Exploring the realm of day trading can be a complex journey, especially when considering the utilization of the top 10 Parabolic SAR indicators. These tools are designed to enhance decision-making processes and capitalize on market trends efficiently.

With a plethora of strategies available, each tailored to specific trading styles and preferences, the Parabolic SAR indicators offer a versatile approach to navigating the fast-paced world of day trading.

As traders aim to interpret these indicators effectively, the potential for unlocking key insights and maximizing profit becomes increasingly intriguing.

Best Settings for Parabolic SAR

Determining the optimal configuration of Parabolic SAR parameters is essential for enhancing its efficacy in day trading strategies. When considering the best settings for Parabolic SAR, traders often focus on adjusting the Acceleration Factor (AF) and the Step parameter.

The default Step setting of 0.02 and Max setting of 0.20 provide a starting point for customization. Altering the Step parameter can impact how quickly the indicator responds to price changes, influencing the sensitivity of Parabolic SAR.

Experimenting with different AF values allows traders to fine-tune the indicator to suit varying market conditions and timeframes. It is important to note that different timeframes may require specific Parabolic SAR settings to achieve optimal performance.

Understanding how these settings interact with each other and with price movements is crucial for maximizing the effectiveness of Parabolic SAR in day trading scenarios. By carefully selecting and adjusting these parameters, traders can better utilize Parabolic SAR as a valuable tool in their trading strategies.

Parabolic SAR Strategy Examples

Various strategy examples incorporating Parabolic SAR, such as EMA Crossover, MACD, Scalping, and ADX combinations, offer traders effective tools for generating trading signals.

The EMA Crossover with Parabolic SAR Strategy and the Double Parabolic SAR Strategy are popular methods that help traders maximize profits by identifying potential entry and exit points.

Combining Parabolic SAR with MACD can assist in spotting trend reversals, while integrating it with ADX provides insights into trend strength and possible reversals, aiding traders in making informed decisions.

Additionally, the Parabolic SAR Scalping Strategy is commonly used by traders looking to capitalize on short-term opportunities in volatile market conditions.

The ADX + Parabolic SAR Strategy stands out as a robust approach that merges trend strength indications with potential reversal signals, offering traders a comprehensive method for enhancing their trading strategies and improving overall performance.

Parabolic SAR for Intraday Trading

The use of Parabolic SAR in intraday trading is beneficial for capturing short-term market trends and providing timely entry and exit signals.

By adjusting the Acceleration Factor in the settings, intraday traders can enhance the indicator's sensitivity, enabling quicker responses to price fluctuations.

Combining Parabolic SAR with other indicators and intraday trading strategies can further optimize trading performance and risk management.

SAR for Market Trends

Parabolic SAR indicators offer day traders a valuable tool for swiftly identifying and capitalizing on market trends during intraday trading sessions. With its ability to pinpoint potential reversals and trend shifts within the same trading day, Parabolic SAR is instrumental in setting effective stop-loss levels to manage risk during intraday market movements.

The indicator's sensitivity to short-term price changes makes it well-suited for capturing intraday trading opportunities by providing clear signals for market trends. Traders can enhance their intraday trading strategies by combining Parabolic SAR with other technical indicators to validate signals and improve overall trading decisions.

Incorporating Parabolic SAR into intraday trading routines can help traders stay agile and responsive to dynamic market conditions.

SAR Entry Signals

Intraday traders leverage SAR Entry Signals as key indicators for swift decision-making in volatile market conditions, aiding in prompt entry and exit points for optimizing day trading strategies.

When considering SAR Entry Signals for day trading, traders should keep in mind the following:

- SAR Entry Signals are generated when the price crosses the Parabolic SAR dots, signaling potential trend reversals.

- Traders use these signals for quick entry and exit points in volatile markets, enhancing decision-making efficiency.

- Parabolic SAR dots positioned above the price indicate a possible downtrend, prompting traders to consider short positions.

- Combining SAR Entry Signals with other indicators can provide confirmation and validation before executing trades, improving overall trading precision.

Parabolic SAR on 5-Minute Chart

Analyzing the Parabolic SAR on a 5-minute chart involves understanding its calculation method. The importance of setting parameters correctly and interpreting the signals it generates are crucial for traders seeking to capitalize on short-term price movements efficiently.

SAR Calculation Explained

Calculating the SAR value on a 5-minute chart involves utilizing the previous period's SAR, the acceleration factor, and the highest or lowest price to provide dynamic insights for day trading strategies.

