Exploring the intricacies of mastering Keltner Channels Analysis unveils a realm of strategic depth and nuanced application in the realm of Forex trading.

The five guides curated for honing this analytical tool delve into the essential components, optimal settings, and strategic integrations that elevate one's trading prowess.

From understanding the foundations of this method to advanced techniques like combining it with Bollinger Bands for enhanced analysis, each guide offers a unique perspective to unlock the full potential of Keltner Channels.

The fusion of theory and practical application in these guides promises a comprehensive journey towards mastering this powerful trading tool.

Keltner Channel Strategy for Trading Mastery

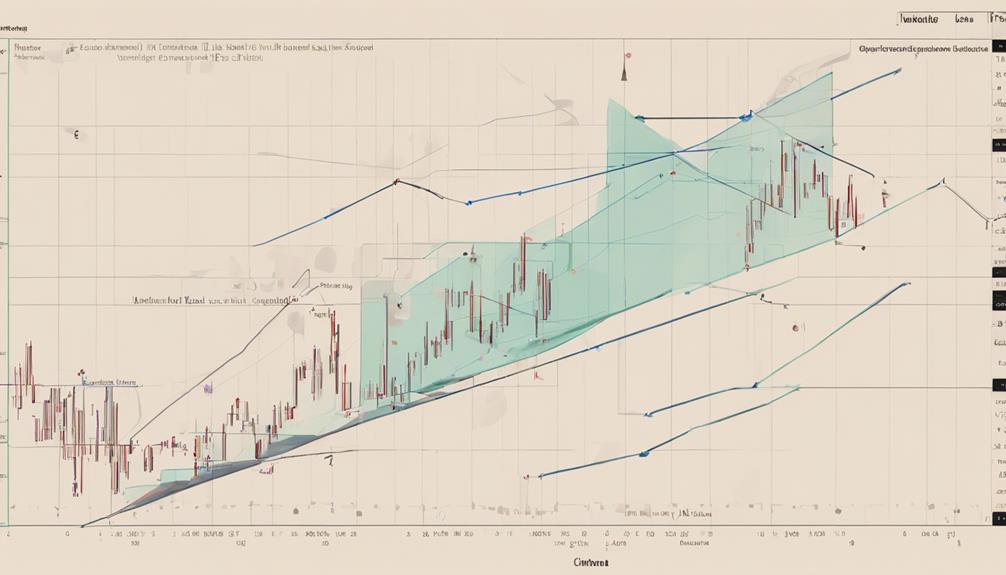

The Keltner Channel Strategy for trading mastery leverages a 20-period EMA and ATR multiplier to identify trends effectively and enhance decision-making in volatile market conditions. By incorporating these key indicators, traders can pinpoint potential entry and exit points with more precision, aiding in the management of risk levels. The Keltner Channel's ability to assess volatility is particularly beneficial for traders looking to navigate fluctuating market conditions.

Moreover, combining the Keltner Channels with complementary indicators like Bollinger Bands further refines the analysis, offering a comprehensive view of the market movements. This strategy is versatile and adaptable, making it suitable for both day trading and swing trading approaches. Day traders can capitalize on short-term price fluctuations, while swing traders can benefit from capturing larger market swings.

Optimal Keltner Channel Settings Guide

Building on the foundation of optimal Keltner Channel settings, traders can refine their analysis by fine-tuning the parameters to align with their unique trading preferences and market conditions. When customizing Keltner Channel settings, traders should consider using a 20-period EMA as the middle line and an ATR offset multiplier of 1 to calculate the upper and lower bands. These settings aid in identifying trends, assessing market volatility, and determining entry and exit points with more precision.

Adjusting the lengths of the EMA and ATR provides flexibility to adapt to different market conditions and time frames, allowing for more personalized analysis and enhancing the effectiveness of the Keltner Channel strategy.

- Utilize a 20-period EMA as the middle line

- Apply an ATR offset multiplier of 1 for calculating upper and lower bands

- Customize EMA and ATR lengths for flexibility in analysis

- Enhance trend identification and market entry/exit points by adjusting settings

Enhanced Analysis With Bollinger Bands Integration

Integrating Bollinger Bands with Keltner Channels enhances the depth of price volatility and trend analysis, offering traders a more comprehensive understanding of market dynamics. By combining these two indicators, traders can benefit from a holistic view of volatility and trends in the market.

