Exploring advanced techniques in pivot points analysis can significantly elevate one's ability to interpret market movements effectively and enhance trading strategies.

From incorporating Fibonacci levels to utilizing multiple time frames and volume analysis, these methods offer a sophisticated approach to understanding price action dynamics.

By delving deeper into the intricate world of pivot point analysis, traders can gain a competitive edge in navigating the complexities of financial markets.

Advanced Pivot Points Calculation Methods

In exploring advanced pivot points calculation methods, traders can augment their analysis by incorporating various techniques to derive more precise support and resistance levels. Utilizing multiple timeframes allows for a comprehensive view of the market dynamics, enabling traders to identify key support and resistance levels more accurately.

Fibonacci retracement levels, when integrated into pivot point calculations, add a layer of sophistication by pinpointing significant price levels based on the Fibonacci sequence. Camarilla pivot points provide traders with additional support and resistance levels beyond the traditional pivot points, offering a more nuanced analysis of price movements.

Woodie's pivot points, which consider the previous day's trading range, offer a different perspective on support and resistance levels, contributing to a holistic understanding of market dynamics. Demark pivot points offer unique price levels derived from specific formulas, aiding traders in making strategic decisions based on calculated price levels.

Incorporating these advanced pivot point calculation methods enhances traders' ability to make informed decisions in the dynamic financial markets.

Using Fibonacci Levels With Pivot Points

Exploring the integration of Fibonacci levels with pivot points enhances traders' ability to pinpoint key support and resistance levels for more precise trading decisions. By combining these two technical analysis tools, traders can better identify potential price reversals and establish optimal entry and exit points.

Fibonacci retracement levels serve to validate the significance of pivot point levels, offering traders additional confirmation when determining potential support and resistance areas. The confluence between Fibonacci levels and pivot points is sought after by many traders as it provides stronger trade signals, indicating areas where price movements may stall or reverse.

Particularly, the 61.8% Fibonacci retracement level holds special importance when used in conjunction with pivot points, aiding in trend confirmation. Overall, the incorporation of Fibonacci levels with pivot points adds a layer of depth to traders' technical analysis strategies, allowing for more informed and strategic decision-making in the financial markets.

Incorporating Multiple Time Frames Analysis

Analyzing pivot points across different time frames offers traders a more comprehensive understanding of market dynamics.

By considering variations in data interpretation and trend identification across various time frames, traders can make more informed decisions.

Incorporating multiple time frames analysis is essential for creating a robust trading strategy that accounts for both short-term fluctuations and long-term trends.

Time Frame Selection

Utilizing multiple time frames analysis in pivot points evaluation provides traders with a comprehensive perspective on market dynamics and aids in pinpointing crucial support and resistance levels accurately. When selecting time frames for analysis, traders should consider:

- Broader Market Context: Examining various time frames helps in understanding the overall market trend.

- Trend Strength: Analyzing multiple time frames allows traders to assess the strength of a trend.

- Precise Entry and Exit Points: Shorter time frames can be used to identify optimal entry and exit points for trades.

Interpreting Data Variations

Incorporating data variations from multiple time frames in pivot point analysis provides traders with a comprehensive understanding of market trends and price movements. By analyzing data across different time frames like daily, weekly, and monthly, traders can identify both long-term trends and short-term fluctuations. This comparison of data aids in confirming support and resistance levels derived from pivot points, enhancing the accuracy of pivot point analysis and decision-making in trading choices.

Utilizing multiple time frame analysis with pivot points enables traders to adapt to changing market conditions, leading to more informed decisions. This approach not only facilitates precise support and resistance level identification but also improves overall trading strategies.

Enhancing Trend Identification

Enhancing trend identification through the integration of multiple time frames analysis provides traders with a more comprehensive perspective on market movements and potential trading opportunities.

- Analyzing pivot points on various time frames helps identify strong trends and potential reversals.

- Utilizing daily, weekly, and monthly pivot points enhances trend identification accuracy.

