Mastering the Parabolic SAR involves understanding its calculation process, interpreting signals for trend reversals and continuations, and integrating it with other indicators like moving averages and RSI for enhanced analysis. Implementing a dual SAR strategy can amplify signal reliability and filter out noise in trending markets. Backtesting allows traders to refine strategies and optimize entry/exit points. Effective risk management techniques, such as setting stop-loss levels and adjusting position sizes based on SAR signals, are essential. Adapting strategies to market conditions ensures flexibility and profitability. Harness the power of Parabolic SAR for precise market insights and strategic decision-making.

Understanding Parabolic SAR Calculation

The calculation process of the Parabolic SAR indicator is essential for traders seeking to grasp its underlying mechanics and interpret market trends effectively. In determining the Extreme Point (EP) within a trend, the Parabolic SAR calculation involves utilizing the Acceleration Factor (AF), which initiates at 0.02 and incrementally increases by 0.02 with each new EP.

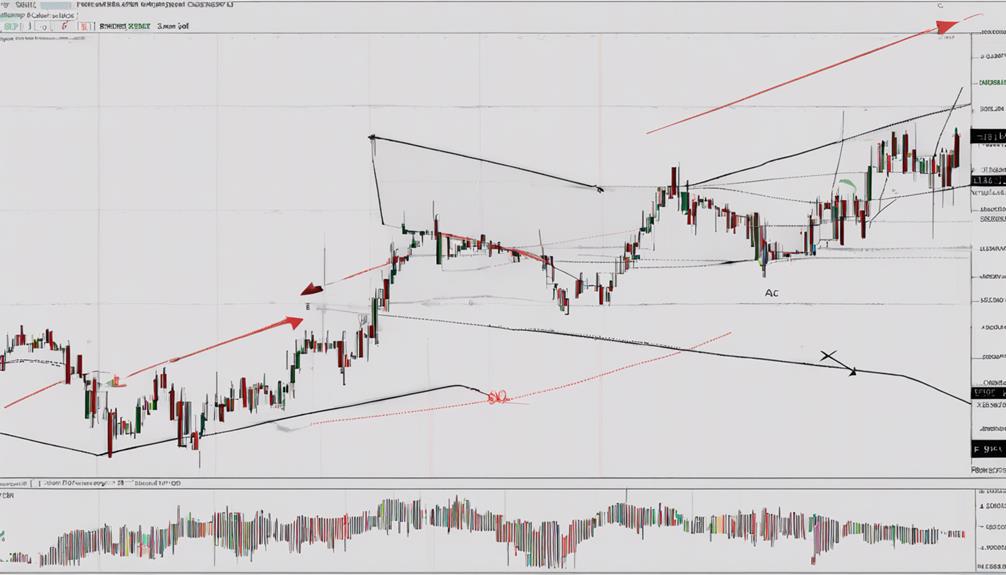

For uptrends, the formula adjusts the SAR by adding the AF to the previous EP. Conversely, in downtrends, the SAR calculation deducts the AF from the prior EP. This distinction is vital as it impacts the positioning of the SAR dots on the price chart.

Traders should pay close attention to instances where the price crosses the Parabolic SAR, as it often signifies a potential trend reversal. Understanding the intricacies of the Parabolic SAR calculation equips traders with the knowledge needed to interpret market movements accurately, distinguishing between uptrends and downtrends, and identifying key points for strategic decision-making.

Interpreting Parabolic SAR Signals

Analyzing Parabolic SAR signals is essential for traders to identify potential trend reversals and trend continuations.

Understanding the point where price bars intersect with SAR dots can signal shifts in market sentiment.

Signal Reversals

When interpreting Parabolic SAR signals for signal reversals, traders rely on the precise moment of price movement across the dots to anticipate potential trend shifts. A bullish reversal is signaled when the price moves above the SAR dots, indicating a shift from a downtrend to an uptrend.

Conversely, a bearish reversal occurs when the price falls below the SAR dots, indicating a change from an uptrend to a downtrend. Traders use these signals to adjust their positions, set stop losses effectively, and capitalize on trend changes.

In strong trending markets with significant price movements, these reversal signals are particularly reliable for making timely decisions and maximizing profit potential. Understanding Parabolic SAR signals is essential for successful trading in dynamic market conditions.

Trend Continuation

Utilizing Parabolic SAR signals in trend continuation scenarios provides traders with valuable insights into sustained market momentum and ideal entry and exit points.

When the Parabolic SAR dots consistently remain below price bars, it signifies a sustained uptrend with strong bullish momentum, presenting potential buying opportunities. Traders rely on these signals to maximize profits by staying in trades during established trends.

The continuous presence of SAR dots below price bars confirms the ongoing uptrend's strength and direction, aiding traders in making informed decisions. Correctly interpreting trend continuation with Parabolic SAR helps traders avoid premature exits, enabling them to ride the trend and capitalize on favorable market conditions effectively.

Integrating Parabolic SAR With Other Indicators

By incorporating Parabolic SAR with complementary technical indicators, traders can enhance their market analysis and make more informed trading decisions.

Combining Parabolic SAR with moving averages can help confirm trend directions and filter out false signals that may occur.

When used alongside the Relative Strength Index (RSI), Parabolic SAR can assist traders in identifying overbought or oversold conditions, indicating potential reversal points in the market.

Integrating Parabolic SAR with the Moving Average Convergence Divergence (MACD) provides valuable insights into trend momentum and direction, enabling traders to make more precise trading choices.

