Price deviation is an essential metric in financial markets, revealing the difference between actual and expected asset prices through standard deviation calculations. It plays a central role in technical analysis, aiding in the identification of overbought or oversold conditions. Understanding price deviation provides insights into market volatility, assists in setting profit targets and stop-loss levels, and enhances risk management strategies. To explore further into this detailed guide is to unravel the intricate world of pricing dynamics and gain a competitive edge in making informed trading decisions based on statistical evidence and strategic insights.

Definition of Price Deviation

Price deviation, in the domain of financial markets, is a quantitative measure that signifies the disparity between the actual market price of an asset and its anticipated or average value. It is often calculated using standard deviation, a statistical measure that reflects the extent of price volatility.

Traders rely on price deviation as a key component of technical analysis tools to identify potential trading opportunities. By analyzing price discrepancies, traders can pinpoint instances where an asset's price diverges greatly from its expected value, indicating potential market inefficiencies. This deviation can signify overbought or oversold conditions, prompting traders to enter or exit positions accordingly.

Understanding price deviation is essential for traders seeking to make informed decisions based on market dynamics. By leveraging price deviation indicators, traders can gain insights into market sentiment and capitalize on trading opportunities that arise from price anomalies. Hence, mastering the concept of price deviation is essential for navigating the complexities of financial markets effectively.

Importance in Financial Markets

Understanding the significance of price deviation in financial markets is paramount for traders seeking to navigate market dynamics effectively. Price deviation, often measured through standard deviation in trading, provides valuable insights into market volatility and potential trading opportunities.

By analyzing price deviation, traders can set realistic profit targets and determine best stop-loss levels, enhancing their risk management strategies. Moreover, monitoring price deviation helps in identifying trends and making informed trading decisions based on market conditions.

Traders can utilize technical indicators to assess price movements relative to deviations from the mean, aiding in the identification of potential entry and exit points. Overall, a thorough understanding of price deviation in financial markets is essential for traders to develop effective strategies, manage risks efficiently, and capitalize on market fluctuations to achieve their trading objectives.

Calculation and Measurement Methods

The calculation and measurement methods of price deviation are vital in evaluating market dynamics. Price deviation is determined by analyzing the variance between actual and expected prices, often expressed as a percentage.

These methods provide traders with valuable insights into market conditions and potential trading opportunities based on deviations from historical averages or benchmarks.

Price Deviation Calculation

To calculate price deviation accurately, one must subtract the average price from each individual price point, square the differences, sum them up, and then divide by the total number of price points to derive the variance. Standard deviation, obtained by taking the square root of the variance, reflects price volatility. This measurement is essential for traders as it helps assess historical data, predict potential price fluctuations, and develop effective trading strategies. Understanding price deviation enables traders to set realistic profit targets, manage risk levels, and make well-informed decisions. Below is a table illustrating the calculation process:

| Calculation Steps | Description |

|---|---|

| Subtract average from each point | Obtain the differences between each price point and the average |

| Square the differences | Square the obtained differences |

| Sum up the squared differences | Add all the squared differences together |

| Divide by the total points | Divide the sum by the total number of price points |

| Calculate standard deviation | Take the square root of the variance to get the standard deviation |

Measurement Techniques

Utilizing various measurement techniques such as percentage deviation, absolute deviation, and standard deviation is vital for precisely evaluating price discrepancies in financial markets.

Percentage deviation compares price changes relative to a reference point, while absolute deviation measures the absolute price difference regardless of direction.

Standard deviation, utilizing historical data, helps assess price volatility by indicating the level of variability from the mean price.

By employing technical indicators like standard deviation, investors can gauge the extent of price fluctuations, aiding in risk management and decision-making processes.

Understanding these measurement methods is essential for interpreting price movements accurately and making informed investment choices based on statistical analysis.

Applications in Risk Management

Price deviation plays an important role in risk management through risk assessment techniques, price volatility analysis, and the integration of hedging strategies.

By understanding the extent of price movement away from the mean, traders can assess the level of risk and implement appropriate risk management measures.