- The Acceleration Factor (AF) increases incrementally until reaching the maximum AF, often set at 0.2, facilitating faster adjustments on short-term charts.

- SAR values on a 5-minute chart aid in identifying potential short-term trend reversals and precise entry/exit points with heightened sensitivity.

- The Parabolic SAR calculation on a 5-minute chart dynamically adjusts to price movements, offering timely signals for day trading strategies.

- Day traders benefit from using Parabolic SAR on a 5-minute chart to gain rapid trend insights and establish accurate stop-loss levels in volatile market conditions.

Setting Parameters Correctly

When optimizing Parabolic SAR parameters on a 5-minute chart, adjusting the Step and Maximum values is crucial for enhancing signal accuracy and capturing short-term trends effectively.

While the default Step value is commonly 0.02, traders can customize this parameter to align with their specific trading styles. Similarly, the Maximum value, often preset at 0.20, dictates the maximum acceleration factor considered during trend analysis.

Fine-tuning these parameters on a 5-minute chart empowers day traders to identify and manage short-lived trends efficiently. By setting the parameters correctly, the accuracy of Parabolic SAR signals on the 5-minute chart is significantly improved, enabling traders to execute well-informed decisions promptly in response to market movements.

Interpreting SAR Signals

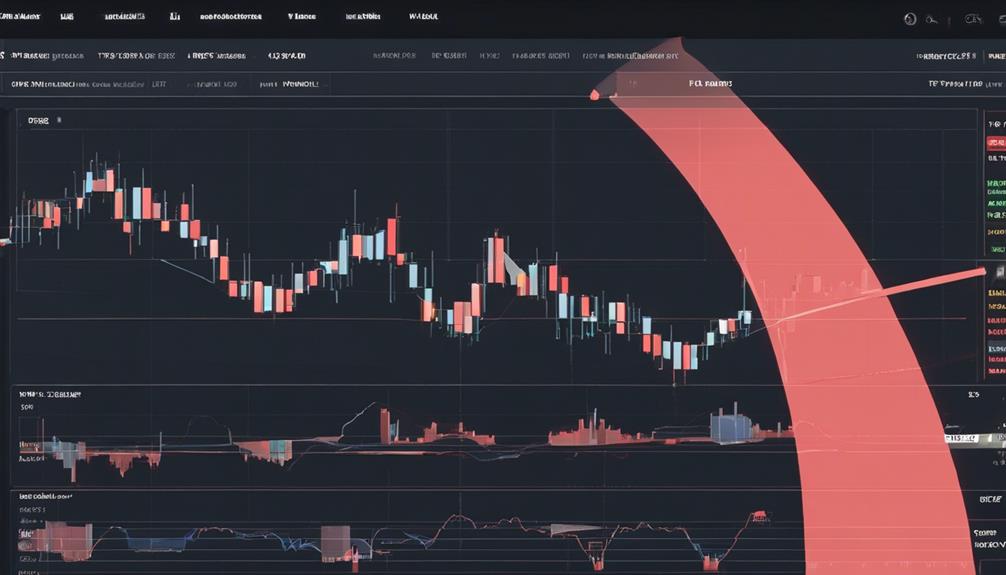

To effectively interpret Parabolic SAR signals on a 5-minute chart, traders must keenly observe the positioning of the SAR dots relative to price candlesticks for identifying potential trends and trade opportunities.

- When Parabolic SAR is below the price on a 5-minute chart, it indicates a bullish trend, signaling potential buy opportunities.

- Conversely, if the Parabolic SAR is above the price candlesticks in a 5-minute chart, it suggests a bearish trend, indicating potential short sale opportunities.

- Confirmation of trend reversal on a 5-minute chart occurs when three consecutive Parabolic SAR dots appear on the opposite side.

- Traders utilize Parabolic SAR on a 5-minute chart to capture momentum in trending markets and adjust stop-loss levels accordingly.

Parabolic SAR for Scalping

Scalping in day trading with the Parabolic SAR indicator necessitates a rapid-fire trading approach tailored to capturing small, quick price movements for immediate profits. Scalpers utilizing the Parabolic SAR typically focus on short-term trends and reversals to exploit quick opportunities in the market. By using tight stop losses and entering and exiting positions swiftly, traders aim to capitalize on these fleeting price fluctuations.

The Parabolic SAR's ability to swiftly adjust to changing market conditions makes it a valuable tool for identifying potential entry and exit points in scalping strategies. Given the fast-paced nature of scalping, precise timing and disciplined risk management techniques are crucial for success. Scalping with the Parabolic SAR demands constant attention to the market and the ability to make quick decisions based on the indicator's signals to maximize profitability in short timeframes.

