Master MACD indicator techniques for an optimized trading strategy. Understand MACD signals like crossovers for buy/sell prompts. Implement a precise MACD crossover strategy, confirming exits with price actions and additional indicators. Utilize MACD divergence analysis for trend reversal hints based on price-MACD comparisons. Analyze MACD histogram peaks and troughs for trend confirmation and buy/sell indicators. Fine-tune MACD settings for different market conditions, customizing moving average and signal line parameters. Enhance market momentum reading by confirming volume trends alongside MACD. Combine MACD with other indicators, backtest techniques to validate and optimize trading strategies effectively. Optimize your trading decisions with advanced MACD methods.

Understanding MACD Indicator Signals

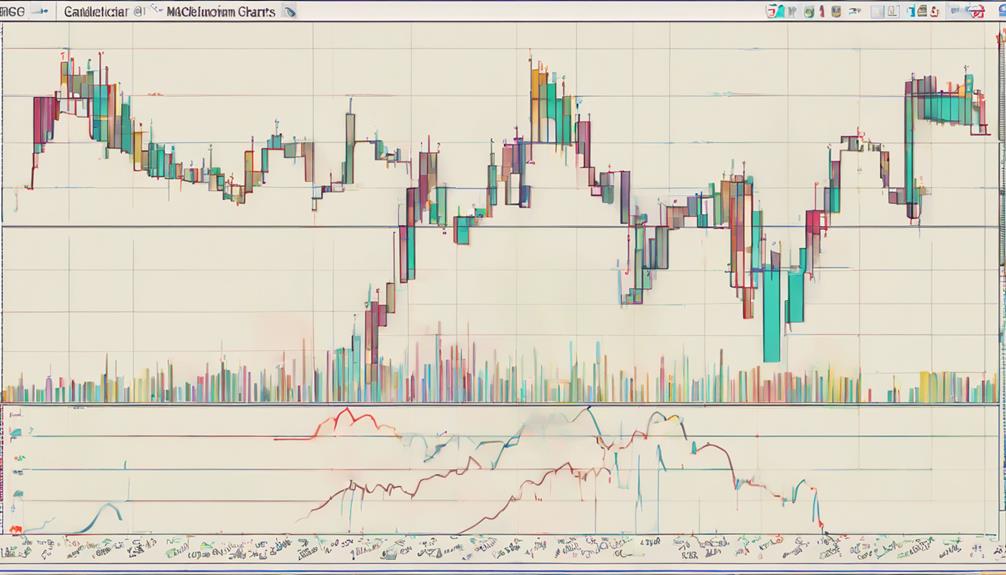

The comprehension of MACD indicator signals is essential for effectively interpreting market trends and executing strategic trading decisions in financial markets. The MACD (Moving Average Convergence Divergence) indicator generates signals through crossovers between the MACD line and the signal line, indicating potential buy or sell opportunities. When the MACD line crosses above the signal line, it produces a bullish signal, suggesting an uptrend may be imminent. Conversely, a bearish signal is triggered when the MACD line crosses below the signal line, indicating a possible downtrend. These crossovers serve as important entry and exit points for traders looking to capitalize on market movements.

Additionally, the MACD histogram, which illustrates the variance between the MACD line and the signal line, offers insights into market momentum. Understanding these signals is vital for traders as they provide valuable information for identifying trend changes and gauging the strength of price movements. By analyzing these indicators, traders can make well-informed decisions to optimize their trading strategies and potentially enhance their overall profitability in the financial markets.

Implementing MACD Crossover Strategy

The MACD Crossover Strategy focuses on identifying entry signals when the MACD line crosses above or below the signal line and confirming exit signals based on price action.

Traders often rely on the convergence of MACD crossovers with other technical indicators to validate trading decisions. Understanding how to interpret these signals can enhance the effectiveness of this strategy in capturing trends within the market.