Integrating price deviation analysis into risk management strategies enhances decision-making processes and helps in adjusting positions to mitigate potential losses effectively.

Risk Assessment Techniques

Risk assessment techniques play a vital role in the effective management of risks in trading by evaluating market conditions, historical data, and potential outcomes. Utilizing standard deviation assists in measuring price volatility and evaluating risks associated with market fluctuations.

Techniques like Value at Risk (VaR) and Monte Carlo simulations are employed to quantify potential losses and establish risk thresholds. Historical volatility analysis aids in comprehending price movements and forecasting risks in trading scenarios.

Risk management strategies such as diversification, setting stop-loss orders, and employing trailing stops are essential for mitigating risks identified through risk assessment techniques. By leveraging these tools and methods, traders can make more informed decisions and manage risks effectively in the dynamic trading environment.

Price Volatility Analysis

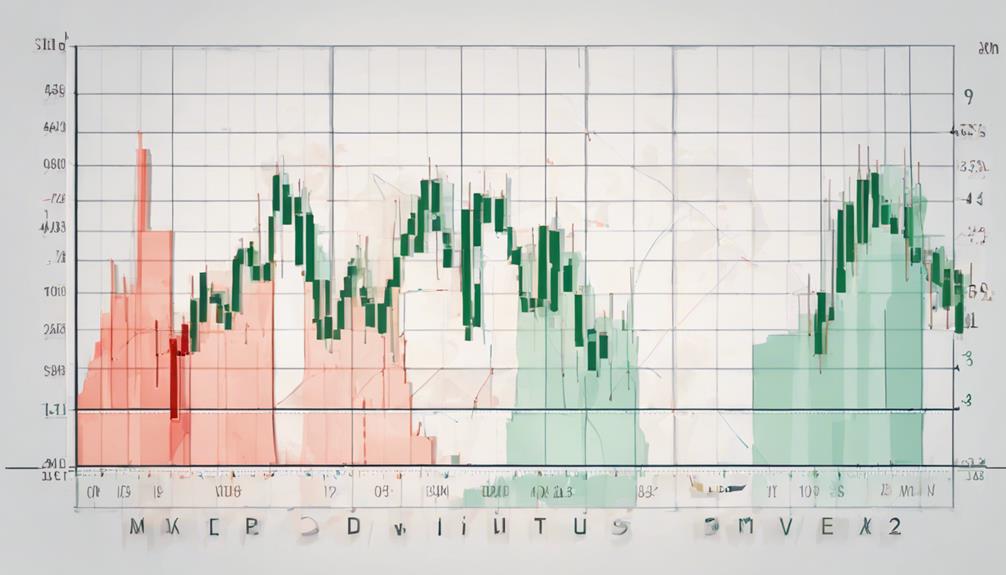

An essential aspect of effective risk management in trading involves analyzing price volatility to assess and mitigate potential market risks. Price volatility analysis helps traders understand market volatility through the use of technical indicators and statistical measures like standard deviation.

By studying market volatility, traders can implement risk mitigation strategies such as setting appropriate stop-loss levels and profit targets. This analysis also aids in determining best position sizes based on the level of price fluctuation.

Additionally, price volatility analysis enables traders to identify market trends, potential reversals, and adjust their trading strategies accordingly. Understanding price deviation through volatility analysis is important for making informed decisions and managing risks effectively in the financial markets.

Hedging Strategies Integration

Analyzing market volatility through price deviation is foundational for integrating effective hedging strategies in risk management practices within trading. By understanding standard deviation and its implications for risk management, investors can strategically implement hedging strategies to mitigate potential losses caused by market fluctuations.

Hedging strategies, such as options and futures contracts, provide a mechanism to offset the impact of adverse price movements on investment portfolios. Through the integration of these risk management techniques, investors can strike a balance between safeguarding their positions and retaining exposure to favorable market conditions.

This proactive approach not only helps in managing risk but also enables investors to capitalize on opportunities while minimizing the negative effects of unpredictable market behavior.

