So, you think understanding the Relative Strength Index is as simple as spotting an overbought or oversold condition? Well, there's more to it than meets the eye.

By following the five best steps outlined, you'll uncover a world of insights that can potentially transform your trading game.

From mastering RSI basics to avoiding common pitfalls, each step plays a crucial role in enhancing your comprehension of this powerful indicator.

Ready to take your RSI knowledge to the next level?

RSI Basics and Calculation

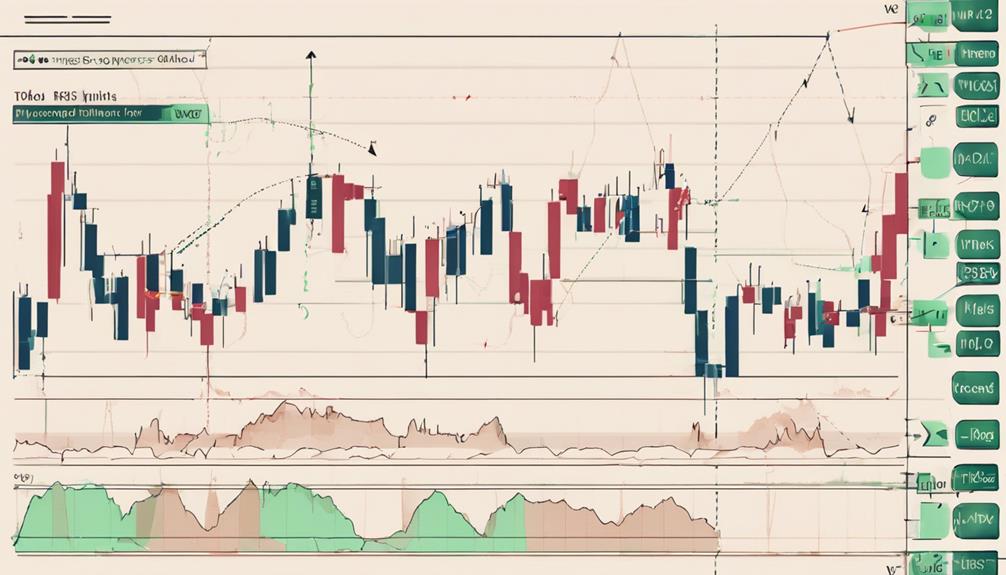

To grasp the essence of Relative Strength Index (RSI), understanding its basics and calculation method is paramount. RSI is a technical indicator widely used in investment and trading to analyze market trends. It evaluates the price changes of a security to determine if it's overbought (above 70) or oversold (below 30).

The calculation of RSI involves assessing the average gains and losses over a specified period, typically 14 trading days. By tracking RSI readings, investors can make informed decisions about potential trend reversals in the market. Mastering the interpretation of RSI levels is essential for utilizing this tool effectively in analyzing price movements and maximizing investment strategies.

Interpreting RSI Signals

Interpreting RSI signals involves analyzing the Relative Strength Index values to identify potential market trends and decision points based on overbought and oversold conditions. When interpreting RSI signals, consider the following:

- Double Tops and Bottoms: Watch for patterns where the RSI reaches similar highs (double top) or lows (double bottom), indicating potential trend reversals.

- Divergence Occurs: Look for inconsistencies between RSI and price movements, such as bullish divergence (rising RSI with falling prices) or bearish divergence (falling RSI with rising prices), signaling possible shifts in the market.

- Trading Signals: Utilize RSI levels above 70 for overbought signals and below 30 for oversold signals to determine potential entry or exit points in the market based on support and resistance levels.

Understanding Overbought and Oversold Levels

As RSI values above 70 indicate overbought conditions and below 30 signify oversold levels, understanding these thresholds is crucial for making informed trading decisions based on potential market reversals and opportunities.

Overbought levels suggest a potential trend reversal or correction, indicating a probable time to consider selling. On the other hand, oversold levels imply potential buying opportunities or price rebounds, signaling a potential time to buy.

Incorporating RSI Into Trading Strategies

Incorporate Relative Strength Index (RSI) into your trading strategies by utilizing the default 14-period setting for swing trading. When integrating RSI into your trading decisions, consider the following:

- For Intraday Traders: Opt for lower RSI settings to receive more frequent signals suitable for short-term trades.

- For Medium-Term Traders: Stick to the default 14-period setting to analyze market trends effectively.

- Identifying Market Conditions: RSI levels above 70 indicate overbought conditions, signaling a potential price decline, while levels below 30 suggest an oversold market, indicating a potential price increase in your trading decisions.

How Can Understanding the Relative Strength Index Help in Calculating it?

Understanding the relative strength index (RSI) is crucial for calculating relative strength index accurately. It helps in determining the momentum and strength of a stock or market. By analyzing the RSI, traders and investors can make informed decisions about buying or selling securities.

Common Mistakes to Avoid With RSI

To maximize the effectiveness of Relative Strength Index (RSI) in your trading strategies, it's crucial to steer clear of common pitfalls that can undermine your decision-making process. Avoid relying solely on RSI readings of 70 and 30 to make investment decisions; instead, consider other factors like market conditions and chart patterns.

Overlooking the overall trend of the asset can lead to false signals, so ensure you analyze the trend alongside RSI. Don't overlook the significance of volume and price action when using RSI to confirm trends and reversals.

Additionally, refrain from overtrading based solely on RSI signals and always incorporate risk management strategies to avoid potential losses. By avoiding these mistakes, traders can more effectively utilize RSI as a momentum oscillator in their trading endeavors.

Frequently Asked Questions

How Do You Understand Relative Strength?

To understand relative strength, focus on RSI's oscillation between zero and 100, spotting overbought conditions above 70 and oversold below 30. Identify trend reversals and market trends via RSI's support/resistance levels, ranges, divergences, and failure swings for trading insights.

What Is the Best Strategy for RSI Trading?

Focus on identifying overbought and oversold levels (above 70 and below 30) for potential signals. Apply RSI to different timeframes based on your trading style. Combine RSI with other indicators like MACD for more robust decisions and confirmations.

How Do You Read RSI Levels?

To read RSI levels, monitor values ranging from 0 to 100. Identify overbought conditions above 70 and oversold conditions below 30. Adjust RSI levels for precise readings based on market behavior. Look for trend continuations or reversals through support, resistance, and divergence signals.

What Is the Best Setting for Relative Strength Index?

For the Relative Strength Index (RSI), the best setting varies based on your trading style. Swing traders commonly use the default 14 periods, while intraday traders may prefer 9-11 periods for more signals. Tailor your RSI to match your trading frequency.

Conclusion

In conclusion, mastering the Relative Strength Index (RSI) is crucial for successful trading. By understanding its basics, interpreting signals, and incorporating it into your strategies, you can navigate the market with confidence.

Remember to avoid common mistakes and always consider market conditions. With the right approach, RSI can be a powerful tool in your trading arsenal.

Keep honing your skills, and watch as your trading success grows.