The Average Directional Index (ADX) offers beginners a straightforward yet powerful means of assessing market trends. By pinpointing crucial thresholds at 20 and 40, traders can effectively discern trend strength.

ADX values below 20 signal feeble trends, while readings within the 20-40 range indicate robust trends, and values exceeding 40 suggest extreme trends. With a scale ranging from 0 to 100, ADX values below 20 represent weak trends, while those surpassing 50 signify potent trends.

As beginners navigate the intricacies of market analysis, grasping the nuances of ADX can equip them with invaluable insights into market dynamics.

Understanding the Average Directional Index

Analyzing the Average Directional Index (ADX) involves examining a trend strength metric that does not offer insight into the direction of the trend itself. The ADX values range from 0 to 100, where readings below 20 suggest weak trends, while values above 50 indicate strong trends.

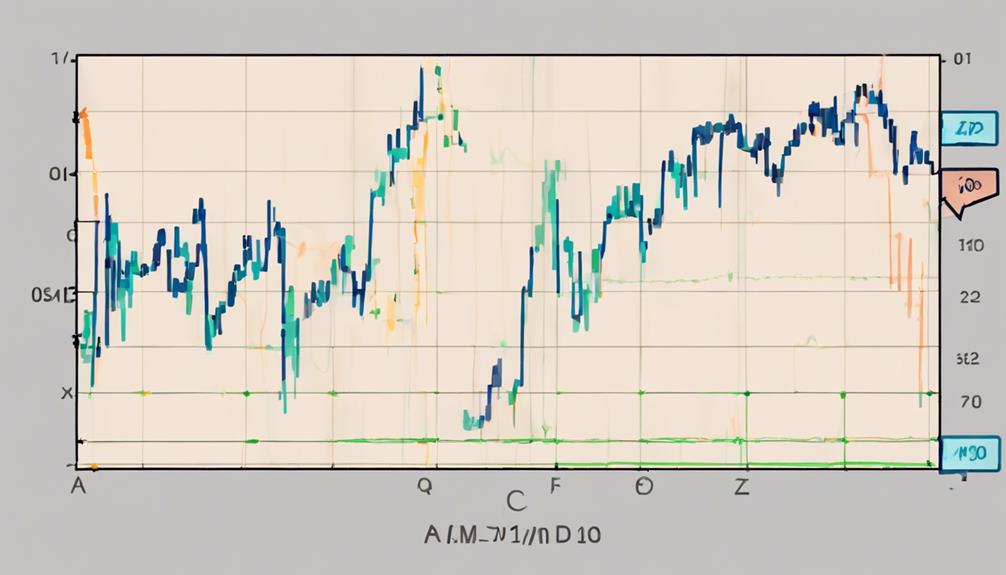

ADX is calculated based on price range expansion over a specific period, typically 14 bars. Rising ADX values signify strengthening trends, reflecting increased trend strength, while falling ADX suggests weakening trends, indicating a loss of trend momentum.

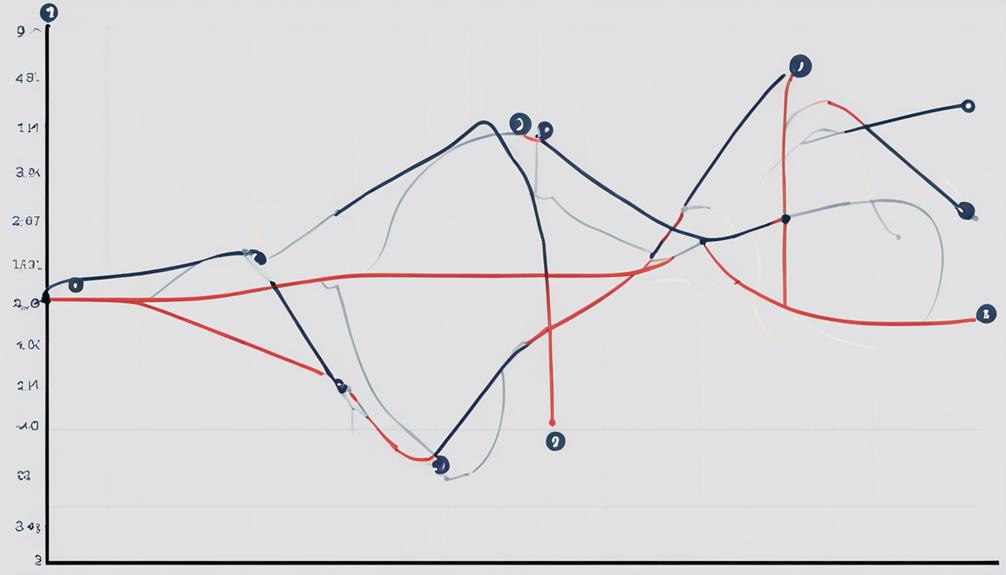

Traders commonly use ADX in conjunction with the Directional Movement Indicator (+DI and -DI) to evaluate market trends effectively. By understanding the Average Directional Index, investors can gain valuable insights into the strength of prevailing trends, enabling them to make informed decisions regarding potential entries or exits in the market based on the identified trend strengths.

