In the realm of trading, the Standard Deviation Indicator stands as a pivotal tool for market analysis and decision-making.

Delving into its intricacies reveals a world of nuanced strategies and insights that can significantly impact trading outcomes.

From understanding market volatility to identifying trend reversals, each tip uncovered sheds light on the indicator's immense potential.

As we explore the depths of these top 10 tips, a deeper understanding of the Standard Deviation Indicator's application in real-world trading scenarios emerges, promising a journey rich in knowledge and opportunity.

Importance of Standard Deviation Indicator

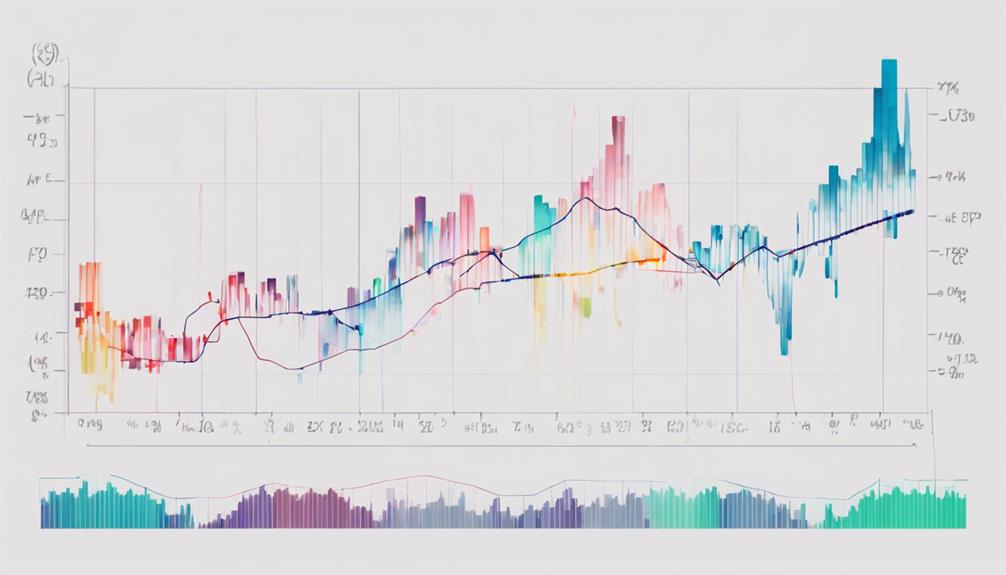

The significance of the Standard Deviation Indicator lies in its ability to quantitatively measure price volatility, providing valuable insights into market dynamics and trend analysis. By calculating the deviations from the mean price, this indicator offers a clear representation of price volatility levels within a given timeframe.

High standard deviation values indicate significant price swings, reflecting high volatility in the market. On the other hand, low standard deviation values suggest a period of low volatility characterized by a narrow trading range. Understanding these volatility levels is crucial for assessing market sentiment and predicting potential price movements.

Moreover, the Standard Deviation Indicator plays a vital role in identifying trend strengthening. When combined with other technical analysis tools, it helps traders and investors make informed decisions based on the current market conditions. Therefore, mastering the interpretation of standard deviation values is key to navigating the complexities of price movements and market behavior effectively.

Understanding Volatility Measurement

Volatility plays a crucial role in understanding market dynamics. It impacts trading strategies and risk management decisions. By analyzing historical price movements, traders can gain insights into the level of uncertainty or stability within a given market.

Recognizing the relationship between volatility and market behavior is essential for effectively utilizing the Standard Deviation Indicator in financial analysis.

Volatility and Market Behavior

Market behavior exhibits distinct patterns in response to changes in volatility, reflecting underlying shifts in trader sentiment and market dynamics. Understanding market volatility through standard deviation is essential for traders to navigate varying market conditions effectively. Here are some key points to consider:

- High standard deviation: Indicates significant price swings and heightened market volatility.

- Low standard deviation: Suggests a narrow trading range and lower market volatility.

