Elliott Wave Theory stands as a cornerstone in technical analysis due to its ability to uncover underlying patterns within market movements. By offering a systematic approach to interpreting price action, this theory equips traders with a valuable tool to navigate the complexities of financial markets.

Understanding the principles of Elliott Wave Theory not only sheds light on market sentiment but also aids in identifying potential trading opportunities with a higher degree of precision. With its emphasis on structure and wave patterns, this theory provides a unique perspective that can significantly enhance one's analytical toolkit in deciphering market dynamics.

Importance of Elliott Wave Theory

Elliott Wave Theory plays a pivotal role in technical analysis by offering traders a structured framework to interpret market trends and potential turning points. By analyzing wave patterns, traders can identify key levels of support and resistance, aiding in the prediction of market movements.

The incorporation of Fibonacci ratios within the theory enables traders to pinpoint precise entry and exit points, as well as forecast price targets with a high degree of accuracy. Distinguishing between impulse waves, which move in the direction of the trend, and corrective waves, which move against the trend, allows traders to manage risk effectively and adjust their trading strategies accordingly.

Understanding Elliott Wave Theory enhances traders' ability to anticipate market reversals, providing valuable insights for decision-making. Overall, the theory's emphasis on wave patterns, Fibonacci ratios, and distinguishing between wave types equips traders with a comprehensive toolkit to navigate the complexities of financial markets and make informed trading decisions.

Market Trend Prediction With Elliott Waves

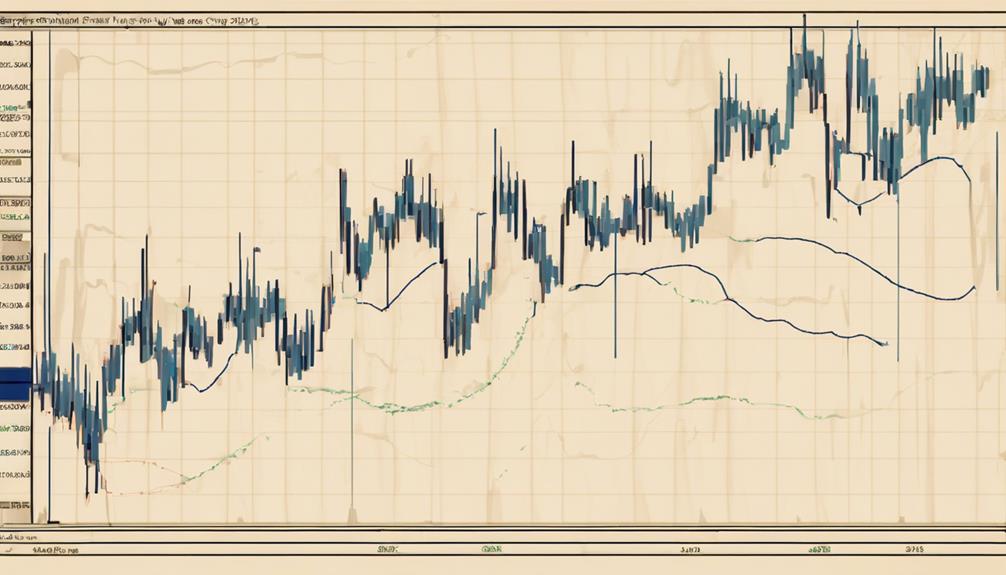

Drawing on the structured framework provided by Elliott Wave Theory, market trend prediction with Elliott Waves involves analyzing impulse and corrective waves to anticipate potential turning points and trend reversals in financial markets. Elliott Wave Theory categorizes market cycles into five-wave impulse moves and three-wave corrective patterns, providing a roadmap for understanding market trends.

Technical analysts utilize this framework to identify key levels for entry and exit points based on wave patterns. By incorporating Fibonacci ratios, analysts can further enhance their analysis by pinpointing critical support, resistance, and price target levels within Elliott Wave patterns. This analytical approach enables traders to make informed decisions and strategize effectively in dynamic market environments.

Understanding and applying Elliott Waves play a pivotal role in forecasting market trends and identifying potential trend reversals, empowering traders with valuable insights for navigating the complexities of financial markets.

Utilizing Fibonacci Ratios in Analysis

Utilizing Fibonacci ratios in technical analysis provides traders with essential tools for pinpointing support, resistance, and potential reversal levels in market trends. Key Fibonacci ratios like 38.2%, 50%, and 61.8% play a critical role in determining these levels within Elliott Wave Theory.

These ratios assist traders in identifying not only support and resistance but also potential price targets and reversal points in the market. Additionally, Fibonacci extension levels such as 161.8%, 261.8%, and 423.6% are instrumental in forecasting the length of impulse waves, aiding in understanding the potential magnitude of market moves.

Traders also leverage Fibonacci time zones at 38.2%, 50%, and 61.8% to predict the duration of price movements based on historical patterns. By incorporating Fibonacci ratios into their analysis, traders enhance the precision of Elliott Wave analysis, providing vital reference points for decision-making in technical analysis.

