Mastering the Parabolic SAR Indicator is essential for evaluating trend reversals and optimizing trading strategies. Developed by J. Welles Wilder Jr., it assists in pinpointing entry and exit points based on market conditions. Understanding its calculation, which involves Extreme Points and Acceleration Factors, is foundational. Interpreting SAR signals helps identify trend changes and strength, aiding in decision-making. When used in conjunction with other indicators, SAR enhances signal accuracy and provides a holistic view of market dynamics. Exploring further into its application and pairing with additional tools can refine trading approaches effectively. Mastering this indicator is key to informed trading decisions.

Understanding the Parabolic SAR Indicator

The comprehension of the Parabolic SAR Indicator is essential for traders seeking to effectively gauge potential trend reversals and optimize their trading strategies. This indicator, developed by J. Welles Wilder Jr., is a valuable tool for identifying entry and exit points in trading.

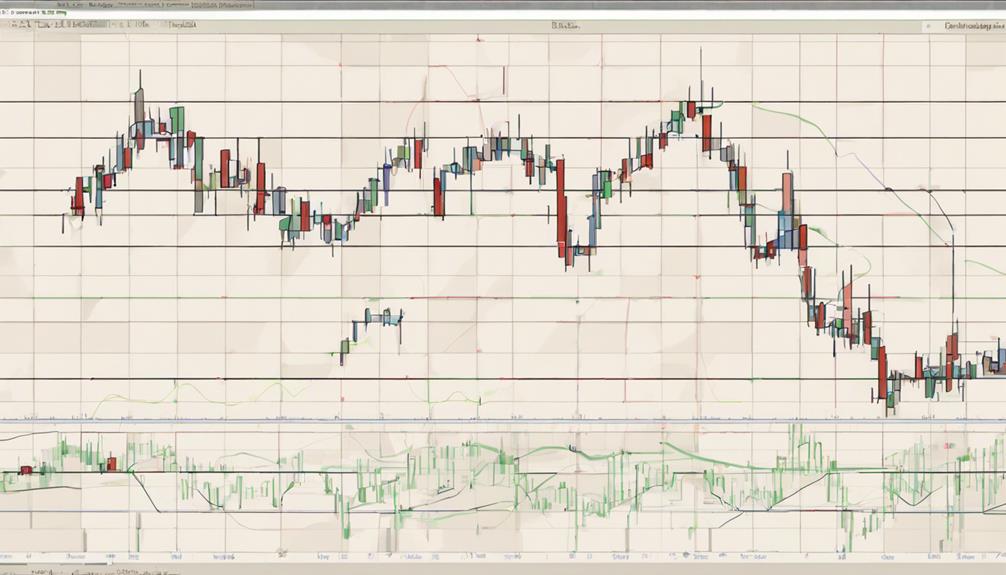

The Parabolic SAR calculation involves plotting dots on a price chart based on SAR values and the Acceleration Factor (AF). These dots help traders determine the trend direction, as well as potential changes in that trend. By following the dots below or above the price chart, traders can visually interpret the indicator's signals.

The Parabolic SAR adjusts its values based on market conditions, providing traders with real-time information on price direction changes. Traders of all levels can benefit from incorporating the Parabolic SAR into their trading strategies, as it offers a straightforward method for understanding market trends and making informed trading decisions.

Basics of Parabolic SAR Calculation

In the calculation process of the Parabolic SAR indicator, traders determine the Extreme Point (EP) by identifying the highest high or lowest low within the ongoing trend. The Acceleration Factor (AF) plays a vital role, starting at a predetermined value and increasing by 0.02 each time a new EP is formed, with a maximum cap of 0.20. The Prior Parabolic SAR value is utilized to adjust the SAR values with the introduction of new data points. Trading platforms such as IG provide users with intuitive visualizations of the Parabolic SAR indicator, facilitating the identification of potential market entry and exit points. Understanding the intricacies of Parabolic SAR calculation empowers traders to interpret the indicator's signals accurately, aiding in the formulation of effective trading strategies.

| Factor | Description | Example |

|---|---|---|

| Extreme Point (EP) | Highest high or lowest low within the ongoing trend used in the calculation of the Parabolic SAR. | 150 |

| Acceleration Factor (AF) | Incrementally increases by 0.02 each time a new EP is formed, capped at 0.20. | 0.08 |

| Prior Parabolic SAR | Previous SAR value utilized in the calculation process to adjust SAR values with the introduction of new data points. | 145 |

Interpreting Parabolic SAR Signals

When interpreting Parabolic SAR signals, traders should pay attention to SAR signal reversals and continuations.