Entry Signals Identification

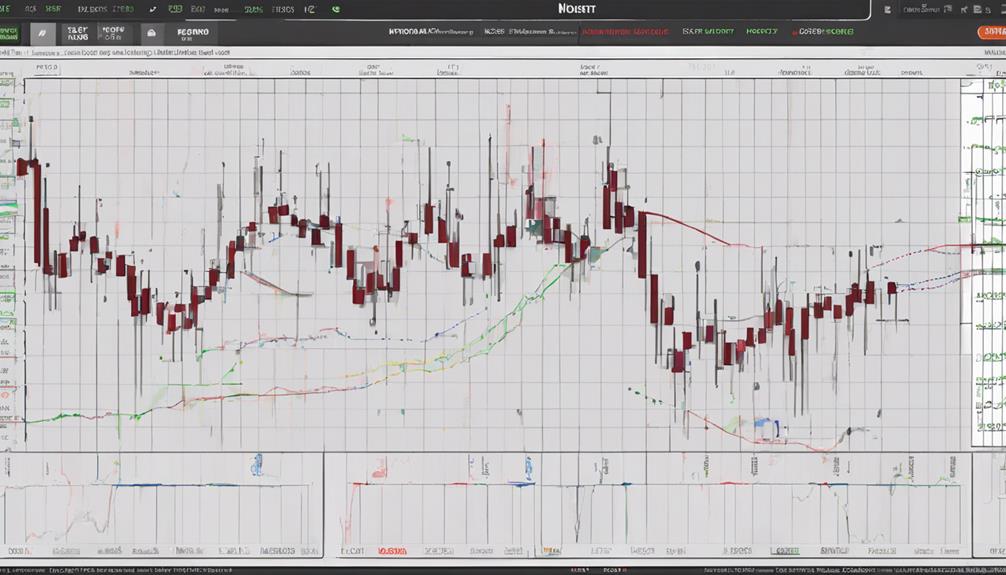

Implementing the MACD crossover strategy for entry signal identification involves monitoring the point at which the MACD line crosses above or below the signal line. This strategy is a fundamental aspect of MACD trading techniques, where traders analyze the interaction between the MACD line and the signal line to determine potential entry points in the market.

By waiting for the MACD line to cross above the signal line, traders aim to capture buying opportunities, while crossing below indicates selling opportunities. It is essential for traders to seek confirmation from price action to validate these entry signals effectively.

The MACD crossover strategy aids in identifying trend changes and provides insights into momentum shifts within market trends, enhancing decision-making processes in trading scenarios.

Exit Signals Confirmation

Utilizing the MACD crossover technique for confirming exit signals is a pivotal aspect of refining trading strategies and managing risk effectively in the financial markets.

Exit signals in the MACD crossover strategy are confirmed when the MACD line crosses below the signal line, indicating a potential reversal in the trend. This confirmation empowers traders to make informed decisions to exit positions, thereby helping them manage risk and lock in profits.

Leveraging MACD Divergence Analysis

Efficiently leveraging MACD Divergence Analysis enhances a trader's ability to recognize potential trend reversals in financial markets. This analysis involves comparing price action with the MACD indicator to identify discrepancies that may signal a change in market direction.

Bullish divergence is observed when price makes lower lows while MACD forms higher lows, indicating a potential uptrend. On the other hand, Bearish divergence occurs when price forms higher highs while MACD creates lower highs, suggesting a possible downtrend.

By paying attention to these divergences between price movements and MACD peaks, traders can anticipate trend reversals before they occur. Divergence analysis provides valuable insights into market dynamics, offering early warnings of potential shifts in price momentum.

Incorporating MACD Divergence Analysis into trading strategies can improve decision-making processes and enhance overall trading performance in various financial markets.

Analyzing MACD Histogram Patterns

Analyzing MACD Histogram patterns involves evaluating peak and trough formations as well as interpreting divergence signals. Peaks indicate potential reversal points, while troughs suggest possible continuation of trends. Understanding these patterns can provide valuable insights into market dynamics and aid traders in making strategic decisions.

Peak and Trough Analysis

When examining the MACD histogram, proficient traders meticulously identify peaks and troughs to gauge shifts in momentum, essential for strategic decision-making in trading.

Peaks in the histogram signal potential selling opportunities, while troughs indicate possible buying opportunities within the market. By analyzing histogram patterns, traders can anticipate trend reversals and assess the strength of existing trends.

The presence of higher peaks or lower troughs in the histogram validates the momentum of price movements, aiding in confirming market trends. Understanding peak and trough patterns in the MACD histogram is pivotal for enhancing decision-making and formulating effective trading strategies based on the analysis of momentum shifts and trend dynamics.

Divergence Signals Interpretation

Traders proficient in MACD indicator techniques recognize that interpreting divergence signals in the histogram is instrumental for identifying potential trend reversals and making well-informed trading decisions.

Divergence signals in the MACD histogram occur when the price trend deviates from the MACD indicator trend. Bullish divergence manifests when the price forms lower lows while the MACD histogram shows higher lows, suggesting a potential bullish reversal. Conversely, bearish divergence occurs when the price achieves higher highs, but the MACD histogram displays lower highs, indicating a potential bearish reversal.

Analyzing MACD histogram patterns enables traders to pinpoint possible trend reversals and adjust their strategies accordingly based on informed trading decisions. Understanding these divergence signals and patterns enhances traders' ability to anticipate market movements effectively.