Double Parabolic SAR Strategy

The Double Parabolic SAR Strategy's effectiveness lies in its reliance on two Parabolic SAR indicators to validate trend reversals, leading to more precise signals.

By blending a fast Parabolic SAR with a slower counterpart, traders gain a comprehensive view of market momentum and potential shifts.

This strategy's emphasis on aligning both indicators before trade entry helps traders filter out false signals and enhances the reliability of trend change indications.

Entry and Exit Rules

Utilizing two Parabolic SAR indicators as part of the Double Parabolic SAR Strategy enables traders to identify entry and exit points based on the crossover of these indicators in alignment with the prevailing trend.

- Entry signals are triggered when the faster SAR crosses over the slower SAR in the direction of the trend.

- Exit signals are generated when the faster SAR changes direction and crosses the slower SAR.

- This strategy aims to capture strong trend movements effectively.

- Proper risk management techniques should be combined with the Double Parabolic SAR Strategy for successful day trading.

Adjusting for Volatility

Adjusting for volatility in the Double Parabolic SAR Strategy involves incorporating two sets of Parabolic SAR indicators to provide more accurate signals and filter out false signals in highly volatile markets.

This strategy is designed to help traders navigate fast-moving market conditions by confirming trend reversals and avoiding unreliable signals. By utilizing two Parabolic SAR indicators, traders can enhance their decision-making process and improve the accuracy of their trades, leading to better risk management and increased profitability in day trading scenarios.

The Double Parabolic SAR Strategy is particularly effective in volatile markets where traditional indicators may struggle to keep up with the rapid price movements, making it a valuable tool for traders looking to capitalize on short-term opportunities.

EMA Crossover With Parabolic SAR

How does the EMA crossover with Parabolic SAR enhance trend confirmation for day traders? This strategy combines two powerful indicators to provide a more robust signal for potential trend reversals.

Here's how it works:

- Confirmation of Trend Changes: By waiting for the EMA to cross above or below the price along with the Parabolic SAR dots, traders can confirm potential trend shifts more effectively.

- Filtering Out False Signals: The EMA crossover with Parabolic SAR helps in filtering out false signals that may occur when using either indicator alone, leading to more accurate trading decisions.

- Buy Signals: A buy signal is generated when the EMA crosses above the price and the Parabolic SAR dots, indicating a possible uptrend in the market.

- Sell Signals: Conversely, a sell signal is triggered when the EMA crosses below the price and the Parabolic SAR dots, suggesting a potential downtrend that traders may capitalize on.

This strategy is popular among day traders seeking to identify and act on trend reversals in volatile market conditions.

Parabolic SAR and MACD Strategy

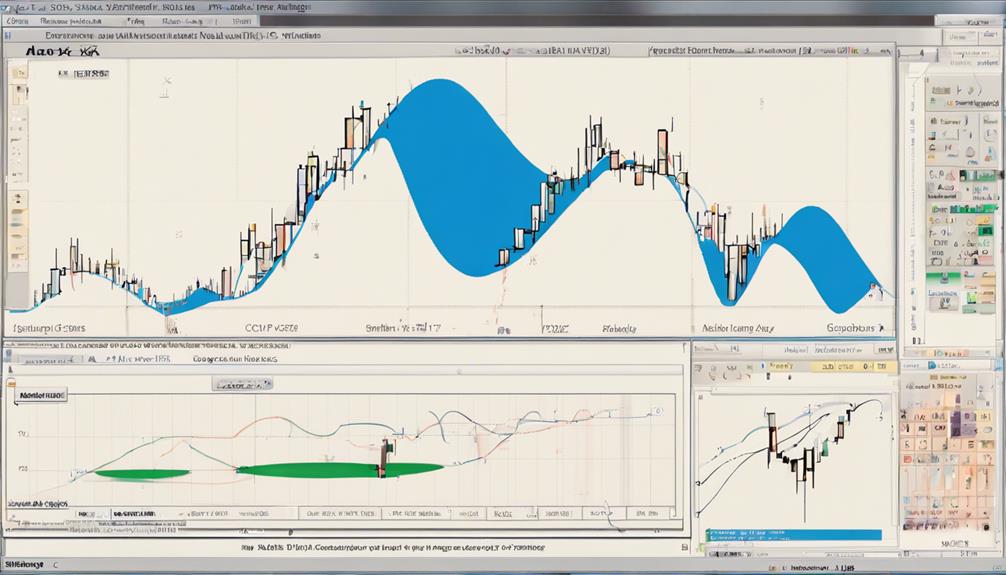

The integration of the Parabolic SAR and MACD indicators in trading strategies is known for its effectiveness in confirming trends and providing precise entry/exit signals for day traders.

