Standard Deviation serves as a cornerstone in evaluating risk within various financial contexts. As investors navigate the complexities of market fluctuations, mastering the nuances of standard deviation can provide a competitive edge.

By honing in on five effective tips tailored to harnessing standard deviation for risk analysis, professionals can elevate their strategies and fortify their decision-making processes.

Through a meticulous exploration of these tips, a deeper comprehension of risk assessment and mitigation strategies emerges, leading to more informed and calculated investment choices.

Understanding Standard Deviation

In risk analysis, the concept of standard deviation serves as a fundamental metric for quantifying the dispersion of data points around the mean. Standard deviation is a key tool for assessing the volatility and risk associated with investments. By showing how prices deviate from the average, standard deviation provides valuable insights into market unpredictability.

Investors rely on standard deviation to make informed decisions, as a higher standard deviation indicates higher risk but also the potential for greater returns. Understanding standard deviation enables investors to gauge the variability of their investments and anticipate potential outcomes. It plays a crucial role in risk analysis by highlighting the range within which data points fluctuate, thus aiding in the assessment of market uncertainties.

Calculating Standard Deviation

Utilizing a mathematical approach, the calculation of standard deviation involves deriving the square root of the variance to quantify the dispersion of data points around the mean. To compute standard deviation, one must first calculate the mean of the dataset.

Subsequently, the differences between each data point and the mean are determined, squared, summed, divided by the sample size, and then the square root is taken to arrive at the standard deviation. This metric is crucial for risk analysis in investments as it assists in quantifying the variability and risk associated with a dataset.

Investors rely on standard deviation to assess the potential range of returns, enabling them to make informed decisions based on their risk tolerance levels. By understanding how to calculate standard deviation accurately, investors can make sound judgments regarding their investment strategies and optimize their portfolio based on the level of risk they are willing to undertake.

Interpreting Standard Deviation for Risk

When analyzing standard deviation for risk, a crucial aspect to consider is the extent of variability exhibited by data points around the mean. This provides key insights into the level of risk associated with the dataset. Standard deviation acts as a measure of variability, aiding in risk assessment by indicating the degree of fluctuations in returns.

A higher standard deviation suggests a higher risk level, as the data points are spread out over a wider range, resulting in less predictable returns. On the contrary, a lower standard deviation signifies lower risk and more stable returns, making investments potentially less volatile.

Utilizing Standard Deviation in Analysis

An essential technique for incorporating standard deviation in financial analysis involves evaluating the degree of variability in data points around the mean to gauge the level of risk present within the dataset. Standard deviation is a crucial tool for investors to assess the potential volatility and risk associated with their investments. By calculating the standard deviation, investors can gain insights into the spread of returns, providing a clearer understanding of the potential risks involved.

The process of calculating standard deviation includes squaring the deviations from the mean, summing these squared values, and then taking the square root of the total. A higher standard deviation indicates a greater level of risk and volatility in investment returns, signaling to investors the potential fluctuations they may encounter.

Utilizing standard deviation in analysis allows investors to make more informed decisions based on their risk tolerance levels. It helps in comparing different investments and understanding the variability in returns, enabling investors to assess and manage risks effectively.

