Enhancing market predictions through the application of Gann Theory is a meticulous process that demands attention to detail and strategic analysis. By unraveling the intricacies of Gann angles, traders can uncover valuable insights into market behavior.

However, merely scratching the surface won't suffice; a deeper understanding of Gann indicators and their implications is essential.

Stay tuned to discover how these 10 tips can elevate your market predictions and trading strategies to new heights of precision and profitability.

Key Principles of Gann Theory

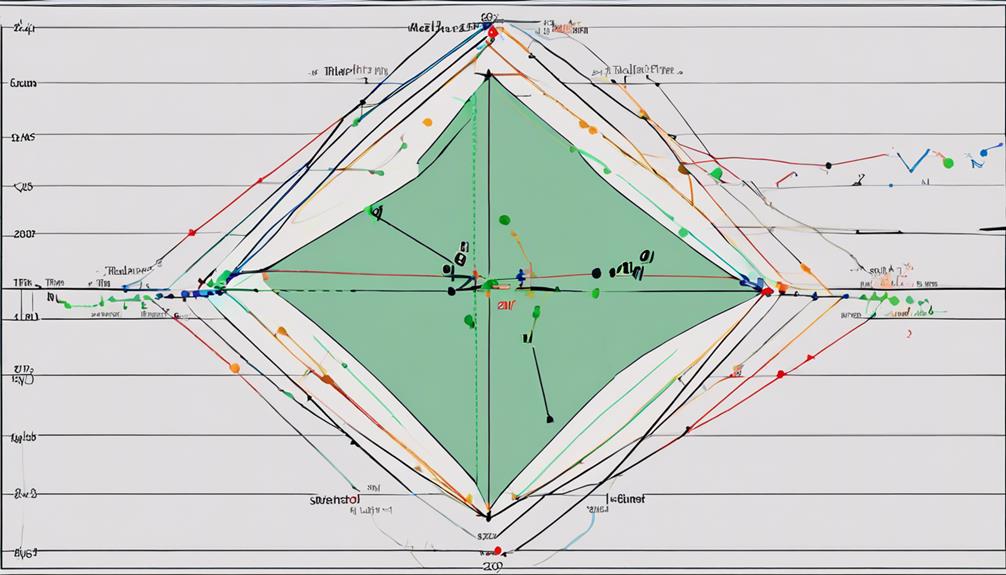

Key Principles of Gann Theory encompass a systematic approach to analyzing market dynamics through the strategic integration of time, price, and volume metrics. Central to Gann Theory are Gann Angles, which are diagonal lines drawn on price charts to predict future price movements. These angles, such as the 1×1 and 2×1, play a crucial role in forecasting potential price levels and trends. By utilizing Gann Angles, traders can identify key support and resistance levels, aiding in making informed trading decisions.

Moreover, Gann Theory emphasizes the significance of price analysis in understanding market behavior. The theory suggests that price movements follow specific patterns and ratios, allowing traders to anticipate future price action. By applying Gann's principles on price analysis, traders can gain insights into potential price targets and reversal points.

In essence, mastering Gann Angles and price analysis is fundamental to effectively applying Gann Theory in market predictions. These key principles provide traders with a structured framework for interpreting market dynamics and making informed trading decisions based on price movements.

Utilizing Gann Angles Effectively

Building upon the foundational understanding of Gann Theory's principles, the effective utilization of Gann Angles is essential in enhancing market analysis and guiding strategic trading decisions.

Gann Angles, typically drawn at a 45-degree angle (1×1), serve as crucial indicators of strong trend directions within the market. Moreover, variations such as the 1×2 and 2×1 Gann Angles play a significant role in identifying levels of support and resistance, aiding traders in making informed decisions regarding entry and exit points.

By combining Gann Angles with other technical indicators, traders can elevate the accuracy of their market analysis, leading to more successful trades. Understanding the nuances and significance of Gann Angles is paramount for traders seeking to navigate the complexities of the market effectively.

Identifying Market Trends With Gann

Gann Theory offers traders a systematic approach to identifying market trends by using precise trend analysis techniques.

By applying Gann Angles on price charts, traders can pinpoint key support and resistance levels, aiding in trend identification.

The intersection of price and time through Gann Angles provides a data-driven method for predicting market trends accurately.

Trend Analysis Techniques

Utilizing advanced trend analysis techniques, market analysts can effectively identify and interpret market trends with precision, especially when incorporating Gann Theory into their analysis.

- Gann Angles: Provide insights into the strength and direction of market trends.

- Trendlines: Offer valuable support and resistance levels for price movements.

- Cyclical Nature: Understanding the cyclical nature of market trends helps in making accurate predictions.