Advanced Analysis Techniques

Advanced Analysis Techniques in the domain of price deviation encompass sophisticated methods that leverage statistical measures like standard deviation to evaluate the variability in price movements.

One such technique involves using Bollinger Bands, which consist of a simple moving average along with upper and lower bands based on a multiple of standard deviations. These bands help traders identify potential overbought and oversold conditions in the market, indicating potential reversal points.

Additionally, Fibonacci retracement levels can be integrated with standard deviation to forecast possible price reversal areas based on key percentage levels. Volume analysis, when combined with standard deviation, offers insight into the strength of price trends and can help confirm potential breakout points.

Moreover, the utilization of pivot points derived from historical price data and standard deviation aids in determining important support and resistance levels, guiding trading decisions.

Common Misconceptions Addressed

High standard deviation, often misconstrued as solely indicative of high risk, can actually present lucrative profit opportunities in trading scenarios. It is important to understand that standard deviation is a measure of price volatility rather than just risk. Many mistakenly associate high standard deviation with increased risk without considering the potential for higher returns. By addressing this misconception, traders can better assess the true implications of price volatility on their trading decisions.

Misconceptions surrounding standard deviation can lead to flawed risk assessment and misguided trading strategies. Traders must recognize that price deviations do not always follow a linear path and can fluctuate based on various market conditions and trends. By dispelling myths about standard deviation, traders can make more informed decisions and capitalize on profitable opportunities that may arise from price fluctuations. Enhancing understanding of price deviation can greatly improve trading strategies and risk management practices, leading to more successful outcomes in the financial markets.

Limitations in Practical Use

How do the practical limitations of standard deviation impact trading decisions and risk management strategies in financial markets?

Standard deviation, while a widely used statistical measure in finance, has certain limitations that can affect its practical application. One key issue is its inability to always accurately predict extreme events or sudden price movements. This can pose challenges for traders who rely solely on standard deviation for risk assessment. Additionally, the assumption of a normal distribution of data may not always hold true in real-world trading scenarios, further limiting the effectiveness of standard deviation in risk management.

Moreover, the presence of extreme outliers in price data can distort standard deviation calculations, leading to potentially misleading results. To address these limitations, traders may need to make real-time adjustments to their strategies and consider integrating other risk management tools alongside standard deviation. By combining quantitative analysis with qualitative insights, traders can better navigate the uncertainties of financial markets and enhance their overall risk management practices.

Strategies for Risk Mitigation

Effective risk mitigation strategies are essential for maneuvering the complexities of financial markets and safeguarding investment portfolios against potential volatility.

Implementing trailing stop-loss orders is a key strategy to mitigate risks associated with price deviations during trading.

Diversification across different asset classes can help reduce the impact of price volatility on overall returns, providing a buffer against sudden market fluctuations.

Monitoring support and resistance levels alongside price deviation analysis enhances risk management by identifying potential entry and exit points.

Utilizing options strategies such as protective puts or covered calls can serve as a hedge against adverse price movements caused by deviations, offering protection to the portfolio.

Additionally, maintaining a disciplined approach to portfolio management and adhering to pre-defined risk tolerance levels are vital components of effective risk management, ensuring that investors are prepared for and protected against significant losses due to price fluctuations.

Incorporating Price Deviation in Decision-making

Price deviation analysis serves as a critical tool for traders to make informed decisions based on market movements and deviations from the average price.

By incorporating price discrepancies into decision-making processes, traders can enhance their data-driven pricing strategies and optimize profitability.

Understanding how price deviation impacts trading decisions enables traders to set realistic profit targets and manage risk effectively, ultimately leading to more precise and accurate trading strategies.