Standard Deviation and Risk Management

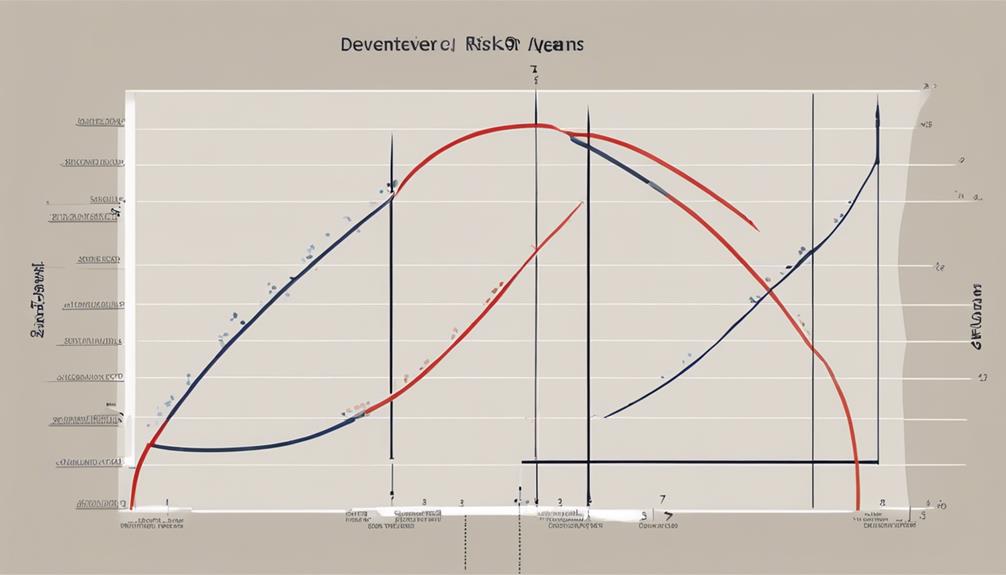

Standard deviation serves as a fundamental tool in risk management for investors, providing a quantitative measure of the variability in investment returns around the average. It quantifies the level of risk by assessing the spread of data points around the mean, aiding investors in understanding the potential unpredictability and range of returns in their investment portfolios. This understanding is crucial for making informed decisions aligned with one's risk tolerance and potential return ranges.

High standard deviation indicates higher risk and volatility, suggesting a more unpredictable investment, while low standard deviation implies lower risk and greater stability. By calculating standard deviation, investors can effectively evaluate the variability of returns, enabling them to manage risk more efficiently and optimize their investment strategies for better outcomes.

In essence, standard deviation is a key metric that empowers investors to gauge and navigate the risks associated with their investment portfolios.

How Do I Use Standard Deviation for Risk Analysis Based on Deep Dive Tips?

When conducting risk analysis, a deep dive into standard deviation can provide valuable insight into the volatility of data points. By calculating the standard deviation, you can assess the spread of values and anticipate potential fluctuations. This statistical tool is essential for identifying and mitigating risks in various industries.

What Are Some Effective Tips for Using Standard Deviation in Risk Analysis?

When conducting risk analysis, a deep dive into standard deviation can provide valuable insights. By understanding the variability of data points around the mean, one can better assess potential risks. Effective tips include using standard deviation to measure volatility, identify outliers, and make informed decisions based on the level of risk.

Frequently Asked Questions

What Is Whether Standard Deviation Is a Good Measure of Risk?

Standard deviation serves as a crucial risk measure in finance, aiding investors in gauging the volatility and potential returns of investments. However, its effectiveness as a standalone metric depends on the investment's characteristics and objectives, warranting supplementary risk assessment tools.

What Is Considered a Good Standard Deviation?

A good standard deviation in investments is one that reflects lower risk and stable returns, indicating consistency and predictability. For risk-averse investors, a lower standard deviation is preferable, as it signifies reduced price volatility and a more secure investment environment.

What Are the Disadvantages of Standard Deviation as a Measure of Risk?

Standard deviation as a risk measure has limitations, like overlooking tail risk and asymmetric deviations, and assuming a normal distribution. Alternative metrics such as Value at Risk may better capture non-normal distributions, urging investors to combine metrics for a holistic risk assessment.

How Do You Interpret Standard Deviation in Risk and Return?

Standard deviation in risk and return analysis quantifies the dispersion of an investment's returns around the mean. A higher standard deviation indicates greater volatility and risk. Investors utilize this metric to evaluate potential return ranges and make informed decisions aligned with their risk tolerance.

Conclusion

In conclusion, mastering the concept of standard deviation is essential for effective risk analysis in investing. By understanding how to calculate and interpret standard deviation, investors can make informed decisions based on the level of risk associated with their investments.

Utilizing standard deviation in analysis and risk management strategies can help mitigate potential losses and maximize returns. Remember: 'Knowledge is power.'