Utilizing Gann Analysis in your trading strategy can greatly enhance your success. This method accurately predicts price movements, highlights critical support and resistance levels, and aids in determining ideal entry and exit points. Incorporating Gann angles and patterns enhances trend reversal anticipation, while focusing on time, price, and volume optimizes forecasting accuracy. By mastering Gann Theory basics and utilizing its indicators effectively, traders gain an edge in understanding market dynamics and investor behavior. Implementing these strategies can elevate your trading game to new heights, offering a competitive advantage in the financial markets.

Importance of Gann Analysis

The significance of Gann Analysis in trading strategies lies in its proven ability to provide traders with highly accurate predictions of future price movements. By incorporating Gann angles and patterns, traders can effectively anticipate trend reversals and identify key support and resistance levels in the market. This technical analysis method not only aids in pinpointing best entry and exit points but also enhances risk management strategies.

Gann analysis utilizes time cycles and geometric shapes to forecast market behavior, offering traders a complete toolkit for making informed trading decisions. Through the lens of Gann theory, traders gain a deeper understanding of market dynamics and price action, leading to improved trading performance. By embracing Gann analysis within their trading strategies, traders can leverage its predictive capabilities to navigate the complexities of the financial markets with greater confidence and precision.

Gann Theory Basics

Building a solid foundation in Gann Theory basics equips traders with essential tools for precision in predicting market movements and enhancing trading strategies. Developed by W.D. Gann, this theory focuses on time, price, and volume to forecast future price movements.

Gann Angles, such as 1×1, 1×8, and 1×4, indicate pivotal support and resistance levels that influence trading decisions. Utilizing geometric shapes and time cycles, Gann Theory can predict price movements with up to 90% accuracy. Patterns and angles of assets are key factors in understanding stock movement and investor behavior.

Utilizing Gann Angles Effectively

Utilizing Gann Angles effectively enhances traders' ability to forecast future price movements with precision. These diagonal lines, known for their vital speed, offer valuable insights into market dynamics.

Different Gann angles such as 1×1, 1×2, and 2×1 play an important role in identifying key support and resistance levels. By analyzing Gann angles, traders can assess trend strength and direction, aiding in decision-making processes.

Additionally, monitoring market rotations from one angle to another provides a detailed view of price action. Understanding Gann angles is essential in predicting potential trend reversals and anticipating price movements with more accuracy.

Incorporating these angles into trading strategies can greatly improve the ability to navigate the markets effectively. As traders master the art of interpreting Gann angles, they gain a strategic advantage in deciphering market movements and making informed trading decisions.

Integrating Gann Indicators

Integrating Gann indicators into trading strategies allows for a thorough analysis of price movements and potential turning points.

By combining Gann indicators with other technical tools, traders can gain a more complete view of the market trends.

This integration enhances decision-making processes and aids in identifying ideal entry and exit points for trades.

Gann Indicator Basics

Analyzing market dynamics through Gann indicators offers traders valuable insights into predicting price movements and identifying strategic entry and exit points.

- Gann angles and fans help predict support and resistance levels.

- Gann analysis integrates time, price, and volume factors for accurate market forecasts.

- Gann angles, like 1×1 and 1×2, determine price movement patterns.

- Gann indicators aid in identifying key entry and exit points for trading strategies.

- Integrating Gann theory enhances risk management and decision-making in trading practices.

Practical Application Tips

The practical application of Gann indicators in trading strategies enhances decision-making precision by incorporating key market dynamics. Integrating Gann Theory with trend lines and moving averages can provide a thorough technical analysis framework. Emphasizing time cycles in Gann Analysis helps traders predict market movements more accurately. Implementing risk management strategies such as setting stop-loss orders is essential when utilizing Gann Indicators to mitigate potential losses. Backtesting trading strategies and utilizing demo accounts can enhance understanding and application of Gann Theory effectively.

| Key Concepts | Benefits | Implementation |

|---|---|---|

| Support and Resistance Levels | Accurate decision-making | Identify key price levels |

| Trend Lines | Enhanced technical analysis | Visualize market trends |

| Moving Averages | Improved trend identification | Smooth out price fluctuations |

| Risk Management Strategies | Mitigating potential losses | Setting stop-loss orders |

Gann Analysis for Trend Identification

Analyzing trend lines for identification, understanding the intricate relationships between time and price, and applying geometric angles are essential components of Gann Analysis for trend identification.