Enhancing Trading Strategies With Elliott Waves

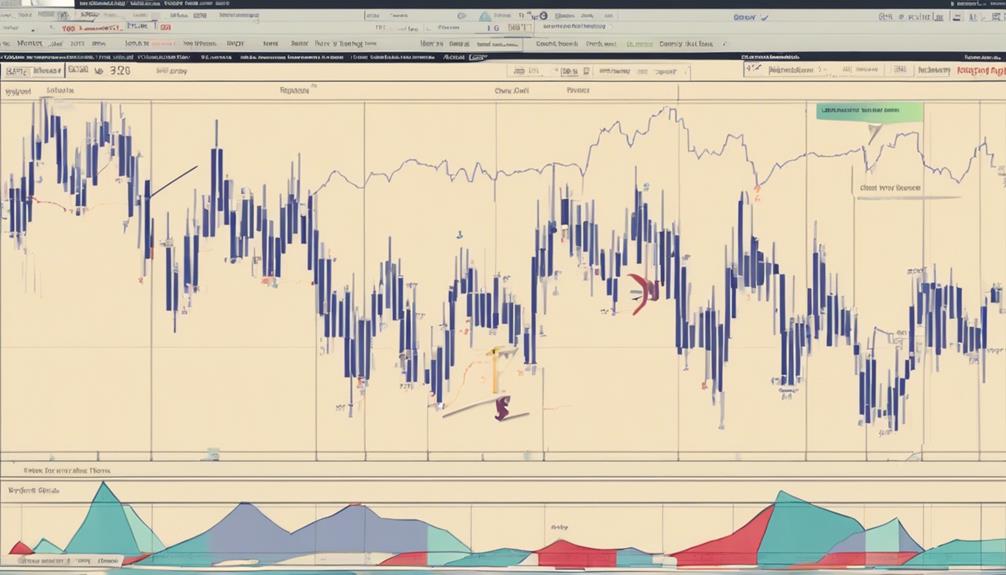

When integrating Elliott Wave Theory into trading strategies, traders can gain a competitive edge by utilizing wave patterns to optimize their entry and exit points in the market. By recognizing key wave patterns, traders can better pinpoint potential entry points to open positions and exit points to secure profits or cut losses. This strategic approach enhances risk management as traders can set appropriate stop-loss orders based on the identified wave patterns, thereby safeguarding their capital.

Furthermore, understanding Elliott Wave patterns aids traders in forecasting market reversals, enabling them to adjust their position sizes accordingly. Incorporating Elliott Waves into trading strategies assists in anticipating price movements, which is vital for effective trade management. Integrating these wave patterns with other technical analysis tools such as moving averages enhances decision-making accuracy, providing traders with a comprehensive view of the market dynamics.

Overcoming Limitations of Elliott Wave Theory

To address the inherent challenges posed by the subjective nature and varying effectiveness of Elliott Wave Theory in technical analysis, traders and analysts seek methods to overcome the limitations of this predictive tool. While Elliott Wave Theory is a valuable tool in technical analysis, it comes with its own set of challenges that can impact its reliability and interpretive accuracy.

Here are some ways traders can overcome these limitations:

- Utilizing additional technical indicators can enhance the reliability of Elliott Wave Theory predictions.

- Traders often face challenges due to the subjective nature of wave interpretation in Elliott Wave Theory.

- Effectiveness of Elliott Wave Theory may vary depending on different market conditions and scenarios.

- Analysts frequently debate the reliability of Elliott Wave Theory predictions and its application in technical analysis.

- Understanding the differences between Dow's theory and Elliott Wave Theory can help clarify their respective predictive capabilities.

What is the Importance of Elliott Wave Theory in Technical Analysis for Futures Trading?

Understanding the elliott wave theory essentials is crucial for successful futures trading. This technical analysis tool helps traders identify market trends and potential reversal points, leading to more informed trading decisions. By recognizing wave patterns, traders can anticipate market movements and adjust their strategies accordingly.

Frequently Asked Questions

What Is the Relevance of Elliott Wave Theory in Technical Analysis?

Elliott Wave Theory is vital in technical analysis for identifying market trends, determining entry/exit points, managing risk through stop-loss orders, forecasting reversals, and adjusting positions. Integrating it with analysis tools improves trading decisions and strategy accuracy.

What Are the Advantages of Elliott Wave Theory?

Elliott Wave Theory provides a systematic approach to analyzing market trends, aiding in identifying optimal entry and exit points. By integrating Fibonacci ratios, it enhances precision in determining price targets and support/resistance levels, offering valuable insights into market psychology for informed decision-making.

What Does Elliott Wave Theory Tell You?

Elliott Wave Theory provides valuable insights into market price movements through the identification of recurring wave patterns, distinguishing between trend-following impulses and corrective waves. Utilizing Fibonacci ratios aids in predicting potential reversal points, enabling a comprehensive analysis of price behaviors in financial markets.

What Is the Application of Elliott Wave Theory?

The application of Elliott Wave Theory involves analyzing wave patterns in stock price behavior to forecast market trends and identify potential entry and exit points. This method categorizes waves, uses Fibonacci ratios, and aids in recognizing market reversals.

Conclusion

In conclusion, the significance of Elliott Wave Theory in technical analysis cannot be understated. Its structured framework and wave patterns provide valuable insights into market movements, aiding in trend prediction and trading strategies.

Despite its limitations, Elliott Wave Theory remains a vital tool for experienced analysts navigating financial markets.