Did you know that the Technology Growth Fund in Hong Kong saw a remarkable 52.33% return last year?

This fund, along with several others, made significant strides in the market.

As you explore the top seven performing mutual funds in Hong Kong, you'll uncover compelling insights into their strategies, sectors of focus, and the factors that contributed to their success.

Fund A: Technology Growth Fund

If you're looking to invest in the dynamic world of technology, Fund A: Technology Growth Fund in Hong Kong focuses on tech companies and has shown impressive growth. This Hong Kong Equity fund specifically targets technology stocks, making it an attractive option for investors interested in this sector. The fund's portfolio includes top players like Tencent and Alibaba, which have contributed to its strong performance in the technology industry.

Investing in Fund A provides exposure to the high-growth potential of the technology sector within the Hong Kong Equity market. The fund's strategy of focusing on tech companies has paid off, as evidenced by its significant growth and performance. By investing in this fund, you can tap into the innovation and advancements driving the technology industry forward, potentially reaping the benefits of this dynamic sector. Consider Fund A if you want to capitalize on the opportunities presented by technology companies in the Hong Kong Equity market.

Fund B: Asia Pacific Equity Fund

Considering your interest in top-performing mutual funds, let's now shift our focus to Fund B: Asia Pacific Equity Fund in Hong Kong, known for its strong returns in the Asia Pacific region. Here are some key points about this fund:

- Equity Funds Focus: Fund B primarily concentrates on equity investments within the Asia Pacific region, including countries like Japan, Australia, and South Korea. This strategic focus allows the fund to capitalize on the diverse opportunities present in these markets.

- Asia Pacific Region Returns: The fund has consistently delivered robust returns in the Asia Pacific region, showcasing its ability to navigate and excel in the dynamic market environment of this region.

- Diversified Portfolio: With a diversified portfolio, Fund B ensures that investors benefit from exposure to various sectors within the Asia Pacific markets. This diversification helps in spreading risk and capturing growth opportunities across different industries. Investors in Fund B have enjoyed the rewards of a well-structured and high-performing equity fund tailored to the Asia Pacific region.

Fund C: Healthcare Innovation Fund

The Healthcare Innovation Fund, Fund C, has garnered attention for its focus on investments in innovative healthcare companies. In 2021, the fund experienced significant growth driven by the rising demand for healthcare solutions. With a remarkable return of 35.75% in 2021, the Healthcare Innovation Fund outperformed many other funds, solidifying its position as one of the top-performing mutual funds in Hong Kong.

The fund's top holdings comprised innovative healthcare companies with strong growth potential, offering investors a strategic advantage within the healthcare sector. Investors in the Healthcare Innovation Fund benefited from its targeted approach, which capitalized on the opportunities presented by the evolving healthcare landscape.

As the fund continues to thrive on its investment strategy centered around healthcare innovation, it remains a compelling choice for those seeking growth and exposure to this dynamic sector.

Fund D: Sustainable Energy Fund

Shifting focus to Fund D, the Sustainable Energy Fund, which centers on investments in renewable and sustainable energy companies. This fund strategically targets the increasing demand for clean energy solutions worldwide, aiming to capitalize on the shift towards environmentally friendly investments. Here are three key points about Fund D:

- Renewable Energy Focus: Fund D's primary focus lies in companies involved in renewable energy sources like solar, wind, and hydropower. By investing in these sectors, the fund contributes to the advancement of clean energy solutions.

- Performance in 2021: Fund D has exhibited robust performance throughout 2021, aligning with the global trend towards sustainable investing. Investors in this fund have reaped the benefits of the rising interest in sustainable energy opportunities.

- Environmental Impact: By supporting companies engaged in sustainable energy practices, investors in Fund D play a direct role in promoting a greener future and combating climate change. The fund's portfolio not only offers financial returns but also contributes to a cleaner and more sustainable planet.

Fund E: Emerging Markets Bond Fund

Investors seeking exposure to emerging market debt securities may find potential diversification benefits and higher yields in Fund E, the Emerging Markets Bond Fund. This fund focuses on investing in bonds issued by emerging market countries, offering investors a chance to tap into the debt securities of developing economies.