Fine-Tuning MACD Settings for Efficiency

Fine-tuning the settings of the Moving Average Convergence Divergence (MACD) indicator is vital for optimizing trading efficiency and signal accuracy. Adjusting the MACD fast and slow moving average parameters according to different market conditions can enhance overall performance. It is essential to fine-tune the MACD signal line parameter, such as utilizing a 9-day Exponential Moving Average (EMA), to generate more precise buy and sell signals.

Setting appropriate open, close, high, and low values for candlesticks is also significant in improving the effectiveness of MACD signals. Additionally, considering minimum and maximum parameters within MACD settings plays a significant role in optimizing trading strategy performance. Specific parameters like levels tailored for various MACD strategies, including crossovers or divergences, are key in fine-tuning trading setups for better results in the market.

Integrating MACD With Other Indicators

Integrating MACD with other indicators enhances the thoroughness of market analysis and strengthens trading signals for informed decision-making. When combined with the Relative Strength Index (RSI), MACD can confirm trend reversals and provide additional validation for trading decisions.

Incorporating Bollinger Bands alongside MACD helps in identifying overbought or oversold conditions, improving entry and exit points. The Stochastic Oscillator, when used in conjunction with MACD, offers insights into the market momentum's strength, further refining trading signals.

Additionally, integrating On-Balance Volume (OBV) with MACD can confirm volume trends, adding another layer of validation to the signals generated. By combining these indicators with MACD, traders can gain a thorough view of market dynamics, leading to more informed trading decisions and ultimately optimizing their overall strategy for better results.

The synergy created by using multiple indicators with MACD allows for a more all-encompassing approach to analyzing market conditions and enhancing the accuracy of trading signals.

Backtesting MACD Techniques for Validation

Conducting rigorous backtesting of MACD techniques is essential to validate their effectiveness in trading strategies.

Backtesting involves testing these strategies on historical data to assess their performance and profitability. It allows traders to identify the strengths and weaknesses of MACD strategies under various market conditions.

By backtesting, traders can fine-tune MACD parameters for peak performance before implementing them in live trading. This process provides valuable insights into the reliability and consistency of trading signals generated by MACD indicators.

Traders can analyze how MACD strategies would have performed in the past, helping them make more informed decisions about their use in the present and future. Overall, backtesting MACD techniques is a critical step in ensuring that trading strategies based on MACD indicators are robust and capable of delivering consistent results across different market scenarios.

Frequently Asked Questions

What Is the Best MACD Indicator Setting for Option Trading?

The best MACD indicator setting for option trading involves a 12-period EMA, 26-period EMA, and a 9-period signal line EMA. Traders commonly use these settings to capture short to medium-term price movements in options markets.

By adjusting the MACD settings based on volatility and timeframe, traders can identify potential trend changes, ideal entry points, and manage risks effectively.

Evaluating market conditions, utilizing technical analysis, and considering profit potential are essential in option analysis.

What Is a Good Indicator to Use With Macd?

When looking for a good indicator to use with MACD, the Relative Strength Index (RSI) stands out as a valuable tool. RSI helps confirm potential trend reversals when combined with MACD signals.

Additionally, incorporating Bollinger Bands can further enhance your analysis by identifying overbought or oversold conditions in conjunction with MACD.

This combination of RSI and Bollinger Bands can provide a more thorough view for optimizing your trading strategy.

What Is the Best Timeframe for MACD Strategy?

The best timeframe for a MACD strategy depends on the trader's preferred trading style and objectives. Short-term traders often utilize lower timeframes like 5-minute or 15-minute charts for quick signals, while swing traders and investors may find daily or weekly charts more suitable for reliable signals.

Backtesting reveals that different timeframes can impact signal accuracy. Adapting the MACD timeframe to match market conditions and personal trading approach is essential for success in intraday analysis, swing trading, and other trading techniques.

What Is the Success Rate of MACD Trading Strategy?

The success rate of the MACD trading strategy, as indicated by backtesting data, typically ranges between 70-80%.

Achieving consistent success with this strategy involves understanding market conditions, employing proper risk management techniques, and mastering trading psychology.

Traders must carefully consider profit potential, entry and exit signals, stop losses, position sizing, and market volatility to optimize their performance when utilizing the MACD indicator in their trading strategies.

Conclusion

To sum up, mastering MACD indicator techniques can greatly enhance your trading strategy. By understanding MACD signals, implementing crossover and divergence strategies, analyzing histogram patterns, fine-tuning settings, and integrating with other indicators, traders can optimize their decision-making process.

Backtesting these techniques for validation is essential for success in the market. Just like a skilled craftsman uses various tools to create a masterpiece, a trader must utilize different indicators to achieve profitable results in the financial markets.