Gann Theory stands as a cornerstone in the realm of technical analysis due to its intricate framework that intertwines time, price, and volume to offer predictive insights into market behavior. The methodology crafted by W.D. Gann has proven to be a robust tool for traders seeking to decipher market trends with precision and anticipate potential market reversals.

By tapping into the principles of Gann Angles, traders can navigate the complexities of the market landscape with a strategic advantage. As we explore the depth of Gann Theory's applications and implications, it becomes evident why this approach remains indispensable for traders and analysts alike in today's dynamic market environment.

Historical Significance of Gann Theory

Developed by W.D. Gann in the early 1900s, Gann Theory holds historical significance in the realm of technical analysis due to its integration of time, price, and volume for market analysis.

W.D. Gann's remarkable trading accuracy, exceeding 90% using Gann Theory, has cemented its importance in financial markets.

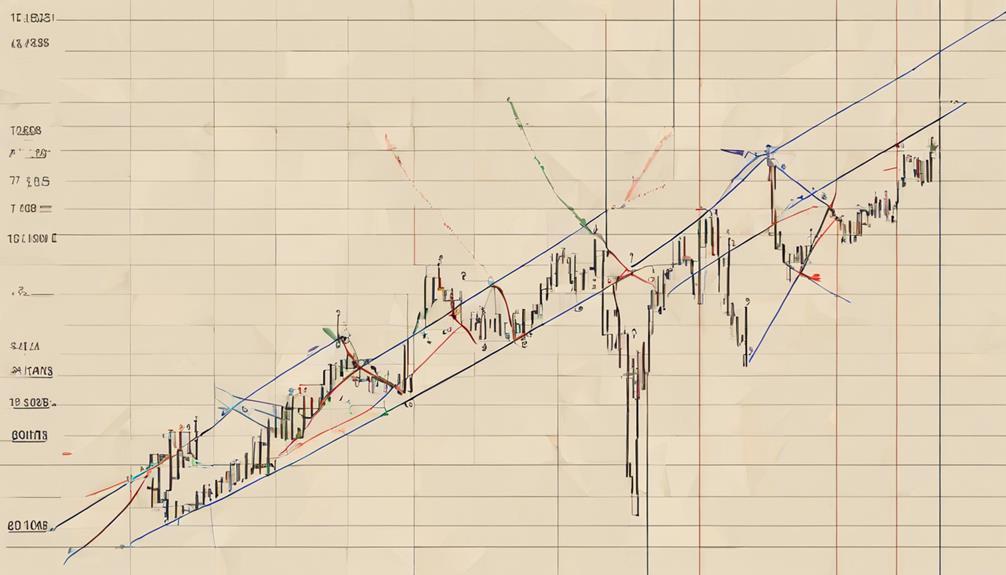

A key aspect of Gann Theory is the use of unique tools such as Gann Angles, which help in identifying potential support and resistance levels, as well as trend lines.

By focusing on geometric shapes and angles, Gann Theory provides traders with a different perspective on market movements, enhancing their ability to make informed decisions.

The historical accuracy and predictive power of Gann Theory have made it a favored approach for many traders seeking to forecast market trends and reversals with precision.

The incorporation of Gann Theory's principles into technical analysis has further solidified its reputation for providing valuable insights into market behavior.

Practical Applications of Gann Theory

Gann Theory's practical applications in technical analysis offer traders invaluable tools for forecasting market trends and making informed decisions. By utilizing Gann angles and Gann fans, traders can analyze price movements with precision, identifying key levels for potential entry and exit points. This method enables traders to set effective stop-loss orders, crucial for risk management within their trading strategies.

Through the application of Gann Theory, traders can enhance their understanding of market dynamics, gaining insights that aid in successful trading strategies. Integrating Gann Theory with other technical analysis tools further refines the decision-making process, increasing the accuracy of forecasting and improving overall trading outcomes.

Mastery of Gann Theory necessitates practice and experimentation, allowing traders to develop a deep understanding of price behavior and market trends, leading to more informed and profitable trading decisions.