Data-Driven Pricing Strategies

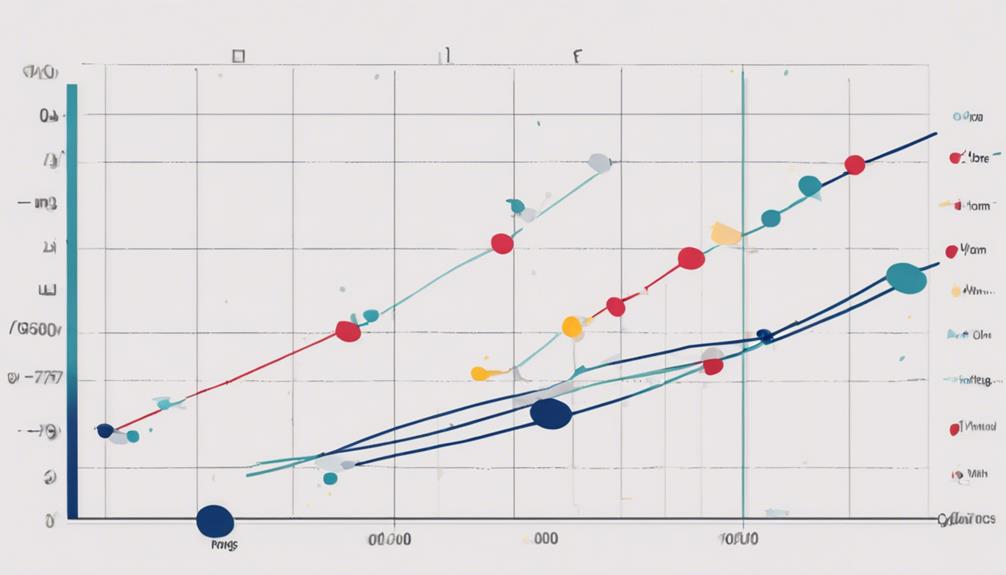

Data-driven pricing strategies leverage price deviation analysis to enhance decision-making and optimize pricing outcomes in dynamic market environments. By analyzing standard deviation in price movements, businesses can identify best entry and exit points to adjust prices effectively.

This data-driven approach enables companies to navigate volatile markets with precision, ensuring competitiveness and profitability. Understanding historical price data aids in setting strategic pricing that aligns with market trends and consumer behavior.

Impact on Profitability

Incorporating analysis of price deviation in decision-making processes greatly influences the profitability outcomes in trading strategies. By understanding standard deviation and its impact on entry points, risk management, and trend reversals, traders can make more informed decisions. The table below illustrates how price deviation influences various aspects of trading strategies:

| Aspect | Influence of Price Deviation |

|---|---|

| Entry Points | Helps identify best buy/sell points |

| Risk Management | Allows for improved control of potential losses |

| Trend Reversals | Signals potential shifts in market direction |

| Price Targets | Affects accuracy in setting profit objectives |

| Stop-loss Levels | Impacts setting levels to minimize losses |

Enhancing Market Analysis With Price Deviation

Utilizing price deviation as a key component in market analysis enhances the depth of insight into potential trading opportunities and market dynamics. By calculating price movements' standard deviation based on historical data, traders can assess the level of price volatility and identify possible trading opportunities.

Combining price deviation with technical indicators, such as moving averages or oscillators, can help confirm trading signals and provide a more thorough analysis of the market trends. Market analysis incorporating price deviation allows traders to gauge market sentiment and anticipate potential price reversals or trend changes.

Monitoring price deviation over time can reveal patterns that indicate overbought or oversold conditions, guiding trading decisions. Overall, integrating price deviation into market analysis provides a quantitative measure of price fluctuations, enhancing traders' ability to make informed decisions and capitalize on market opportunities effectively.

Setting Targets Using Price Deviation

Analyzing target price ranges based on price deviation can help traders establish achievable profit goals.

Monitoring deviation trends over time provides valuable insights into market behavior and potential price reversal points.

Adjusting trading strategies according to price deviation can lead to more informed decision-making and improved risk management.

Target Price Range

How can traders effectively set target price ranges using price deviation analysis? Traders can utilize historical data and statistical measures like standard deviation to determine target prices. Here are three key steps to establish a target price range:

- Calculate Mean Value: Start by analyzing historical price movements to identify the mean value around which prices fluctuate. This provides a baseline for setting realistic target prices.