Additionally, pairing Parabolic SAR with the Average Directional Index (ADX) can help assess trend strength and filter out noise in market movements, further refining trading strategies.

Implementing the 2 Parabolic SAR Strategy

Implementing the 2 Parabolic SAR Strategy involves leveraging two Parabolic SAR indicators with distinct settings to enhance trading signal reliability and minimize market noise. By utilizing one Parabolic SAR for early trend detection and the other for confirmation, this strategy aims to provide more reliable trading signals.

The 2 Parabolic SAR Strategy helps traders avoid whipsaws and false signals by combining signals from both indicators. Through this approach, traders can strengthen their profit potential and make more informed trading decisions.

This strategy is designed to filter out market noise effectively, enabling traders to identify genuine trading opportunities while reducing the likelihood of entering trades based on false signals. By incorporating two Parabolic SAR indicators, traders can enhance their ability to detect trends early and improve the overall accuracy of their trading decisions, ultimately leading to more profitable outcomes.

Backtesting for Trading Success

Backtesting presents as an essential tool for traders seeking to evaluate the effectiveness and reliability of their trading strategies through historical data analysis. By backtesting trading strategies, traders can assess performance, profitability, and risk management strategies.

Here are some key aspects to ponder when utilizing backtesting:

- Backtesting enables traders to simulate trades based on historical data, providing insights into strategy viability.

- It aids in optimizing entry and exit points, enhancing the overall effectiveness of trading strategies.

- Traders can determine suitable stop loss levels through backtesting, improving risk management practices.

- By adjusting strategy parameters based on backtesting results, traders can refine their approaches to enhance profitability.

Through meticulous backtesting, traders can fine-tune their trading strategies, leading to improved decision-making and potentially greater trading success.

Risk Management Techniques

Utilizing Parabolic SAR signals can greatly enhance traders' risk management techniques in the dynamic world of financial markets. Setting stop loss levels based on Parabolic SAR dots is essential to managing risk effectively.

Adjusting position sizes according to Parabolic SAR signals helps in controlling potential losses and optimizing risk management. Incorporating trailing stop orders in conjunction with Parabolic SAR not only protects profits but also limits downside risk by securing gains as the trend progresses.

Evaluating the distance between price and Parabolic SAR dots enables traders to determine favorable risk-reward ratios, assisting in making informed trading decisions. A structured risk management plan that integrates Parabolic SAR signals ensures a systematic approach to managing risk, enhancing overall trading performance.

Adapting Strategies to Market Conditions

Adapting trading strategies to varying market conditions is essential for achieving consistent success and maximizing profitability in the dynamic world of financial markets. To navigate the complexities of market conditions effectively, traders can employ the following strategies:

- Adjust Parabolic SAR settings in volatile markets to increase sensitivity and accurately capture rapid price movements.

- In ranging markets, consider utilizing longer timeframes or combining Parabolic SAR with a trend confirmation indicator like ADX to filter out false signals.

- During trending markets, leverage Parabolic SAR with shorter timeframes and higher acceleration factors to capitalize on strong trends and optimize profits.

- Implement trailing stop-loss orders based on Parabolic SAR levels to secure gains during favorable price movements and mitigate risks of potential reversals.

Frequently Asked Questions

What Is the Best Strategy With Parabolic Sar?

The best strategy with Parabolic SAR involves utilizing it for trend confirmation, identifying reversal signals, determining entry points, setting stop loss placement, and managing trades effectively.

By filtering signals and avoiding false signals through price action analysis, traders can enhance risk management.

Combining Parabolic SAR with other indicators like MACD or RSI can provide additional confirmation and improve the overall effectiveness of the strategy.

What Is the Best Timeframe to Use Parabolic Sar?

When determining the best timeframe to use Parabolic SAR, traders should consider their trading style and objectives. Short-term traders engaged in intraday analysis and day trading often find success with shorter timeframes like 1-hour or 4-hour charts.

On the other hand, swing traders focusing on trend identification and seeking entry and exit signals may prefer longer timeframes such as daily or weekly charts. Understanding volatility, price action, and combining indicators can further enhance the effectiveness of Parabolic SAR.

What Is the Success Rate of Parabolic Sar?

The success rate of Parabolic SAR varies based on market conditions, historical data analysis, and trader strategies. It tends to perform well in trending markets with strong price movements, offering accurate entry and exit points.

However, its success rate may diminish in choppy or ranging markets due to false signals. Traders often combine Parabolic SAR with other indicators, backtest and optimize its parameters to improve accuracy, profitability, and risk management.

How to Use Parabolic SAR for Scalping?

Scalping with Parabolic SAR involves utilizing short timeframes for quick trades. Traders focus on capturing small price movements efficiently. Entry signals are important, often based on rapid price changes and trend identification.

Scalpers need effective exit strategies, incorporating tight stop-loss orders for risk management. Combining Parabolic SAR with other indicators can enhance confirmation signals in fast-paced trading environments.

Successful scalping with Parabolic SAR requires a disciplined approach to position sizing, profit targets, and volatility considerations.

Conclusion

To sum up, mastering the effective use of Parabolic SAR requires a deep understanding of its calculation, interpretation, and integration with other indicators. By implementing proven strategies like the 2 Parabolic SAR strategy and conducting thorough backtesting, traders can increase their chances of success in the market.

Remember the old adage: 'The trend is your friend' – staying adaptable to market conditions and employing sound risk management techniques are key to maneuvering through the complexities of trading with Parabolic SAR.