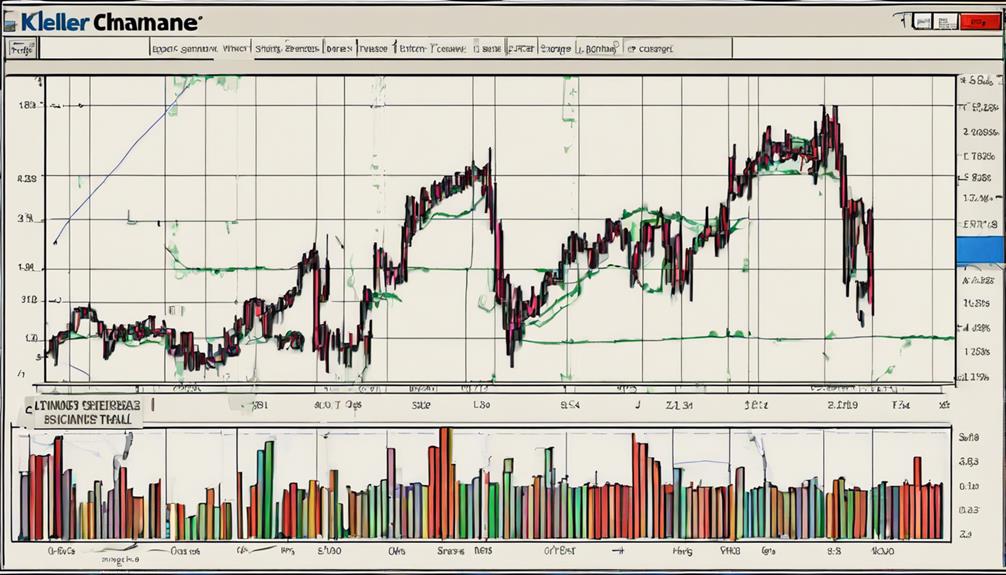

Optimizing Keltner Channel settings is key for effective trading strategies. These settings leverage volatility signals and dynamic support/resistance levels, enhancing risk management and trading performance. Keltner Channels, developed by Chester Keltner in the 1960s and refined by Linda Raschke, use the Average True Range (ATR) and exponential moving averages (EMA) for trend identification and entry/exit points. By adjusting parameters like the ATR multiplier and aligning with other indicators such as RSI and MACD, traders can further improve signal reliability. Utilizing Keltner Channels provides a structured framework for making informed trading decisions that maximize profitability and mitigate risks.

Historical Overview of Keltner Channels

How did the development of Keltner Channels by Chester Keltner in the 1960s revolutionize volatility-based trading strategies?

Keltner Channels, a technical analysis tool, were created to capture price movements and market volatility. They are constructed using the Average True Range (ATR) indicator to determine the width of the channels. This innovation provided traders with a dynamic approach to evaluating market conditions and identifying potential entry and exit points. By incorporating ATR into the calculation, Keltner Channels offer a more flexible and responsive method for setting support and resistance levels compared to traditional fixed methods.

Chester Keltner's creation laid the foundation for traders to gauge market volatility and establish trend directions effectively. Linda Raschke's later refinements further enhanced the tool's utility by optimizing trend identification and risk management capabilities. The use of exponential moving averages (EMAs) in conjunction with ATR calculations within Keltner Channels offers traders a detailed framework for making informed trading decisions based on market conditions.

This historical overview underscores the significance of Keltner Channels in modern volatility-based trading strategies.

Understanding Keltner Channel Logic

Keltner Channels are a technical analysis tool that incorporates an EMA to establish trend direction and volatility levels.

Understanding the channel width significance helps traders gauge the intensity of price movements and potential breakouts.

Additionally, interpreting volatility signals within the Keltner Channels aids in identifying ideal entry and exit points for trades.