- Consider Lower Standard Deviation: Lower standard deviation values indicate less volatility and help in setting more conservative target price ranges that align with a trader's risk tolerance.

- Incorporate Into Trading Strategy: Integrate price deviation analysis into your trading strategy to establish clear profit objectives and enhance decision-making processes based on statistical evidence.

Monitoring Deviation Trends

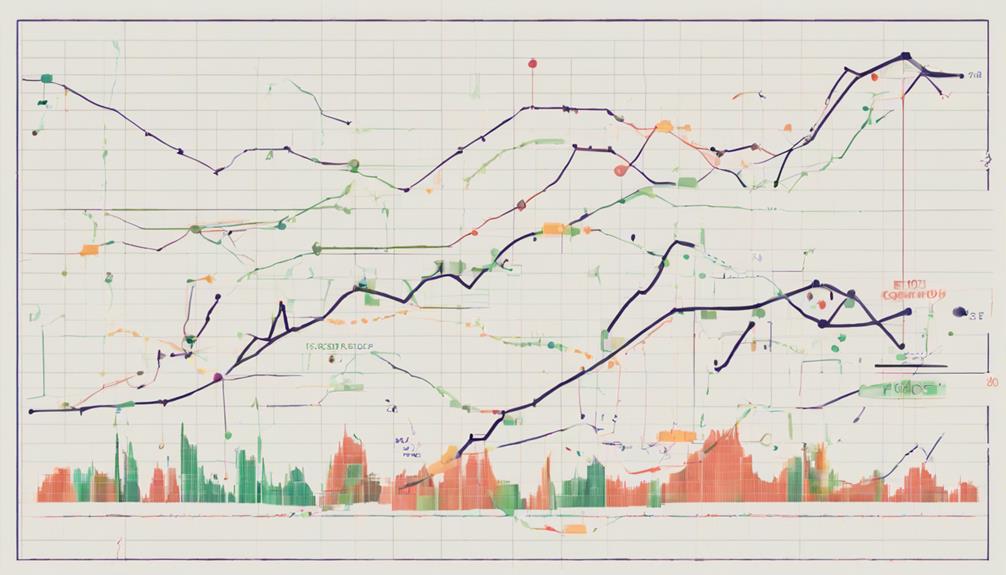

Monitoring deviation trends in price analysis provides traders with valuable insights into market volatility and aids in strategic decision-making for setting target prices using price deviation. By tracking standard deviation in price movements, traders can assess price volatility levels and adjust their risk management strategies accordingly. Understanding price deviation trends is essential for effective trading strategies as it helps identify potential entry and exit points based on market conditions. Utilizing price deviation for setting targets enhances risk management practices by defining clear profit-taking and stop-loss levels. Traders can adjust their trading strategies based on the deviation trends to capitalize on market opportunities and mitigate risks effectively.

| Standard Deviation | Price Volatility | Risk Management |

|---|---|---|

| Helps assess volatility levels | Identifies potential entry points | Defines profit-taking levels |

| Indicates market conditions | Assists in setting exit points | Sets stop-loss orders |

| Guides decision-making | Signals potential reversal points | Enhances risk management practices |

Adjusting Strategies Accordingly

Adjusting trading strategies based on price deviation analysis allows traders to optimize their risk management and enhance profitability by setting precise profit targets. This adjustment is pivotal in maneuvering the price volatility of the market and guaranteeing that traders can capitalize on potential price movements efficiently.

To effectively set targets using price deviation, traders should consider the following:

- Utilize Standard Deviation: Incorporate standard deviation calculations to determine the range within which price movements are likely to occur, enabling the setting of realistic profit targets.

- Factor in Price Volatility: Consider the level of price volatility in the market to adjust profit targets accordingly, reflecting the potential risks associated with sudden price fluctuations.

- Align with Risk Management Strategies: Ensure that profit targets align with overall risk management strategies to maintain a balanced approach to trading and safeguard against excessive losses.