- Integrating multiple time frames analysis aids in confirming trend direction, allowing traders to make more informed decisions and improve their trading strategies.

Applying Volume Analysis to Pivot Points

Volume analysis plays a crucial role in evaluating market dynamics when applied to pivot points, providing traders with valuable insights into the strength of price movements and market sentiment. By analyzing trading volume in conjunction with pivot points, traders can assess market strength and confirm support and resistance levels. High trading volume at pivot points signals substantial buying or selling pressure, influencing entry and exit decisions.

This analysis helps validate pivot point signals, leading to more informed trading choices based on the level of market participation. The combination of volume analysis with pivot points can enhance the accuracy of identifying key price levels and potential market reversals. Monitoring volume trends around pivot points offers valuable insights into market sentiment and the intensity of price movements, aiding traders in making well-informed decisions.

Incorporating volume analysis into pivot point strategies empowers traders to better understand market dynamics and improve their overall trading performance.

Utilizing Pivot Points for Trend Confirmation

Pivot points play a crucial role in confirming market trends by serving as reference points for determining the prevailing direction based on support and resistance levels.

Traders rely on pivot points to validate trend signals and assess the overall market sentiment accurately.

Utilizing pivot points for trend confirmation aids traders in distinguishing genuine trend movements from temporary fluctuations, enhancing the reliability of their trading strategies.

Trend Reversal Signals

When price movements intersect with the central pivot point, a crucial signal for potential trend reversal emerges in pivot points analysis. This pivot point confirmation can provide valuable insights into market sentiment and potential shifts in trends.

Here are key points to consider:

- A break above the central pivot point indicates a possible bullish trend reversal.

- Conversely, if the price drops below the central pivot point, it may signal a bearish trend reversal.

- Traders can enhance the accuracy of these signals by combining pivot points with other indicators, leading to more informed trading decisions.

Price Action Validation

In the realm of technical analysis, the validation of price action through pivot points serves as a critical tool for confirming trends and guiding trading decisions. Price action validation involves confirming trends by observing how prices interact with pivot levels and looking for price reactions at these points to validate trend directions.

Bullish trends are typically confirmed when prices hold above pivot levels, while bearish trends are confirmed when prices remain below them. This method helps traders make informed decisions by considering pivot point interactions, ultimately enhancing their trading strategies and increasing accuracy in market analysis.

Market Sentiment Analysis

Utilizing pivot points in market sentiment analysis provides traders with a structured method for confirming trend directions and making informed decisions on entry and exit points based on price interactions at key support and resistance levels. Traders rely on pivot points to validate market sentiment and enhance their trading strategies.

Key aspects of market sentiment analysis with pivot points include:

- Determining bullish or bearish trends through trading above or below pivot points.

- Using pivot points as essential support and resistance levels for confirming market sentiment and trend directions.

- Predicting potential price reversals and trend continuations by understanding market sentiment through pivot points.

This structured approach aids traders in effectively analyzing market sentiment and making well-informed decisions for successful trading strategies.

Implementing Advanced Stop Loss Strategies

Implementing advanced stop loss strategies is crucial for traders seeking to safeguard profits and manage risk effectively in the dynamic realm of trading. These strategies involve setting predefined exit points, such as trailing stops, volatility-based stops, and percentage-based stops, to limit potential losses.

By utilizing advanced stop loss techniques, traders aim to protect profits and navigate market fluctuations successfully. Trailing stops allow traders to secure gains by adjusting the stop loss level as the trade moves in their favor. Volatility-based stops consider market volatility to set stop loss levels accordingly, while percentage-based stops calculate stop loss placement based on a percentage of the asset's price.

These advanced methods not only protect profits but also enhance overall risk management, ensuring that traders can limit losses and optimize their trading performance effectively. In essence, integrating advanced stop loss strategies is vital for traders to navigate the complexities of the market with prudence and foresight.

