Mastering the ADX indicator is crucial for traders seeking to navigate the complexities of the financial markets successfully. By understanding the intricacies of this powerful tool, traders can gain valuable insights into trend strength and market dynamics.

However, merely grasping the basics is not enough; to truly excel, traders must delve deeper into top practices that can optimize their use of the ADX indicator. These practices encompass a range of strategies and techniques that can significantly enhance trading outcomes and pave the way for more informed decision-making.

ADX Indicator Strategy Rules

In the realm of technical analysis, the effective utilization of the ADX indicator hinges upon the strict adherence to a set of meticulously crafted strategy rules. The ADX, or Average Directional Index, is a powerful tool used by traders to assess the strength of a trend rather than predicting market direction. This indicator provides a numerical value between 0 and 100, with readings below 25 indicating a lack of a clear trend and values above 25 signaling a strong trend in the market.

When incorporating the ADX into trading strategies, it is essential to follow specific rules to maximize its effectiveness. Traders should consider initiating positions when the ADX is rising and above 25, suggesting the presence of a strong trend. Additionally, using the ADX in conjunction with other technical indicators can help confirm potential trade opportunities. Understanding these rules and signals can significantly enhance decision-making processes, allowing traders to capitalize on favorable market conditions and minimize risks associated with uncertain price movements.

ADX Indicator for Day Trading

Utilizing the ADX indicator effectively in day trading requires selecting the optimal period setting to accurately analyze trends and enhance trading strategies. For day trading, the best ADX setting is typically the 3-period setting, allowing traders to capture short-term trends efficiently.

Day traders often customize ADX settings based on their time frames to align with specific trading goals and strategies. To enhance trend intensity analysis, combining the ADX indicator with other indicators like RSI can provide a comprehensive view of market trends.

While the 14-period ADX setting is commonly used for optimal signals and trend confirmation in day trading, traders should adapt this parameter based on their preferences and market conditions. By incorporating ADX into their day trading strategies, traders can achieve more accurate signals, make informed decisions, and work towards realizing their trading objectives successfully.

ADX Indicator Strategy for Swing Trading

For effective swing trading strategies, optimizing the ADX indicator settings based on various time frames is crucial to capturing trends accurately and making informed trading decisions.

When utilizing the ADX indicator in swing trading, especially with longer periods like 14, traders can confirm trend strength and potential reversals, enhancing their ADX trading strategies.

Combining the ADX with other indicators such as moving averages can further refine swing trading approaches, providing a more comprehensive view of market conditions.

Adhering to specific ADX rules in swing trading helps traders identify optimal entry and exit points for profitable trades, increasing the effectiveness of their trading decisions.

The ADX indicator is particularly beneficial in swing trading to navigate trending markets effectively, distinguishing strong trends from choppy market conditions.

Best ADX Indicator Settings

Optimizing the ADX indicator settings plays a crucial role in enhancing trading strategies by capturing trends accurately and aiding in informed decision-making processes. When it comes to determining the best ADX indicator settings, considerations vary based on different trading styles and timeframes.

Here are some key points to keep in mind:

- The best ADX indicator setting for day trading is typically a 14-period setting.

- Adjusting the ADX settings for swing trading can depend on the specific time frames being used.

- Using a 3-period ADX setting is recommended for day trading strategies to capture short-term trends.

- A 20-period ADX setting is often used in combination with moving averages for trend confirmation.

- The ADX indicator can be optimized for different trading styles by adjusting the period settings accordingly.

