Gann Theory has long been regarded as a powerful tool in the realm of trading. Its intricate blend of mathematical precision and time analysis offers traders a unique perspective on market behavior. By incorporating Gann's principles into their strategies, traders gain a deeper understanding of the underlying market dynamics, leading to more informed decision-making.

The question remains: how exactly does this theory translate into tangible improvements in trading performance? Let's explore the intriguing interplay between Gann Theory and trading results to uncover the rationale behind its effectiveness.

Principles of Gann Theory

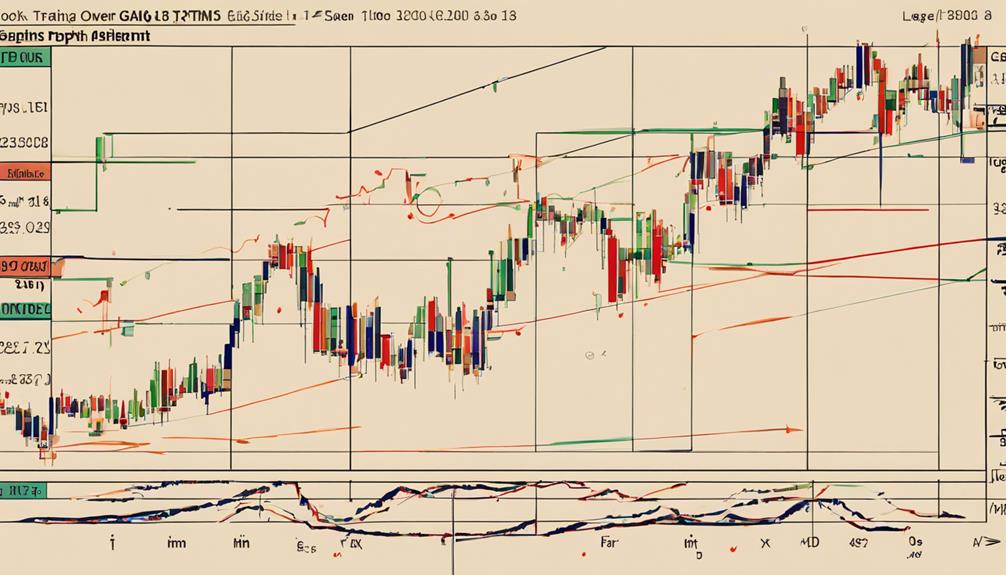

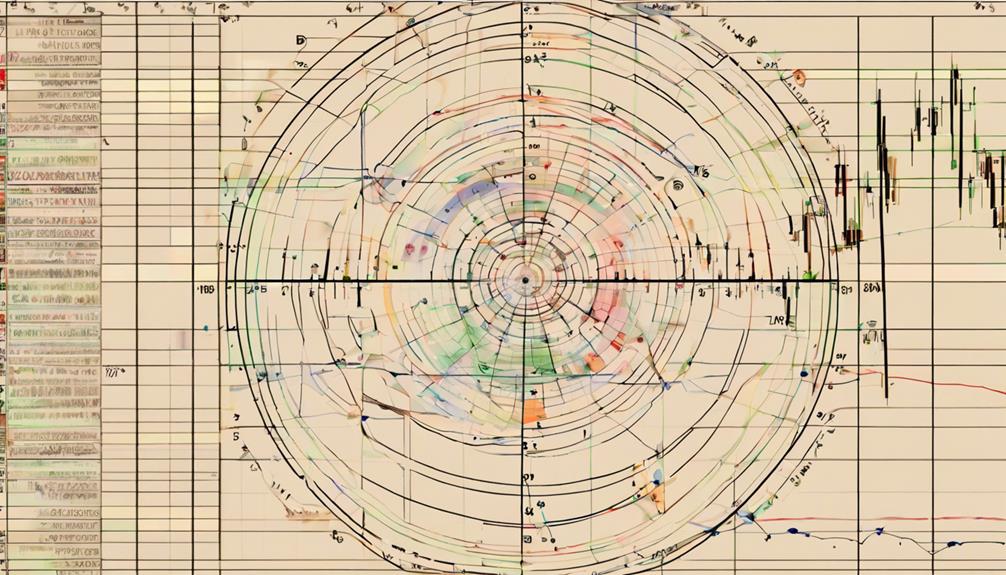

The foundational principles of Gann Theory, rooted in a sophisticated blend of geometry, mathematics, and time cycles, serve as a powerful framework for analyzing and interpreting price fluctuations in financial markets. Gann Theory provides traders with a comprehensive set of tools such as Gann Angles, Gann Fans, and Gann Squares to identify key support and resistance levels accurately.

By conducting price and time analysis, traders can recognize patterns and angles that signify potential market trends. This technical analysis tool aids in determining optimal entry and exit points, enabling traders to make well-informed decisions based on concrete data rather than speculation.

