You might find it intriguing that over 70% of Hong Kong's exports are destined for mainland China, showcasing the strong economic ties between the two regions.

As you delve into the interplay between China's economic indicators and Hong Kong stocks, you'll uncover a complex relationship influenced by various factors beyond just trade volumes.

From policy changes to market sentiments, understanding this connection can provide valuable insights for investors navigating the dynamic landscape of global markets.

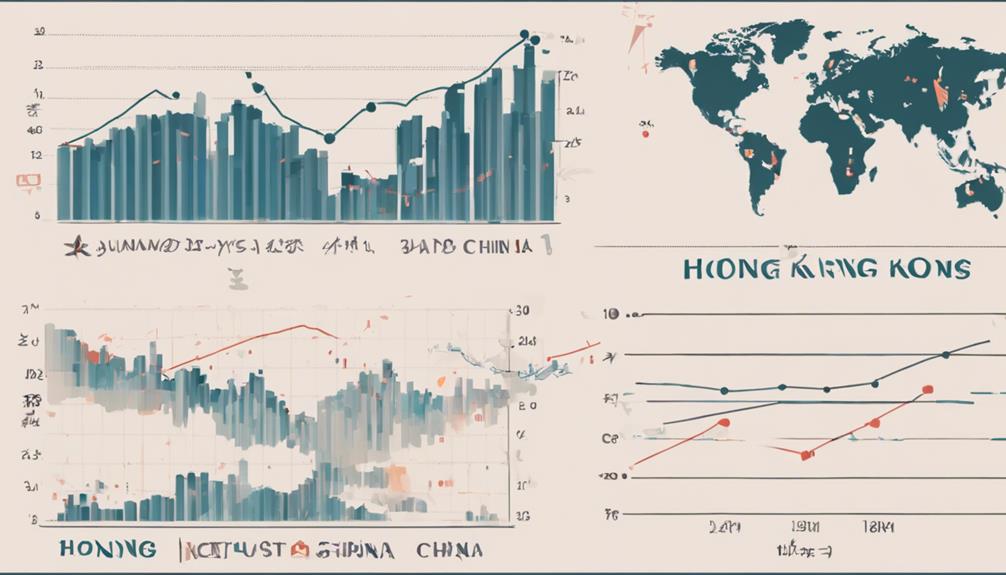

China's GDP Growth Impact on HK Stocks

China's struggling economy, with a mere 5.2% GDP growth in 2023, has had a profound effect on Hong Kong stocks. Market values in Hong Kong have plummeted by over $6 trillion since early 2021 due to the close ties between China's economic challenges and the performance of Hong Kong stocks.

Factors like China's shrinking population and aging workforce contribute to the uncertainty surrounding Hong Kong's stock market. Investors in Hong Kong are keeping a vigilant eye on China's GDP growth as it directly impacts market sentiment and investor confidence.

The hopes for a consumption boom in China following the relaxation of zero-COVID policies have failed to materialize, leading to a misalignment with expectations in the Hong Kong stock market. The interplay between China's economic struggles and Hong Kong stocks underscores the intricate relationship between the two markets, highlighting the need for investors to navigate these challenges with caution and foresight.

Political Unrest and HK Market Reaction

Amidst the economic challenges faced by Hong Kong stocks due to China's struggling economy, the political unrest in Hong Kong significantly influences the market reaction. This is particularly evident in the sharp drops seen in the Hang Seng index.

The ongoing political unrest in Hong Kong has led to increased market volatility and heightened investor uncertainty, impacting stock prices and trading volumes. Beijing's tightening grip on Hong Kong's political landscape exacerbates these uncertainties, further fueling market instability.

Concerns surrounding national security risks and dissent in Hong Kong add to the atmosphere of uncertainty, deterring investors and affecting market confidence. The diminishing rights and freedoms in Hong Kong contribute to a crisis of confidence in the stock market, as investors grapple with the implications of these developments on their investments.

The interplay between political unrest and market reactions underscores the delicate balance between socio-political factors and financial markets in Hong Kong.

