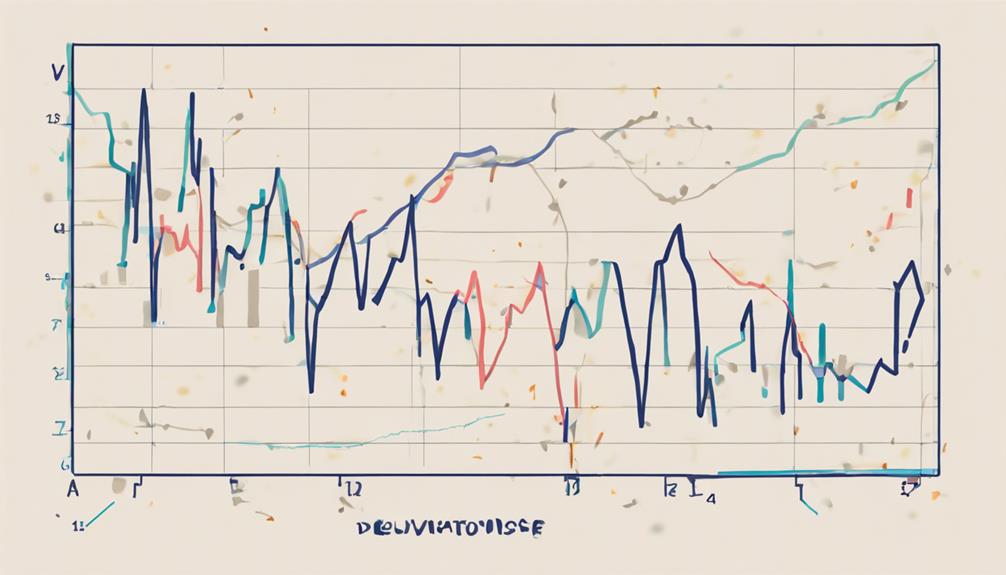

The Standard Deviation Indicator serves as a crucial tool in analyzing market dynamics and assessing risk levels within financial markets. Understanding how this metric reflects price dispersion can provide traders with valuable insights into potential trading opportunities.

By exploring the nuances of interpreting standard deviation values, traders can enhance their risk evaluation processes and refine their strategies for navigating volatile market conditions effectively. However, beyond these foundational aspects lie seven key insights that can offer traders a deeper understanding of how to leverage standard deviation for informed decision-making and improved trading outcomes.

Definition of Standard Deviation Indicator

The Standard Deviation Indicator, a fundamental tool in financial analysis, quantifies the degree of dispersion of asset prices from their mean value, providing insights into market volatility. This statistical measure is essential for evaluating risk and understanding the volatility of financial assets.

By calculating the standard deviation, traders can assess the extent to which asset prices deviate from the average price, indicating the level of market volatility. It serves as a lagging indicator, reflecting historical price movements and market fluctuations rather than predicting future price changes.

Understanding the standard deviation of asset prices is crucial for analyzing market conditions and making informed decisions in trading. The dispersion of prices around the mean, as measured by standard deviation, offers valuable information on the stability and predictability of financial markets.

Traders rely on this indicator to gauge the level of risk associated with investing in various assets and to navigate the complexities of market volatility effectively.

Importance of Standard Deviation Interpretation

The importance of standard deviation interpretation lies in its ability to provide clarity in assessing market volatility and understanding data variability.

By grasping the significance of interpreting standard deviation values, traders can make well-informed decisions regarding entry and exit points, thus enhancing their risk management strategies.

This understanding aids in identifying trends, potential reversals, and overall market stability, enabling traders to adjust their approaches based on the insights gained.

Interpretation Clarity Importance

Understanding the importance of interpreting standard deviation is paramount for traders seeking to navigate market volatility and assess risk levels effectively. Standard deviation serves as a crucial metric in evaluating the variability of asset prices around the mean, providing insight into price stability or instability within the market.

By interpreting standard deviation values, traders can discern the level of market volatility present. High standard deviation values indicate greater price volatility, signifying potential market instability, while low values suggest more price stability. This interpretation clarity is essential for traders to make informed decisions and effectively manage risk exposure.

Utilizing standard deviation to analyze market conditions allows traders to adapt their strategies according to the prevailing levels of risk and uncertainty.

Data Variability Understanding

Navigating market volatility and assessing risk levels effectively requires a deep understanding of data variability through the interpretation of standard deviation. When delving into data variability, traders gain critical insights into market stability, volatility, and risk assessment.

To paint a clearer picture:

- Standard deviation helps measure variability in asset prices, indicating the extent of price dispersion and potential market entry points.

- It plays a vital role in confirming trends by analyzing how prices deviate from the mean, enhancing decision-making processes.

- High volatility signals can be better understood through standard deviation, allowing traders to react promptly to rapid price movements and adjust strategies accordingly.

