You might be thinking that understanding investment in the Hong Kong stock market trends sounds complex and overwhelming.

However, breaking down the market's dynamics can provide valuable insights into potential opportunities for growth and profit.

As you explore the intricacies of Hong Kong's stock market landscape, you'll uncover key trends that influence investment decisions and strategies.

Stay tuned to discover how these trends can shape your approach to investing in one of Asia's most significant financial hubs.

Key Trends in Hong Kong Stock Market

Key trends in the Hong Kong stock market showcase a strong focus on technology stocks and sustainability factors driving investment decisions. The Hong Kong market has seen a surge in technology stocks like Tencent and Alibaba, which have significantly influenced market performance. Investors are increasingly considering sustainability and ESG factors when making investment decisions, reflecting a growing consciousness towards responsible investing practices. Thematic investing has also gained traction, with sectors such as renewable energy and fintech becoming popular choices among investors looking for long-term growth opportunities.

Moreover, the market has witnessed a rising interest in IPOs and SPACs as alternative investment avenues, providing investors with more options to diversify their portfolios and participate in emerging opportunities. These trends indicate a shift towards more dynamic and forward-thinking investment strategies in the Hong Kong stock market, aligning with global market trends towards tech-driven and sustainable investments. By staying informed and adaptable to these evolving trends, investors can position themselves strategically for potential growth and success in the market.

Factors Driving Stock Market Trends

The Hong Kong stock market trends are primarily influenced by a combination of economic indicators, political stability, global market conditions, industry-specific factors, and investor sentiment. When considering investment opportunities in the Hong Kong stock market, it's crucial to understand the various factors that can drive market trends.

- GDP growth: The overall economic health of Hong Kong, as indicated by GDP growth rates, can impact stock market performance.

- Political stability: Changes in government policies and trade relations can influence investor confidence and market movements.

- Global market conditions: Factors like US-China trade tensions and geopolitical events can create volatility in the Hong Kong stock market.

- Investor sentiment: Market psychology, fund flows, and investor sentiment play a significant role in shaping short-term trends in the stock market.

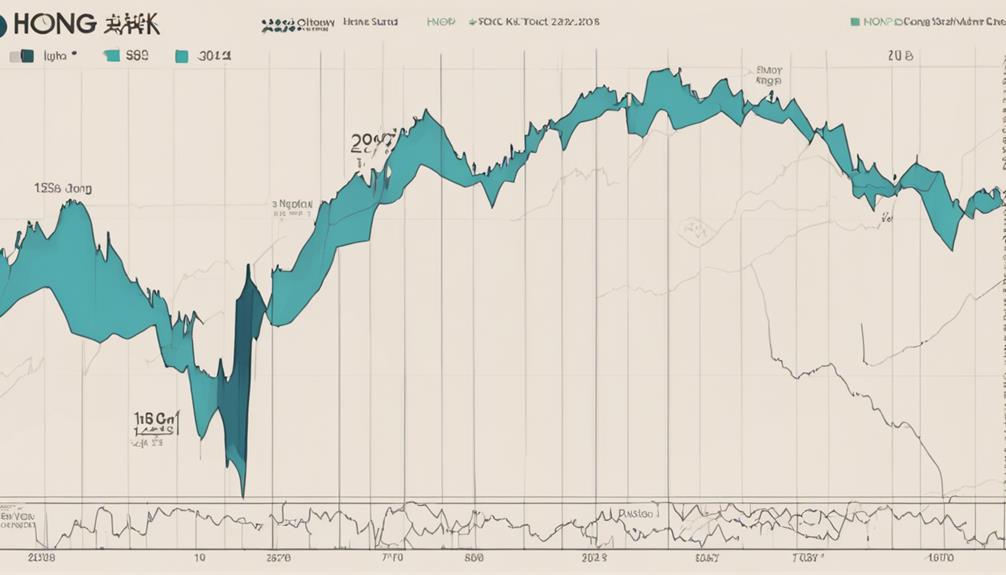

Analyzing Historical Stock Market Trends

Delve into the depths of historical stock market trends in Hong Kong to gain a comprehensive understanding of market dynamics and potential investment insights.

