When considering the best Hong Kong mutual funds for investment, it's essential to pinpoint the ones that align with your financial goals and risk tolerance.

As an investor seeking optimal returns in the dynamic Asian market, you'd want to explore diverse options that cater to growth, stability, and sustainability.

These funds offer a spectrum of opportunities that may resonate with your investment strategy, potentially paving the way for a prosperous financial future.

Top Performer Fund

Showcasing impressive growth potential, the top performer fund FHKCX – Fidelity China Region Fund boasts a 5-year annualized return of 7.83%. This fund focuses on investing in common stocks of companies within the China region, making it an attractive option for those eyeing Hong Kong investments.

With a moderately high risk profile due to its concentration in Chinese equities, FHKCX has managed to maintain a Morningstar Rating of 4 stars. Despite the risks, investors can benefit from a dividend yield of 0.75% and a turnover rate of 31%.

Managed by Jing Ning since 2019, this fund maintains no sales charge, although a 1% redemption fee is applicable if held for less than 90 days. FHKCX's net assets have been steadily growing, reflecting investor confidence in its performance within the Hong Kong investment landscape.

If you're considering Hong Kong mutual funds for investment, FHKCX's track record of returns and management expertise make it a compelling option to explore.

Growth Opportunity Portfolio

Focused on capitalizing on growth opportunities, the Growth Opportunity Portfolio within the Fidelity China Region Fund (FHKCX) targets investments in companies across various sectors within the Chinese region. This portfolio aims to leverage market trends and high volatility to achieve long-term capital growth. By strategically allocating assets to technology, consumer discretionary, and communication services sectors, the fund positions itself to benefit from the dynamic growth potential within these industries. Despite the high volatility associated with Chinese equities, the fund employs robust risk management strategies to navigate fluctuations effectively.

Managed by Jing Ning since 2019, the Growth Opportunity Portfolio has demonstrated a moderately high risk profile due to its concentration in Chinese companies. Over the past 5 years, the portfolio has delivered an annualized return of 7.83%, showcasing its ability to capitalize on growth opportunities while effectively managing risk. With a Morningstar Rating of 4 stars, this portfolio presents an attractive option for investors seeking exposure to the vibrant Chinese market.

Stable Income Fund

For investors seeking a reliable source of income with lower risk compared to equity investments, the Stable Income Fund focuses on providing a consistent and reliable income stream through investments in fixed income securities such as bonds and money market instruments. Here's why you may consider this fund:

- Income Stability, Risk Management: The Stable Income Fund prioritizes income stability by investing in fixed income assets, which helps in managing risk and providing a steady cash flow.

- Capital Preservation, Low Volatility: With a focus on capital preservation, this fund aims to minimize volatility, making it a suitable choice for investors looking for lower-risk options.

- Conservative Approach, Fixed Income Assets: By adopting a conservative approach and predominantly investing in fixed income securities like bonds and money market instruments, the fund offers a stable investment avenue.

If you're looking for a dependable source of income while prioritizing capital preservation and maintaining low volatility in your investment portfolio, the Stable Income Fund could be a prudent choice.

Low-Risk Investment Strategy

Considering the stability and reliability of low-risk investment strategies in Hong Kong mutual funds, investors often prioritize blue-chip companies with a history of consistent performance. These funds adopt a risk management approach centered around capital preservation. By focusing on conservative allocation and diversification benefits across sectors, they aim to reduce overall risk exposure.

Fund managers employ a defensive investment strategy to safeguard capital and shield against market downturns. Low-risk Hong Kong mutual funds are known for their stable returns and may appeal to investors seeking income generation with minimized volatility. The emphasis on dividend-paying stocks or bonds provides a steady income stream while maintaining a cautious investment stance.

Investors looking for a more conservative investment option often find low-risk mutual funds in Hong Kong attractive due to their track record of stability and lower risk profile in comparison to higher-risk investment alternatives.

