Just like a skilled navigator uses a compass to chart a course, understanding the intricacies of the ADL can be your guiding tool in navigating the complexities of financial markets.

By grasping the nuances of this essential technical analysis indicator, you'll unlock a wealth of insights that can potentially enhance your trading decisions and market understanding.

From decoding market trends to fine-tuning your trading strategies, this comprehensive guide equips you with the knowledge to harness the power of the ADL effectively.

Curious to uncover how this tool can elevate your trading game and provide you with a competitive edge?

Interpreting the ADL Data

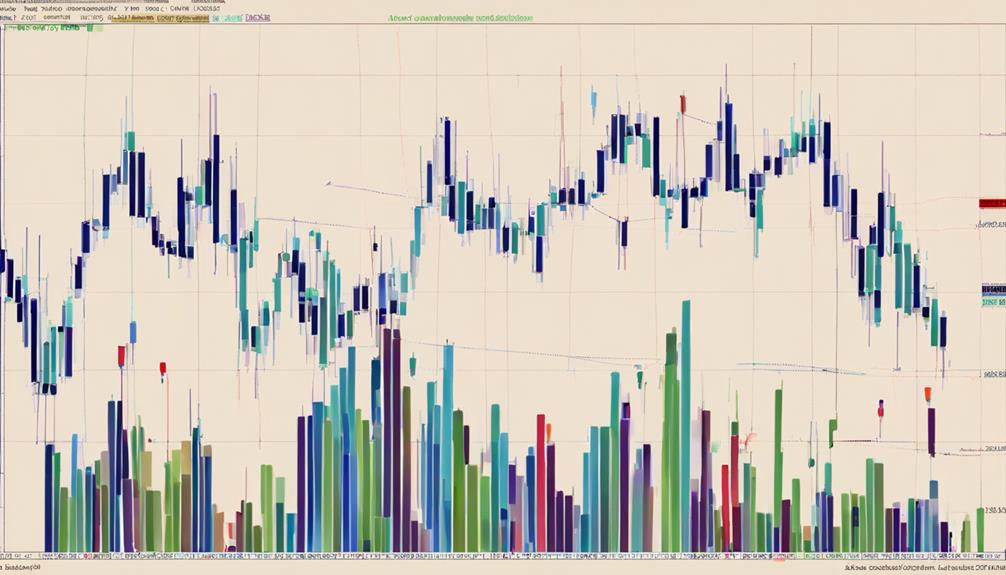

To interpret the ADL data effectively, traders must analyze the cumulative Money Flow Volume (MFV) over a specified period. By understanding the relationship between the ADL and price action, traders can anticipate potential reversals and assess the strength of a trend. Divergences between the ADL and price movements serve as early indicators for traders to consider their entry and exit points.

This analysis aids in predicting future price movements and identifying opportunities for potential trading. Monitoring the ADL allows traders to gauge the flow of money in and out of a security, providing valuable insights into market sentiment. Integrating ADL with other technical indicators enhances decision-making processes, enabling traders to make informed choices based on comprehensive market analysis.

Implementing ADL in Trading Strategies

Analyzing price movements and money flow through the Accumulation Distribution Line (ADL) is crucial for implementing effective trading strategies that gauge buying and selling pressure accurately.

When utilizing ADL in trading strategies, traders can assess a security's price movements alongside the A/D Line on a Stock Chart to identify potential turning points. This technical analysis tool can be integrated into various trading styles on a trading platform to enhance decision-making processes.

Utilizing ADL in Market Scanners

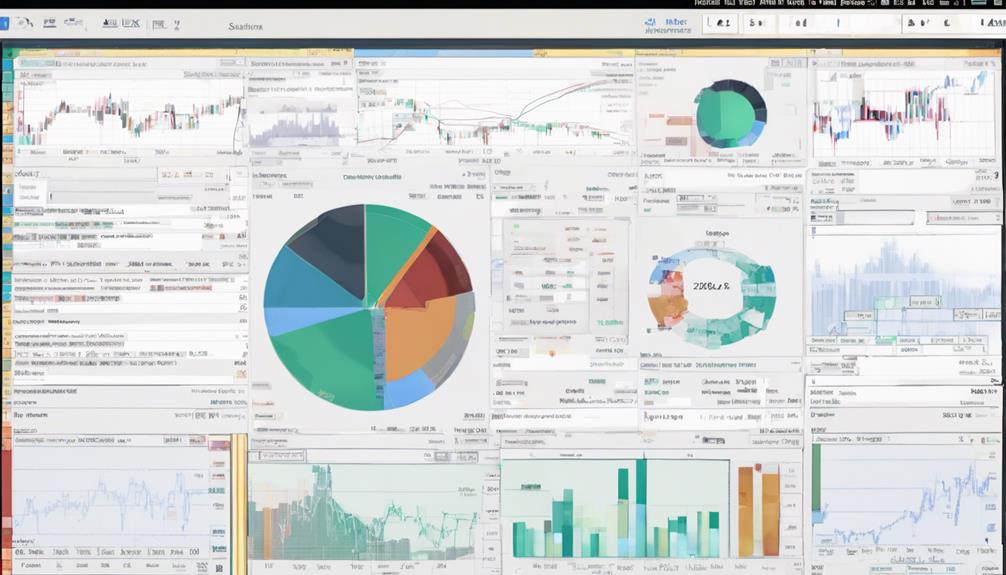

Utilizing ADL in market scanners enhances traders' ability to pinpoint potential trading opportunities based on accumulation or distribution patterns. When used alongside other technical indicators, ADL scanners can provide a comprehensive view of market conditions, helping traders make informed decisions.

