In the world of trading, the Advance-Decline Line can be likened to a compass guiding you through the vast seas of market movements.

Have you ever wondered how this technical tool can offer valuable insights that shape your trading decisions?

Understanding the intricacies of the ADL functionality can be a game-changer in your approach to analyzing market breadth and trends.

As we unravel the layers of its functionality, you will uncover key insights that can potentially transform the way you navigate the complexities of the stock market.

Definition and Purpose of Advance Decline Line

The Advance-Decline Line, a fundamental tool in market analysis, tracks the net advancing and declining stocks within a given market index. It serves as a crucial indicator of market breadth and overall trend health. By calculating net advances (advancing issues minus declining issues), traders can forecast stock market direction and identify potential trend reversals.

This information is invaluable for confirming trends and making informed trading decisions. The AD Line plays a pivotal role in understanding market direction and identifying potential reversals, equipping you with essential insights to navigate the dynamic landscape of the stock market. Utilizing this tool effectively can lead to more informed and strategic trading decisions based on the underlying market dynamics.

Understanding ADL Calculation Process

How does the Advance-Decline Line (ADL) calculation process provide real-time insights into market breadth and direction?

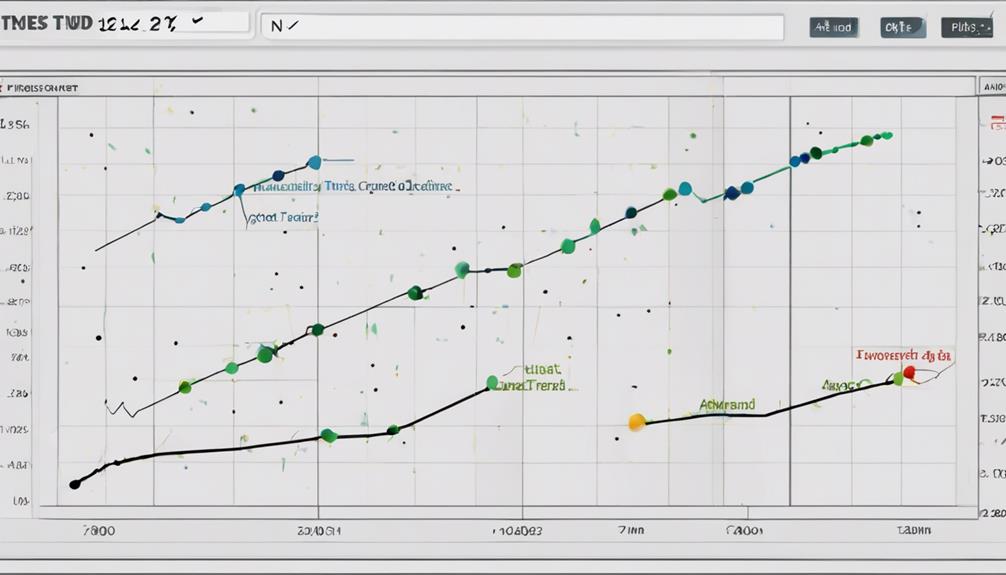

The ADL is derived by summing the Net Advances, which represent the difference between advancing and declining issues. By calculating ADL values daily using the formula ADL = Net Advances + Previous ADL value, analysts can track the daily changes in market breadth.

This constant updating of ADL values offers a dynamic view of market direction, acting as a breadth indicator. Creating a time-series of ADL values enables investors to identify market trends and potential reversals promptly.

Therefore, understanding the ADL calculation process is crucial for gaining valuable insights into the broader market movements.