Trade Policies' Influence on HK Investments

When considering investments in Hong Kong, it's essential to understand how trade policies between China and Hong Kong can significantly influence various sectors. Trade policies play a crucial role in shaping stock prices and investment opportunities in Hong Kong. Changes in trade regulations, such as tariffs, export restrictions, and trade tensions, can lead to fluctuations in stock prices of companies with substantial exposure to China.

Investors need to stay informed about trade policy announcements by China, as these can trigger sell-offs or rallies in Hong Kong stocks depending on the implications for businesses. Additionally, trade agreements and disputes between China and other countries are closely monitored by investors for potential effects on Hong Kong's stock market.

Therefore, staying abreast of evolving trade policies and their impact on investments is vital for making informed decisions in the Hong Kong market.

Tech Sector Boom in HK Stock Exchange

The tech sector's impressive growth in the Hong Kong Stock Exchange has garnered attention from investors worldwide. Here are some key points to consider regarding the current boom in the tech sector:

- Fluctuating Stock Prices: Recent fluctuations have been observed in the stock prices of major tech companies in the Hong Kong Stock Exchange. Companies like Tencent, Alibaba, JD.com, Trip.com, and Meituan have experienced declines ranging from 2.9% to 7.5%, impacting the overall performance of the tech sector.

- Market Sentiment Impact: The movements in the tech sector are closely monitored by investors due to their potential to influence market sentiment. Changes in stock prices of tech giants can significantly affect trading patterns and overall market sentiment in Hong Kong.

- Reflection of Economic Conditions: The performance of these tech companies serves as an indicator of broader trends in the tech sector, reflecting not only domestic but also global economic conditions. Understanding the dynamics of these tech giants is crucial for investors navigating the Hong Kong Stock Exchange.

Tourism Trends and HK Stock Performance

Tourism trends significantly impact the performance of Hong Kong stocks, reflecting the economy's reliance on tourist-related activities. The stock performance in Hong Kong is closely tied to the fluctuations in tourism, making it susceptible to changes in tourist arrivals. Factors such as political unrest and the ongoing pandemic have led to declines in tourists visiting Hong Kong, subsequently affecting the stock market negatively.

Industries like retail, hospitality, and entertainment, which heavily depend on tourism, experience direct impacts on their stock prices due to changes in tourist numbers. The correlation between tourism trends and stock performance underscores the vulnerability of Hong Kong's economy to external influences.

Shifts in travel patterns, restrictions, and consumer behavior play a pivotal role in determining the financial well-being of Hong Kong-listed companies involved in tourism-related sectors. As such, staying attuned to tourism trends is crucial for investors looking to navigate the Hong Kong stock market efficiently.

How Does China’s GDP Impact the Economy of Hong Kong and its Stock Investments?

China’s GDP impact Hong Kong can have a significant effect on its economy and stock investments. Since Hong Kong is closely tied to China economically, any changes in China’s GDP could directly impact the performance of Hong Kong’s stock market and overall economic growth.

Frequently Asked Questions

How Important Is Hong Kong to China's Economy?

Hong Kong is vital to China's economy due to its economic impact and trade relations. As a financial hub with global connections, its stability affects China's policies and future developments, emphasizing the interconnectedness of their economies.

How Is Hong Kong Related to China?

In terms of economic integration, Hong Kong and China share a close relationship. Hong Kong serves as a financial hub with global influence due to its trade relations with China. Despite political autonomy, cultural differences exist.

What Is Hong Kong's GDP Relative to China?

In the vast sea of economies, Hong Kong's GDP is just a drop compared to China's ocean. Yet, Hong Kong's pivotal role in global finance shines bright, connecting China's economic tides with international investment currents.

Why Is Hong Kong Listed Separately From China?

Hong Kong is listed separately from China due to its political independence, being a financial hub, and having unique trade relations. Its distinct legal and economic systems contribute to its separate listing status.

Conclusion

As you navigate the complex relationship between China's economy and Hong Kong stocks, remember that history often repeats itself. Just as past challenges have shaped the market, current events will continue to influence its trajectory.

By staying informed and adapting to changing circumstances, you can position yourself for success in the ever-evolving world of finance. Keep your eyes on the horizon, and be ready to seize opportunities as they arise.