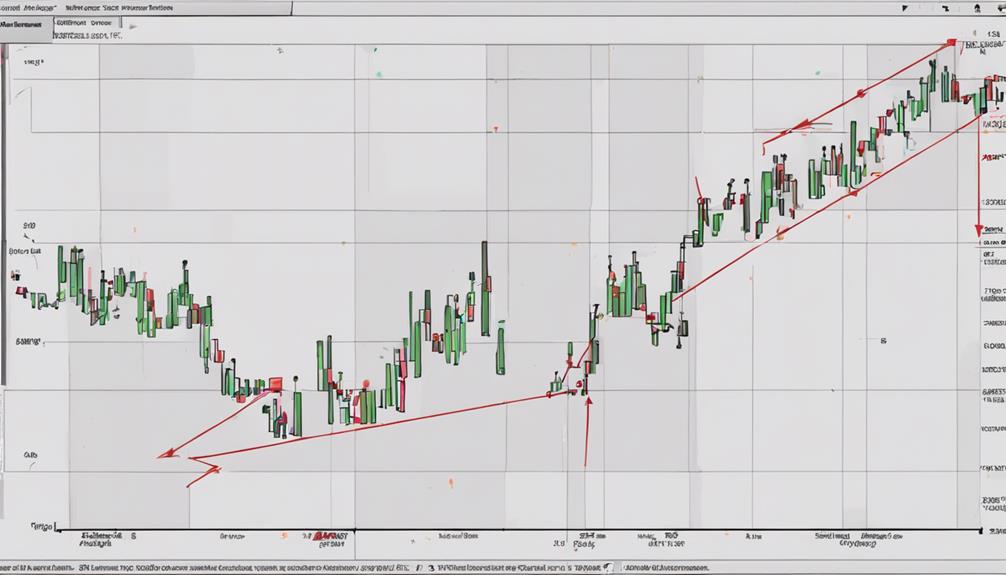

When it comes to efficiently utilizing the Zig Zag Indicator in trading, three straightforward steps can enhance one's ability to track price movements effectively.

Starting with selecting a pivotal point on the chart, traders establish a foundation for their analysis.

Next, setting a percentage price movement threshold aids in defining significant market shifts.

The final step involves connecting subsequent swing highs or lows with trendlines, forming a clear trajectory.

These fundamental procedures lay a solid groundwork for traders seeking to leverage the Zig Zag Indicator's potential for identifying trends and potential reversals in the market.

Understanding the Zig Zag Indicator

In the realm of technical analysis, understanding the Zig Zag Indicator is crucial for identifying pivotal points in price movements. This indicator functions by filtering minor price movements, focusing on swing highs and lows to highlight significant changes in price trends. Zig Zag lines are plotted based on a user-defined percentage deviation, allowing traders to adjust the sensitivity of the indicator to suit their analysis needs.

By effectively filtering out noise, the Zig Zag Indicator helps traders visualize trend changes more clearly and supports the identification of potential reversal points in the market. When used in conjunction with other technical tools, such as moving averages or support and resistance levels, the Zig Zag Indicator can provide a comprehensive analysis of price patterns.