- Impact on trader sentiment: Increased volatility at market tops may signal nervous and indecisive traders.

- Trend strength indication: Standard deviation helps assess the strength of market trends based on price dispersion.

- Trading opportunities: Identifying volatility patterns can unveil potential trading opportunities for informed decision-making.

Impact on Trading Strategies

In trading strategies, an in-depth understanding of volatility measurement, particularly through standard deviation analysis, is crucial for informed decision-making and effective risk management. Standard deviation serves as one of the essential volatility indicators, offering insights into the price fluctuations and potential risks associated with a financial instrument.

By comprehending volatility through standard deviation, traders can better assess market conditions, set appropriate stop orders, and manage their exposure to risk. Moreover, standard deviation plays a significant role in identifying trend reversals, signaling potential shifts in market direction.

When combined with other technical indicators, standard deviation can enhance the effectiveness of trading strategies, providing traders with a more comprehensive view of market dynamics for making well-informed decisions.

Historical Price Movements

An examination of past price movements is fundamental in comprehending the dynamics of volatility measurement within financial markets. Historical price movements provide valuable insights into market behavior and risk assessment. Here are some key points to consider when analyzing historical price movements:

- Historical price movements are essential for understanding market volatility and risk assessment.

- Standard deviation measures the dispersion of historical prices from the mean, indicating volatility.

- Volatility is crucial for assessing potential price swings and market behavior over time.

- Analyzing historical price movements helps in identifying trends and making informed trading decisions.

- Understanding historical price data aids in predicting future price movements and adjusting trading strategies accordingly.

Calculation of Standard Deviation

The process of computing standard deviation involves a systematic calculation that quantifies the dispersion of data points from their mean value. By finding the mean of a set of data points and measuring how spread out those points are from the mean, standard deviation provides a measure of volatility or dispersion within the data set.

This calculation includes squaring the differences between each data point and the mean, summing these squared differences, dividing by the number of data points, and finally taking the square root of the result. Standard deviation serves as a crucial tool for traders to assess the extent of price movements and to anticipate potential market trends based on historical data analysis.

Understanding the calculation of standard deviation is paramount for interpreting market volatility accurately and making well-informed decisions when formulating trading strategies.

Trading Strategies for Flat Breakouts

Analyzing price movements during flat breakouts requires traders to implement strategic approaches that leverage volatility measures like standard deviation to identify potential breakout points accurately. When trading flat breakouts, consider the following strategies:

- Set Tight Stop-Loss Orders: Protect your capital by placing stop-loss orders close to your entry point to limit potential losses.

- Target Price Levels Beyond Breakout Range: Aim for profits by setting realistic target prices beyond the breakout range to capture significant price movements.

- Use Confirmation Indicators: Enhance your trading decisions by confirming flat breakouts with other indicators like volume or trend analysis.

- Monitor Standard Deviation Changes: Keep an eye on standard deviation levels to gauge increasing or decreasing volatility, aiding in timing your trades effectively.

- Adjust Strategies Based on Market Conditions: Adapt your approach based on evolving market conditions to stay flexible and capitalize on opportunities during flat breakouts.

Identifying Trend Reversals Early

Observing the peaks and troughs of the standard deviation indicator can offer valuable insights into potential trend reversals in the market.

By analyzing these patterns, traders can interpret early signals of changes in market direction.

Utilizing multiple timeframes in conjunction with standard deviation analysis can provide a comprehensive view for traders aiming to identify and act upon trend reversals promptly.

Early Trend Reversal Signals

Utilizing standard deviation indicator waves enables traders to proactively pinpoint potential early trend reversals through the detection of significant price deviations and volatility shifts. When looking for early trend reversal signals, consider the following:

- Watching for standard deviation peaks and troughs helps in spotting trend changes early.

- Significant price divergences can indicate a potential reversal in the trend.

- Combining standard deviation with other indicators enhances the accuracy of trend reversal signals.

- Volatility shifts can signal upcoming trend changes.

- Understanding standard deviation patterns and trends is crucial for timely decision-making in trading.