Sector-Specific Fund Selection

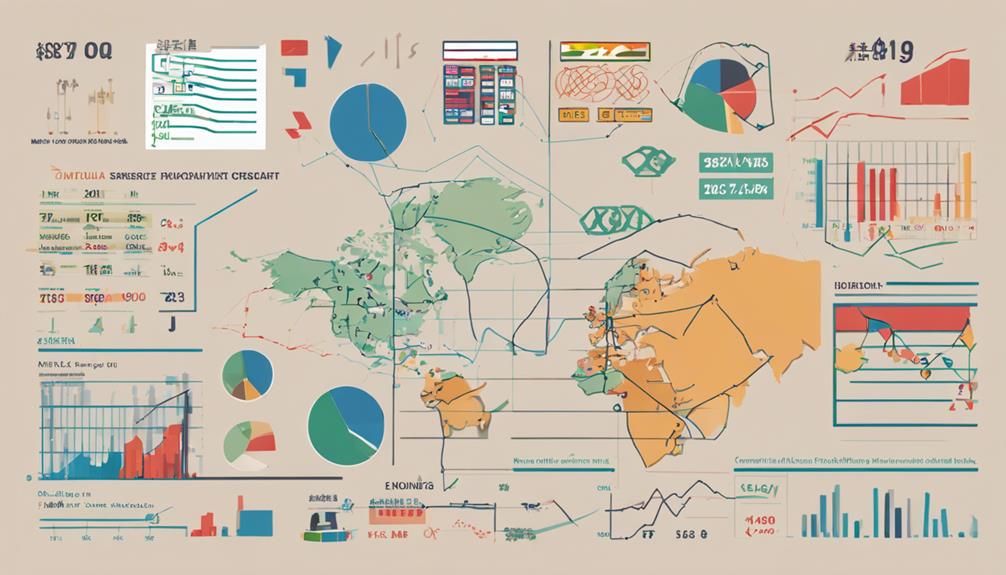

When exploring sector-specific fund selection in Hong Kong mutual funds, investors can target specific industries or themes for potential diversification within their portfolio. Here are some key considerations to keep in mind when selecting sector-specific funds:

- Sector Rotation: Keep an eye on the economic cycle and consider rotating into sectors that are poised to outperform based on the current market conditions in Hong Kong.

- Performance Analysis: Evaluate the historical performance of the sector-specific funds you're interested in to gauge how they've fared in different market environments.

- Risk Assessment: Understand the risk exposure of each sector-specific fund and ensure it aligns with your risk tolerance and overall investment strategy.

- Diversification Benefits: Sector-specific funds can offer diversification benefits by focusing on specific sectors within the Hong Kong market, potentially reducing overall portfolio risk.

Emerging Market Fund

Interested in diversifying your investment portfolio with exposure to high-growth potential in developing countries like Hong Kong? Emerging market funds could be the answer for you. These funds specifically target investing in countries with strong growth prospects, such as Hong Kong, offering a diverse range of opportunities across various industries and sectors within the market.

However, it's important to note that investing in emerging markets comes with higher volatility levels compared to more established markets. To navigate this, effective risk management strategies are crucial.

When considering an investment in an emerging market fund focused on Hong Kong, staying informed about market trends and the economic outlook of the region is key. Hong Kong's strategic location and robust financial infrastructure make it an attractive investment destination within the emerging markets category.

Conducting thorough research and due diligence is essential when selecting the best Hong Kong mutual funds that align with your investment goals and risk tolerance in the emerging market segment.

ESG-focused Investment Fund

Prioritizing Environmental, Social, and Governance criteria in investment decisions, ESG-focused investment funds aim to generate positive impacts alongside financial returns. By employing impact investing strategies, sustainable finance approaches, and responsible investment practices, these funds offer a unique opportunity to align your investment portfolio with your values.

- Positive Impact: Investing in companies with strong ESG practices allows you to contribute to sustainability and responsible corporate behavior.

- Risk Management: ESG integration assists in managing risks effectively, potentially leading to more stable long-term performance.

- Attractiveness to Investors: Embracing ESG factors can attract socially conscious investors who prioritize ethical and sustainable investments.

- Value Alignment: With ESG-focused funds, you can align your investment decisions with your personal values, promoting a more ethical and sustainable financial market.

Consider exploring ESG-focused investment funds in Hong Kong to promote sustainability while aiming for financial growth.

What Makes These Mutual Funds the Best for Investment in Hong Kong?

Looking to invest in Hong Kong? Consider the top mutual funds Hong Kong has to offer. With diverse portfolios, strong track records, and expert management, these funds provide a solid investment option for those looking to take advantage of the growing financial market in Hong Kong.

Frequently Asked Questions

What Is the Best Investment in Hong Kong?

When considering wealth management, asset allocation, and risk assessment for the best investment in Hong Kong, it's vital to research and choose mutual funds wisely. Look for funds with a solid track record and low fees.

What Is the Best Hong Kong Etf?

Looking for the best Hong Kong ETF? Consider ETF comparison, expense ratios, market trends, and performance analysis. Tailor your investment strategies to manage risk effectively. Find the right fit for your portfolio goals.

What Are the Top 5 Performing Mutual Funds?

When looking at mutual fund rankings, it's crucial to analyze investment strategies and performance. Understanding top performers can guide your choices. Evaluate funds with a critical eye to make informed decisions.

What Is the Best China Fund to Invest In?

When looking for the best China fund to invest in, you should consider factors like China tech's growth potential, emerging markets for diversification, and the impact of global economy and geopolitical risks.

Conclusion

You've explored the top mutual funds in Hong Kong, each offering a unique investment opportunity. From growth potential to stable income, low-risk strategies to sector-specific selections, there's something for every investor.

Whether you're seeking emerging market growth or prioritizing ESG factors, these funds have you covered. So, dive in, make your choice, and watch your investments bloom like a garden in full bloom.

Happy investing!