- Enhanced Accuracy: Combining trend analysis techniques with Gann Theory improves the accuracy of market trend forecasts, leading to informed decision-making.

Gann Angles Application

Incorporating Gann angles into market analysis provides a strategic approach to identifying and understanding market trends through the analysis of price movements along specific angles. These angles serve as crucial indicators of support and resistance levels, aiding traders in making informed decisions.

For instance, angles like 1×1 and 2×1 can signal the strength and direction of market trends, helping traders anticipate potential price movements. By integrating Gann angles with other technical indicators, traders can validate market trends more effectively, enhancing the accuracy of their predictions.

Price and Time Intersections

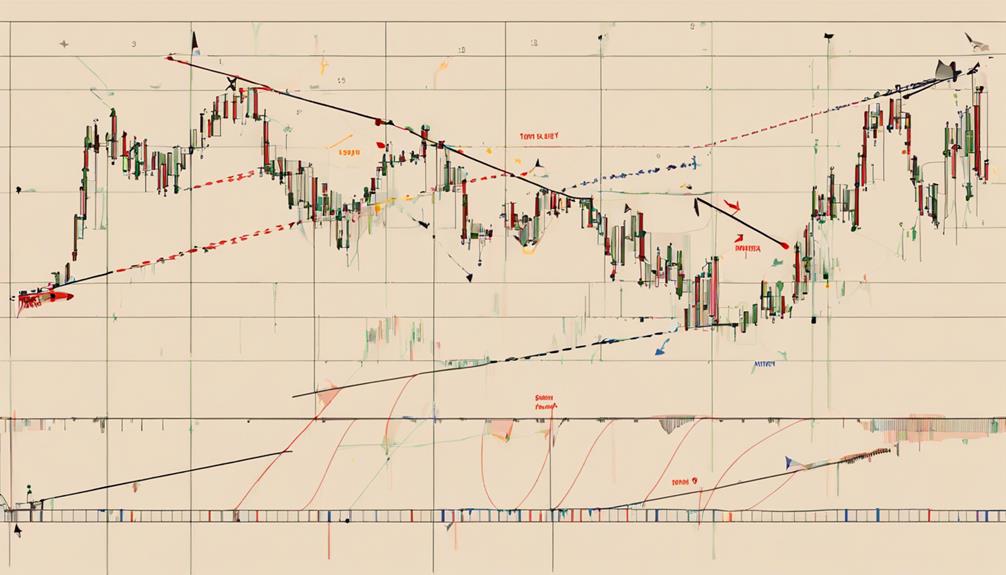

Analyzing the intersections of price and time on charts is a fundamental aspect of Gann Theory in identifying market trends. This technique of price and time analysis helps traders pinpoint key support and resistance levels, crucial for making informed trading decisions.

By observing where price movements align with specific time intervals, traders can anticipate potential turning points in the market with greater precision. Gann Theory emphasizes the significance of these intersections, as they provide valuable insights into market dynamics and help traders interpret the underlying forces driving price movements.

Incorporating Gann angles into this analysis further enhances the predictive power of identifying market trends based on price and time relationships.

- Price and time intersections offer valuable insights into market dynamics.

- Key support and resistance levels guide trading decisions.

- Gann Theory emphasizes the significance of price and time alignment.

- Gann angles enhance the predictive power of identifying market trends.

Enhancing Price Forecasting Accuracy

Enhancing the accuracy of price forecasting involves utilizing Gann angles to pinpoint critical support and resistance levels in market analysis. By incorporating Gann angles into price forecasting, traders can identify key levels where the price is likely to experience barriers or reversals. These angles act as dynamic indicators that adjust based on the price movement and time, providing valuable insights into potential price trends. When combined with other technical indicators such as moving averages or Fibonacci retracements, Gann angles can enhance the overall accuracy of market predictions.

To maintain forecasting accuracy, traders should regularly adjust Gann angles to adapt to changing market conditions. Utilizing multiple time frames in conjunction with Gann angles offers a comprehensive view of market trends, allowing traders to make more informed decisions. Additionally, setting stop-loss orders based on Gann angle support and resistance levels can help traders manage risks effectively. By leveraging Gann angles effectively, traders can improve their price forecasting accuracy and make more informed trading decisions.

Avoiding Common Gann Theory Mistakes

Common mistakes in Gann Theory include using an excessive number of angles and neglecting support and resistance levels. These errors can hinder accurate market predictions. Failing to adjust angles according to market shifts may result in flawed forecasts.

Understanding key Gann principles, interpreting charts correctly, and maintaining patience in analysis are critical in avoiding these errors and improving prediction outcomes.