Keltner Channel Basics

Exploring the fundamental principles underlying the Keltner Channel can provide traders with a solid foundation for understanding its logic and application in financial markets.

Keltner Channels incorporate an Exponential Moving Average (EMA) to identify trends and establish dynamic support and resistance levels. The upper band is calculated as EMA plus twice the Average True Range (ATR), while the lower band is EMA minus twice the ATR.

Developed by Chester Keltner in the 1960s and later refined by Linda Raschke, Keltner Channels are effective tools for risk management practices and trend determination across various financial markets.

Traders can optimize their strategies by using Keltner Channels to set personalized stop-loss and take-profit levels, enhancing their overall trading approach.

Channel Width Importance

The significance of channel width in Keltner Channels lies in its role in determining dynamic support and resistance levels, important for effective trading strategies. Keltner Channels derive their width from the Average True Range (ATR), reflecting market volatility. This dynamic nature of the channels allows traders to adapt to changing market conditions and adjust risk management strategies accordingly. A wider channel suggests higher volatility and potential for larger price movements, indicating stronger support and resistance levels. Conversely, a narrower channel signifies lower volatility and may signal a period of consolidation or lower trading activity. Understanding the relationship between channel width, ATR, and dynamic support and resistance is essential for traders utilizing Keltner Channels in their decision-making process.

| Keltner Channels | Channel Width Importance |

|---|---|

| ATR | Reflects market volatility |

| Dynamic Support | Adjusts with channel width |

| Dynamic Resistance | Responsive to price changes |

| Trading Strategies | Adapt based on channel width |

Volatility Signal Interpretation

Utilizing volatility signals within the context of Keltner Channels entails a meticulous analysis of price dynamics and market movements to inform strategic decision-making in trading.

- Average True Range (ATR) is utilized to measure price volatility and establish dynamic support and resistance levels.

- The Exponential Moving Average (EMA) within Keltner Channels aids in trend identification and risk management by smoothing price data.

- Keltner Channels assist traders in interpreting signals such as overbought and oversold conditions, as well as identifying trend shifts for effective decision-making.

- Incorporating EMAs with Keltner Channels enhances signal accuracy and improves trade management strategies.

- By integrating ATR values into Keltner Channels, traders can better gauge price volatility and adjust risk parameters accordingly.

Pros and Cons of Keltner Channels

Despite their potential benefits, Keltner Channels in trading come with inherent drawbacks that traders must carefully consider. One of the key disadvantages of Keltner Channels is their lagging nature, which can pose challenges for traders aiming for precise risk management. The delayed response of Keltner Channels to price movements may result in difficulties in setting stop-loss levels or determining the most favorable entry and exit points.

Additionally, Keltner Channels have been found to generate false signals, leading to potential losses and missed opportunities for traders. The average win rate of 28% associated with Keltner Channels highlights their unreliability across different settings and timeframes, further complicating trading decisions. Traders need to be cautious when relying solely on Keltner Channels for risk management, as their limitations can hinder effective risk mitigation strategies.

It is essential for traders to carefully weigh the pros and cons of using Keltner Channels in their trading approach to make informed decisions and maximize their chances of success.

Effective Trading Strategies With Keltner Channels

Given the challenges associated with the lagging nature and potential unreliability of Keltner Channels, developing effective trading strategies that leverage their strengths is paramount for maximizing success in the financial markets. When crafting trading strategies with Keltner Channels, incorporating key elements such as Exponential Moving Averages (EMAs), Average True Range (ATR), and robust risk management practices can greatly enhance trading outcomes.

Here are five essential components to take into account:

- Utilize EMAs in conjunction with Keltner Channels to enhance signal accuracy and confirm trend direction.

- Adjust Keltner Channel settings based on market volatility to adapt to changing conditions effectively.

- Implement stop-loss orders aligned with Keltner Channel levels to manage risk and protect trading capital.

- Use Keltner Channel signals to identify potential entry and exit points, particularly during overbought or oversold conditions.