SAR signal reversals can indicate potential trend changes, with the first green or red dot after a series of the opposite color suggesting a possible market reversal.

On the other hand, SAR signal continuations may confirm existing trends, providing traders with insights on market momentum and potential entry or exit points.

SAR Signal Reversals

Signaling potential shifts in market direction, SAR signal reversals in Parabolic SAR indicator analysis indicate pivotal turning points for traders to contemplate adjusting their strategies.

These reversals, whether bullish or bearish, mark possible trend changes, guiding traders on when to enter or exit positions.

A bullish reversal occurs when the dots shift from above to below the price, signaling an upward trend, while a bearish reversal indicates a potential downtrend. Recognizing the significance of the first green dot after a series of red dots for a bullish reversal, and the first red dot after a series of green dots for a bearish reversal, is essential.

Combining SAR signal reversals with other technical indicators can enhance the accuracy of trend reversal predictions, aiding traders in making informed decisions for maximizing profit potential.

SAR Signal Continuations

Indicative of the trend's strength, SAR signal continuations in Parabolic SAR analysis are discerned through consecutive dots of the same color. Green dots appearing below the price indicate a bullish trend continuation, while red dots above the price suggest a bearish trend continuation.

The spacing between these dots can offer insights into the momentum behind the ongoing trend. Traders should pay attention to the angle and proximity of the SAR dots concerning the price to assess both the speed and sustainability of the trend continuation.

Importance of Indicator Complementarity

Strategically pairing Parabolic SAR with other indicators creates a synergy that enhances the overall analysis of price movements.

By combining complementary indicators like moving averages, stochastic, or RSI with Parabolic SAR, traders can confirm trends and minimize false signals.

This practice not only strengthens the reliability of trading signals but also provides a more thorough understanding of market dynamics.

Indicator Synergy

Utilizing a combination of Parabolic SAR with complementary indicators such as RSI, MACD, and moving averages greatly enhances signal accuracy in trading analysis. Synergy with indicators like DMI and Klinger Oscillator helps confirm trends, identify market momentum, and provide trade signals. Additionally, incorporating Parabolic SAR with Displaced Moving Average (DMA) can help smooth out price data and pinpoint potential trend reversals. This indicator complementarity is essential for improving trading decisions, as each indicator offers unique insights into the market dynamics. Pairing Parabolic SAR with various indicators creates a holistic trading strategy that leverages the strengths of each indicator for more informed decision-making.

| Indicator | Functionality | Benefit |

|---|---|---|

| RSI | Overbought/Oversold conditions | Confirming potential trend reversals |

| MACD | Trend direction and momentum | Identifying market strength |

| Moving Averages | Price trend smoothing | Providing support/resistance levels |

| DMI | Trend strength | Confirming trend direction |

Strategic Pairing

When incorporating Parabolic SAR with other indicators, the strategic pairing emphasizes the importance of complementarity to enhance signal accuracy and improve trading analysis.

Pairing Parabolic SAR with indicators like RSI aids in identifying overbought or oversold conditions, guiding traders in making informed trading decisions.

Additionally, leveraging the MACD indicator alongside Parabolic SAR provides insights into trend direction and momentum, facilitating strategic decision-making processes.

By combining multiple indicators with Parabolic SAR, such as moving averages, DMI, and Klinger Oscillator, traders can reduce false signals and gain a holistic view of market trends and momentum.

This strategic pairing approach enhances the overall trading strategy by minimizing risks and increasing the probability of successful trades.