Applying the Zig Zag Indicator

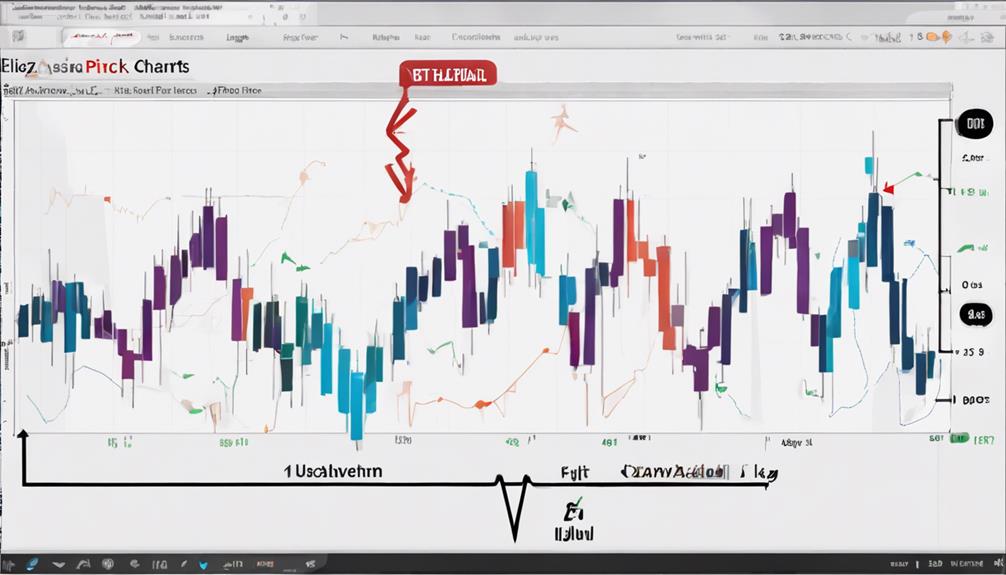

When integrating the Zig Zag Indicator into technical analysis strategies, traders can pinpoint significant price reversals with enhanced precision. This tool is particularly useful for identifying potential support and resistance zones, filtering out noise in price movements.

By adjusting the parameters of the Zig Zag indicator, traders can adapt to varying market conditions and align the tool with their trading strategies effectively. Additionally, when used in conjunction with Elliot Wave Theory, the Zig Zag indicator can help confirm trend directions and patterns, providing a comprehensive view of market dynamics.

Understanding how to apply the Zig Zag indicator empowers traders to conduct in-depth trend analysis, leading to more informed decision-making processes in trading activities. By leveraging the insights provided by this indicator, traders can make more strategic decisions and improve their overall trading performance.

Maximizing the Zig Zag Indicator

To optimize the effectiveness of the Zig Zag Indicator in technical analysis, traders can employ various strategies to maximize its utility across different market conditions and timeframes. Adjusting parameters such as percentage change and depth can help tailor the indicator to specific market dynamics, ensuring it captures significant price reversals while filtering out minor fluctuations for clearer trend analysis.

Additionally, combining the Zig Zag Indicator with other technical tools like moving averages or the Relative Strength Index (RSI) can provide confirmation of trade setups and enhance decision-making. Experimenting with different settings of the Zig Zag Indicator is crucial to finding the optimal configuration that aligns with one's trading strategy and goals.

While the Zig Zag Indicator is valuable in identifying trends and reversals, it is essential to use it in conjunction with other indicators for comprehensive analysis and effective risk management. By maximizing the capabilities of the Zig Zag Indicator through these approaches, traders can enhance their technical analysis and potentially improve trading outcomes.

– Can the Same Steps Used for Navigating the ADX Indicator be Applied to the Zig Zag Indicator?

When it comes to navigating the Zig Zag Indicator, the essential tips navigating ADX Indicator can also be applied. Both indicators require a solid understanding of price trends and momentum, making it possible to use similar steps for successful navigation. Understanding their respective signals and patterns is key.

What are the benefits of using the Zig Zag indicator for navigation?

The navigate zig zag indicator is a useful tool for traders to identify potential trend reversals. By analyzing the price movements of an asset, it helps in making informed decisions and finding entry and exit points. This can lead to better trading outcomes and improved profitability for investors.

Frequently Asked Questions

How Do You Use a Zigzag Indicator?

Utilize the Zigzag indicator to identify price reversals by connecting swing highs and lows based on a specified percentage deviation. Adjust its settings for various securities and timeframes. Combine with other technical tools for enhanced market analysis.

What Is the Zigzag Line Strategy?

The Zigzag Line Strategy is a method used in trading to identify trend reversals by connecting swing highs and lows. By setting a percentage threshold for price movements, it helps traders pinpoint potential entry and exit points in a trending market.

How Do You Use a Zigzag Line?

To use a Zigzag line effectively, traders track price reversals and filter market noise by connecting swing highs and lows. By adjusting settings to fit various stocks and market conditions, the Zigzag line helps identify trends, support, and resistance levels.

What Is the Best Value for the Zigzag Indicator?

The optimal value for the Zig Zag indicator typically falls within the range of 5% to 10% price change. Traders must experiment with different percentages to fine-tune settings for specific stocks, considering market volatility and desired sensitivity to price movements.

Conclusion

In conclusion, mastering the Zig Zag Indicator requires precision and patience. By understanding its function, applying it effectively, and maximizing its potential, traders can navigate price movements with ease.

The Zig Zag Indicator serves as a valuable tool for identifying trends and potential reversals in the market. Remember, practice and persistence are key to perfecting the art of using this indicator.

Embrace the Zig Zag Indicator's zigzagging ways to win in the trading game!