- Regularly review and refine trading strategies with Keltner Channels to optimize performance and adapt to evolving market dynamics.

Interpreting Keltner Channel Signals

Interpreting Keltner Channel signals is a critical aspect of technical analysis in financial trading, providing valuable insights into market conditions and potential trading opportunities. The upper band of the channel indicates overbought conditions, suggesting that prices may be due for a reversal or a pullback. Conversely, oversold conditions are signaled when prices touch the lower band of the Keltner Channels, indicating a possible buying opportunity.

Additionally, trend shifts can be identified when prices break out of the channel boundaries, signaling a potential change in market direction. It is essential for traders to take into account these signals in conjunction with other technical indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm trading decisions.

Understanding and interpreting Keltner Channel signals enable traders to make informed choices regarding entries, exits, and trend continuations, ultimately enhancing their trading performance and profitability.

Calculating Keltner Channels Indicator

The calculation of Keltner Channels involves utilizing a 20-day Exponential Moving Average (EMA) as the central line and incorporating the Average True Range (ATR) to determine the upper and lower bands. This methodology combines these key elements to create a dynamic channel that adapts to market volatility effectively.

- Keltner Channels are constructed around the 20-day EMA.

- The upper band is calculated by adding 2 times the ATR to the EMA.

- The lower band is determined by subtracting 2 times the ATR from the EMA.

- ATR values are pivotal in evaluating price volatility for channel boundary definition.

- The synergy of EMA, ATR, and a multiplier forms the basis of the Keltner Channel indicator visualization on price charts.

This calculation method ensures that the Keltner Channels adjust to the market conditions by factoring in both the trend (EMA) and the volatility (ATR), offering traders a comprehensive view of potential price movements.

Optimal Settings for Keltner Channels

To optimize the effectiveness of Keltner Channels in trading strategies, selecting appropriate parameters, such as a 20-period EMA for the central line, is essential. The 20-period EMA serves as a robust indicator of the trend, providing a smooth representation of price movements.

When determining the upper band, traders commonly use the formula EMA + (2 x ATR), and for the lower band, EMA – (2 x ATR) is typically employed. The ATR multiplier, often adjusted based on market volatility, influences the width of the channels, allowing traders to adapt to changing market conditions effectively.

Integrating stop loss levels based on channel breakouts is vital for managing risk efficiently. By tailoring Keltner Channel settings to align with specific trading strategies, traders can enhance their overall performance and make informed decisions. Finding the right balance between the EMA period, ATR multiplier, and implementing effective stop-loss strategies can greatly improve trading outcomes.

Using Keltner Channels for Risk Management

With the utilization of Keltner Channels, traders can effectively manage risk by setting dynamic stop-loss and take-profit levels based on market volatility. By incorporating the Average True Range (ATR) and Simple Moving Average (SMA) with Keltner Channels, risk management strategies can be enhanced greatly.

Here are five key points to keep in mind for utilizing Keltner Channels for risk management:

- Adjust position sizes based on ATR to manage risk exposure effectively.

- Utilize Keltner Channels to define dynamic support and resistance levels for trades.

- Incorporate SMA to provide additional insights into trend direction and potential reversals.

- Monitor volatility levels using ATR aids in adapting position sizes for enhanced risk management.

- Use Keltner Channels to set trailing stops that move with price fluctuations, locking in profits and limiting losses efficiently.

Combining Keltner Channels With Other Indicators

Integrating Keltner Channels with other indicators like RSI or MACD can enhance the reliability of trading signals by providing cross-confirmation. This approach allows for a more thorough analysis of market movements, leveraging the synergy benefits of multiple indicators.

Indicator Synergy Benefits

The synergy derived from combining Keltner Channels with other indicators enhances trend confirmation and signal accuracy in trading strategies. When paired with RSI, Keltner Channels provide a more thorough assessment of market trends.

