In the realm of stock analysis, the significance of standard deviation cannot be overstated. It serves as a pivotal metric in evaluating the level of risk associated with specific investments, offering crucial insights into market volatility and potential price fluctuations.

By understanding the implications of standard deviation on stock performance, investors can navigate the complexities of financial markets with a more informed perspective. This fundamental concept not only aids in risk assessment but also plays a pivotal role in shaping investment strategies and optimizing portfolio management.

Importance of Standard Deviation in Stocks

The significance of standard deviation in stock analysis lies in its ability to quantify the historical volatility of stock prices, offering investors crucial insights into the potential risks associated with their investment decisions. Standard deviation is a statistical measure that calculates the dispersion of data points from the mean.

In the context of stock analysis, the standard deviation serves as a key metric for assessing the level of volatility or risk attached to a particular stock. Stocks with a high standard deviation are considered riskier investments as they exhibit greater price volatility, indicating a wider range of potential outcomes.

On the other hand, stocks with a lower standard deviation are perceived as more stable, with less price fluctuation over time. Understanding the standard deviation of a stock enables investors to gauge the potential level of risk involved in their investment, assisting them in making informed decisions to manage and mitigate risks effectively in their stock portfolio.

Calculating Standard Deviation for Analysis

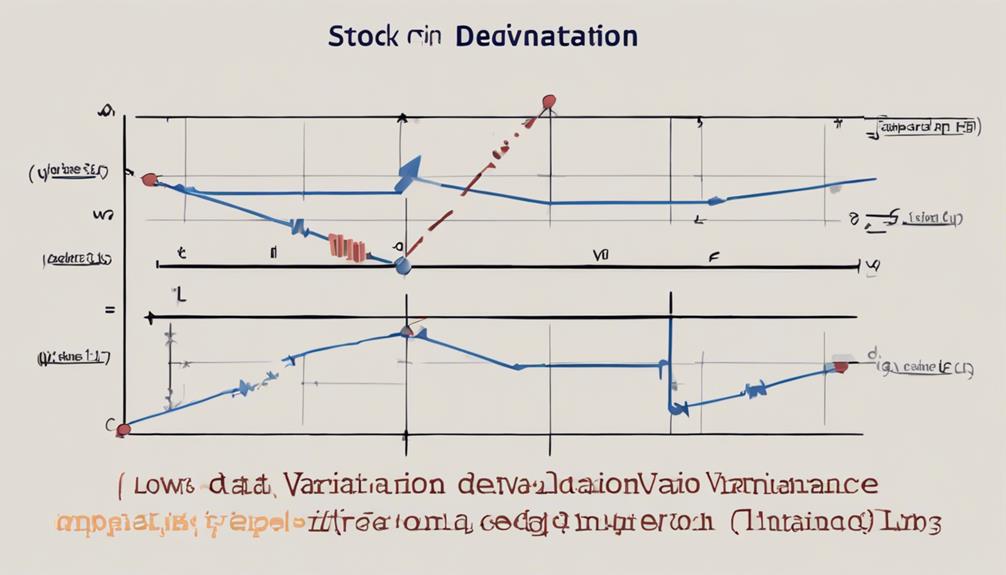

In stock analysis, the process of calculating standard deviation involves deriving the variance initially by squaring the variances between data points and the mean. This variance is the average of the squared differences, reflecting the dispersion of the data points.

Subsequently, the standard deviation, which is the square root of the variance, is computed. Here's how the calculation unfolds:

- Find the Mean: Calculate the average of the data points to establish the central value.

- Calculate Variance: Determine the squared differences between each data point and the mean, then find the average of these squared differences.

- Compute Standard Deviation: Take the square root of the variance to obtain the standard deviation, which quantifies the spread of data around the mean.

Understanding these calculations is essential for evaluating the volatility and risk associated with stock prices based on historical data. Standard deviation serves as a fundamental tool in risk measurement, providing insights into the variability of returns under the assumption of a normal distribution.

