You might believe that the Relative Strength Index (RSI) holds all the answers when it comes to predicting market trends, but the reality might surprise you. While RSI provides valuable insights into potential buying and selling opportunities, its role is just a piece of the puzzle.

To truly grasp the impact of RSI on market trends, understanding its limitations and knowing when to complement it with other indicators is key. Stay tuned to uncover the nuanced relationship between RSI and market predictions.

RSI Calculation and Interpretation

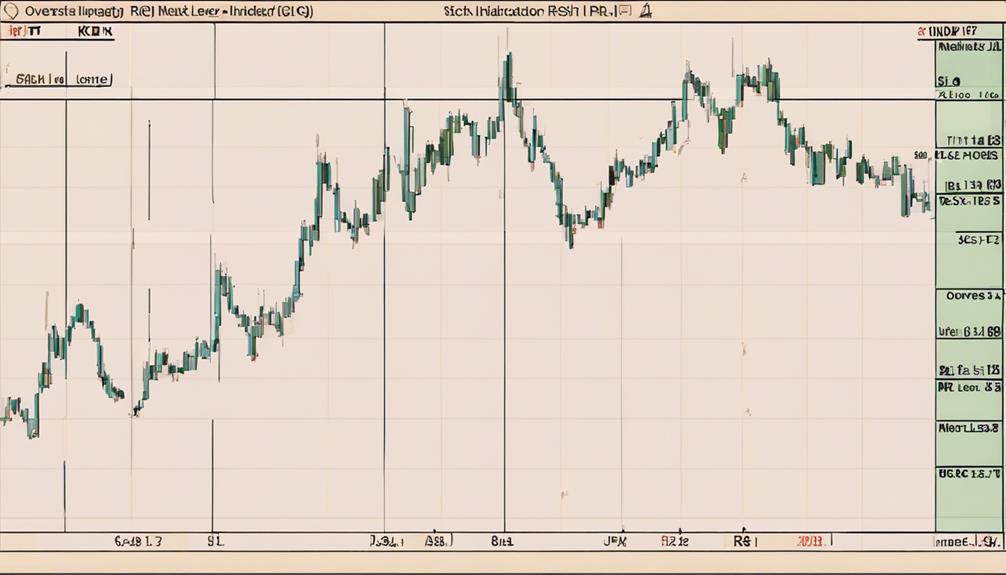

When calculating and interpreting the Relative Strength Index (RSI), traders rely on average gains and losses over a specified period to determine the relative strength of a market asset. RSI values above 70 indicate overbought conditions, signaling potential selling opportunities, while values below 30 suggest oversold conditions, indicating possible buying opportunities.

Divergence between price movement and RSI can signal trend weakening or reversal, providing traders with a valuable momentum signal. By analyzing RSI readings, traders can predict market trends and make informed trading decisions.

Understanding the relationship between RSI, price movements, and market trends is crucial for effectively navigating the dynamic nature of trading environments. The RSI calculation and interpretation play a significant role in guiding traders towards profitable trading strategies.

Overbought and Oversold Conditions With RSI

Monitoring the Relative Strength Index (RSI) allows traders to identify overbought and oversold conditions, crucial for anticipating potential trend reversals and market sentiment shifts. Overbought conditions are signaled when RSI values exceed 70, indicating a possible downtrend or price correction. Conversely, oversold conditions occur when RSI values drop below 30, suggesting a potential uptrend or price rebound.

Traders rely on RSI levels to pinpoint extremes in market sentiment, using the technical indicator to gauge whether a security is overvalued (overbought) or undervalued (oversold). RSI readings above 70 and below 30 offer valuable insights into market conditions and can help predict shifts in price direction, guiding traders in making informed decisions based on these extremes.

RSI in Identifying Trend Continuations

RSI plays a crucial role in confirming trend continuations by consistently staying above 50 in uptrends and below 50 in downtrends, offering traders valuable insights into market direction. When it comes to identifying trend continuations, understanding RSI's behavior around the 50 level is key. Here's why:

- Confirmation of Bullish Trends: RSI readings above 50 signal strength in an uptrend.

- Confirmation of Bearish Trends: Readings below 50 confirm a downtrend.

- Validation of Trend Direction: Traders monitor RSI to validate the ongoing trend.

- Signaling Trend Shifts: RSI levels crossing above or below 50 can indicate potential shifts in market trends.

Combining RSI With Other Indicators

Combining RSI with other indicators enhances trend identification and confirmation, providing traders with a more comprehensive analysis of market dynamics. When RSI is combined with moving averages, it offers confluence in trend identification and confirmation.

Additionally, pairing RSI with Bollinger Bands helps pinpoint potential reversal points more accurately. Integrating RSI with volume indicators offers a holistic view of market trends and possible reversals.

Moreover, utilizing RSI alongside trendline analysis enhances the precision of trend confirmation and entry/exit signals. By combining RSI with oscillators like the Stochastic Oscillator, traders can reinforce the reliability of trend predictions and potential reversals.

This amalgamation of RSI with various indicators empowers traders to make more informed decisions regarding market trends and movements.

Can RSI Help in Predicting Market Trends or Only Reversals?

The RSI indicator is a popular tool for traders to gauge market sentiment and potential reversals. While it can be helpful in identifying potential market reversals, some traders also use RSI to predict overall market trends. Understanding how to utilize the RSI and market reversal is essential for successful trading strategies.

Applying RSI to Market Trends

To effectively apply RSI to market trends, consider its role in identifying potential reversals and confirming existing trend strength amidst market dynamics. When utilizing RSI for market analysis, keep in mind the following:

- Signaling Overbought or Oversold Conditions: RSI helps recognize extremes in buying or selling pressure, indicating potential trend shifts.

- Confirming Trend Strength: Traders use RSI to validate the momentum of ongoing market trends, providing confidence in decision-making.

- Predicting Trend Reversals: Combining RSI with other technical indicators can enhance the accuracy of predicting market reversals.

- Divergence and Market Trends: Divergence between price movements and RSI readings can offer insights into changing market directions, aiding in trend forecasting.

Frequently Asked Questions

How Do You Use RSI to Determine Trend?

To determine trends using RSI, you analyze price movements over a set period. Above 50 indicates uptrend, below 50 downtrend. Use RSI to gauge trend strength and potential reversals. Combine with other indicators for a comprehensive market view.

What Is the Role of RSI in Stock Market?

In the stock market, RSI acts as a key indicator for traders. By signaling overbought and oversold conditions, it aids in predicting potential trend reversals. Combining RSI with other tools enhances market trend analysis for informed decisions.

What Does the RSI Indicator Tell You?

RSI indicator tells you about overbought conditions above 70 and oversold conditions below 30. It helps spot potential trend reversals through price-RSI divergence. Values between 30 and 70 indicate trend continuation. Traders rely on RSI for trend strength and trading signals.

Why Is RSI Important in Trading?

In trading, RSI is vital as it helps gauge market sentiment and potential turning points. By identifying overbought and oversold conditions, RSI assists in spotting selling or buying opportunities, guiding your trading decisions effectively.

Conclusion

As you delve into the world of market trends, remember that RSI is a powerful tool, but not a crystal ball. While it can provide valuable insights into potential buying or selling opportunities, it's crucial to combine RSI with other indicators for a comprehensive analysis.

Think of RSI as a guiding light in the complex labyrinth of market movements, illuminating potential paths to success amidst the chaos of price fluctuations.