Embarking on the journey of understanding Elliott Wave Theory can unveil a structured approach to interpreting market behaviors. As traders and analysts navigate through the intricate wave patterns and grasp the significance of impulse and corrective waves, a deeper understanding of market dynamics begins to emerge.

By unraveling the complexities of Elliott Wave Theory, one can potentially gain a strategic advantage in their trading decisions. This listicle aims to dissect the basics of this theory, offering a roadmap for those seeking to enhance their analytical skills in the financial markets.

Basics of Elliott Wave Theory

The Basics of Elliott Wave Theory provide a foundational understanding of how price movements in financial markets are analyzed and predicted through the identification of specific wave patterns. Developed by Ralph Nelson Elliott in the 1930s, this theory distinguishes between impulse waves, which align with the main trend, and corrective waves, which move against the trend.

By recognizing recurring wave patterns driven by market psychology, Elliott Wave Theory assists traders and analysts in pinpointing potential trading entry points. Key elements of the theory include Wave 1, which signifies the start of a new trend, and Wave 5, marking the final move in that direction. Understanding these components is crucial for effectively applying Elliott Wave Theory in navigating the complexities of financial markets.

Wave Patterns Overview

Building upon the foundational understanding of Elliott Wave Theory, the Wave Patterns Overview delves into the structured composition of impulse and corrective waves essential for analyzing and predicting market movements.

In Elliott Wave Theory, wave patterns consist of impulse waves and corrective waves. Impulse waves are characterized by 5 sub-waves that move in the direction of the larger trend, helping to identify the current trend's direction.

On the other hand, corrective waves are composed of 3 sub-waves that move against the larger trend, providing opportunities for market corrections. By recognizing and interpreting these wave patterns, traders and analysts can apply Fibonacci ratios and other technical tools to conduct thorough market analysis.

Understanding the intricacies of motive waves and corrective waves is crucial for predicting potential turning points in the market and making informed decisions about future price movements. Wave patterns serve as the backbone for Elliott Wave Theory, offering a systematic approach to deciphering market dynamics and anticipating future trends.

Impulse Waves Explained

An essential component of Elliott Wave Theory, impulse waves represent the directional movements crucial for identifying and interpreting market trends. These waves consist of five sub-waves, labeled 1, 2, 3, 4, and 5, with Wave 3 typically being the longest and strongest. They play a vital role in indicating the current trend in the market, providing valuable insights for traders and analysts.

Impulse waves are fundamental in understanding the Elliott Wave sequence, as they precede corrective waves. Wave 3, known as the strongest wave within an impulse move, often exhibits the most significant price movement in the direction of the prevailing trend. This wave is crucial for traders as it can offer lucrative trading opportunities when identified accurately.

Corrective Waves Simplified

Having grasped the concept of impulse waves in Elliott Wave Theory, understanding corrective waves becomes imperative for a comprehensive analysis of market trends.

Corrective waves, labeled as Waves 2 and 4 within a larger trend, are crucial countertrend moves that aim to correct the preceding impulse waves. These corrective waves typically consist of three sub-waves labeled as A, B, and C, working to retrace a portion of the preceding impulse wave's movement.

By resetting market sentiment, corrective waves provide an opportunity for the market to catch its breath before the larger trend resumes. Understanding the intricacies of corrective waves is essential for investors and analysts to make informed decisions based on the cyclical nature of market movements.

- Corrective waves are labeled as Waves 2 and 4 within a larger trend.

- They are countertrend moves that correct the preceding impulse waves.

- Corrective waves typically exhibit three sub-waves labeled as A, B, and C.

- These waves aim to retrace a portion of the preceding impulse wave's movement.