Compared to bonds from developed markets, Fund E may present opportunities for increased diversification and potentially higher yields. However, it's crucial for investors to consider the risks associated with investing in emerging markets when choosing this fund. Factors such as currency fluctuations and political instability can impact the performance of the Emerging Markets Bond Fund.

Investors should be aware that the fund's success may be influenced by specific circumstances in the countries issuing the bonds held in the portfolio. Before investing in this fund, it's essential to carefully assess the risks and potential rewards associated with emerging market bond funds.

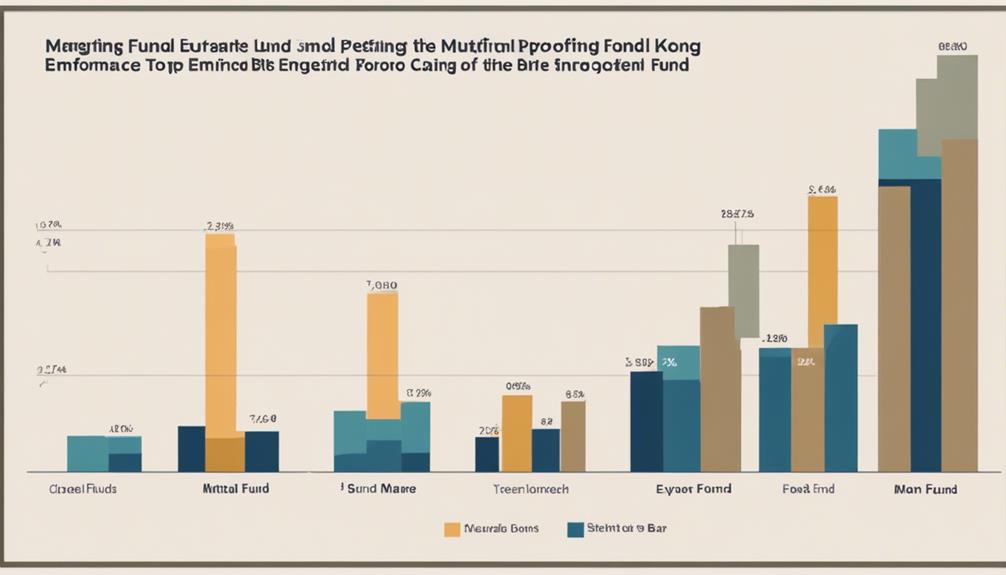

What are the top-performing mutual funds in Hong Kong and how do they comply with the regulations?

When it comes to the top-performing mutual funds in Hong Kong, investors look for options that comply with the strict Hong Kong mutual funds regulations. These regulations ensure that the funds are managed with transparency, accountability, and in the best interests of the investors.

Frequently Asked Questions

What Are the Top 5 Performing Mutual Funds?

To identify top mutual funds, consider their returns, risk management strategies, and investment opportunities for effective portfolio diversification. Evaluate performances like Schroder ISF Global Energy A Acc USD at 44.98% return in 2021.

What Is the Best Investment in Hong Kong?

Discover the ideal investment in Hong Kong for your wealth management goals. Explore the dynamic stock market offerings and seize lucrative investment opportunities. Uncover the top performers and tailor your portfolio for maximum returns.

What Is the Best Performing Hong Kong Etf?

When comparing Hong Kong ETFs, consider the Hang Seng Tech Index ETF for high-growth tech exposure. It outperformed many funds in 2021. Diversify your portfolio with market trends in mind. This ETF includes top tech companies like Tencent and Alibaba.

Which Mutual Fund Is Best Performer?

For the best performer, consider the Schroder ISF Global Energy A Acc USD with a 44.98% return in 2021. It stands out in mutual fund comparison, investment analysis, and portfolio performance. Evaluate its success for potential investment opportunities.

Conclusion

As you navigate the world of mutual funds in Hong Kong, remember that the best-performing funds are like shining stars in a dark sky.

Keep an eye on the Technology Growth Fund, Asia Pacific Equity Fund, Healthcare Innovation Fund, Sustainable Energy Fund, and Emerging Markets Bond Fund for potential growth opportunities.

Stay informed, stay vigilant, and watch your investments soar to new heights.

Happy investing!