Calculating Standard Deviation Effectively

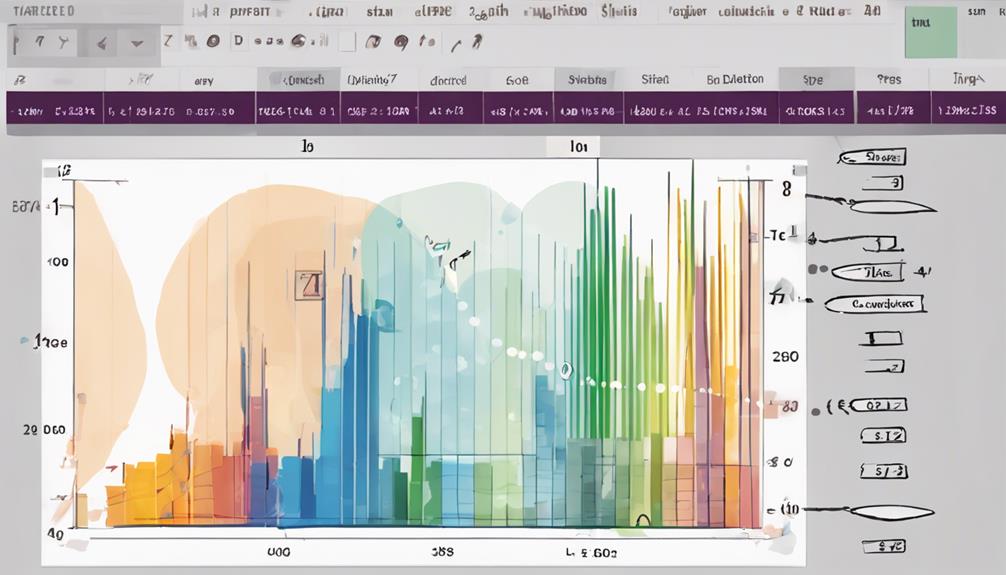

Utilizing a systematic approach to data analysis is essential for accurately calculating standard deviation. Standard deviation is a statistical measure used to assess the volatility and variability of asset prices in trading.

To calculate standard deviation effectively, one must first find the mean of the data set. Next, calculate the squared differences between each data point and the mean, sum these squared differences, divide by the number of data points, and finally, take the square root of the result. This process is crucial in transforming variance, which represents the average of the squared differences from the mean and provides a measure of data dispersion, into standard deviation for easier interpretation.

Standard Deviation Vs. Variance Analysis

A comparison between standard deviation and variance analysis elucidates the nuanced differences in measuring data dispersion and variability with distinct mathematical approaches.

- Calculation Method: Variance involves squaring the differences from the mean, while standard deviation is the square root of this average squared difference.

- Units of Measurement: Variance is in squared units, making it less interpretable in real-world terms, whereas standard deviation is in the same units as the data, providing a clearer understanding of the spread.

- Preference in Analysis: Standard deviation is more commonly used in financial analysis due to its intuitive measure of data variability, making it easier for analysts to interpret and draw conclusions from the data.

In essence, while both standard deviation and variance are crucial in analyzing data variability, standard deviation's square root transformation of variance offers a more practical and user-friendly metric for understanding the dispersion of data in various fields, especially in financial analysis scenarios.

Practical Use of Standard Deviation in Trading

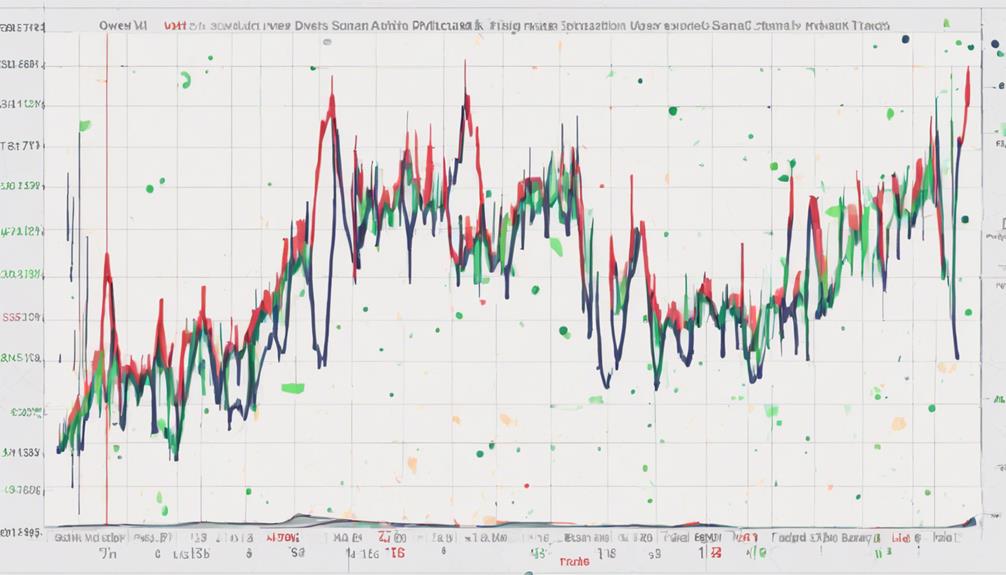

The application of standard deviation in trading provides valuable insights into price volatility and market risk assessment. Traders utilize standard deviation to evaluate market conditions, identify potential trend strengths, anticipate trend reversals, and set effective stop orders in response to market fluctuations.