Risk Assessment Using Standard Deviation

Evaluating stock risk through standard deviation analysis provides investors with a quantitative measure of historical price volatility. Standard deviation, a key metric in stock analysis, helps measure risk by assessing the volatility of stock returns over a specific period. It indicates the extent of price fluctuations around the average return, giving insights into the stock's volatility.

Stocks with higher standard deviations are considered riskier due to their greater price fluctuations, appealing to more risk-tolerant investors seeking higher returns. Conversely, lower standard deviations suggest a more stable stock price movement, which may attract risk-averse investors looking for predictability.

Standard Deviation Vs. Variance in Stocks

Comparing standard deviation and variance in stock analysis provides investors with essential insights into the level of price fluctuations and aids in strategic portfolio adjustments. When used in stock analysis, standard deviation and variance differ in their interpretation and significance:

- Statistical Measure:

Variance is a statistical measure that calculates the average squared deviations from the mean of a dataset, providing a numerical value representing data dispersion.

- Interpretation:

Standard deviation, as the square root of variance, offers a more intuitive understanding of investment risk. Higher standard deviation means higher volatility, indicating greater potential fluctuations in stock prices.

- Risk Assessment:

Investors calculate the standard deviation to assess the investment risk associated with a particular stock. It helps in visualizing the distribution of prices around the mean, often represented by a bell-shaped curve, enabling investors to make informed decisions based on the level of volatility present.

Standard Deviation's Role in Stock Performance

Standard deviation plays a crucial role in stock performance analysis by providing investors with valuable insights into the volatility and risk associated with a stock's price movements. It serves as a measure of how much the stock's price deviates from its average, offering a clear indication of the stock's volatility. Stocks with higher standard deviations tend to exhibit larger price swings, indicating higher risk levels due to their unpredictability.

Conversely, lower standard deviation values suggest a more stable stock with smaller price fluctuations, signaling lower risk. By analyzing standard deviation in stock performance, investors can better assess the potential risks involved in an investment and make more informed decisions. Understanding the relationship between standard deviation and a stock's price movements is essential for investors looking to manage risk effectively and optimize their investment strategies.

How Does Standard Deviation Impact Stock Analysis?

Standard deviation is one of the key aspects of stock analysis. It measures the volatility of a stock’s price in relation to its average. High standard deviation indicates a larger price range, making the stock riskier. Understanding this metric helps investors assess potential risks and make informed investment decisions.

Frequently Asked Questions

What Is the Importance of Standard Deviation in an Analysis?

Standard deviation is vital in analysis for quantifying variability. It provides a measure of dispersion from the mean, aiding in risk assessment. Higher standard deviation indicates greater fluctuation, while lower values suggest stability. This aids decision-making and risk management.

Why Is Standard Deviation Important in a Company?

Standard deviation is crucial in evaluating a company as it measures the dispersion of stock prices from the mean, offering insights into price volatility and risk levels. This statistic aids in assessing stability and making informed investment decisions.

How Much Standard Deviation Is Acceptable in Stock?

Acceptable standard deviation in stock analysis varies based on risk tolerance and investment goals, typically ranging between 10-20%. Conservative investors prefer lower deviations, while aggressive investors may tolerate higher levels for potential returns. Understanding personal risk appetite is crucial.

What Does the Standard Deviation of a Stock Portfolio Tell You?

The standard deviation of a stock portfolio reveals the extent to which individual stock returns diverge from the portfolio's average return. A higher standard deviation signals greater volatility, aiding investors in assessing risk and potential fluctuations.

Conclusion

In conclusion, standard deviation plays a crucial role in stock analysis by providing a measure of variability and helping investors assess market volatility and risk.

By quantifying the degree of variation of individual stock values from the mean, standard deviation allows for informed decision-making based on risk tolerance.

Its importance in modern portfolio theory cannot be overstated, making it an indispensable tool for both individual investors and financial institutions in managing investment risks.