Integrating Pivot Points With Market Sentiment

Integrating market sentiment with pivot points is a strategic approach that enhances traders' ability to interpret and act upon price levels effectively. Understanding market sentiment plays a crucial role in confirming or adjusting pivot point analysis, influencing traders' decision-making process. When incorporating market sentiment with pivot points, traders often consider the following:

- Bullish sentiment: This can validate support levels identified through pivot points, indicating potential areas of buying interest.

- Bearish sentiment: Helps confirm resistance levels determined by pivot points, suggesting zones where selling pressure may intensify.

- Strength of price levels: Traders assess the interplay between market sentiment and pivot points to gauge the robustness of support and resistance levels, informing their trading strategies accordingly.

Advanced Entry and Exit Strategies

To enhance trading precision and optimize decision-making, utilizing advanced entry and exit strategies based on pivot point analysis is paramount. Advanced entry strategies involve identifying key support and resistance levels for precise trade entries. Traders can use pivot point analysis to determine optimal exit points by considering pivot point levels and current market conditions.

Techniques such as pivot point breakouts and bounces can be implemented for strategic entry and exit decisions. Additionally, incorporating pivot point confluence with other technical indicators can help confirm entry and exit signals, enhancing overall accuracy.

Advanced pivot point analysis aids in optimizing risk management practices by setting appropriate stop-loss levels based on pivot point support and resistance zones. By integrating these advanced entry strategies into trading approaches, traders can make more informed decisions and potentially improve their overall trading performance.

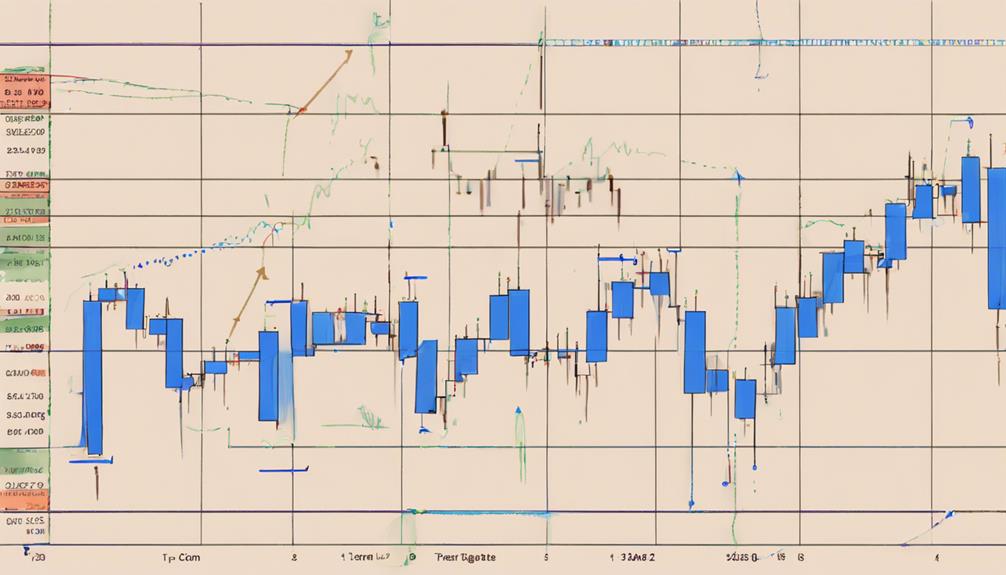

Using Pivot Points for Intraday Trading

Pivot points in intraday trading serve as crucial reference levels for entry timing strategies, stop-loss placement, and identification of potential reversal points. By utilizing these key levels derived from the previous day's price action, intraday traders can make informed decisions on when to enter or exit trades and effectively manage risk.

The central pivot point acts as a focal point for monitoring price action and determining market sentiment throughout the trading day.

Entry Timing Strategies

Intraday trading strategies leverage pivot points to pinpoint optimal entry times based on market dynamics and price movements. Traders utilizing pivot points for entry timing in intraday trading focus on:

- Identifying potential support and resistance levels to make informed trading decisions.