Key Gann Principles

To effectively apply Gann Theory in market predictions, it is crucial to adhere to key principles that include accurately identifying support and resistance levels and adjusting Gann angles in alignment with changing market conditions.

When considering Gann Theory, it's essential to avoid using an excessive number of Gann angles to prevent confusion and maintain accuracy. Additionally, adjusting Gann angles according to market fluctuations enhances the precision of analysis.

Key Gann principles stress the significance of correctly pinpointing support and resistance levels for more effective market predictions. Ignoring these levels can lead to flawed forecasts using Gann theory. Therefore, adjusting Gann angles to align with price movements is imperative to avoid common mistakes and enhance the quality of market predictions.

Proper Chart Interpretation

Proper interpretation of charts in Gann Theory necessitates a meticulous identification of critical support and resistance levels on price charts. It is crucial to avoid common mistakes such as overloading charts with numerous Gann angles, as this can lead to confusion and inaccurate predictions.

Adapting Gann angles to changing market conditions is essential for maintaining precision in forecasting price movements. To enhance market analysis, it is advisable to combine Gann angles with other technical indicators for a more comprehensive approach.

Effectively integrating Gann Theory can help confirm trend direction and strength by utilizing angles in conjunction with trendlines. By focusing on key support and resistance levels while avoiding common errors, practitioners of Gann Theory can improve the accuracy of their market predictions.

Patience in Analysis

In the realm of Gann Theory analysis, exercising patience plays a pivotal role in steering clear of erroneous conclusions driven by premature assessments and incomplete data.

- Patience allows for thorough analysis, leading to more accurate predictions.

- Ignoring support and resistance levels can result in faulty forecasts.

- A disciplined approach helps in staying focused and avoiding impulsive decisions.

- Waiting for confirmation before acting can prevent costly mistakes and increase the chances of success.

Incorporating Gann Theory in Trading Strategies

Utilizing Gann Theory within trading strategies enhances market analysis by incorporating Gann angles to pinpoint key support and resistance levels. By integrating Gann angles into trading strategies, traders can identify crucial levels where the price is likely to face obstacles or find support, aiding in making informed decisions on entry and exit points. Gann Theory tools like Gann Fans and Gann Squares further complement this analysis, providing traders with a more comprehensive view of market trends.

When combined with other technical indicators, Gann angles offer a robust framework for assessing market dynamics and potential price movements. Adjusting Gann angles according to evolving market conditions ensures that predictions remain accurate and adaptable, optimizing trading strategies for success. Additionally, leveraging Gann Theory to recognize essential support and resistance levels facilitates effective risk management strategies, enabling traders to control and mitigate risks effectively during trading activities.

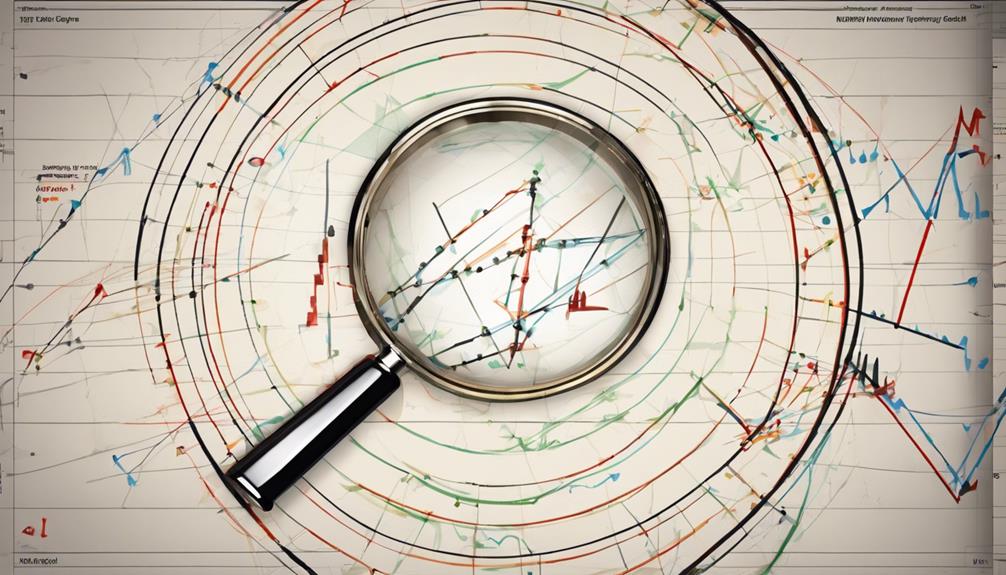

Leveraging Gann Indicators for Analysis

Employing Gann indicators in market analysis enhances predictive capabilities by offering insights into crucial support and resistance levels. Traders rely on Gann angles and squares to pinpoint market tops, bottoms, and anticipate future price movements accurately. These indicators are instrumental in forecasting trend strength and direction with precision, aiding traders in making informed decisions. By incorporating past, present, and future data, Gann indicators provide a comprehensive view of market trends, enabling traders to stay ahead of market changes. Despite the evolving market dynamics, Gann angles remain valuable tools for technical analysis and forecasting price movements.