Calculating the Average Directional Index

To calculate the Average Directional Index (ADX), traders utilize a formula that incorporates the True Range, +DI, and -DI indicators. This calculation involves several steps:

- Calculate the True Range: Determine the True Range, which is the greatest of the following:

- Current high minus the current low.

- Absolute value of the current high minus the previous close.

- Absolute value of the current low minus the previous close.

- Calculate the Directional Movement (DX): Calculate the +DI and -DI using the following formulas:

- +DI = (Current high – Previous high) / True Range * 100

- -DI = (Previous low – Current low) / True Range * 100

- DX = |(+DI – (-DI))| / (+DI + (-DI)) * 100

- Smoothed Average of DX: Derive the ADX from the smoothed average of the DX values over a specified period to determine the strength of the trend.

Interpreting the Average Directional Index

After calculating the Average Directional Index (ADX) using the True Range, +DI, and -DI indicators, interpreting the ADX values provides insight into the strength of market trends and potential trading strategies. ADX values range from 0 to 100, with readings below 20 indicating weak trends and values above 50 suggesting strong trends.

Rising ADX signifies a strengthening trend, while falling ADX suggests a weakening trend in the market. It is essential to note that ADX does not provide buy or sell signals but aids in determining the strength of ongoing trends.

Values above 25 indicate a strong trend suitable for trend-trading strategies, while values between 0-25 suggest weak or absent trends. Understanding ADX peaks can reveal trend momentum, with higher peaks indicating increasing momentum and lower peaks signifying decreasing momentum.

Trading Strategies With ADX

Utilizing the Average Directional Index (ADX) in trading strategies enhances trend confirmation and aids in identifying potential breakout opportunities for making informed entry and exit decisions. When incorporating ADX into trading strategies, the following points are crucial for effective analysis:

- Combine with Other Indicators: Combining ADX with other indicators can improve the accuracy of trend analysis, providing a more comprehensive view of the market dynamics.

- Utilize ADX Values: ADX values above 50 indicate strong trends, while values below 20 suggest weak trends. Traders can capitalize on this information to make informed decisions on entry and exit points.

- Determine Trend Strength: ADX helps traders assess trend strength, enabling them to decide whether to go long or short based on the prevailing market conditions. Understanding the strength of the trend is essential for successful trading strategies.

Common Mistakes to Avoid

When implementing the Average Directional Index (ADX) in trading strategies, it is imperative to steer clear of common mistakes that can undermine decision-making and trading outcomes. One common error to avoid is relying solely on ADX signals without confirmation from other indicators or price action. Rushing into trades based on ADX crossovers can lead to premature entries or exits, impacting profitability.

It's crucial to note that a falling ADX line does not always indicate a trend reversal, especially if the ADX is still above 25, emphasizing the need for a comprehensive analysis. Trading based solely on ADX during ranging markets can result in false signals and poor trading decisions. To enhance the effectiveness of ADX, consider using leading indicators in conjunction with the ADX indicator to confirm signals and avoid common trading errors.

How Can Beginners Use the Average Directional Index in Trading?

The average directional index (ADX) is a helpful tool for beginners in trading. To decode average directional index, start by understanding that it measures the strength of a trend. Traders can use it to determine whether to enter or exit a trade. Utilizing the ADX can assist in making more informed trading decisions.

Frequently Asked Questions

How Do You Calculate the Average Directional Movement Index?

To calculate the Average Directional Movement Index (ADX), determine the Directional Movement Index (DX) by utilizing True Range, +DI, and -DI values. Smooth the DX values over a specified period, typically 14, to derive ADX.

What Is the Best ADX Setting for Day Trading?

Efficiency in day trading hinges on selecting optimal parameters like the 14-period ADX setting, known for its balance between responsiveness and smoothing. This choice aids in capturing short-term trends and making informed trading decisions promptly.

What Is Average Directional Index Ig?

Average Directional Index (ADX) is a technical indicator developed by J. Welles Wilder to quantify trend strength. It ranges from 0 to 100. Traders use ADX in conjunction with directional indicators for trend analysis and to make informed decisions.

What Is the Average Directional Volatility Moving Average?

The Average Directional Volatility Moving Average (ADXVMA) adapts its sensitivity to market volatility, offering a smoother trend signal by combining the Average True Range (ATR) and ADX. Traders benefit from reduced noise and clearer trend identification during volatile periods.

Conclusion

In conclusion, the Average Directional Index (ADX) serves as a valuable tool for beginners to gauge trend strength in the market. By monitoring key levels and interpreting ADX values, individuals can make informed decisions on trading strategies.

It is essential to avoid common mistakes and utilize ADX readings effectively to navigate market trends successfully. As the saying goes, 'knowledge is power' when it comes to understanding and utilizing the Average Directional Index in trading.