When navigating the intricate world of trading, mastering key technical indicators can be likened to decoding a complex puzzle.

By harnessing the power of indicators like MACD, Fibonacci retracements, and volume analysis, you can unlock valuable insights into market trends and potential price movements.

Understanding how these indicators interact and influence each other is not just a skill but a necessity for traders looking to stay ahead in the fast-paced and competitive realm of financial markets.

Want to uncover the secrets to enhancing your trading strategies and gaining a deeper understanding of market dynamics?

Understanding Moving Averages

To understand moving averages effectively, traders must grasp the fundamental concepts behind how these indicators smooth price data to reveal underlying trends. In trading, moving averages are essential technical analysis tools that help identify potential trend reversals and support and resistance levels in the stock market.

There are two common types of moving averages: simple moving averages (SMA) and exponential moving averages (EMA). The EMA gives more weight to recent prices, making it more responsive to short-term price movements compared to the SMA.

Utilizing Relative Strength Index (RSI)

Moving on from understanding moving averages, delve into the practical application of the Relative Strength Index (RSI) in analyzing market momentum and identifying potential trading opportunities. The RSI is a momentum oscillator that helps traders assess the strength of price movements.

Here are key points to consider when utilizing RSI:

- RSI is scaled from 0 to 100 and indicates overbought or oversold conditions.

- Traders use RSI to confirm trends and spot divergences between price and momentum.

- RSI calculations involve comparing average gains and losses over a specified period to determine the strength of price movements.

Understanding RSI can assist in making informed decisions about market entries, exits, and potential trend reversals based on momentum analysis.

Mastering Stochastic Oscillator

The Stochastic Oscillator, a pivotal momentum indicator in trading, compares a closing price to its price range over a specific period to identify market conditions. This tool helps traders recognize overbought (above 80) and oversold (below 20) levels, signaling potential trend reversals and entry/exit points.

Comprised of %K and %D lines that fluctuate between 0 and 100, understanding how to interpret these signals is crucial for making informed trading decisions. Effectively utilizing the Stochastic Oscillator enhances risk management strategies, guiding you in determining optimal entry and exit points.

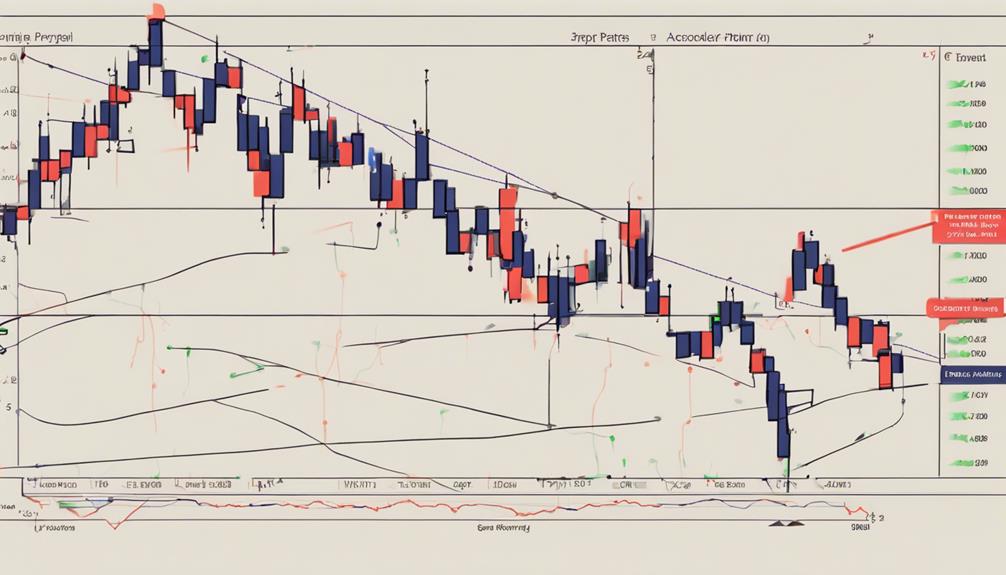

Identifying Chart Patterns

Identifying chart patterns serves as a crucial aspect of technical analysis in trading, offering valuable insights into potential market trends and price movements. When analyzing chart patterns, you can look for specific formations that indicate various market conditions.

Here are some key patterns to watch for:

- Head and shoulders pattern signaling a potential trend reversal

- Double top pattern indicating a possible downside reversal

- Flags and pennants as continuation patterns after strong price movements

Implementing Technical Indicators in Trading

Utilizing key technical indicators in trading enhances your ability to interpret market dynamics and make informed decisions based on trend analysis and momentum shifts.

Incorporating moving averages like the simple moving average (SMA) and exponential moving average (EMA) can help identify potential price trends and support/resistance levels.

By analyzing price movements alongside trend lines and price patterns, technical indicators offer valuable insights into market trends and potential price action.

Understanding how to use these tools effectively can improve your ability to navigate the complexities of the market and make strategic trading decisions.

Which Technical Indicators Should I Focus on to Master Trading?

When mastering trading, it’s essential to focus on the right technical indicators. Use a guide to technical indicators to understand which ones will benefit your trading strategy the most. From moving averages to the relative strength index, each indicator serves a specific purpose in analyzing market trends and making informed trade decisions.

Frequently Asked Questions

Why Professional Traders Don T Use Indicators?

Professional traders don't use indicators because they prioritize understanding supply, demand, and market psychology directly through price action. They believe indicators can lag, leading to delayed signals. Real-time analysis and market conditions guide their decisions.

What Indicator Do Most Traders Use?

Most traders rely heavily on indicators like Moving Averages, RSI, MACD, Fibonacci retracement, and Bollinger Bands. These tools act as a navigator guiding you through the turbulent waters of the market, like a lighthouse in the storm.

How Do You Master Technical Analysis in Trading?

To master technical analysis in trading, understand key indicators like moving averages, RSI, and Bollinger Bands. Practice using tools to spot trends, analyze historical data for insights, recognize patterns for entry/exit. Continuously refine skills by staying updated and testing strategies.

Which Technical Indicator Is the Most Accurate?

In trading, the most accurate technical indicator depends on various factors like market conditions and strategy. Consider the Relative Strength Index (RSI) for overbought/oversold, MACD for trend changes, Bollinger Bands for breakouts, Fibonacci for support/resistance, and ATR for volatility.

Conclusion

As you navigate the turbulent waters of trading, remember that mastering key technical indicators is like having a compass in a stormy sea. By understanding moving averages, RSI, stochastic oscillator, and chart patterns, you can steer your trading ship with precision and confidence.

Implement these tools wisely, and you'll chart a course towards success in the dynamic world of trading. Stay focused, stay informed, and let the indicators be your guiding stars.