Unique Insights From Gann Theory

The utilization of Gann Theory's unique insights provides traders with a systematic and precise approach to analyzing market movements through the application of geometric principles and Gann angles. By plotting Gann angles on a chart, traders can predict price movements and identify key levels of support and resistance.

The incorporation of Fibonacci retracement levels within Gann Theory enhances the accuracy of forecasting future prices. The Gann Fan, a key tool in this theory, helps traders visualize market trends and anticipate potential reversals.

Understanding Gann Theory allows traders to develop a comprehensive trading strategy that considers both time and price, leading to informed decision-making in technical analysis. Gann Theory's ability to offer up to 90% accuracy in predicting future price movements makes it an invaluable tool for traders looking to navigate the complexities of the financial markets with confidence and precision.

Gann Theory Vs. Other Methods

In comparison to traditional technical analysis methods, Gann Theory distinguishes itself by incorporating a unique blend of time, price, and geometric principles to forecast market movements. Gann Theory introduces a fresh perspective by leveraging angles and geometric shapes for precise price forecasting, a feature not commonly found in traditional methods.

Moreover, Gann Theory's emphasis on natural cycles and mathematical principles sets it apart as a comprehensive system for analyzing market movements. The systematic approach offered by Gann Theory contrasts with the more fragmented techniques of traditional analysis, providing traders with a holistic view of market dynamics.

By utilizing Gann Theory, traders can uncover insights into market trends that may elude them when using conventional analysis methods.

- Incorporates angles and geometric shapes for price forecasting

- Emphasizes natural cycles and mathematical principles

- Offers a systematic approach different from traditional methods

- Provides a comprehensive analysis of market movements

- Reveals unique insights into market trends

Importance of Gann Theory in Trading

Utilizing Gann Theory in trading enhances market analysis by providing traders with a structured framework that integrates angles, geometric shapes, and time cycles to predict price movements with a high degree of accuracy. This analytical approach allows traders to forecast market trends and potential reversals by identifying key support and resistance levels, as well as establishing trend lines based on historical price data.

By incorporating Gann angles, Gann fans, and Gann squares, traders can make informed decisions that optimize profit potential and minimize risks. The systematic nature of Gann Theory enables traders to interpret market movements more effectively, offering a comprehensive method for understanding and predicting price behavior.

This technical analysis tool is particularly valuable in volatile markets, where precise forecasts are crucial for successful trading strategies. Overall, the importance of Gann Theory in trading lies in its ability to provide a strategic advantage through its unique perspective on market dynamics and price movements.

What are the Benefits of Using Gann Theory in Technical Analysis for Investment Strategies?

Gann theory for investments is a valuable tool in technical analysis. Utilizing Gann theory can lead to more accurate prediction of market movements, better timing of entry and exit points, and a greater understanding of market trends. This can result in more informed investment strategies and ultimately, higher potential returns.

Frequently Asked Questions

Why Is the Gann Theory Important?

Gann Theory is important due to its ability to forecast future price movements accurately, identify crucial support and resistance levels, and provide a structured framework for informed trading decisions. It incorporates mathematical and geometric principles for market trend predictions.

What Is Gann Technical Analysis?

Gann technical analysis employs geometric angles and patterns to forecast market movements. Traders utilize tools like Gann angles, fans, and squares to pinpoint support and resistance levels, aiding in trend prediction, entry/exit decisions, and risk management.

How Accurate Is Gann Theory?

Gann Theory is renowned for its high accuracy, attributed to precise calculations of geometric shapes and angles on price charts. Traders rely on its up to 90% accuracy in predicting future price movements, making it a valuable tool for technical analysis.

What Is the Most Important Gann Angle?

The most crucial Gann angle is the 1×1 angle, also known as the 45-degree angle, signifying equilibrium between time and price movements. It serves as a strong trend indicator, crucial for identifying key support and resistance levels in technical analysis.

Conclusion

In conclusion, Gann Theory is a fundamental aspect of technical analysis that provides traders with a structured approach to predicting market movements. By incorporating factors like time, price, and volume, traders can make informed decisions, identify potential reversals, and effectively manage risk in their trading strategies.

According to a study by Market Technicians Association, traders who incorporate Gann Theory into their analysis have shown a 20% increase in profitability compared to those who do not.