By leveraging these key points, traders can gain insights into the direction and strength of trends, enabling them to make informed decisions in their trading strategies.

The integration of these elements enhances the accuracy of trend analysis, allowing traders to better anticipate potential reversals and continuation points in the market.

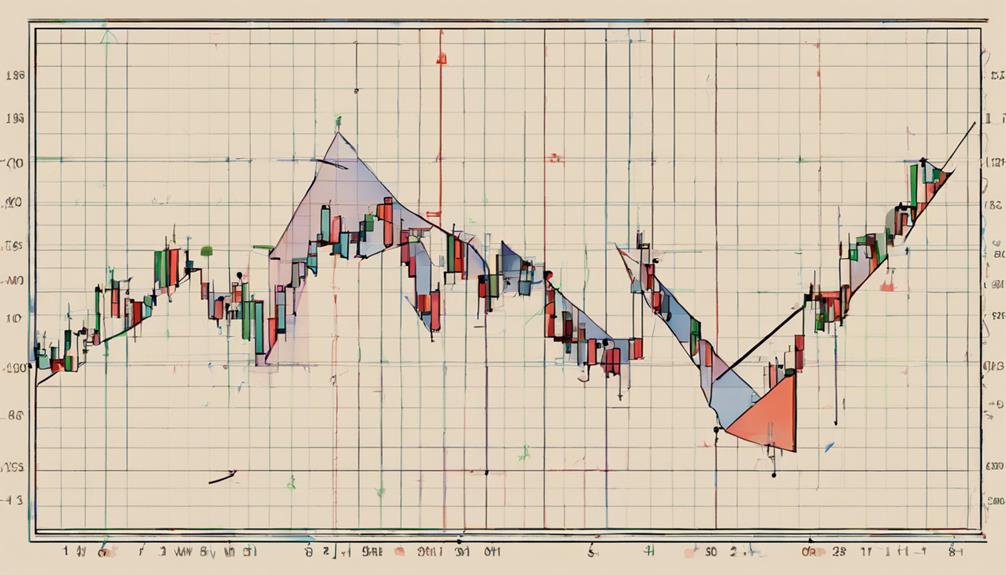

Trend Lines for Identification

Utilizing trend lines in Gann Analysis is integral for effectively identifying and interpreting market trends in trading.

- Gann Analysis utilizes trend lines to visualize market trends.

- Trend lines connect swing highs and lows, aiding in trend identification.

- These lines assist in determining potential entry and exit points.

- By following trend lines, traders can evaluate the strength of price movements.

- Trend lines also help assess the sustainability of market trends.

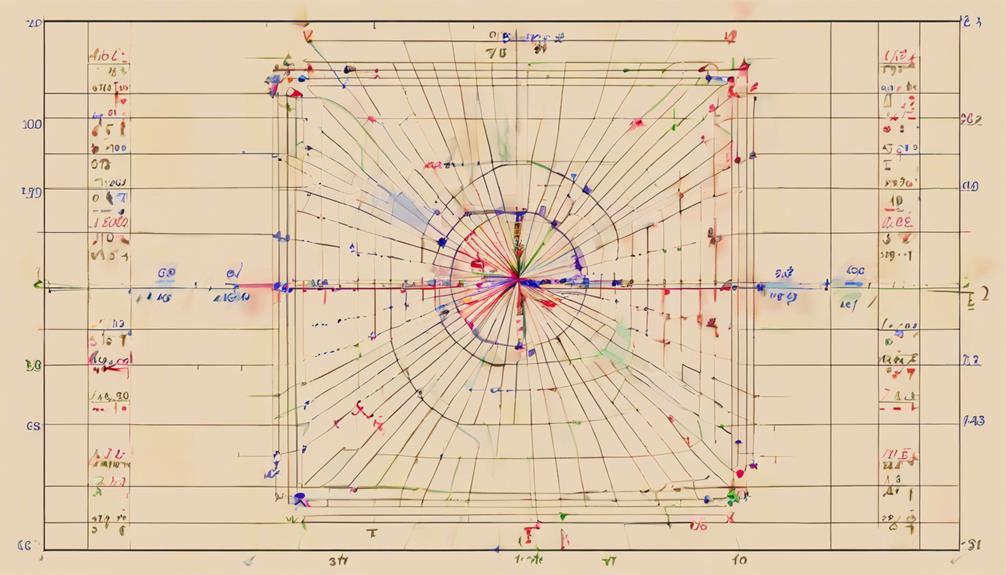

Time and Price Relationships

Examining time and price relationships is foundational in Gann Analysis for accurately identifying trends and forecasting market movements. By analyzing Gann Angles and geometric angles, traders can anticipate price movements and establish key support and resistance levels. Gann theory highlights the significance of time cycles in determining potential market reversals, aiding traders in making informed decisions.