By measuring deviations from the mean price, standard deviation indicates the extent to which prices deviate from the average over a specific period, aiding in assessing risk and making informed decisions. When combined with other technical indicators, standard deviation enhances trading strategies by offering valuable insights into market volatility and potential price movements.

This statistical tool is pivotal in helping traders navigate dynamic market conditions, manage risk effectively, and optimize their trading approach based on historical price variability. In essence, standard deviation serves as a critical metric for traders seeking to gauge price volatility, interpret market trends, and make well-informed decisions in response to changing market dynamics.

Impact of Volatility on Standard Deviation

Impacted by fluctuations in market conditions, volatility directly influences the standard deviation indicator by amplifying price dispersion from the mean. This relationship between volatility and standard deviation plays a crucial role in assessing market dynamics and risk levels for traders.

Here are three key points to consider:

- High Volatility Leads to Larger Price Swings: When market volatility increases, price fluctuations become more pronounced, resulting in higher standard deviation values. This signifies a greater degree of uncertainty and risk in the market environment.

- Standard Deviation Reflects Market Uncertainty: As volatility rises, standard deviation values also tend to spike, indicating rapid changes in asset prices. Traders often use these spikes in standard deviation as a signal of increased market uncertainty.

- Adjusting Strategies in Response to Market Volatility: Given the impact of volatility on standard deviation, traders adjust their strategies accordingly to navigate the price swings and uncertainties associated with heightened market volatility.

Optimizing Standard Deviation for Trading Strategies

Optimizing standard deviation parameters is crucial for refining trading strategies to align with market dynamics. By adjusting these settings based on asset type, timeframes, and preferred trading styles, traders can enhance signal accuracy and improve risk management.

Customizing standard deviation allows for precise identification of entry and exit points, aiding in adapting to varying market conditions.

Trading Strategy Optimization

Effectively optimizing standard deviation for trading strategies involves precise adjustment of indicator settings to align with current market conditions and trading objectives. To achieve this optimization, traders can follow these key steps:

- Fine-tune standard deviation parameters such as length and source to enhance indicator responsiveness and accuracy.

- Utilize standard deviation to identify optimal entry and exit points in the market, improving timing and decision-making.

- Integrate standard deviation with other technical indicators to develop more comprehensive and effective trading strategies.

Utilizing Standard Deviation

In the realm of trading strategy optimization, a crucial component lies in the meticulous utilization of standard deviation to align with dynamic market conditions and strategic objectives. Traders use standard deviation to measure market volatility, assess risk levels, and anticipate potential price fluctuations. By incorporating standard deviation indicators like Bollinger Bands, traders can adapt to high volatility by widening bands and vice versa for low volatility.

Calculating the standard deviation involves statistical steps to gauge price dispersion accurately. Utilizing standard deviation in trading strategies enhances market entry points, aids in risk management by setting appropriate stop orders, and supports trend identification for effective decision-making. Strategic integration of standard deviation with other technical indicators amplifies the precision of analyzing market activity levels and trend reversals.

Are the Key Insights Into Standard Deviation Indicator Covered in the 10 Best Ways to Understand It?

When it comes to understanding standard deviation, it’s important to cover the key insights into this indicator. The 10 best ways to understand standard deviation can provide valuable information and insights into how it measures the dispersion of data points in a dataset, helping to make better-informed decisions in various fields.

Frequently Asked Questions

What Is the Indication of Standard Deviation?

Standard deviation indicates the dispersion of asset prices from the average, reflecting market volatility and risk levels. High standard deviation signals greater price fluctuation and risk, while low standard deviation suggests stability. Traders utilize this metric to gauge trends and make informed decisions.

How Do You Interpret Standard Deviation Results?

Interpreting standard deviation results involves analyzing the extent of price dispersion from the mean. High values indicate increased market volatility and risk, while low values signify stability. Understanding these results aids traders in assessing market dynamics and potential opportunities.

What Information Will the Standard Deviation Provide Toward Achieving the Purpose?

Standard deviation offers crucial insights into asset price variability, aiding in risk assessment and market analysis. It provides valuable data on price dispersion around the mean, indicating market volatility levels, guiding traders towards informed decisions.

Why Is It Important to Know the Standard Deviation of a Stock?

Understanding the standard deviation of a stock is crucial for assessing price volatility and risk. It provides valuable insights for traders to gauge potential price fluctuations, make informed decisions, and implement effective risk management strategies in the financial markets.

Conclusion

In conclusion, the Standard Deviation Indicator serves as a crucial tool for traders in assessing market volatility and risk.

By understanding how to interpret and calculate standard deviation effectively, traders can make informed decisions, optimize their trading strategies, and manage risks more efficiently.

Utilizing standard deviation in trading can provide valuable insights into market conditions and help traders navigate the complexities of the financial markets with greater precision.