In the realm of technical analysis, 'Advanced Gann Theory: A Comprehensive Technical Analysis Guide' stands as a beacon for traders seeking to navigate the complexities of market trends and cycles. With a meticulous examination of Gann Angles, Timing Counts, and other advanced tools, this book provides a roadmap for traders to decipher the enigmatic patterns of the market.

As the pages unfold, a deeper understanding of Gann's principles emerges, shedding light on the intricacies of forecasting techniques and trend analysis. This guide offers a gateway into a realm where precision meets strategy, promising a wealth of insights for those who seek to master the art of technical analysis.

Understanding Gann Theory Fundamentals

The foundation of Gann Theory lies in its multidisciplinary approach, integrating mathematics, geometry, astrology, and numerology to analyze financial markets with a holistic perspective.

Gann Theory revolves around the concepts of Price and Time, emphasizing the crucial relationship between these two elements in market analysis. By studying historical price movements and identifying significant time cycles, Gann analysts aim to forecast future price movements and potential reversal points.

Gann Angles, such as the 1×1 and 1×2 angles, serve as both trend indicators and support/resistance levels, offering valuable insights into market dynamics. Additionally, Gann Fans play a vital role in determining trend direction and pinpointing possible reversal zones based on significant price levels.

This intricate blend of Price and Time analysis forms the backbone of Gann Theory, providing traders with a comprehensive framework for making informed decisions in the financial markets.

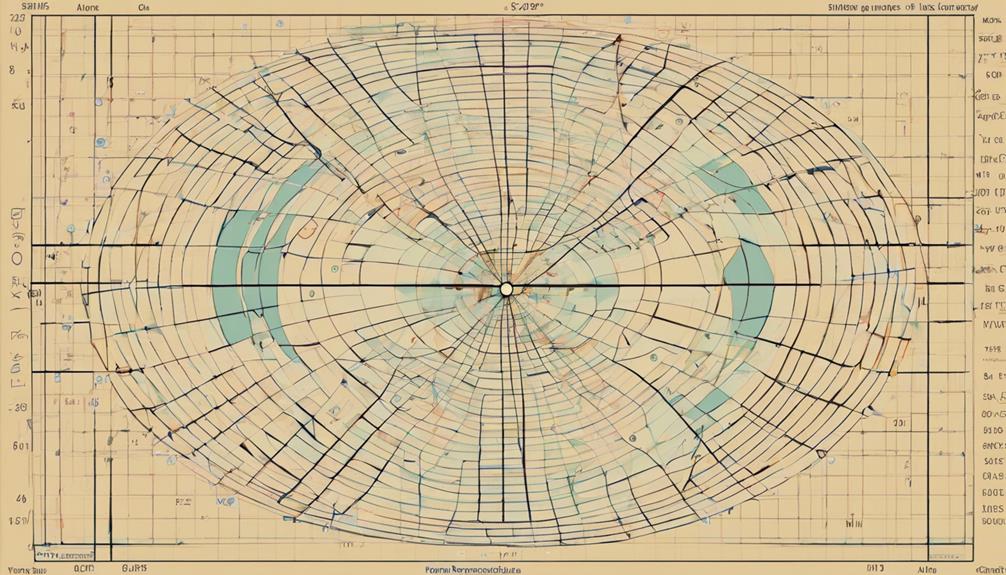

Exploring Gann Angles and Applications

With a focus on precision and strategic analysis, delving into the exploration of Gann Angles and their practical applications unveils a realm of geometric insights essential for navigating the complexities of financial markets. Gann angles play a crucial role in technical analysis and trading by providing valuable information about market movements, trend strength, and potential reversal points based on the relationship between time and price.

Here are four key aspects to consider when exploring Gann angles:

- Trend Strength: Gann angles help traders assess the strength of a trend and anticipate potential changes in direction.

- Forecasting: By utilizing Gann angles, traders can forecast future price movements and identify significant levels of support and resistance.

- Entry and Exit Points: Gann angles assist traders in determining optimal entry and exit points for their trades, enhancing decision-making processes.

- Geometric Principles: Understanding the geometric principles behind Gann angles is essential for accurate analysis and interpretation of market dynamics.