Understanding the intersection of time and price is essential for developing a robust trading strategy based on data-driven insights. Incorporating these principles into trading practices can enhance the ability to navigate fluctuating market conditions effectively. By leveraging time and price relationships, traders can adapt their strategies to align with market trends and maximize trading opportunities within support and resistance levels.

Geometric Angles Application

Incorporating geometric angles in Gann Analysis provides traders with a structured approach to identifying trends and evaluating their strength within the market.

- Gann Analysis utilizes geometric angles like 1×1, 1×2, and 2×1 to identify trend direction and strength.

- These angles help establish support and resistance levels for precise market analysis.

- Price movements follow specific geometric patterns and angles in Gann Analysis.

- Gann angles aid in anticipating potential trend reversals and key price levels.

- Understanding and implementing Gann angles greatly enhance trend identification in trading strategies.

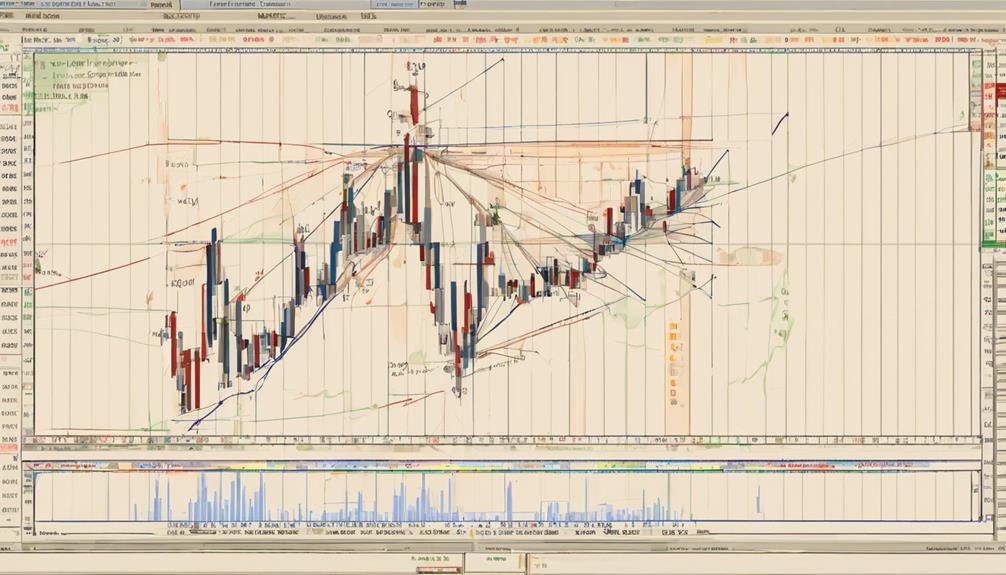

Enhancing Entry and Exit Points

Gann analysis offers traders a strategic advantage by enabling precise identification of key support and resistance levels for ideal entry and exit points in trading. By utilizing Gann angles, traders can pinpoint perfect entry points based on price movements and trend strength. This technique also facilitates the setting of stop-loss orders at critical levels to effectively manage risk during trades.

Integrating Gann indicators enhances the accuracy of entry and exit decisions by analyzing price action and patterns effectively. The structured framework provided by Gann theory aids traders in determining entry and exit points, thereby improving the overall effectiveness of their trading strategies. Ultimately, incorporating Gann analysis into trading approaches can lead to more informed and strategic decision-making processes, resulting in potentially improved trading outcomes.

Practical Gann Strategy Application

Utilizing practical applications of Gann theory in trading strategies can greatly enhance decision-making processes and improve trading outcomes. When applying Gann strategies, traders can benefit from:

- Identifying Support and Resistance Levels: Gann analysis helps in accurately pinpointing important levels where the price is likely to face obstacles or find support.