Common Challenges in SAR Trading

Mastering the intricacies of SAR trading presents traders with a range of common challenges that require careful consideration and strategic decision-making. One of the primary challenges is the occurrence of false signals, especially in ranging markets, which can lead to potential losses if traders solely rely on the Parabolic SAR indicator. Additionally, determining the best Acceleration Factor (AF) settings for different market conditions can be challenging and may require thorough testing and adjustment.

Emotional decision-making is another obstacle faced by traders using Parabolic SAR, particularly after experiencing losses. Without proper filtering tools in place, emotional reactions can hinder objective analysis and decision-making, impacting trading outcomes negatively. Backtesting plays a significant role in evaluating the effectiveness of Parabolic SAR in real trading scenarios and understanding its limitations. Traders must be aware of these limitations and know when to stay out of the market to mitigate risks and overcome challenges in SAR trading successfully.

Solutions for SAR Trading Difficulties

When dealing with the challenges encountered in SAR trading, integrating extra filter tools alongside the Parabolic SAR indicator can significantly enhance signal quality and improve overall accuracy.

By incorporating additional filter tools in conjunction with Parabolic SAR, traders can refine their trading strategies to screen out false signals, especially in range-bound markets. These filter tools are vital for maintaining signal quality and making well-informed decisions in varying market conditions.

They help traders avoid emotional decisions, particularly after losses, enabling them to focus on maximizing profitable trades with the Parabolic SAR indicator.

Successfully maneuvering through the complexities of trading with Parabolic SAR requires a disciplined approach that integrates filter tools to enhance performance and minimize risks. Understanding when to stay out of the market based on Parabolic SAR signals is essential for effective risk management and long-term success in trading.

Utilizing ADX and Moving Average

The strategic combination of ADX and Moving Average with Parabolic SAR plays a pivotal role in enhancing trading decisions. Understanding the significance of ADX in determining trend strength and incorporating Moving Average for trend confirmation can amplify the effectiveness of Parabolic SAR signals.

ADX Importance Explained

By combining the Average Directional Index (ADX) with moving averages, traders can effectively assess trend strength and filter out false signals in the financial markets.

The ADX, a technical analysis tool, measures the strength of a trend without indicating its direction. A rising ADX suggests a strong trend, while a falling ADX indicates a weakening trend. Values above 25 typically signify a robust trend, while values below 20 suggest a weak trend.

When used in conjunction with moving averages, traders can confirm trends and identify potential trend changes. Traders rely on ADX to make informed decisions on entering or exiting trades based on the strength of the trend indicated by the average directional index.

Moving Average Strategy Tips

Implementing a strategic combination of ADX and moving averages enhances trend analysis accuracy in the Moving Average Strategy. When utilizing moving averages alongside Parabolic SAR, traders can better identify trend strength and determine best entry/exit points.

The ADX indicator complements this strategy by filtering out false signals and providing a clearer picture of market trends. Moving averages smooth out price movements, aiding in trend confirmation when used in conjunction with Parabolic SAR.

Additionally, crossovers of moving averages offer valuable buy or sell signals, improving the precision of trading decisions. By integrating ADX and moving averages into the Parabolic SAR Strategy, traders can enhance trend analysis, reduce noise, and elevate their overall trading performance.

Integration for Best Results

Integration of ADX and Moving Average for best results in trading involves strategically combining trend strength indicators with key price levels to enhance trend analysis accuracy and improve decision-making processes.

ADX, known for measuring trend strength, can be used alongside moving averages to confirm the direction of a trend. By utilizing moving averages with Parabolic SAR, traders can better identify support and resistance levels, enhancing the overall analysis.

The crossover of moving averages with Parabolic SAR signals can provide valuable insights for trade entries and exits. Integrating ADX and moving averages with Parabolic SAR not only helps to filter out false signals but also boosts the effectiveness of trend-following strategies, ultimately improving trading precision.

Incorporating Slow Stochastic Indicator

Incorporating the Slow Stochastic Indicator alongside the Parabolic SAR can provide traders with valuable insights into both momentum and trend reversals.

The Slow Stochastic Indicator is a technical tool that measures momentum by comparing the current price to a range of prices over a specific period. It consists of %K (fast line) and %D (slow line) which helps identify overbought and oversold conditions in the market.