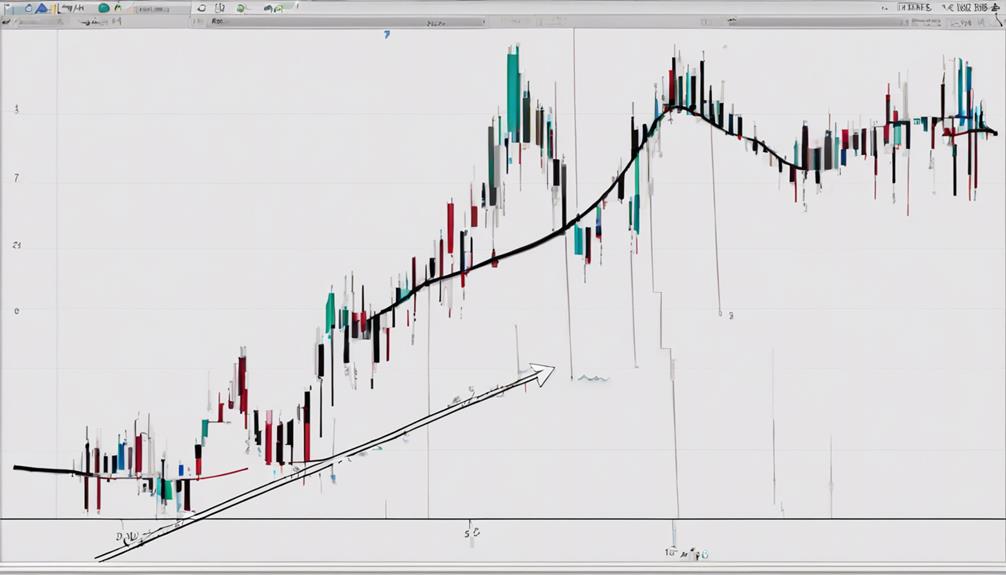

ADX Trading Strategy Video

The instructional video on ADX trading strategy offers practical insights into applying the indicator effectively in real-time market analysis. By showcasing various trading scenarios, the video visually demonstrates how ADX can be used to assess trend strength and make well-informed trading decisions.

It elaborates on interpreting ADX readings and integrating them into trading strategies to navigate different market conditions successfully. Through the real-time market analysis presented, viewers can grasp the practical use of ADX as a valuable educational tool for enhancing their understanding of this trend indicator.

The video serves as a comprehensive guide for traders looking to leverage ADX efficiently in their trading activities, emphasizing its significance in formulating robust trading strategies based on trend analysis and market dynamics. Overall, the ADX trading strategy video equips traders with the knowledge and skills necessary to optimize the use of this essential tool in their trading repertoire.

What are the Best Practices for Using the ADX Indicator for Efficient Trading?

When utilizing the ADX indicator for efficient trading, it’s crucial to implement effective ADX indicator strategies. This includes understanding how to interpret the ADX line, using it in combination with other indicators, and setting appropriate parameters to filter out false signals. Stick to proven effective ADX indicator strategies to improve your trading performance.

Frequently Asked Questions

How Do You Use ADX Indicator Effectively?

To use the ADX indicator effectively, analyze values above 25 for strong trends suitable for trend-trading strategies. ADX readings of 0-25 indicate weak trends. Values from 25-100 represent trend strength levels, guiding entry and exit points in trading decisions.

What Are the Most Accurate ADX Settings?

The most accurate ADX settings vary based on trading strategies and timeframes. Shorter periods like 3 suit day trading, while longer settings like 28 are ideal for swing trading. Optimal ADX selection aligns with timeframe for precise trend analysis.

What Is the Best Indicator to Combine With Adx?

When looking to enhance ADX indicator usage, a powerful complement is the Relative Strength Index (RSI), aiding in spotting overbought or oversold conditions. This tandem approach can offer a comprehensive view of market dynamics.

What Is the 2 Period ADX Strategy?

The 2-period ADX strategy is focused on identifying potential market breakouts by analyzing the Average Directional Index over a short timeframe. It aids in predicting imminent price movements rather than trend identification, enhancing trading accuracy for traders.

Conclusion

In conclusion, mastering the ADX indicator involves:

- Utilizing strategic rules

- Adapting to different trading styles

- Optimizing indicator settings

By incorporating the ADX indicator into trading strategies, traders can effectively gauge trend strength and make informed decisions in the markets.

Like a compass guiding a ship through rough waters, the ADX indicator serves as a valuable tool for navigating the complexities of trading with precision and confidence.