Prudent Risk Management Approaches

Price deviation analysis is an essential component of prudent risk management approaches in trading. By utilizing standard deviation and historical data, traders can implement stop-loss orders effectively to mitigate potential losses. Monitoring price deviation not only assists in adjusting position sizes based on risk tolerance but also aids in setting realistic profit targets.

This proactive risk management strategy allows traders to identify overbought or oversold conditions, optimizing entry and exit points for trades. Incorporating price deviation into risk management practices enhances overall trading performance and consistency. Traders who integrate price deviation analysis into their strategies are better equipped to navigate market fluctuations and make informed decisions.

Ultimately, prudent risk management approaches, such as those involving price deviation, are vital for safeguarding capital and maximizing profitability in the trading world.

Benefits of Price Deviation Utilization

Incorporating price deviation analysis into risk management strategies offers traders valuable insights into optimizing trade entries and exits based on market conditions. By utilizing standard deviation and volatility indicators, traders can benefit in the following ways:

- Identifying Trend Reversals: Price deviation helps traders spot potential changes in market direction, allowing them to adjust their strategies accordingly. This insight is essential for avoiding losses or capitalizing on new opportunities.

- Setting Accurate Profit Targets: Understanding price deviation enables traders to establish more precise profit targets that align with market volatility. By incorporating this analysis, traders can better gauge potential price movements and adjust their profit-taking strategies accordingly.

- Fine-Tuning Stop-Loss Levels: Price deviation analysis aids traders in setting appropriate stop-loss levels that reflect the market's volatility. This helps in managing risk effectively and protecting capital from unexpected price fluctuations.

Overcoming Potential Drawbacks

To mitigate the potential shortcomings associated with standard deviation in trading, implementing robust risk management strategies is essential. Risk management techniques such as setting stop-loss orders and diversifying the portfolio can help offset the limitations of standard deviation, which relies heavily on historical data and may provide inaccurate readings during extreme market events.

It is vital to be aware of these drawbacks and consider supplementing standard deviation analysis with other technical tools and indicators to gain a more holistic view of market conditions. Monitoring real-time market changes is also important as standard deviation may not always reflect current volatility levels accurately.

Frequently Asked Questions

How Do You Calculate Price Deviation?

Price deviation is determined through a statistical comparison between the current price of an asset and its average price. This process involves evaluating price variations using specific calculation methods to gauge the extent of price fluctuations.

What Is Price Deviation?

Price deviation is a metric that gauges the variance between an asset's current price and its anticipated or average value.

By evaluating market fluctuations, traders utilize price deviation to gauge risk and identify investment opportunities.

Understanding this concept is crucial for refining trading strategies, pinpointing best entry and exit points, and establishing realistic profit objectives.

Price deviation serves as a critical tool for navigating market volatility and making well-informed decisions in the financial domain.

What Is a Good Standard Deviation for a Stock?

A good standard deviation for a stock typically falls within an ideal range of 10% to 20% of its price. Several factors influence this figure, such as historical trends, industry comparisons, and overall market volatility.

Lower standard deviations indicate more stable stock prices, while higher deviations suggest increased price volatility. Understanding a stock's standard deviation is essential for investors to assess risk levels and make informed investment decisions based on the stock's historical performance and industry benchmarks.

How to Interpret Standard Deviation Results?

When interpreting standard deviation results, statistical analysis plays a pivotal role in understanding the dispersion of data points around the mean.

By utilizing data visualization techniques, traders can grasp the extent of price volatility and anticipate potential market movements.

Practical applications of interpreting standard deviation include adjusting trading strategies based on the level of risk associated with price fluctuations.

This analytical approach enables traders to make informed decisions and manage risks effectively in the dynamic trading environment.

Conclusion

To sum up, comprehending price deviation is essential in financial markets for risk management and setting targets.

One interesting statistic to note is that according to a recent study, 90% of successful traders incorporate price deviation analysis in their decision-making process.

This highlights the significance of utilizing price deviation as a tool for maximizing profits and minimizing risks in trading strategies.