Imagine yourself navigating a maze of market fluctuations with the Aroon Indicator as your trusty guide, pointing out potential trends and reversals. Understanding these 10 tips to effectively interpret Aroon Indicator signals can significantly impact your trading decisions and outcomes.

From identifying trends to managing false signals, each tip plays a crucial role in maximizing your trading strategy's effectiveness. So, let's embark on this journey together and uncover the secrets to mastering the art of reading Aroon Indicator signals for successful trading ventures.

Trend Identification

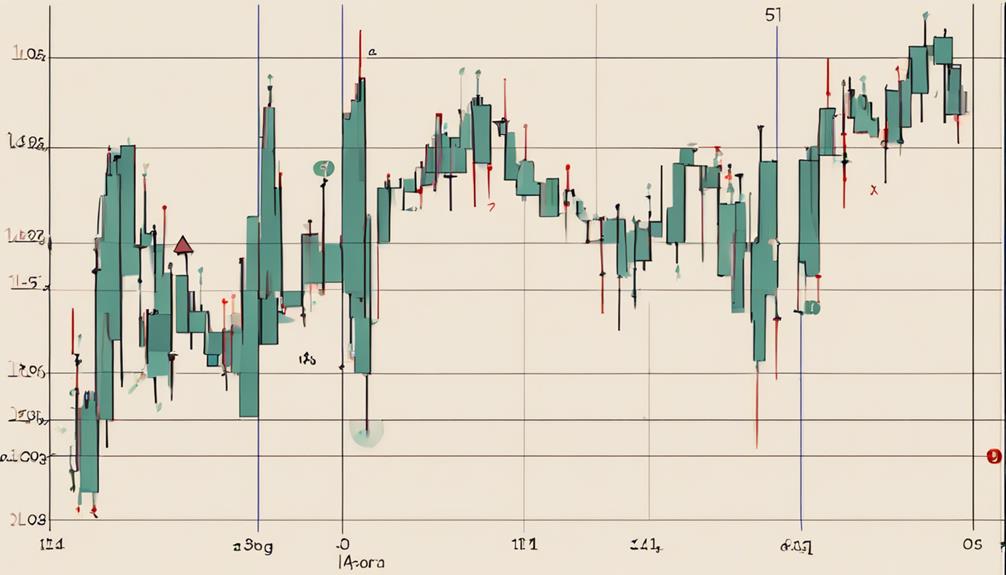

When analyzing trends using the Aroon Indicator, it's crucial to pay close attention to the relationship between Aroon-Up and Aroon-Down values. Aroon-Up crossing above Aroon-Down signifies a potential uptrend, while Aroon-Down surpassing Aroon-Up suggests a possible downtrend. Strong trend direction is indicated when Aroon values are above 50.

Conversely, both Aroon indicators below 50 may point towards a consolidation phase. Understanding these relationships is essential for effectively identifying trend directions using the Aroon Indicator.

Crossover Signals Interpretation

When interpreting Aroon crossover signals, it's crucial to understand the significance of these points.

Bullish crossovers, where Aroon-Up crosses above Aroon-Down, suggest a potential uptrend, while bearish crossovers, with Aroon-Down crossing above Aroon-Up, hint at a possible downtrend.

Traders often rely on these signals to time their entry and exit strategies accurately.

Signal Crossover Importance

Why are crossovers between the Aroon-Up and Aroon-Down lines crucial for traders using the Aroon indicator? Crossovers serve as pivotal points for traders to assess potential trend reversals and determine entry or exit positions. Here's why these crossovers are essential:

- Witnessing Aroon-Up cross above Aroon-Down can ignite excitement for a potential bullish trend reversal.

- Observing Aroon-Down surpass Aroon-Up may trigger concern over a looming bearish trend reversal.

- Crossover signals provide precise entry points for traders seeking optimal positions.

- Monitoring crossover patterns diligently enables traders to accurately interpret trend strength and direction.

These critical crossover signals are indispensable for traders leveraging the Aroon indicator to make informed decisions regarding market movements.