The Hang Seng Index (HSI) has seen significant growth, surpassing 36,000 points in 2015. Despite facing market corrections such as the Asian Financial Crisis in 1997 and the Global Financial Crisis in 2008, the Hong Kong stock market has shown resilience, bouncing back from downturns to achieve new highs.

Sector analysis reveals the impact of industries like technology, finance, and real estate on overall market performance and investor sentiment. By studying historical trends, investors can grasp market cycles, volatility patterns, and identify promising investment opportunities within the Hong Kong stock market.

Understanding the historical context of market fluctuations and the market's ability to recover and thrive can guide investors in making informed decisions for long-term growth and success.

Impact of Global Events on Stock Market

Analyzing the impact of global events on the Hong Kong stock market reveals intricate connections between economic developments and market fluctuations. Global events such as trade tensions, political unrest, economic indicators, and global health crises play significant roles in influencing investor sentiment and stock prices in Hong Kong.

Here are a few key points to consider:

- Trade tensions between major economies like the US and China can create market uncertainty and drive fluctuations in stock prices.

- Political unrest in Hong Kong or mainland China can lead to heightened market volatility and impact investor confidence.

- Economic indicators from global economies serve as crucial factors affecting the Hong Kong stock market's performance.

- Outbreaks of global health crises, such as the COVID-19 pandemic, can result in significant ripple effects on stock prices and overall market stability.

Understanding how these diverse global events interplay with the Hong Kong stock market is essential for investors navigating through dynamic market trends.

What Are the Key Trends and Approaches to Investing in the Hong Kong Stock Market?

Understanding Hong Kong stock investment is crucial for investors in the current market. Key trends include the rise of technology and green energy sectors, as well as increasing foreign interest in the market. Approaches like value investing and diversification are essential for success in the Hong Kong stock market.

Strategies for Navigating Market Trends

Navigating market trends successfully involves implementing strategic approaches such as utilizing technical analysis and employing risk management tools like stop-loss orders. By conducting technical analysis, you can identify trends and patterns in stock price movements, helping you make informed investment decisions.

Implementing stop-loss orders is crucial for managing risk and protecting your investments from potential losses. Stay informed about market news, economic indicators, and geopolitical events as they can significantly impact stock market trends.

Diversifying your portfolio across different sectors and asset classes can help mitigate risks associated with specific trends, ensuring a more balanced investment approach. Consider using trailing stop orders to lock in profits as stock prices trend upwards, maximizing your gains while minimizing potential losses.

What Are the Key Trends to Watch for in the Hong Kong Stock Market?

When it comes to a comprehensive approach to Hong Kong stock investment, it’s essential to keep an eye on key trends in the market. Some of the current trends to watch include the integration of technology, impact of international trade policies, and the growing influence of ESG considerations on investment decisions.

Frequently Asked Questions

Is It Good to Invest in Hong Kong Stocks?

Investing in Hong Kong stocks can be good, but consider market volatility, economic indicators, and risk assessment. Evaluate sector performance, market analysis, and investor sentiment. Seek long-term growth, diversify your portfolio, and conduct market research for investment opportunities.

Why Is Hong Kong Stock Market Falling?

Feeling uncertain about why the Hong Kong stock market is falling? Economic instability, trade tensions, and political uncertainty stir up market volatility. Investor panic rises with regulatory changes, corporate scandals, and global recession fears.

Is Hong Kong a Good Country to Invest In?

Hong Kong offers a stable economy with diverse market opportunities, boosting investor confidence. The regulatory environment ensures transparency and risk management. Despite occasional volatility and political risks, the financial sector presents promising trends for investment.

What Is the Stock Market Forecast for Hong Kong?

You'll find market analysis in Hong Kong crucial for understanding investment opportunities. Economic indicators guide trading strategies. Risk assessment is key due to market volatility. Consider industry performance, capital growth, investor sentiment, and stock valuation for informed decisions.

Conclusion

As you navigate the bustling waters of the Hong Kong stock market, remember to stay vigilant and adapt to the changing tides.

Just like a skilled sailor adjusting their sails to the wind, you must be flexible and responsive to market trends.

By analyzing historical data, understanding global events, and implementing strategic approaches, you can chart a successful course towards your investment goals.

So set sail with confidence, and let the waves of opportunity carry you to financial success.