- Setting entry points based on market sentiment and price action analysis.

- Enhancing precision in capturing profitable trading opportunities through effective use of pivot points.

This approach not only improves risk management but also enhances trade execution in fast-moving markets. By incorporating pivot points into entry timing strategies, traders can increase their chances of success in the volatile intraday trading environment.

Setting Stop-Loss Levels

Utilizing pivot points for intraday trading stop-loss levels involves strategically identifying key support levels derived from pivot point calculations to effectively manage risk and protect trading capital in volatile market conditions.

Pivot points assist in determining potential price reversal points, guiding where to place stop-loss orders for intraday traders. By aligning stop-loss levels with market sentiment and price action, traders can enhance risk management practices and safeguard their trading capital.

Incorporating pivot points into stop-loss strategies is crucial for intraday trading, as it provides a structured approach to setting stop-loss orders based on calculated support levels. This method not only aids in minimizing potential losses but also contributes to overall trading discipline and improved decision-making processes in fast-paced intraday trading environments.

Identifying Reversal Points

When examining market dynamics in intraday trading, astute traders leverage pivot points to pinpoint potential reversal points with precision and insight. Pivot points help identify key support and resistance levels, aiding traders in spotting reversal points as price action approaches these levels. This is crucial for understanding market sentiment shifts and anticipating trend changes.

Advanced Risk Management Techniques

Implementing stop-loss orders based on pivot points is a crucial element of employing advanced risk management techniques in trading. Pivot points serve as a valuable tool for setting profit targets and adjusting position sizes to align with the levels identified.

By making daily adjustments to pivot points, traders can effectively navigate changing market conditions and determine optimal entry and exit points for their trades. Incorporating historical price movements in conjunction with pivot point levels aids in devising robust risk management strategies.

This strategic approach enables traders to react to fluctuations in market dynamics while safeguarding against potential losses. By leveraging pivot point risk management effectively, traders can enhance their decision-making process and adapt to the evolving market landscape with confidence.

Staying attuned to the insights provided by pivot points allows traders to proactively manage risk and optimize their trading performance in various market scenarios.

How Can I Use Advanced Pivot Points Analysis in my Day Trading Strategies?

Advanced pivot points in day trading can be a valuable tool for analyzing market trends and identifying potential entry and exit points. By incorporating pivot points into your day trading strategies, you can gain a deeper understanding of price action and make more informed trading decisions based on key support and resistance levels.

Frequently Asked Questions

What Is the Best Pivot Point Strategy?

The best pivot point strategy involves identifying key support and resistance levels to guide trading decisions. Traders combine pivot points with technical indicators for enhanced accuracy. Setting entry/exit points and risk management based on calculated levels are crucial.

What Is the Most Accurate Pivot Indicator?

The most accurate pivot indicator often considered is the Standard Pivot Point formula. Calculated using the previous day's high, low, and closing prices, it provides clear support and resistance levels, aiding traders in informed decision-making based on market sentiment.

What Is the Most Efficient Way to Modify a Calculated Field on a Pivottable?

To efficiently modify a calculated field on a PivotTable, access the PivotTable Fields pane and locate the desired field under Values. Right-click on the field, select 'Modify,' adjust the formula in the dialog box, and click OK to update the calculations instantly.

What Is Advanced Pivottable?

An advanced PivotTable is a sophisticated data analysis tool that empowers users to perform complex calculations, summaries, and visualizations from extensive datasets. It offers dynamic features like sorting, filtering, and data modeling for comprehensive analysis.

Conclusion

Incorporating advanced techniques for pivot points analysis can significantly enhance trading strategies and decision-making processes. By leveraging Excel VBA automation, Fibonacci levels, multiple time frames analysis, and volume analysis, traders can gain deeper insights and improve the accuracy of their trades.

Integrating pivot points with market sentiment, advanced entry and exit strategies, and intraday trading techniques can further refine trading approaches. Overall, mastering these advanced techniques can lead to more informed and successful trading outcomes.