Integrating MACD with Keltner Channels offers a detailed analysis of both trend strength and momentum. Utilizing Bollinger Bands alongside Keltner Channels enhances the evaluation of price volatility and trend direction.

Additionally, integrating the Stochastic Oscillator with Keltner Channels can help in identifying potential overbought or oversold market conditions. Finally, combining Moving Average crossovers with Keltner Channels aids in confirming trend reversals and determining the most complete entry and exit points.

This synergy creates a more holistic approach to analyzing market movements and making informed trading decisions.

Cross-Indicator Confirmation Signals

Combining Keltner Channels with complementary indicators enhances the reliability and confirmation of trading signals, providing a thorough analysis of market dynamics. By integrating indicators like RSI and MACD with Keltner Channels, traders can validate their decisions and reduce the incidence of false signals.

These cross-indicator confirmation signals offer a detailed view of the market, improving the accuracy of trade entries and exits. Utilizing multiple indicators alongside Keltner Channels strengthens the effectiveness of trading strategies, as confirmation signals from RSI or MACD can further validate the signals generated by Keltner Channels.

This integrated approach helps traders make more informed decisions, leading to potentially more successful trading outcomes.

Diversifying Signal Sources

To enhance the reliability of trading signals and confirm market dynamics effectively, incorporating Keltner Channels with complementary indicators such as RSI or MACD can be advantageous.

Diversifying signal sources with Keltner Channels increases the robustness of trading strategies and improves overall trade accuracy. Utilizing multiple indicators helps validate trade signals and reduce false signals.

Incorporating moving averages along with Keltner Channels provides additional confirmation for trade entries and exits. Using oscillators like Stochastic or ADX in conjunction with Keltner Channels can improve trend identification and trade decision-making.