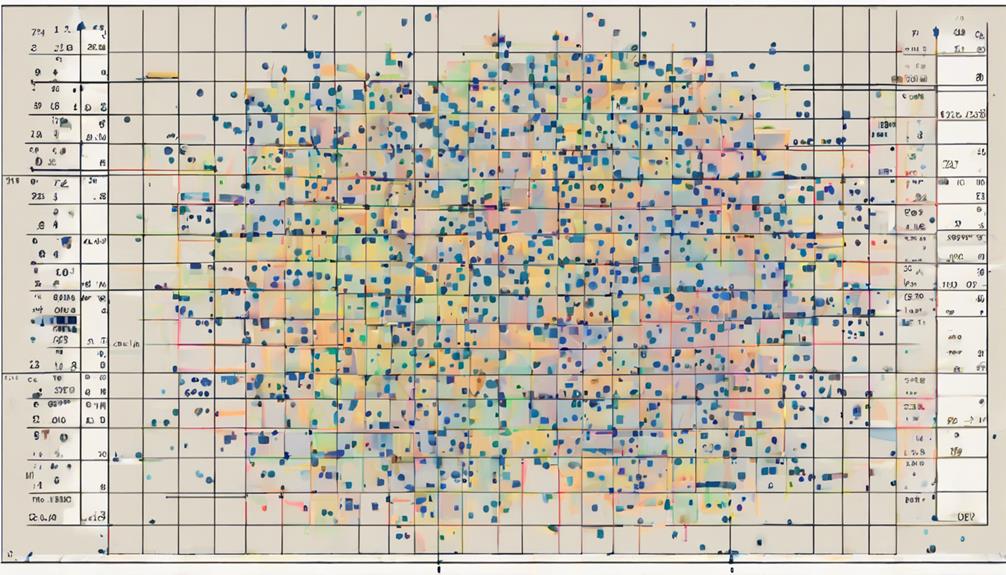

Utilizing Gann Squares for Analysis

Utilizing Gann Squares in financial analysis provides traders with a structured framework for predicting market shifts and evaluating trading opportunities based on numerical sequences and geometric relationships.

Gann Squares are grids of numbers that offer support and resistance levels, time parameters, and price targets. By integrating with Fibonacci sequences, Gann Squares enable traders to make well-informed trading decisions and projections.

This systematic approach to technical analysis equips traders with essential levels and projections, aiding in measuring market cycles, identifying trend changes, and anticipating potential reversals effectively. Understanding Gann Squares is crucial for traders seeking to navigate the complexities of the market and establish a strategic approach to trading.