Interpretation for Traders

To enhance their trading strategies, traders can effectively identify potential trend reversals early by closely monitoring volatility changes indicated by spikes in standard deviation values. By keeping an eye on volatility levels and observing significant deviations from the norm, traders can anticipate potential trend reversals in the market.

Early detection of these reversals provides traders with the opportunity to adjust their positions accordingly or capitalize on emerging market opportunities. Additionally, combining standard deviation with other technical indicators can further enhance the accuracy of predicting trend reversals.

Understanding how standard deviation interacts with market dynamics can offer valuable insights into the strength and direction of trends, empowering traders to make informed decisions for optimal trading outcomes.

Utilizing Multiple Timeframes

Traders can significantly enhance their ability to identify potential trend reversals early by incorporating an analysis of standard deviation across multiple timeframes.

Here are five reasons why utilizing multiple timeframes is crucial for identifying trend reversals early:

- Comprehensive View: Comparing standard deviation values on different timeframes provides a comprehensive view of price volatility and trend strength.

- Confirmation of Trends: Utilizing multiple timeframes with standard deviation allows traders to confirm trends and avoid false signals.

- Enhanced Strategies: Early identification of trend reversals through multiple timeframe analysis with standard deviation enhances trading strategies.

- Crucial Monitoring: Monitoring standard deviation consistently on various timeframes is crucial for effective trend analysis and risk management in trading.

- Risk Mitigation: Identifying trend reversals early helps in mitigating risks and maximizing trading opportunities.

High Vs. Low Standard Deviation

Standard deviation serves as a key metric for discerning between high and low volatility levels in the market. High standard deviation indicates high volatility characterized by significant price swings, reflecting a market with pronounced fluctuations and increased uncertainty. Conversely, low standard deviation suggests low volatility, depicting a market with minimal price movements and a more stable trading environment within a narrow range.

Market sentiment plays a crucial role in standard deviation analysis. Increased volatility at market tops often signifies nervous and indecisive traders, leading to heightened price fluctuations. On the other hand, decreasing volatility at market tops may indicate a maturing bull market and a shift in trader behavior towards more stability.

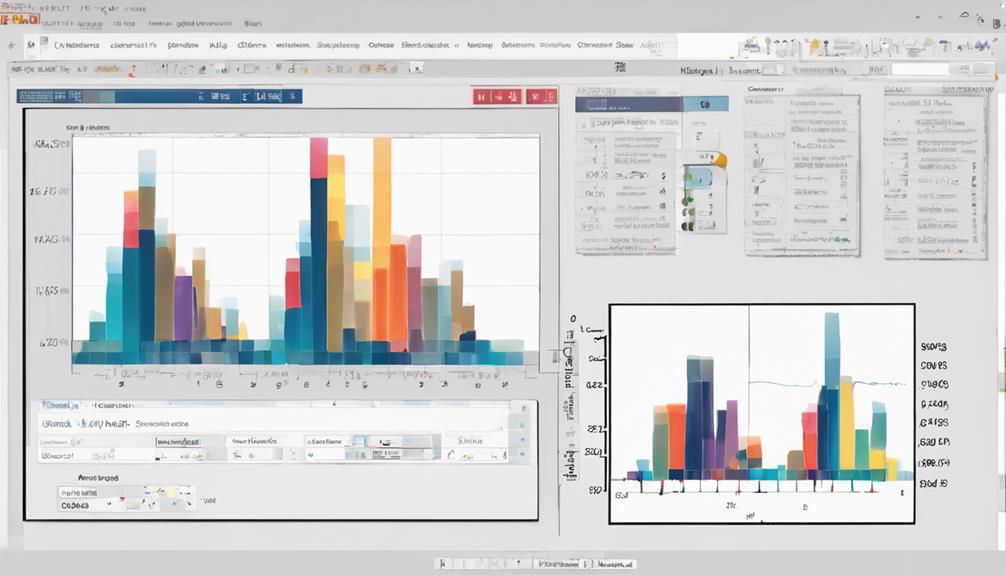

Setting Up the Indicator

The setup of the standard deviation indicator involves configuring indicator parameters and customizing display options for optimal analysis.