- Combining Keltner Channels with RSI or MACD

- Utilizing multiple indicators for validation

- Incorporating moving averages

- Using oscillators like Stochastic or ADX

- Diversifying signal sources

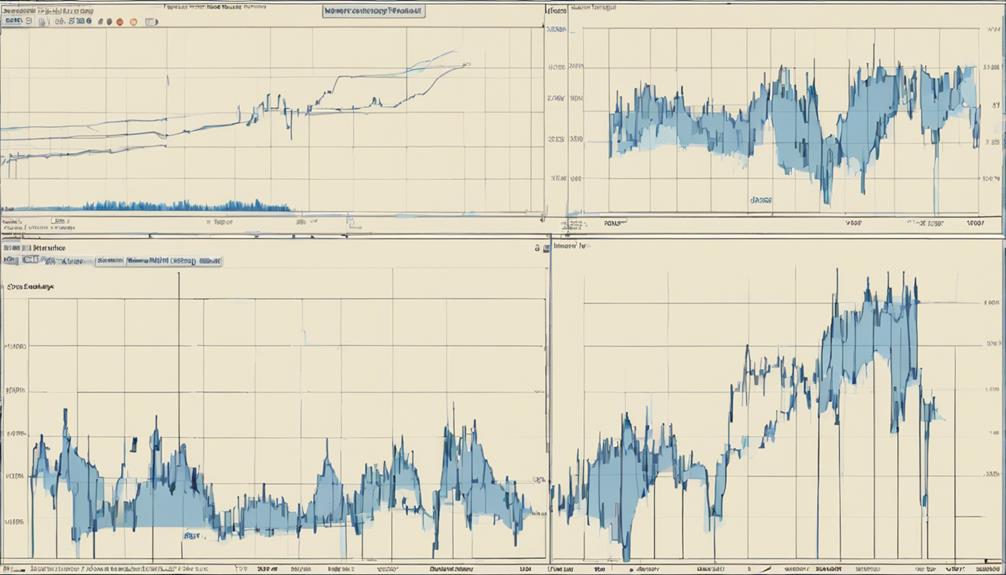

Assessing the Reliability of Keltner Channels

Evaluating the reliability of Keltner Channels is vital for discerning their effectiveness in informing trading decisions. Keltner Channels have an average win rate of 28%, indicating moderate success in trading. However, they may produce false signals and demonstrate low success rates on varying timeframes. The dependability of Keltner Channels can fluctuate based on the chosen settings and prevailing market conditions, directly impacting their overall effectiveness. One important point to take into account is that these channels often lag behind price movements, potentially causing traders to miss out on profitable opportunities. Hence, evaluating the reliability of buy and sell signals generated by Keltner Channels is paramount for traders looking to optimize their risk management strategies.

| Aspects of Reliability | Description | Impact |

|---|---|---|

| Win Rate | Indicates average success in trading | Moderately successful |

| False Signals | Potential for misleading trading signals | Decreases reliability |

| Lagging Indicator | Tendency to lag behind price movements | Missed trading opportunities |

| Market Conditions | Influence on channel effectiveness | Variable reliability |

Frequently Asked Questions

Considering the intricacies of Keltner Channels and their impact on trading decisions, an exploration of Frequently Asked Questions can shed light on optimizing strategies and risk management techniques.

- How are Keltner Channels calculated, and what role does the Average True Range (ATR) play in this process?

- What contributions did Linda Raschke make in refining Keltner Channels for trading applications?

- How can Keltner Channels be utilized to identify dynamic support and resistance levels for effective risk management?

- Why is the central line of Keltner Channels typically a 20-day Exponential Moving Average (EMA)?

- In what ways can incorporating Keltner Channels into specific trading strategies enhance profitability and mitigate potential losses?

Answering these questions can provide traders with a deeper understanding of the nuances of Keltner Channels and how to leverage them effectively in their trading endeavors. By grasping the intricacies of these aspects, traders can optimize their use of Keltner Channels and improve their overall trading performance.

Frequently Asked Questions

What Are the Best Settings for the Keltner Channel?

When customizing parameters for Keltner Channels, traders often consider backtesting results and volatility analysis to determine the best settings.

By adjusting the ATR multiplier and period lengths, traders can tailor the channels to specific market conditions and timeframes.

Backtesting helps validate the effectiveness of these settings by analyzing historical performance, while volatility analysis aids in adapting the channels to current market conditions for best trading outcomes.

Is Keltner Channel Strategy Profitable?

The profitability of the Keltner Channel strategy hinges on adept risk management, thorough backtesting, and adapting to trends and volatility. Setting profit targets and stop losses based on historical data can enhance success rates.

While the strategy may have a lower win rate, its effectiveness can improve with meticulous analysis and adjustments. Employing a disciplined approach and continuously evaluating buy and sell signals are crucial for capitalizing on the strategy's potential.

Which Trading Strategy Has the Highest Success Rate?

In evaluating trading strategies for success rates, key factors like risk management, technical analysis, and market psychology play pivotal roles.

The strategy exhibiting the highest success rate typically demonstrates effective risk mitigation, utilizes rigorous technical analysis to identify opportunities, and leverages an understanding of market psychology for best decision-making.

How to Trade With Keltner Channel?

To trade effectively with Keltner Channels, traders can capitalize on entry signals generated by breakouts above the upper band or below the lower band. By combining these signals with rigorous risk management techniques, such as setting stop-loss orders based on channel breakouts, traders can navigate volatile market conditions more confidently.

Additionally, incorporating volatility analysis can enhance the precision of trade entries and exits when utilizing Keltner Channels in trading strategies.

Conclusion

To sum up, effective trading strategies with optimized Keltner channel settings can offer valuable insights into market trends and potential entry and exit points. By understanding the logic behind Keltner channels, traders can make informed decisions and manage risks more effectively.

Combining Keltner channels with other indicators can further enhance trading strategies. The historical overview and practical application of Keltner channels provide a solid foundation for traders seeking to improve their trading outcomes.