Understanding the principles of Gann Theory allows traders to delve deeper into the dynamics of market movements, empowering them to navigate volatile market conditions with more confidence and precision. By integrating Gann Theory into their trading strategies, investors can enhance their ability to interpret market dynamics and make strategic decisions that align with their financial goals.

Gann Angles Explained

Utilizing geometric principles, Gann Angles serve as pivotal tools in technical analysis for predicting price movements and determining key market levels.

- Gann Angles are instrumental in identifying support and resistance levels within the market, aiding traders in making informed decisions.

- These angles, based on specific degrees such as the 1×1 angle representing a 45-degree inclination, help traders anticipate bullish or bearish trends.

- Traders rely on Gann Angles to pinpoint potential entry and exit points, enhancing their ability to capitalize on market opportunities efficiently.

Gann Theory Applications

Gann Theory Applications extend beyond basic technical analysis, offering traders a systematic approach to predict market behavior and optimize trading strategies. Utilizing Gann Angles, traders can pinpoint crucial support and resistance levels, aiding in making well-informed trading decisions.

By analyzing stock price movements through geometric shapes and angles, Gann Theory provides a structured framework for forecasting market trends and potential stock reversals. This approach enables traders to enhance their trading results significantly by accurately predicting investor activity and stock movements.

The theory's ability to predict market trends and reversals with up to 90% accuracy showcases its effectiveness in guiding traders towards profitable opportunities. By incorporating Gann Theory into their trading strategies, traders gain a unique perspective on market dynamics, empowering them to make strategic decisions based on a comprehensive understanding of price movements and investor behavior.

Enhancing Trading Strategies With Gann

Enhancing trading strategies through the application of Gann Theory offers traders a structured framework to optimize decision-making and predict market movements with precision.

- Identifying Support and Resistance: Gann Theory provides clear support and resistance levels, assisting traders in determining optimal entry and exit points for their trades.

- Analyzing Trend Strengths and Reversal Areas: By incorporating Gann strategies, traders can assess the strength of trends and identify potential reversal areas, enhancing the timing of their trades.

- Predicting Market Highs and Lows: Gann Theory's accuracy in forecasting market highs and lows enables traders to make informed decisions regarding price movements, contributing to successful trading outcomes.

Utilizing tools like the Gann Fan tool within Gann Theory aids in setting precise price targets and implementing effective risk management strategies. By integrating these aspects into their trading approaches, traders can enhance their overall performance and increase the likelihood of achieving consistent profitability in the financial markets.

Benefits of Gann Theory

With its proven track record of providing traders with over 92% accuracy in making profitable trading decisions, Gann Theory stands out as a valuable tool for enhancing trading performance. By incorporating Gann square numbers, traders can set precise targets and stop-loss levels, leading to more effective market study and prediction of price movements. This methodology not only enhances the understanding of market dynamics but also enables traders to execute profitable trades by leveraging the principles of Gann Theory.

However, to reap the full benefits of Gann Theory, traders must have the necessary application experience and dedicate time to mastering its techniques. Correctly applying Gann Theory requires a deep understanding of its concepts and their practical implications in the market. With the optimal application of Gann Theory, traders can significantly enhance their trading results and achieve consistent profitability in their trading endeavors.

How Does Gann Theory Specifically Improve Trading Results?

Gann theory enhances profitable trading with Gann theory by using geometry, time, and price to predict market trends. This approach helps traders identify potential entry and exit points, manage risk, and maximize profits. By incorporating Gann theory into their trading strategy, investors can improve their overall trading results.

Frequently Asked Questions

How Effective Is Gann Theory?

Gann Theory is highly effective, boasting over 90% accuracy in predicting asset movements. It is globally trusted for intraday trading strategies, utilizing geometric shapes and time cycles for market analysis. Gann angles enhance support, resistance, and trend analysis.

What Is Gann Strategy in Trading?

Gann strategy in trading utilizes Gann angles to pinpoint crucial support and resistance levels. This method harnesses geometric patterns and natural cycles to forecast market highs and lows with remarkable precision. By employing this strategy, traders gain a systematic approach for analyzing market movements.

Do Gann Angles Work?

Gann angles have proven effective in predicting support and resistance levels, aiding traders in identifying trend changes and entry/exit points. Historical data analysis supports the accuracy of Gann angles in forecasting price movements, showcasing their systematic approach and geometric principles.

What Is the Most Important Gann Angle?

The most critical Gann Angle is the 1×1 angle, a 45-degree angle on price charts. It helps identify key support and resistance levels, assess trend strength, and pinpoint entry/exit points. Understanding and utilizing this angle is crucial for accurate price movement predictions.

Conclusion

In conclusion, Gann Theory offers a systematic approach to analyzing stock market movements through the use of geometry, mathematics, and time cycles.

By understanding Gann Angles and utilizing tools like Gann Squares and Fans, traders can make informed decisions on entry and exit points, predict market trends, and identify key support and resistance levels.

For example, a trader who applied Gann Theory correctly accurately predicted a major market reversal and profited significantly from the trade.