While Bollinger Bands use standard deviation to measure volatility, Keltner Channels rely on the Average True Range, providing complementary perspectives on market conditions. This integration allows for a more nuanced analysis of price movements, aiding in trend identification and breakout confirmation.

Moreover, the use of both indicators together can lead to the development of more robust trading strategies and improved decision-making processes. Traders can leverage the insights gained from this integrated analysis to navigate varying market conditions with greater precision, ultimately enhancing their overall trading performance.

Effective Breakout Strategies With Keltner Channels

Enhancing breakout strategies with Keltner Channels involves leveraging price volatility insights to capitalize on potential trend shifts and maximize trading opportunities. Keltner Channels are a valuable tool for identifying breakout points, where price movements breach the upper or lower bands, indicating potential trend changes.

To enhance the effectiveness of breakout strategies using Keltner Channels, traders can consider the following:

- Confirmation with ADX: Combining Keltner Channels with the Average Directional Index (ADX) can provide confirmation of breakout signals, helping traders identify stronger trade setups.

- Understanding Breakout Patterns: It is essential to study breakout patterns and price behavior around the channel boundaries to make informed trading decisions.

- Capturing Trend Momentum: Breakout strategies with Keltner Channels are effective in capturing trend momentum, allowing traders to ride the trend for maximum profits.

- Maximizing Trading Profits: By accurately identifying breakouts using Keltner Channels, traders can optimize their trading strategies to maximize profits while managing risks effectively.

Utilizing Keltner Channels for Trend Identification

Utilizing Keltner Channels as a tool for trend identification involves leveraging the 20-period EMA as a pivotal indicator for assessing market directionality. By observing price bars extending beyond the Keltner Channel boundaries, traders can identify potential trends.

Pullbacks within trends can be analyzed based on where they terminate concerning the channel lines, aiding in understanding trend strength. Additionally, market flatness or trading ranges can be recognized when prices fail to breach the Keltner Channel, indicating a lack of clear trend direction.

Analyzing the relationship between price bars and the Keltner Channel is crucial for precise trend determination. Traders can use these insights to conduct thorough trend analysis, making informed decisions based on the dynamics of price movement within the channel boundaries.

This methodical approach to trend identification with Keltner Channels enhances traders' ability to navigate various market conditions effectively.

Can I Use the Guides for Mastering Keltner Channels Analysis to Help Me Interpret Keltner Channels?

Yes, you can use the guides for mastering Keltner Channels analysis to help you in interpreting Keltner Channels. With the help of an interpreting Keltner Channels tutorial, you can learn to effectively analyze the market trends and make informed trading decisions based on the Keltner Channels indicators.

Frequently Asked Questions

What Is the Best Strategy for the Keltner Channel?

The optimal strategy for the Keltner Channel involves utilizing it for trend identification and breakout trading, integrating it with other technical indicators for confirmation, setting stop-loss and take-profit levels based on price volatility insights, and customizing parameters for individual trading styles to enhance effectiveness.

What Is the Success Rate of the Keltner Channel?

The Keltner Channel strategy boasts a notable success rate, with studies indicating a trend identification accuracy of over 70%. Its ability to leverage volatility for strategic entry and exit points contributes significantly to its effectiveness in trading.

How Accurate Are Keltner Channels?

Keltner Channels are reliable in assessing price movements by incorporating Average True Range (ATR) for volatility measurement. Customizable settings like EMA period and ATR multiplier enhance accuracy. Combining with other indicators strengthens signal confirmation for traders.

Are Keltner Channels Better Than Bollinger Bands?

Keltner Channels and Bollinger Bands serve distinct purposes in analyzing price volatility and trends. Keltner Channels, based on ATR, offer unique insights, while Bollinger Bands, relying on Standard Deviation, provide different perspectives. Combining both enhances market analysis effectiveness.

Conclusion

In conclusion, mastering Keltner Channels analysis requires a deep understanding of the strategy's components and optimal settings. By integrating other indicators like Bollinger Bands and utilizing breakout techniques, traders can enhance trend identification and improve trading confidence.

The Keltner Channel strategy offers valuable insights for effective Forex trading, making it a powerful tool in the trader's arsenal. Just as the ancient Greek philosopher Socrates once said, 'The only true wisdom is in knowing you know nothing.'