Gann indicators provide a systematic approach to identifying key support and resistance levels.

Traders can leverage Gann angles to forecast trend movements and potential reversal points effectively.

The use of Gann squares enhances the accuracy of predicting future price levels and market turning points.

Understanding Gann Time and Price Relationships

Understanding the intricate interplay between time and price is fundamental to mastering Gann Time and Price Relationships in market analysis. Gann theory emphasizes the correlation between time and price in influencing market movements. Traders who grasp these relationships can enhance their ability to forecast future price changes accurately.

According to Gann theory, time and price are not independent variables but rather interconnected factors that drive market trends. By delving into historical data through the lens of time and price relationships, traders can refine their market predictions. Successful trading decisions, as per Gann theory, hinge on identifying optimal timing and price levels.

This analytical approach underscores the significance of considering both temporal and pricing elements in market analysis. Ultimately, comprehending and applying Gann Time and Price Relationships can provide traders with valuable insights into market dynamics, potentially leading to more informed trading strategies and decisions.

Applying Gann Theory in Different Markets

The versatility of Gann Theory extends across various markets, enabling traders to analyze price movements and anticipate future trends effectively. Traders can apply Gann Theory successfully in stocks, forex, commodities, and cryptocurrencies, harnessing its power to make accurate market predictions.

The adaptability of Gann Theory's principles, such as angles and time cycles, allows for in-depth analysis of diverse market conditions and instruments. This adaptability provides traders with a robust framework to navigate rapidly changing market environments and make informed decisions.

Continuous Learning and Improvement in Gann Theory

Continuous refinement of skills in Gann Theory through the study of geometric shapes and angles is essential for accurately predicting market movements. By mastering the interpretation of Gann angles and recognizing key support and resistance levels, traders can enhance their predictive abilities.

Historical data analysis plays a pivotal role in honing these skills, providing valuable insights into how market trends have behaved in the past and aiding in forecasting future price movements. Regular practice in drawing Gann angles and applying them to historical data sets can significantly improve decision-making processes and increase prediction accuracy.

The continuous learning process in Gann Theory is a dynamic journey that involves staying updated with market trends, experimenting with different strategies, and refining techniques based on real-time market scenarios. Each new application of Gann Theory presents an opportunity for traders to deepen their understanding and improve their forecasting skills, ultimately leading to more informed and successful trading decisions.

How Can Gann Theory Improve Market Predictions in the Futures Market?

Applying Gann theory in futures market analysis can greatly enhance market predictions. By using this technical analysis tool, traders can identify potential trend reversals, price levels, and time targets. Gann theory can provide valuable insights into market movements and assist traders in making informed decisions based on price and time analysis.

Frequently Asked Questions

What Is the 50 Percent Rule in Gann?

The 50 percent rule in Gann Theory signifies that markets often retrace 50% of a prior move. Traders utilize this level to anticipate potential reversals or trend extensions. Drawing Fibonacci retracement levels aids in pinpointing this crucial point for strategic market entries and exits.

What Is the 9 5 Gann Rule?

The 9-5 Gann Rule is a strategic analysis method involving 9 angles and 5 levels to forecast market trends accurately. These angles signify varying trend strengths, while the levels help determine support, resistance, and potential reversals, aiding traders in making informed decisions.

How Accurate Is Gann Theory?

Gann Theory is renowned for its predictive accuracy, boasting up to 90% precision in forecasting future price movements. By leveraging natural geometric shapes and time cycles through Gann angles, traders can identify support/resistance levels for reliable market predictions.

What Is the Most Important Gann Angle?

The most critical Gann angle is the 1×1 angle, representing a 45-degree angle on a price chart. It signifies equilibrium in price and time movement, aiding in identifying support/resistance levels and determining market trend strength and direction.

Conclusion

In conclusion, mastering Gann Theory is essential for improving market predictions and trading strategies. By understanding key principles, utilizing Gann angles effectively, and continuously learning and refining techniques, traders can enhance their analysis accuracy and profitability.

Avoiding common mistakes, leveraging Gann indicators, and applying theory across different markets are crucial for success. Through dedication and practice, traders can navigate the complexities of the market with confidence and precision.