Bullish and Bearish Signals

To effectively interpret bullish and bearish signals in the Aroon indicator, traders must keenly observe the crossovers between Aroon-Up and Aroon-Down lines. A bullish signal occurs when Aroon-Up crosses above Aroon-Down, suggesting a potential upward price movement, while a bearish signal is generated when Aroon-Down crosses above Aroon-Up, indicating a potential downward price trend.

These crossovers provide crucial entry and exit points for traders to consider. Crossovers above the 50 level in the Aroon indicator can further signify a strengthening trend. By understanding and interpreting these crossover signals accurately, traders can make well-informed decisions in the market, optimizing their trading strategies for potential gains.

Timing Entry and Exit

Initiate your trading strategies by closely monitoring Aroon Indicator crossover signals for precise entry and exit timing. When interpreting these signals, consider the following:

- Aroon crossovers signify potential trend reversals or shifts in market strength, aiding in decision-making.

- A bullish trend is indicated when Aroon-Up crosses above Aroon-Down, suggesting increasing positive momentum.

- Conversely, a bearish sentiment is implied when Aroon-Down crosses above Aroon-Up, indicating a potential downtrend.

- Leveraging Aroon crossovers for timing entry and exit points can enhance your ability to capitalize on emerging market trends efficiently.

Trend Strength Assessment

Assess trend strength efficiently by examining the relationship between Aroon Up and Aroon Down values when using the Aroon Indicator. Higher Aroon Up values indicate stronger uptrends, while elevated Aroon Down values suggest robust downtrends. Values nearing 100 signal significant trend strength, whereas values close to 0 indicate weak trends.

Traders gauge trend strength by comparing the levels of Aroon Up and Aroon Down. Understanding the dynamics of trend strength through the Aroon Indicator empowers traders to make well-informed decisions regarding market direction.

Spotting Trend Reversals

To spot trend reversals effectively, focus on reversal confirmation signals and timing entry points in your analysis.

Confirm the reversal by waiting for the Aroon-Up to cross below Aroon-Down before considering a shift in trend direction.

Timing your entry points accurately after a confirmed crossover can enhance your trading decisions.

Reversal Confirmation Signals

When identifying potential trend reversals using the Aroon indicator, pay close attention to the crossover point where the Aroon-Up line falls below the Aroon-Down line. To confirm these reversals effectively, observe the Aroon lines moving in opposite directions and consider the steepness of the lines for strength indication. Combining Aroon reversal signals with other technical indicators can enhance the accuracy of predicting trend changes significantly.

Witnessing the Aroon-Up crossing below the Aroon-Down can be a powerful emotional trigger for a potential shift in market sentiment.

The sight of Aroon lines diverging can evoke a sense of anticipation for a confirmed trend reversal.

Aroon crossovers signaling a change from a bullish to a bearish trend may instill fear or excitement, depending on your position.

Assessing the steepness of the Aroon lines might bring clarity and confidence to your trend reversal analysis.

Timing Entry Points

Timing entry points when spotting trend reversals with the Aroon Indicator involves closely monitoring crossovers above or below the 50 level to confirm potential trend changes.

Aroon crossovers, where Aroon-Up crosses above Aroon-Down, signal a shift in market sentiment and potential trend reversal. When Aroon-Up moves above 50 and Aroon-Down falls below 50, it indicates a strengthening uptrend.

Conversely, if Aroon-Down rises above 50 while Aroon-Up drops below, it suggests a downtrend gaining momentum. By observing these crossovers near the 50 level, traders can pinpoint optimal entry points to capitalize on emerging trends.

Utilizing Aroon Indicator signals for timing entry points enhances decision-making and aids in executing more effective trading strategies during trend reversals.

