Exploring the nuances of market analysis through the lens of Keltner Channels offers traders a structured approach to navigate the complexities of financial markets. By honing in on key strategies and techniques, traders can uncover hidden opportunities and fine-tune their decision-making process.

The utilization of Keltner Channels not only provides a framework for identifying trends but also offers a systematic way to enhance trading precision. Understanding how to integrate these channels effectively can significantly impact one's ability to capitalize on market movements.

Understanding Keltner Channels in Market Analysis

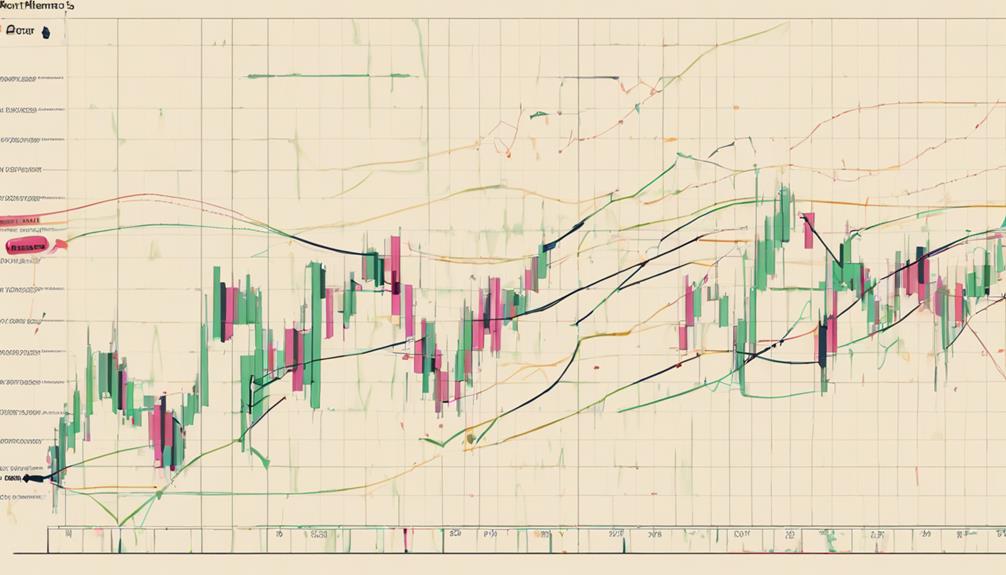

In market analysis, a fundamental understanding of Keltner Channels is essential for interpreting trends and volatility effectively. Keltner Channels are a technical analysis tool that combines an exponential moving average (EMA) with the average true range (ATR) to assess market conditions and potential price movements.

The middle line of the Keltner Channel typically represents a 20-period EMA, serving as a reference point for determining the trend. The upper and lower bands of the channel are calculated using the EMA and ATR to indicate potential overbought and oversold levels in the market.

By analyzing the price movements relative to these bands, traders can identify optimal entry and exit points for their trades. Understanding Keltner Channels allows traders to incorporate volatility-based indicators into their trading strategies, enabling them to make more informed decisions based on the prevailing market conditions.

This analytical approach provides a structured method for assessing trends and determining potential trading opportunities.

Implementing Keltner Channels for Trend Identification

Utilizing Keltner Channels in market analysis offers a systematic approach for identifying trends and potential trading opportunities based on price movements relative to the indicator's bands. Keltner Channels incorporate an exponential moving average (EMA) to track the market trend.

The upper band is calculated as EMA plus two times the Average True Range (ATR), while the lower band is calculated as EMA minus two times the ATR. These bands help traders in trend identification by providing visual cues on the market's direction.

Additionally, Keltner Channels assist in spotting potential breakouts and trend reversals, forming the basis for informed trading decisions. Traders can further enhance the effectiveness of Keltner Channels by adjusting the settings to suit different market conditions and timeframes.

Utilizing Keltner Channels for Entry and Exit Points

When employing Keltner Channels for establishing entry and exit points in trading scenarios, strategic consideration of price volatility and trend dynamics is paramount. Keltner Channels offer valuable insights into market analysis by indicating potential entry points near the lower band in uptrends and the upper band in downtrends.

For exit points, traders often look to the middle band after a significant price movement following a trend. By utilizing Keltner Channels effectively, traders can enhance their risk management strategies, ensuring precise timing of trades and efficient management of positions. This approach allows for a more systematic and disciplined trading process, increasing the potential for successful outcomes.