The crosses between the %K and %D lines offer buy or sell signals, which when used in conjunction with the Parabolic SAR, can enhance trading decisions.

By confirming potential trend reversals, the Slow Stochastic Indicator complements the signals generated by the Parabolic SAR, thereby improving the overall analysis.

When combined, these two indicators provide a holistic approach to trading by incorporating both momentum analysis and trend identification, leading to more informed decision-making processes for traders.

The Objective of Using Parabolic SAR

The objective of using the Parabolic SAR indicator is to assist traders in identifying potential trend reversals and strategic entry and exit points within the market.

By plotting dots on a price chart, the indicator provides valuable insights into trend analysis by incorporating SAR values and the Acceleration Factor (AF).

Traders leverage the Parabolic SAR indicator to make informed decisions across various experience levels, optimizing their position entries and exits effectively.

SAR Indicator Function

A key aspect of utilizing the Parabolic SAR indicator in trading is to accurately determine trend direction and potential reversals for effective decision-making. This indicator functions by plotting dots on a price chart based on SAR values and Acceleration Factor (AF), providing traders with valuable trading signals. Traders rely on Parabolic SAR to identify potential trend movements, assisting in timely entry and exit strategies.

Importance of SAR

Regularly utilized by traders seeking to navigate the complexities of financial markets, the Parabolic SAR indicator serves a pivotal role in determining the directional trends and potential changes in price movements. Traders rely on this technical indicator to pinpoint entry and exit points accurately, identify potential trend reversals, and ascertain the prevailing price trend.

The primary objective of using Parabolic SAR is to aid in decision-making by providing visual cues through its dots on a price chart, calculated based on SAR values and Acceleration Factor (AF). Additionally, traders can employ Parabolic SAR as a trailing stop mechanism to maximize profits during trends efficiently.

Understanding the importance of Parabolic SAR is essential for formulating effective position entry and exit strategies in trading scenarios.

Trading Strategies With Parabolic SAR

Utilizing Parabolic SAR as a trailing stop in uptrends with green dots indicating bullish momentum is a key aspect of effective trading strategies. Traders can use the Parabolic SAR indicator on a price chart to set stop-loss levels that move in the direction of the trend. This dynamic stop-loss approach is valuable as it helps capture profits during upward price movements while protecting against potential reversals.

By incorporating Parabolic SAR alongside other technical indicators such as moving averages and RSI, traders can gain a more thorough view of the market. The Parabolic SAR's ability to signal trend changes, especially when the dots switch from red to green or vice versa, can assist traders in making informed decisions about entry and exit points. Understanding how to interpret these signals is essential for developing successful trading strategies that capitalize on trend direction and potential reversals.

Summary of Parabolic SAR Usage

Parabolic SAR serves as a valuable tool for traders by providing visual cues on trend direction and potential reversals through colored dots displayed on a price chart. These dots change position concerning price movement, making it easier for traders to analyze the trend. Understanding the signals generated by Parabolic SAR requires careful consideration and confirmation from other technical indicators. It is essential to interpret the indicator in conjunction with fundamental analysis for making well-informed trading decisions. Below is a summary of the key points regarding the usage of Parabolic SAR:

| Key Points | Description |

|---|---|

| Price Movement | Parabolic SAR dots track price movement, aiding in trend analysis. |

| Trend Direction | Green dots indicate a bullish trend, while red dots suggest a bearish trend. |

| Potential Reversals | Look for dots of the opposite color after a series for potential reversals. |

Enhancing Trading Skills With Free Courses

Enhance your trading skills effectively through accessible free courses that cover various aspects of Parabolic SAR. These courses provide in-depth insights into trading strategies involving the Parabolic SAR indicator.

By understanding how to adjust parameters and interpret signals effectively, traders can optimize their strategies for better decision-making in the market. The courses typically include interactive exercises that allow learners to apply their knowledge in real-time scenarios, enhancing practical understanding.

Additionally, participants can benefit from learning how to combine the Parabolic SAR with other indicators for a more thorough analysis. With topics ranging from basic calculations to advanced strategies, these resources cater to beginners looking to explore the world of Parabolic SAR trading.