Applying Elliott Waves in Analysis

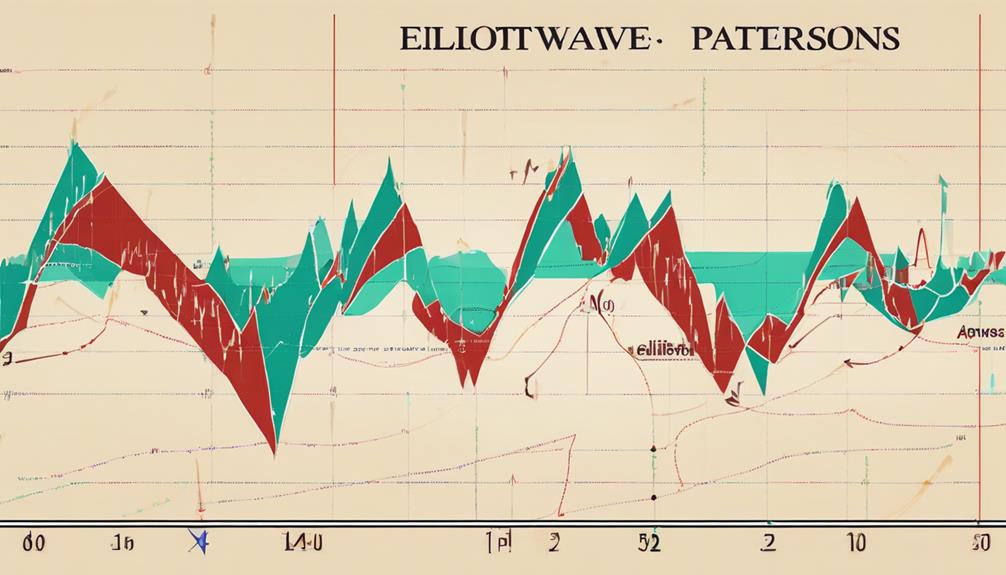

Utilizing Elliott Waves in market analysis enables investors to pinpoint potential turning points by recognizing repetitive behavioral patterns in investor sentiment and psychology. The Elliott Wave Theory, consisting of a 5-wave impulse move followed by a 3-wave corrective move, provides a structured approach to analyzing market trends. By adhering to wave classification rules and understanding wave structures, traders can effectively apply this theory in technical analysis to make informed investment decisions.

Avi Gilburt, a prominent figure in Elliott Wave analysis, offers valuable insights into wave patterns and market dynamics, further enhancing the application of this methodology in financial markets. Moreover, beyond financial markets, applying Elliott Waves to analyze life events can offer individuals insights into personal growth, decision-making processes, and emotional impacts over time. This holistic approach underscores the versatility and depth of Elliott Wave analysis beyond traditional market analysis practices.

What Are the Basics of Elliott Wave Theory for Beginners?

Elliott Wave Theory, a popular tool for analyzing financial markets, can be daunting for beginners. Understanding the basics of mastering Elliott Wave fractals is crucial. By studying the Elliott Wave principles, traders can gain insights into market trends and make informed decisions. Here are the basics of mastering Elliott Wave fractals in a listicle format.

Frequently Asked Questions

What Is the Elliot Wave Theory Simplified?

Elliott Wave Theory simplifies market analysis by identifying repeating patterns in price movements. It involves 5-wave impulse moves followed by 3-wave corrective moves. This theory aids traders in predicting turning points in financial markets, offering a structured framework for understanding market dynamics.

How Do You Trade Elliott Wave for Beginners?

How can beginners trade Elliott Wave Theory effectively? By mastering wave pattern identification, using technical tools for accuracy, applying Fibonacci ratios for validation, maintaining discipline in strategy execution, and practicing on demo accounts to build confidence and skill.

What Is the Starting Point of Elliott Wave?

The starting point of Elliott Wave Theory marks the initiation of a new trend in price movement. Wave 1, the first impulse wave in the sequence, is crucial for traders to identify potential trading opportunities and confirm trend reversals.

What Is the Logic Behind Elliott Wave Theory?

Elliott Wave Theory's logic lies in understanding market dynamics through predictable wave patterns influenced by investor psychology. By identifying impulse and corrective waves, traders anticipate turning points, leveraging the theory's insights on human behavior's repetitive nature.

Conclusion

In conclusion, Elliott Wave Theory serves as a powerful tool for predicting market trends and making informed trading decisions. By understanding the wave patterns, traders can gain valuable insights into market dynamics and psychology.

The application of Elliott Waves in analysis provides a structured approach to identifying entry and exit points, ultimately leading to more successful trading strategies. Embrace the waves of knowledge to navigate the complexities of the financial markets with confidence and precision.