Adjusting the length of the indicator and selecting the appropriate data source are critical steps in fine-tuning its performance.

These settings directly impact the indicator's sensitivity to price movements and its ability to provide meaningful insights for traders.

Indicator Parameters Setup

When configuring the parameters of the standard deviation indicator, traders can tailor settings to align with their specific trading strategies and goals. Here are some key considerations for setting up the indicator:

- Adjust the period length to match your desired level of sensitivity.

- Experiment with different source data options like closing prices or high/low values.

- Fine-tune the indicator's parameters to suit your trading style and preferences.

- Consider the color and line style of the indicator for better visibility on the chart.

- Understanding how these adjustments impact the indicator's signals is essential for making informed trading decisions based on price volatility analysis.

Customizing Display Options

Customizing display options for the Standard Deviation indicator involves adjusting parameters within the indicator settings on your trading platform. Within these settings, you can manipulate the length parameter to determine the number of periods considered in the standard deviation calculation.

Additionally, by selecting the appropriate source parameter, you can specify the price data (such as close, high, or low) utilized for the standard deviation computation. Furthermore, customization extends to the visual representation of the indicator, allowing modifications to colors, line styles, and other visual elements to align with your preferences.

It is advisable to experiment with various settings to establish the optimal configuration that aligns with your trading strategy and analytical requirements effectively.

Combining With ATR for Trading

Enhancing trading strategies by combining Standard Deviation with Average True Range (ATR) offers valuable insights into market volatility and potential price movements. This powerful combination aids in better risk management and decision-making in trading strategies. Here are some key points to consider:

- Enhanced Volatility Assessment: ATR measures the market's volatility, while Standard Deviation indicates price fluctuations. Together, they provide a holistic view of market conditions.

- Improved Risk Management: By using ATR alongside Standard Deviation, traders can set more accurate stop-loss levels based on the current market volatility.

- Precise Entry and Exit Points: The combination of ATR and Standard Deviation helps in identifying optimal entry and exit points, leading to more informed trading decisions.

- Robust Trading Strategies: Utilizing ATR and Standard Deviation together enables traders to create robust strategies that are backed by accurate volatility assessments.

- Informed Decision-Making: Traders benefit from the comprehensive insights offered by ATR and Standard Deviation, leading to more informed and calculated trading decisions.