- Utilizing Gann Angles for Technical Analysis: Incorporating Gann angles along with trend lines and moving averages enhances the depth and accuracy of technical analysis.

- Predicting Market Movements with Time Cycles: Emphasizing time cycles in Gann theory aids in predicting potential market movements with precision.

- Implementing Risk Management Techniques: Integrating risk management tools like stop-loss orders is essential for successful trading based on Gann analysis.

- Enhancing Skills Through Backtesting and Demo Accounts: Backtesting strategies and utilizing demo accounts can improve understanding and application of Gann theory in real trading scenarios.

Maximizing Trading Success With Gann

To maximize trading success with Gann, strategic implementation of Gann theory principles is paramount for informed decision-making and risk management. Incorporating Gann Analysis allows traders to identify support/resistance levels essential for executing well-informed trades.

By utilizing tools such as Gann Angles, Price Time, and Time Cycles, traders can pinpoint key market levels where significant price movements are likely to occur. Placing stop-loss orders at Gann Theory levels enhances risk management by limiting potential losses.

Backtesting trading strategies using Gann Analysis aids traders in refining their approaches and making more effective decisions based on historical data. Adopting structured trading practices grounded in Gann Theory is essential for maximizing success in the markets.

Accuracy and Reliability of Gann Theory

The precision and reliability of Gann Theory in predicting future price movements are underscored by its incorporation of geometric shapes, time factors, and volume analysis.

- Gann Angles like 1×1, 1×2, and 2×1 provide reliable support and resistance levels.

- Gann Theory's use of geometric shapes and time factors enhances accuracy in forecasting.

- Gann Analysis incorporates time cycles for precise market trend predictions.

- Gann Theory's focus on price, time, and volume factors increases the reliability of trading strategies.

Gann Theory's accuracy stems from its ability to combine various elements such as geometric shapes, time cycles, and volume analysis. By utilizing Gann Angles for identifying key support and resistance levels, traders can make informed decisions. Additionally, the incorporation of time factors and market trend predictions further solidifies the reliability of Gann Theory in enhancing trading strategies.

Traders find value in the predictive power of Gann Theory, which can provide insights into potential price movements with a high level of accuracy, making it a valuable tool in the financial markets.

Frequently Asked Questions

What Is the Golden Ratio of Gann?

The Golden Ratio of Gann, akin to Fibonacci ratios, is a mathematical principle used in Gann analysis to identify key levels in market trends. It signifies a balance between time cycles and price movement, serving as support or resistance levels.

Traders leverage this ratio for trend identification, pinpointing entry points based on chart patterns. Understanding the Golden Ratio aids in risk management and helps predict future projections using historical data and technical indicators.

What Is the Most Important GANN Angle?

The most important Gann angle in technical analysis is the 1×1 angle, which represents a 45-degree slope on the price chart. This angle is critical for determining market strength, identifying trend direction, and pinpointing significant support and resistance levels.

Traders closely monitor price movements in relation to the 1×1 angle to anticipate potential trend reversals. The 1×1 angle serves as a primary reference point for making trading decisions based on Gann theory.

What Is the Gann Rule of 4?

The Gann Rule of 4 is a fundamental principle in Gann analysis that divides a stock's price movement into four equal parts. This technique aids traders in identifying important price targets and potential reversal points by segmenting price movements.

How Do You Analyze a Trading Strategy?

Analyzing a trading strategy involves evaluating risk management, entry signals, technical indicators, backtesting results, market trends, stop losses, profit targets, support and resistance levels, and position sizing. Evaluate the strategy's historical performance, consistency in various market conditions, and the effectiveness of key indicators.

Monitor drawdowns and overall profitability to determine long-term viability. Adapting strategies based on data-driven analysis is essential for enhancing trading performance and achieving consistent results.

Conclusion

To sum up, Gann analysis offers traders a powerful tool for enhancing their trading strategies. By understanding the basics of Gann theory, utilizing angles and indicators effectively, and identifying trends accurately, traders can improve their entry and exit points, ultimately maximizing their trading success.

The reliability and accuracy of Gann theory make it a valuable addition to any trader's toolkit, providing a systematic approach to maneuvering the complexities of the financial markets.

Gann analysis is truly a game-changer in the world of trading.