Ichimoku Cloud, the best indicator to complement it is the Relative Strength Index (RSI). RSI validates Ichimoku signals by measuring price movement speed. Combining RSI enhances signal accuracy and confirms overbought/oversold conditions, improving trading decisions.

What Are the Drawbacks of Ichimoku?

Navigating Ichimoku Cloud drawbacks can be tricky. Delays in signals and subjective interpretations may puzzle you. Understand its intricacies, seek confirmation from other tools. Don't rush, stay patient, and consider combining it with complementary indicators for better insights.

What Is the Logic Behind Ichimoku?

Ichimoku's logic involves analyzing multiple components to offer a comprehensive market view. It combines calculations for trend, support/resistance, and momentum shifts. Clear signals and visual representation simplify decision-making. Understanding these interactions leads to effective trading strategies.

What Is the Success Rate of the Ichimoku Cloud Indicator?

The success rate of the Ichimoku Cloud indicator can vary based on market conditions and your proficiency. Higher success rates are often achieved when combining it with other technical tools, validating signals with multiple timeframes and data points.

Conclusion

Mastering the Ichimoku Cloud indicator is simple because it provides clear trading signals and has straightforward components. By understanding the formulas, interpreting the signals, and applying the indicator in practice, traders can gain valuable insights into price movements.

The advantages of mastering the Ichimoku Cloud include support and resistance levels, momentum, and trend direction, all presented in a visually appealing manner. With dedication and practice, mastering this indicator can lead to informed trading decisions and improved trading performance.