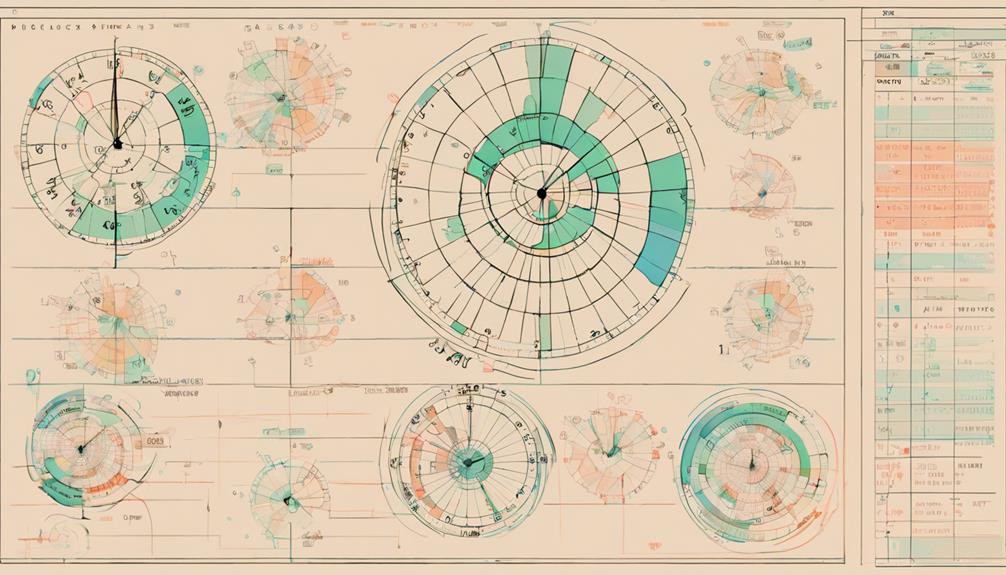

Harnessing the Power of Gann Fans

Harnessing the power inherent in Gann Fans involves strategically drawing lines from significant price points to discern trend direction and crucial support and resistance levels. Gann Fans offer a unique way to analyze market movements and identify potential trading opportunities.

Here are four key aspects to consider when utilizing Gann Fans:

- Angles: Gann Fans consist of nine specific angles based on ratios like 1:1, 2:1, and 3:1, providing valuable insights into market trends and potential price movements.

- Support and Resistance Levels: By connecting key price points, Gann Fans help traders identify important support and resistance levels, which are crucial for making informed trading decisions.

- Market Cycles and Reversal Points: Gann Fans assist in measuring market cycles, phases, and potential reversal points, aiding traders in predicting trend reversals.

- Trend Strength and Market Movements: The angles in Gann Fans offer a way to gauge trend strength and understand potential market movements, enhancing overall technical analysis capabilities.

Advanced Strategies in Gann Theory

Drawing on the foundational principles of Gann Theory, the exploration of advanced strategies delves into the intricate application of multiple Gann angles to pinpoint critical support and resistance levels in trading analysis. Advanced Gann Theory strategies go beyond basic techniques to incorporate a combination of Gann angles and Fibonacci retracement levels, enhancing the precision of market analysis.

By integrating these advanced tools, traders can gain deeper insights into market cycles, trend strength, and potential turning points, enabling more informed decision-making. Utilizing Gann Fans with additional angles beyond the conventional ratios allows for a more robust trend analysis and aids in predicting reversals with greater accuracy.

Mastery of these advanced Gann techniques empowers traders to identify key support and resistance levels, leading to improved trading systems and enhanced profitability. Overall, the strategic application of advanced Gann Theory provides traders with a comprehensive framework for navigating dynamic market conditions and optimizing trading outcomes.

Can a Beginner Apply Advanced Gann Theory Techniques?

Yes, a beginner can apply advanced Gann Theory techniques by first understanding the basics. The beginner’s guide to Gann Theory provides a comprehensive foundation for those new to the concept, making it easier to progress to more advanced techniques. Understanding the fundamentals is crucial before attempting advanced applications.

Frequently Asked Questions

How Accurate Is Gann Theory?

Gann Theory's accuracy stems from its 92.31% success rate in 286 trades over 25 days. W. D. Gann's transformation of $450 into $37,000 through precise pattern, price, and time analysis showcases the theory's effectiveness in forecasting market movements.

What Is the 50 Percent Rule in Gann?

Like a pendulum swinging, Gann's 50 Percent Rule posits that markets often retrace half of their prior move before resuming the original trend. Traders leverage this principle to pinpoint potential support/resistance levels and make strategic trading decisions.

What Is the 9 5 Gann Rule?

The 9 5 Gann Rule, attributed to W.D. Gann, suggests traders work 9 months and rest/study for 5. Balancing work and personal time enhances trading skills, prevents burnout, and improves decision-making, leading to long-term success in trading.

What Is Gann Technical Analysis?

Gann technical analysis is a methodical approach to market analysis that delves into identifying trends, highs, lows, and reversal points through mathematical, geometric, and astrological principles. It provides tools like Gann angles and squares for forecasting price movements.

Conclusion

In conclusion, 'Advanced Gann Theory: A Comprehensive Technical Analysis Guide' provides a thorough exploration of Gann Theory principles and advanced strategies for traders seeking to enhance their trading skills.

By understanding Gann Angles, Squares, and Fans, traders can identify trends, forecast market movements, and improve their trading outcomes.

For example, applying Gann Theory techniques can help traders accurately predict price levels and time cycles, leading to more profitable trading decisions.