Through case studies, quizzes, and hands-on experiences, traders can gain valuable skills that enable them to make informed decisions based on the Parabolic SAR indicator.

Cost Considerations in Trading

Considering the various components of transaction costs in trading is essential for traders utilizing the Parabolic SAR indicator to make informed decisions and optimize profitability. Transaction costs encompass spreads, commissions, and overnight financing fees, all of which can impact the overall profitability of trades based on Parabolic SAR trading signals.

High-frequency trading strategies, characterized by rapid trade executions, may result in increased trading costs due to a higher frequency of transactions. Different brokers offer varying fee structures, influencing the total cost of trading with the Parabolic SAR indicator.

Traders must also take into account slippage, the difference between the expected and actual trade execution prices, as it plays an important role in cost management. Understanding the implications of these costs on profitability is paramount when implementing trading strategies with the Parabolic SAR indicator, as efficient cost management can greatly enhance overall trading performance.

Exploring Market Opportunities

Exploring market opportunities involves delving into various asset classes and analyzing trends to identify potential entry and exit points for strategic trading decisions. The Parabolic SAR indicator plays an important role in this process by providing traders with valuable insights into potential trend reversals and continuations. By interpreting the Parabolic SAR trading signals, traders can ascertain the trend direction and determine suitable stop-loss levels based on price action.

However, to make well-informed trading decisions, it is essential to combine these signals with other technical indicators such as moving averages, RSI, or ADX. This combination enhances the accuracy of trend confirmation and improves overall decision-making. Traders should remember that while Parabolic SAR offers valuable information, thorough analysis beyond these signals is necessary to maximize profit potential and navigate the complexities of the financial markets effectively.

Frequently Asked Questions

What Is the Best Strategy for Parabolic Sar?

The best strategy for utilizing the Parabolic SAR indicator involves identifying entry points and exit signals based on the SAR dots' position relative to the price.

Implementing a trailing stop loss is essential for effective risk management.

Trend identification is key in determining the dominant direction for trading.

Adjusting the acceleration factor according to market volatility can enhance the strategy's performance.

Integrating other indicators can help confirm signals and improve decision-making in trend-following scenarios.

What Is the Best Timeframe for Parabolic Sar?

The best timeframe for Parabolic SAR varies depending on the trading strategy employed. Short-term analysis and intraday trading often favor shorter timeframes like 1-hour or 15-minute charts for quick entries and exits.

Conversely, swing trading and a long-term perspective typically find success on daily or 4-hour charts. Scalping strategies may benefit from even shorter intervals.

Traders should experiment with different timeframes to align with their specific trading style and objectives effectively.

Is Parabolic SAR Indicator Profitable?

Analyzing the profitability of the Parabolic SAR indicator requires a thorough examination of backtesting results across various market conditions.

Effective risk management, accurate interpretation of entry signals, and strategic exit strategies are vital for maximizing profitability.

Consideration of volatility analysis can further enhance the indicator's effectiveness.

Ultimately, the profitability of the Parabolic SAR indicator depends on a trader's ability to interpret signals accurately and adapt to changing market conditions.

What Is the Formula for the Parabolic SAR Indicator?

The Parabolic SAR indicator formula calculates the SAR value for each period using the prior SAR, acceleration factor (AF), and the extreme point (EP) of either the highest high or lowest low. This mathematical derivation adjusts the SAR values based on price extremes, AF increments, and trend direction.

Data interpretation involves analyzing SAR values to identify trends, while sensitivity adjustment through AF controls the indicator's responsiveness to price changes. Historical analysis of SAR values aids in understanding past trend movements.

Conclusion

To sum up, mastering the Parabolic SAR indicator requires a deep understanding of its calculation, interpretation of signals, and complementarity with other indicators.

Overcoming common challenges and continuously enhancing trading skills through free courses can help traders navigate the complexities of the market.

By carefully considering costs and exploring various market opportunities, traders can effectively utilize the Parabolic SAR indicator to make informed trading decisions and improve their overall trading performance.