Utilizing Fibonacci Levels With Standard Deviation

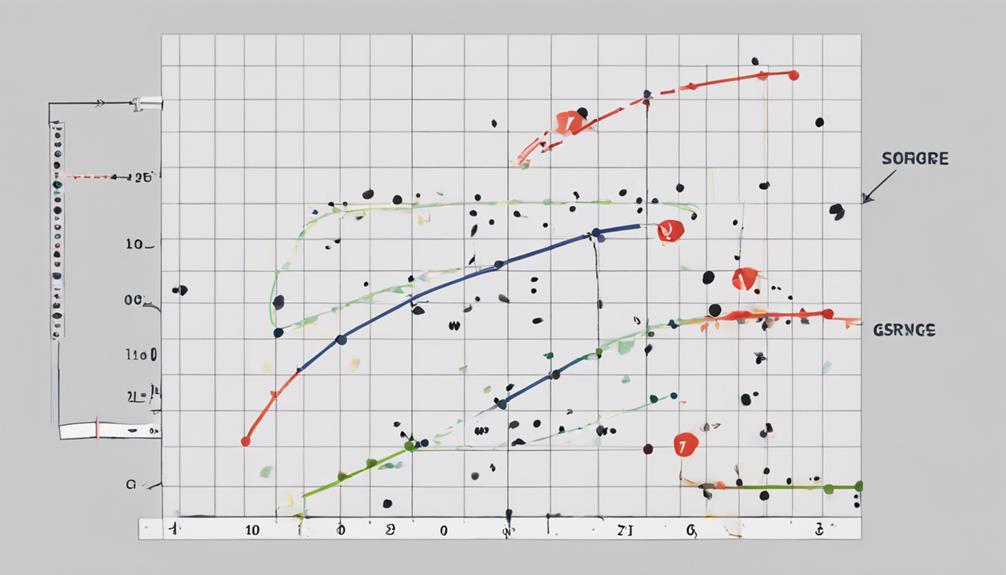

Utilizing Fibonacci levels in conjunction with the standard deviation indicator offers traders a structured approach to identifying key support and resistance levels in the market. By combining these two tools, traders can enhance their understanding of price movements and potential areas of price reversals.

Fibonacci levels provide key levels of support and resistance based on mathematical ratios, while standard deviation helps in measuring the volatility of an asset. When used together, Fibonacci levels act as significant price levels where price reversals or continuations may occur, while standard deviation aids in assessing the likelihood of these movements. This combination can be particularly useful for traders looking to establish entry and exit points more accurately.

Integrating Fibonacci levels with standard deviation creates a robust technical analysis framework that can assist traders in making more informed decisions based on the confluence of these two analytical methods.

Practical Examples and Applications

Building upon the strategic integration of Fibonacci levels and the standard deviation indicator, practical examples and applications demonstrate the efficacy of combining these tools for enhancing trading decisions. The standard deviation indicator aids in assessing volatility and trend strength in trading scenarios, offering valuable insights into market activity levels and deviations from the mean.

By incorporating standard deviation with other indicators, traders can develop effective trading strategies that capitalize on price dispersion and trend reversals. Standard deviation waves serve as early indicators of potential trend reversals, empowering traders to make informed decisions promptly.

Analyzing price dispersion and trend reversals through the application of standard deviation enables traders to navigate the market with precision and confidence, leading to more profitable outcomes.

- Identify market volatility levels

- Enhance trend strength analysis

- Develop robust trading strategies

- Identify early trend reversals

- Make informed decisions based on price dispersion

What Are Some Advanced Tips for Using the Standard Deviation Indicator?

When using the standard deviation indicator, it’s crucial to understand the key insights into standard deviation. One advanced tip is to incorporate different time periods for a more comprehensive analysis. Additionally, using multiple standard deviation levels can provide a clearer picture of market volatility and potential price movements.

How Can I Apply Standard Deviation Indicator in Market Trend Prediction?

One of the key uses of standard deviation is in market trend prediction. By applying the standard deviation indicator to market data, traders can assess the volatility and potential price movements. This helps in identifying potential trend changes and making informed trading decisions.

Frequently Asked Questions

How Do You Trade With Standard Deviation?

Trading with standard deviation involves gauging price volatility and deviation from the mean. It aids in spotting trend changes, setting stop orders, and managing risk. By combining it with other indicators, traders can refine strategies and make informed decisions.

Which Indicator Shows Standard Deviation?

The Bollinger Bands indicator incorporates standard deviation to display price volatility and potential trading ranges, making it an effective tool for analyzing market dynamics. Traders leverage this indicator to identify price extremes and potential trend reversals.

Which Stocks Have Higher Standard Deviation?

Stocks with higher standard deviation exhibit greater price volatility, indicating significant price fluctuations and higher risk levels. Traders seek these stocks for profit opportunities through price movements, but investors must align with risk tolerance and investment goals.

What Is the Best Stochastic RSI Setting for a 1 Minute Chart?

For a 1-minute chart, a Stochastic RSI setting of 5, 3, 3 is often considered optimal due to its ability to capture quick price movements. Traders may fine-tune settings to balance sensitivity and reliability in fast-paced trading environments.

Conclusion

In conclusion, the exploration of the standard deviation indicator has revealed its crucial role in analyzing market trends, identifying volatility, and predicting potential reversals.

By delving into its calculations, applications, and strategic combinations with other indicators, traders can enhance their decision-making processes and optimize their trading strategies.

The standard deviation indicator serves as a valuable tool for traders seeking to navigate the complexities of the financial markets with precision and insight.