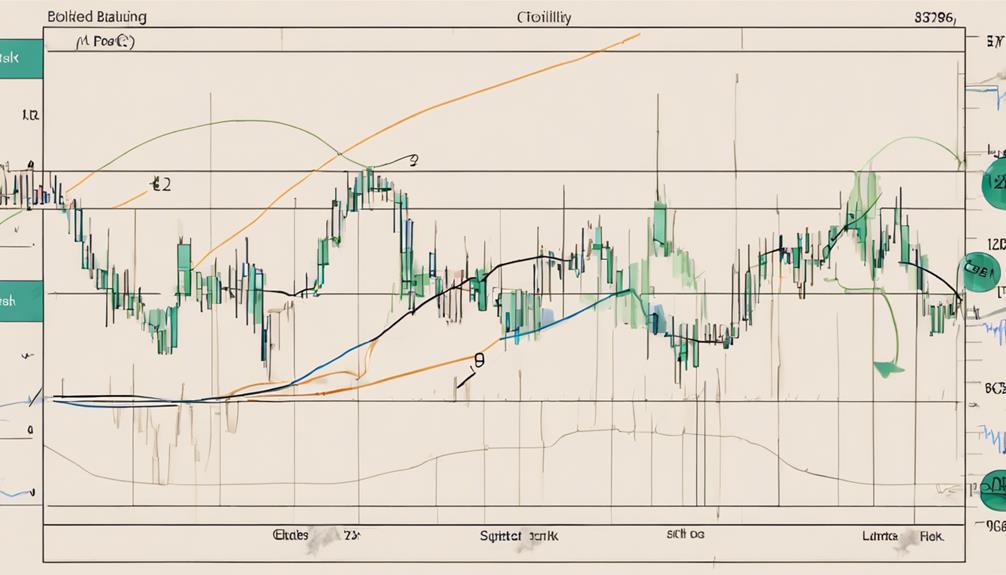

Bollinger Bands, often viewed as a risk management tool, can significantly impact your trading decisions.

But have you ever pondered how these bands precisely influence risk assessment and mitigation?

Understanding the nuanced role they play in determining optimal entry and exit points can elevate your risk control strategies to a whole new level.

By grasping the intricate dynamics of Bollinger Bands, you might unlock a pathway to enhanced risk management practices that could potentially reshape your trading outcomes.

Importance of Bollinger Bands in Risk Management

Bollinger Bands play a pivotal role in risk management strategies by providing traders with essential tools to assess and mitigate potential financial risks. These bands help set risk parameters based on market volatility, enabling traders to limit potential losses effectively. By offering clear stop loss reference points, Bollinger Bands enhance risk management strategies, ensuring capital protection and consistency in trading.

Adjusting stop loss levels in accordance with band movements allows traders to manage risk exposure efficiently. Utilizing Bollinger Bands in this manner not only minimizes losses but also safeguards profits, contributing significantly to the overall effectiveness of risk management strategies in trading.

Utilizing Bollinger Bands for Risk Assessment

Utilizing the principles of Bollinger Bands can significantly enhance your risk assessment capabilities in trading scenarios. By utilizing Bollinger Bands, traders can set risk parameters based on market volatility, allowing for effective risk management.

When engaging in long or short trades, traders often use the opposite band as a reference point to place stop loss orders. Placing stop loss orders below the lower band in long trades and above the upper band in short trades helps protect against adverse market movements. This method ensures that traders aren't excessively exposed to losses, ultimately safeguarding capital.

Through effective risk management with Bollinger Bands, traders can enhance their overall trading strategies, increasing the likelihood of consistent profitability.

Risk Mitigation Strategies Using Bollinger Bands

Implementing risk mitigation strategies with Bollinger Bands involves strategically placing stop-loss orders based on market volatility levels to protect against adverse movements. By utilizing the bands to set risk parameters, traders can safeguard their positions from potential losses due to trend reversals.

Placing stop losses below the lower band in long trades and above the upper band in short trades enhances capital protection and reinforces risk management strategies. This approach not only helps in minimizing risks but also contributes to trading consistency and the potential for sustained profitability.

Incorporating Bollinger Bands into your risk mitigation strategies can play a crucial role in navigating the uncertainties of the market while striving for long-term success.

Bollinger Bands for Identifying Risk Levels

When identifying risk levels in trading, utilizing Bollinger Bands can provide valuable insights into market volatility and potential trend reversals.

Bollinger Bands help in setting risk parameters based on market volatility to prevent excessive losses. They serve as a guide for determining stop loss levels by using the opposite band as a reference point for trade protection.

Stop losses are typically placed below the lower band for long trades and above the upper band for short trades to safeguard against trend reversals.

Incorporating Bollinger Bands in risk management practices enhances the consistency of profitability by minimizing potential losses and improving overall trading performance.

How Do Bollinger Bands Help with Risk Management?

A beginner’s guide to Bollinger Bands can help traders manage risk by providing a visual representation of market volatility. The bands widen during high volatility and narrow during low volatility, indicating potential buy or sell points. This helps traders make informed decisions and set appropriate stop-loss orders to mitigate risk.

How Do Bollinger Bands Help with Risk Management?

Bollinger band basics for beginners can help with risk management by providing a visual representation of market volatility. The bands expand and contract based on price movement, allowing for better identification of potential shifts in market trends. This can help traders make informed decisions to mitigate risk in their investments.

Integrating Bollinger Bands in Risk Control

Integrating Bollinger Bands in risk control enhances your ability to manage market volatility effectively and safeguard against adverse price movements. By utilizing Bollinger Bands, you can set precise risk parameters based on market conditions, allowing you to strategically place stop losses at opposite bands to protect against unfavorable market shifts.

Stop losses are vital for minimizing losses, protecting your capital, and maintaining consistency in profitability. Adjusting risk exposure by monitoring band width fluctuations enables you to adapt your risk management strategies to changing market volatility levels.

This proactive approach not only helps in capital protection but also ensures that you can minimize losses by efficiently adjusting your risk exposure according to the signals provided by the Bollinger Bands.

Frequently Asked Questions

What Is the Purpose of the Bollinger Bands?

Bollinger Bands serve to visually represent price volatility, aiding in identifying potential entry and exit points. They act as dynamic support and resistance levels, helping traders gauge market sentiment and make informed decisions.

What Is the Effective Use of Bollinger Bands?

To effectively use Bollinger Bands, consider price interactions with the bands for trade entries. Utilize upper band touches for short trades and lower band touches for long trades. Adjust risk management strategies based on band width and market volatility.

What Strategy Is Based on Bollinger Bands?

When using the Bollinger Bands strategy, you analyze market volatility and price action to make informed trading decisions. By paying attention to band touches and reversals, you can strategically enter and exit trades, maximizing profit potential.

What Is the Logic Behind Bollinger Bands?

The logic behind Bollinger Bands involves utilizing standard deviations from a moving average to measure price volatility and anticipate reversals. By setting stop-loss levels using the opposite band of your trade entry point, you can effectively manage risk with Bollinger Bands.

Conclusion

In conclusion, Bollinger Bands serve as a valuable tool in risk management, aiding traders in making informed decisions to protect their capital and minimize losses.

By incorporating these bands into your risk assessment and mitigation strategies, you can effectively control risk levels and enhance the overall profitability of your trading activities.

Embracing the power of Bollinger Bands will undoubtedly elevate your risk management capabilities to new heights.