The MACD indicator helps traders identify trend direction and strength, while the Parabolic SAR assists in setting stop-loss and trailing stop levels. By looking for MACD line crosses and changes in the Parabolic SAR, traders can confirm trade entries and exits using this strategy.

This approach is particularly useful for capturing strong trends and offering clear signals for day trading activities. When combined, MACD and Parabolic SAR enhance trend-following strategies, leading to improved trading accuracy.

The synergy between these indicators allows traders to make more informed decisions based on trend confirmation and timely entry/exit signals, ultimately contributing to a more structured and disciplined trading approach.

Parabolic SAR Scalping Strategy

Utilizing the Parabolic SAR indicator, the Parabolic SAR Scalping Strategy focuses on executing short-term trades with rapid entry and exit points to capitalize on small price fluctuations within the market.

- Quick Trades: The strategy aims to profit from rapid price movements, entering and exiting positions swiftly.

- Parabolic SAR Indicator: This tool assists traders in identifying potential trend reversals and setting stop-loss levels.

- Small Price Movements: Scalping strategy thrives on exploiting minor price fluctuations throughout the trading day.

- Dynamic Market Environment: Traders employing this method prefer the fast-paced nature of the market, engaging in high-frequency trading.

The Parabolic SAR Scalping Strategy is well-suited for individuals who prefer active trading, quick decision-making, and a hands-on approach to the market. By leveraging the Parabolic SAR indicator effectively, traders can potentially secure profits from short-term price movements, making this strategy a valuable tool in the arsenal of day traders looking to capitalize on market volatility.

ADX With Parabolic SAR Strategy

Incorporating the ADX with Parabolic SAR strategy enhances trend analysis by combining the Average Directional Index (ADX) with the Parabolic SAR indicator. This strategy allows traders to assess both the strength of a trend through ADX and potential trend reversals using Parabolic SAR.

By utilizing these two indicators together, traders can gain a comprehensive view of the market dynamics, enabling them to make well-informed decisions on entry and exit points. The ADX with Parabolic SAR strategy is particularly effective in confirming trend directions and filtering out false signals that may lead to erroneous trades.

It is widely favored among traders for its ability to provide clear signals and improve the accuracy of trend-following strategies. Overall, this combined approach to trend analysis offers traders a more robust framework for navigating the complexities of the financial markets with greater precision and confidence.

What Are the Best Parabolic SAR Indicators for Day Trading?

When day trading, it’s crucial to find the best parabolic SAR indicators for accurate insights into market trends. These indicators can help traders make informed decisions about entry and exit points, ultimately leading to more successful trades. Understanding the nuances of parabolic SAR indicator insights is essential for day trading success.

Frequently Asked Questions

Which Indicator Is Best With Parabolic Sar?

When considering the best indicator to pair with Parabolic SAR, it is essential to evaluate the specific trading goals and market conditions. Factors such as trend confirmation, overbought/oversold conditions, volatility, and key support/resistance levels play a crucial role in determining the most suitable indicator.

What Are the Parabolic SAR Settings for Day Trading?

In day trading, optimal Parabolic SAR settings typically entail a Step of 0.02 and a Maximum of 0.2. Adjusting the Acceleration Factor (AF) can heighten sensitivity for short-term trades, particularly beneficial on shorter timeframes like 5-minute charts. Traders often fine-tune these settings for improved performance.

Is Parabolic SAR Indicator Profitable?

The profitability of the Parabolic SAR indicator in trading depends on its accuracy in identifying trend reversals and setting stop-loss levels. When used effectively with proper risk management, it can enhance trading strategies and maximize profits.

What Is the Best Indicator for Day Trading?

The best indicator for day trading varies based on individual strategies; popular choices include Moving Averages, RSI, and Bollinger Bands. Traders often combine indicators for confirmation. Testing various indicators is crucial for optimal performance and informed decision-making.

Conclusion

In conclusion, the Top 10 Parabolic SAR Indicators for Day Trading offer traders a powerful set of tools to navigate the volatile markets.

With customizable settings and strategic combinations like EMA Crossover and MACD, these indicators provide valuable insights into market trends and optimal entry/exit points.

By utilizing Parabolic SAR effectively, traders can enhance their trading performance and maximize profits in dynamic market conditions like never before.