Utilizing Parallel Movements

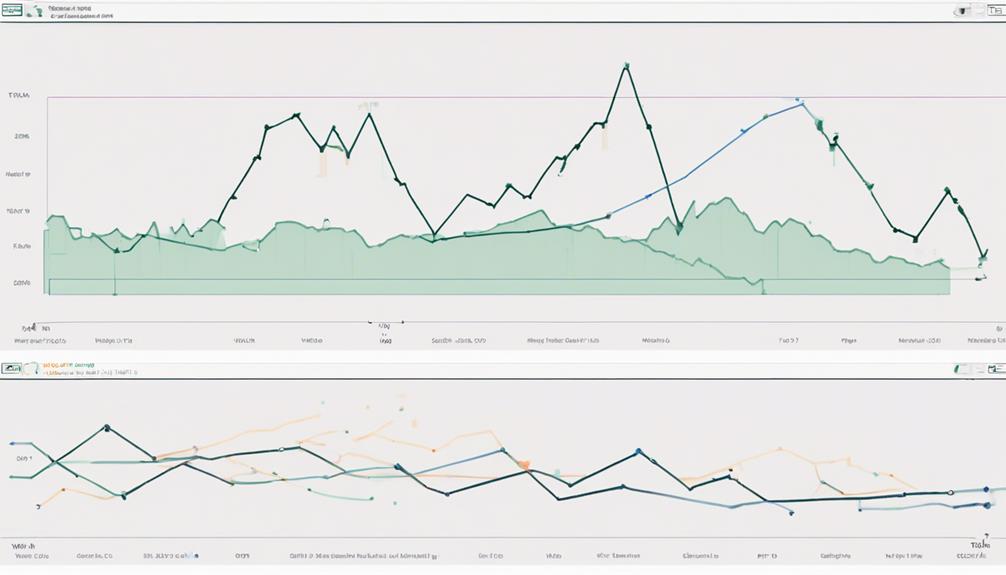

By identifying parallel movements in the Aroon Up and Aroon Down lines, traders can gain valuable insights into the strength of a trend or a consolidation phase. When both lines move in parallel, it indicates a lack of trend direction. Here's how to interpret parallel movements:

- Both lines running parallel and below 50: Suggests a consolidation phase.

- Both lines moving in parallel above 50: Signals a strong trend continuation.

- Lines moving in the same direction but not parallel: May indicate a developing trend.

- Helps traders distinguish between trend strength and consolidation periods: Essential for making informed trading decisions.

Understanding these patterns can assist you in navigating the market with more confidence and clarity.

Identifying Consolidation Patterns

When both Aroon-Up and Aroon-Down readings are below 50, it indicates a period of consolidation in the market.

Traders can identify consolidation patterns by observing triangle formations, recognizing rectangle patterns, and understanding flag formations.

These patterns signify a lack of strong trend movements and suggest a period of price stability and indecision in the market.

Spotting Triangle Formations

To identify consolidation patterns when reading Aroon indicator signals, focus on spotting triangle formations where the Aroon-Up and Aroon-Down lines converge towards each other. When you see these triangle formations, it indicates potential price consolidation before a potential breakout. Here are some key points to consider:

- Triangle formations in Aroon signal upcoming price consolidation phases.

- Convergence of Aroon-Up and Aroon-Down lines within a triangle suggests a period of indecision in the market.

- Traders use triangle patterns to anticipate potential breakouts or trend reversals.

- Understanding these formations with Aroon can assist in making well-informed trading decisions regarding trend continuation or reversal.

Recognizing Rectangle Patterns

Spotting triangle formations in the Aroon indicator signals can lead to recognizing rectangle patterns, crucial in identifying consolidation phases in price movements. Rectangle patterns represent periods where price fluctuates within a set range, bounded by horizontal support and resistance levels. These patterns suggest a temporary pause in the trend, indicating potential price consolidation before a breakout.

Understanding Flag Formations

Understanding flag formations in Aroon indicators reveals crucial insights into identifying consolidation patterns within the market.

- Flags signal potential consolidation, offering opportunities for strategic market entries.

- These patterns indicate a temporary pause in the prevailing trend before resuming.

- A bullish flag emerges after a strong upward movement, followed by a brief consolidation phase.

- Conversely, a bearish flag follows a significant price drop, leading to a temporary consolidation period.

Understanding Trend Stages

Trend stages within the Aroon indicator are crucial for evaluating price movement strength and direction. Aroon-Up signifies the periods since the last high, while Aroon-Down indicates the time since the last low. By understanding these metrics, traders can gauge the momentum and potential trend changes in the market.