Enhancing Volatility Analysis With Keltner Channels

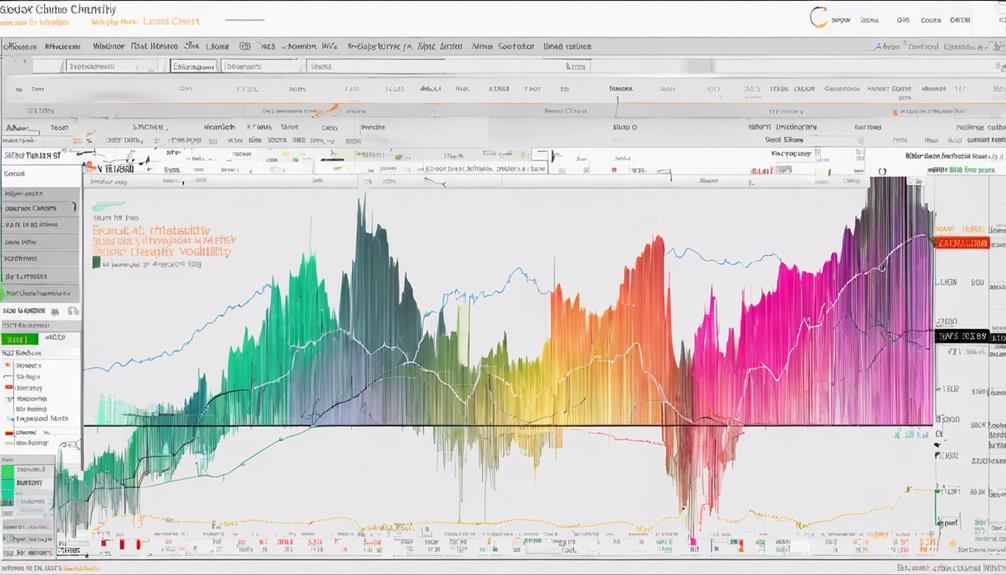

Enhancing market analysis through the utilization of Keltner Channels involves a strategic focus on volatility dynamics and trend identification. Keltner Channels rely on the Average True Range (ATR) to gauge market volatility, which in turn determines the width of the bands.

By analyzing volatility with Keltner Channels, traders can pinpoint potential breakouts and assess the strength of prevailing trends. During periods of high volatility, the bands widen to reflect increased market uncertainty, while they narrow in times of lower volatility. Traders have the flexibility to adjust the ATR multiplier, allowing them to customize the channel width according to prevailing market conditions.

Understanding volatility patterns through Keltner Channels equips traders with valuable insights for making well-informed trading decisions. By fine-tuning their volatility analysis, traders can enhance their ability to identify optimal entry and exit points, ultimately improving their overall trading performance.

Integrating Keltner Channels With Other Indicators

The integration of Keltner Channels with other indicators offers traders a comprehensive approach to confirming trading signals and gaining insights into market volatility and trend direction. Here are some ways in which Keltner Channels can be effectively combined with other indicators:

- Combining with RSI or MACD: Utilizing Keltner Channels alongside Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help validate potential trade entry or exit points.

- Integration with Bollinger Bands: Combining Keltner Channels with Bollinger Bands can provide a more thorough analysis of volatility and trend direction, enhancing decision-making processes.

- Enhancing trend-following strategies with moving averages: Integrating Keltner Channels with moving averages can improve trend-following strategies by providing additional confirmation signals.

- Pinpointing reversal areas with Fibonacci retracement: Using Keltner Channels in conjunction with Fibonacci retracement levels can help traders identify potential reversal points in the market, aiding in decision-making for entry or exit strategies.

How Can Keltner Channels Enhance Market Analysis?

Keltner Channels are a valuable tool for spotting market trends with Keltner Channels. By using these channels, traders can better understand price movements and identify potential entry and exit points. This can greatly enhance market analysis and improve trading decisions for both beginners and experienced traders.

Frequently Asked Questions

What Is the Best Strategy for the Keltner Channel?

The best strategy for the Keltner Channel involves combining trend-pullback and breakout approaches, utilizing the middle line for trend identification and entries, and implementing effective risk management. Adjust settings according to market conditions for optimal analysis results.

Is Keltner Channel Strategy Profitable?

Yes, the Keltner Channel strategy has proven to be profitable based on a net profit of $4,882.20, a 48.82% return, and a 43.12% success rate over 109 trades. Its profit factor of 1.48 and effective risk management further support its profitability.

What Is the Success Rate of the Keltner Channel?

The success rate of the Keltner Channel strategy stands at a commendable 43.12%, reflecting its capability to yield favorable outcomes. This metric underscores the strategy's effectiveness in navigating market conditions and guiding trading decisions with a balanced level of precision.

Is Keltner Channel a Leading Indicator?

The Keltner Channel is not a leading indicator. It is considered a lagging indicator, reacting to price movements after they occur. Traders often combine it with leading indicators for a more comprehensive market analysis.

Conclusion

In conclusion, the utilization of Keltner Channels in market analysis provides traders with valuable insights for trend identification, entry/exit points, and volatility analysis.

By integrating Keltner Channels with other indicators, traders can enhance their trading strategies and decision-making processes.

Experimenting with settings, practicing risk management, and utilizing Keltner Channels across various trading styles are essential for maximizing performance.

In a world driven by data and analysis, Keltner Channels offer a structured approach to navigating the complexities of the market.