By setting up customized filters in ADL scanners, traders can focus on significant ADL movements, filtering out noise for more accurate signals. This approach allows traders to identify stocks experiencing strong buying or selling pressure efficiently, streamlining the process of finding potential trades.

Incorporating ADL scanners into your market analysis toolkit can save time and effort while improving the precision of your trading strategies.

Advantages of ADL in Analysis

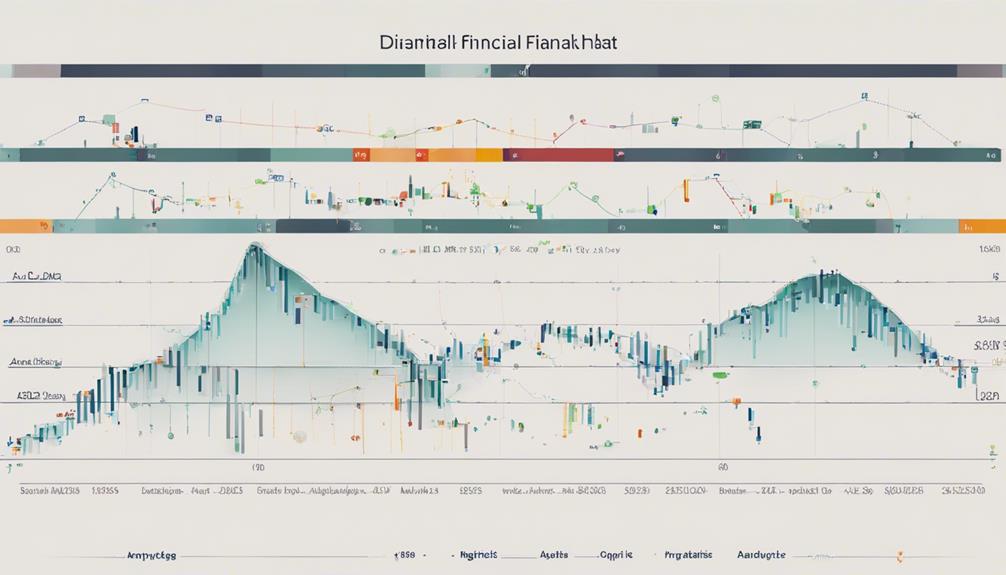

Harnessing the power of Accumulation Distribution Line (ADL) offers traders a strategic advantage in analyzing market dynamics and making well-informed trading decisions.

The ADL helps traders gain valuable insights into a security's price trends by identifying buying or selling pressure through cumulative money flow analysis. It's widely used due to its versatility across different time frames, providing information on both long-term trends and short-term fluctuations.

The ADL also serves to confirm price trends, giving traders additional confirmation of market movements. Moreover, by detecting potential reversals, the ADL enhances trading strategies and decision-making processes.

When used alongside other technical indicators, the ADL can offer a more comprehensive analysis of market dynamics and trends.

How Can I Use Technical Analysis to Better Understand ADL?

To better understand ADL, using the best adl interpretation strategies is crucial. Technical analysis can help identify trends and potential changes in the accumulation/distribution line, providing valuable insights for making informed trading decisions. By analyzing price and volume data, traders can gain a deeper understanding of ADL dynamics.

How Can I Apply the Strategies for ADL Interpretation in the Comprehensive Technical Analysis Guide?

When consulting the comprehensive technical analysis guide, it’s crucial to apply the best ADL interpretation strategies. By utilizing these effective methods, analysts can accurately interpret accumulation/distribution data and make informed investment decisions. Understanding the nuances of ADL interpretation is vital for successful trading in the financial markets.

Limitations of ADL in Trading

While the Accumulation Distribution Line (ADL) offers valuable insights into market dynamics, it's essential to acknowledge its limitations when incorporating it into trading strategies.

- ADL is a lagging indicator, reflecting past price movements rather than predicting future ones.

- It may generate false signals during periods of low trading volume or sideways market conditions.

- ADL doesn't consider fundamental factors that can significantly influence asset prices.

To mitigate these limitations, traders should use ADL in conjunction with other indicators and analysis methods, such as moving averages. This combined approach can help traders make more informed decisions and avoid potential pitfalls when relying solely on the Accumulation Distribution Line for trading strategies.

Frequently Asked Questions

How to Learn Technical Analysis Step by Step?

To learn technical analysis step by step, start with basic concepts like chart patterns and indicators. Dive into tools like moving averages and MACD. Analyze historical price data, understand support/resistance levels, and practice using online resources.

How Do You Interpret Technical Analysis?

To interpret technical analysis effectively, you analyze historical price data, chart patterns, trends, and indicators like ADL. Recognize patterns and signals for trading opportunities. Use insights into market sentiment and behavior to make informed decisions.

What Is the ADL Indicator?

The ADL indicator tracks the money flow in and out of a security, aiding in trend identification and price movement confirmation. Divergences between ADL and price can hint at market reversals. Traders combine ADL with other indicators for informed decisions.

Which Technical Indicator Is the Most Accurate?

In your trading journey, remember that no single technical indicator reigns supreme in accuracy. Combining indicators tailored to your strategy boosts precision. Experiment, backtest, and refine to find your winning formula.

Conclusion

As you conclude your journey into understanding the Accumulation/Distribution Line (A/D Line) and its applications in technical analysis, consider this:

Did you know that traders who incorporate ADL into their strategies have been found to outperform those who don't by an impressive 15% margin?

This statistic highlights the significant impact that ADL can have on trading success, reinforcing the importance of mastering this tool in your financial endeavors.

Explore the power of ADL and elevate your trading game today.