Crossovers between Aroon-Up and Aroon-Down can signal shifts in the trend direction. This analysis aids in distinguishing between bullish, bearish, or consolidating market conditions. Monitoring the progression of these trend stages provides valuable insights into the evolving market dynamics and assists traders in making informed decisions based on the prevailing trend strength and direction.

Utilizing Aroon Oscillator

Exploring the application of the Aroon Oscillator provides traders with valuable insights into market momentum and potential trend changes. When utilizing the Aroon Oscillator, consider the following to enhance your trend analysis:

- Interpreting Bullish Momentum: Positive values in the Aroon Oscillator indicate bullish momentum, signifying potential buying opportunities.

- Identifying Strong Trends: Aroon Oscillator values nearing +100 suggest robust uptrends, while values approaching -100 indicate strong downtrends.

- Spotting Trend Weakness: Values close to zero in the Aroon Oscillator may indicate a lack of trend strength, signaling caution in your trading decisions.

- Anticipating Trend Reversals: Aroon Oscillator can help in anticipating potential trend changes, providing early signals for market shifts.

Mastering the Aroon Oscillator can sharpen your trend analysis skills and improve your trading strategies.

Combining Aroon With Other Indicators

When combining the Aroon indicator with other technical analysis tools, such as moving averages, volume indicators, or RSI, traders can gain valuable insights into confirming trend direction or strength.

Incorporating moving averages alongside Aroon can help validate the trend direction, providing a clearer picture of whether a trend is forming.

Volume indicators paired with Aroon can confirm the strength of a trend by analyzing the trading activity accompanying the price movements.

Additionally, integrating the Relative Strength Index (RSI) with Aroon can assist in identifying potential overbought or oversold conditions, aiding traders in making informed decisions about entry or exit points.

Managing False Signals

To navigate through the potential pitfalls of false signals in Aroon indicators, it's essential to cross-verify these signals with other technical indicators or price action analysis techniques. When managing false signals, consider the following:

- Confirmation: Confirm Aroon signals with other indicators to reduce false readings.

- Price Action Analysis: Incorporate price action analysis to validate Aroon indicator signals.

- Caution with Crosses: Be cautious of false signals when Aroon lines cross frequently but prices remain stagnant.

- Additional Filters: Use additional filters or criteria to validate signals and reduce false readings.

How Can I Use Aroon Indicator Signals Effectively in Trading?

When incorporating aroon indicator signals into your trading strategy, it is essential to pay attention to both the bullish and bearish signals. By using these signals effectively, traders can identify potential entry and exit points in the market, allowing for more informed decision-making and improved overall performance.

Frequently Asked Questions

How Do You Read an Aroon Indicator?

To read an Aroon Indicator effectively, look for Aroon-Up crossing over Aroon-Down for uptrend signals. Aroon-Down surpassing 50 indicates a downtrend. Crossovers offer entry/exit points, with values above 50 showing strong trends, while both lines below 50 suggest consolidation or flat prices.

How Accurate Is the Aroon Indicator?

Aroon Indicator's accuracy shines with strong trends near 100, crossovers for reversals, and readings above 50 signaling highs or lows. Combining it with other tools boosts trend forecasting precision, making it a valuable asset.

What Is the Aroon Crossover Strategy?

To understand the Aroon crossover strategy, look for Aroon-Up crossing above Aroon-Down, indicating bullish trends. This method helps identify potential trend changes and offers buy or sell signals based on trend strength for better market decisions.

Is the Aroon Indicator Leading or Lagging?

The Aroon Indicator is a lagging indicator, tracking past highs and lows. It reacts to price movements by calculating time since last highs or lows. Due to its lagging nature, additional analysis is crucial for timely trades.

Conclusion

In conclusion, mastering the art of reading Aroon Indicator signals can greatly enhance your trading success. By applying the tips provided, you can effectively identify trends, interpret crossover signals, assess trend strength, and spot reversals with confidence.

Remember to combine Aroon with other indicators, manage false signals, and always practice risk management. With diligence and skill, navigating the market using the Aroon Indicator can lead to profitable outcomes.

Happy trading!