Benefits of Utilizing Advance Decline Line

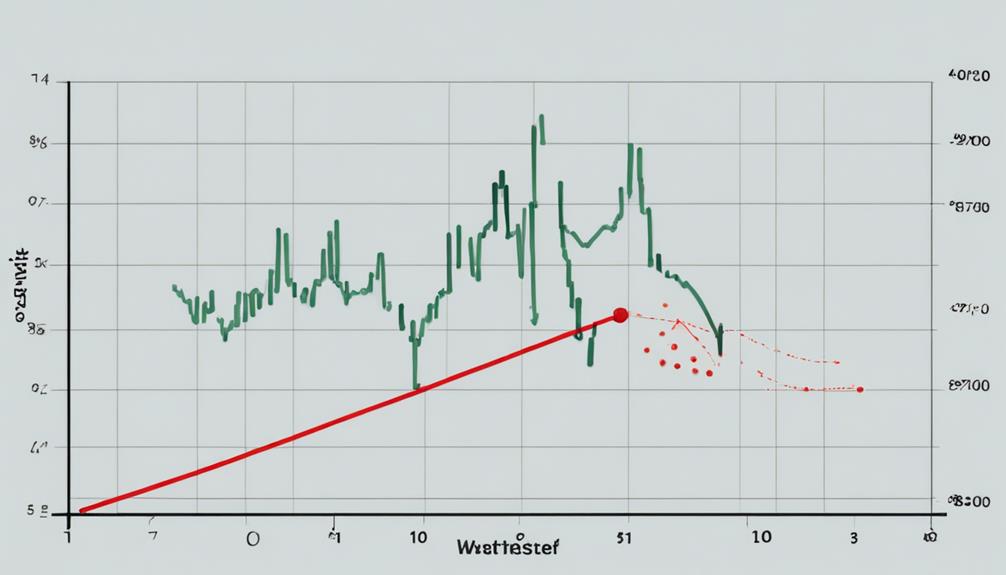

Utilizing the Advance Decline Line provides traders with a comprehensive tool for assessing market breadth and potential trend reversals. By tracking net advancing and declining stocks, this indicator offers insight into market strength and weakness.

Traders rely on the Advance-Decline Line to confirm trends and make informed decisions when predicting stock market directions. Analyzing the AD Line chart enables traders to identify divergences, crossovers, and monitor slope for valuable information.

It's crucial to combine the Advance-Decline Line with other indicators to conduct a thorough and accurate comprehensive analysis. This approach helps traders avoid misleading signals and enhances their ability to make well-informed trading decisions based on a broader market perspective.

Limitations of Advance Decline Line

Considering the constraints of Advance-Decline Line, traders must supplement their analysis with additional indicators to mitigate the risk of misleading signals and ensure robust decision-making in the dynamic stock market environment. The limitations of Advance-Decline Line, such as its restricted historical data and potential oversight of market nuances, can impede its effectiveness, especially in concentrated markets.

To address these shortcomings, it's crucial to combine Advance-Decline Line with other indicators for a more comprehensive approach to technical analysis. While Advance-Decline Line serves as a valuable tool for measuring market strength and spotting potential reversals, its limitations highlight the necessity of a multifaceted strategy to enhance decision-making and navigate the complexities of the stock market successfully.

How Does the Advance Decline Line Functionality Impact Beginners?

The beginner’s advance decline line is a valuable tool for novice traders. By tracking the number of stocks advancing versus declining, it provides a clear gauge of market strength. This functionality helps beginners make more informed decisions, leading to better trading outcomes and increased confidence in their abilities.

Can the Advance Decline Line and CMF Indicator be Used Together for Trading Insights?

When it comes to enhancing trading with CMF indicator, using the Advance Decline Line in conjunction can provide valuable insights. By analyzing the cumulative movement of both indicators, traders can gain a more comprehensive understanding of market trends and potential trading opportunities.

Practical Application in Technical Analysis

To effectively apply the Advance-Decline Line (ADL) in technical analysis, traders utilize it as a tool to confirm market trends and validate the strength of existing trends. The AD Line measures the breadth of market participation, offering insights into possible trend reversals and the overall strength or weakness of a trend. Here are three key ways the ADL can be practically applied in technical analysis:

- The ADL helps confirm market trends by reflecting the net advancing and declining stocks.

- Traders rely on the ADL to identify potential trend reversals and validate the strength of existing trends.

- Plotting the ADL chart alongside other indicators aids in detecting bullish or bearish divergences, assisting in decision-making processes.

Frequently Asked Questions

What Does the Advance-Decline Line Show?

The Advance-Decline Line shows the cumulative net advances of advancing vs. declining stocks in a market index. It offers a comprehensive view of market participation, indicating strength with a rising line and potential weakness with narrowing participation.

How Do You Interpret Advance Decline Ratio?

When interpreting the advance-decline ratio, remember higher than 1 means more rising stocks, signaling bullish vibes. Below 1 indicates more falling stocks, hinting at bearish feels. It's a key tool for assessing market health and predicting potential shifts.

What Is the Advance-Decline Line in Tradingview?

The Advance-Decline Line in Tradingview is a cumulative indicator of net advances, reflecting market breadth and trend strength. By plotting it, you can visually assess market participation, confirm trends, and spot potential reversals.

What Is the Formula for the Advance-Decline Line?

To calculate the Advance-Decline Line (ADL), add net advances to the previous day's ADL value. Net advances result from subtracting declining stocks from advancing stocks. This formula tracks market breadth changes and trends effectively.

Conclusion

In conclusion, the Advance-Decline Line is a powerful tool for traders seeking to understand market breadth and trends. By tracking advancing and declining stocks, this indicator provides valuable insights for decision-making in the stock market.

While not without limitations, the ADL's ability to analyze market direction and forecast movements is unmatched. Incorporating the ADL into technical analysis can lead to groundbreaking discoveries and revolutionize trading strategies, making it a must-have tool for any serious trader.