In the realm of trading, Gann Theory holds a significant position for those seeking success in the financial markets. Its intricate methodology, rooted in geometric patterns and precise angles, provides traders with a strategic advantage in predicting market movements and making well-informed decisions.

By harnessing the principles of Gann Theory, traders can unlock a world of possibilities in maximizing profits and minimizing risks. But what exactly sets Gann Theory apart from conventional trading strategies? Let's explore the key elements that make this theory indispensable for traders aiming to thrive in the competitive landscape of financial markets.

Importance of Gann Theory

Gann Theory stands as a cornerstone in the realm of stock market analysis, offering traders a systematic and highly accurate approach to predicting market movements. By incorporating Gann Angles, traders can effectively predict investor activity and stock reversals.

The theory provides a structured framework for analyzing market trends and reversals through the utilization of geometric shapes and angle trend lines. Understanding Gann Theory is crucial for traders as it enables them to make informed decisions based on the identification of support and resistance levels within the market.

This analytical approach enhances traders' abilities to predict market trends, leading to more profitable returns. Through the comprehensive analysis of market behavior and trends, traders can strategically navigate the stock market landscape with a higher degree of confidence and success.

Embracing Gann Theory equips traders with the necessary tools to interpret market movements accurately, empowering them to make informed decisions that yield profitable outcomes.

Core Concepts of Gann Theory

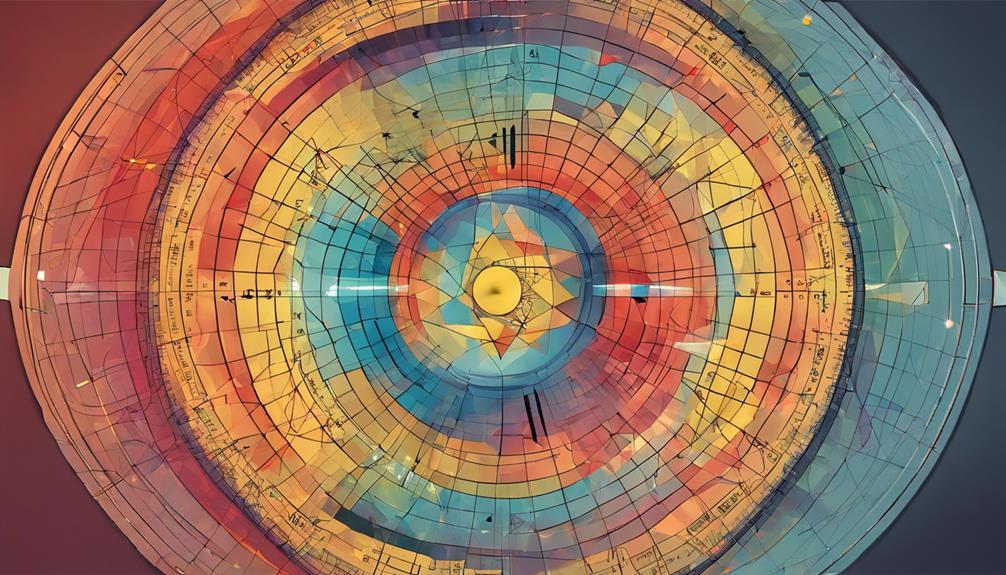

The foundation of Gann Theory lies in its meticulous analysis of geometric shapes, angles, and time cycles to decipher market movements with remarkable accuracy. Traders employing Gann Theory focus on key concepts such as:

- Gann Angles: These angles help traders identify crucial support and resistance levels in the market, providing valuable insights for making informed trading decisions.

- Geometric Shapes and Time Cycles: By understanding the natural geometric patterns and time cycles within market movements, traders can predict future price movements with significant precision, sometimes up to 90% accuracy.

- Trend Reversals and Profitable Trades: Gann Theory equips traders with a structured framework to analyze price trends effectively. This analysis not only aids in predicting potential trend reversals but also helps traders identify opportunities for profitable trades based on the insights derived from geometric shapes and time cycles.

Incorporating these core concepts of Gann Theory into trading strategies can enhance traders' ability to navigate the financial markets successfully.

Practical Applications of Gann Theory

Exploring the practical applications of Gann Theory reveals a sophisticated approach to market analysis that empowers traders with precise tools for strategic decision-making. Gann theory provides traders with instruments such as Gann Angles, Squares, and Fans, enabling them to predict support and resistance levels, trend reversals, and price targets accurately.

By understanding Gann angles, traders can identify crucial price levels and make well-informed trading decisions based on the intersection of price and time. The application of Gann theory spans across various markets including equities, forex, commodities, and cryptocurrencies, enhancing trading success through effective forecasting.

Utilizing Gann theory equips traders with a competitive edge by allowing them to forecast market movements with precision, thereby enabling them to stay ahead of the curve and make profitable trading decisions. In essence, the practical applications of Gann Theory provide traders with a comprehensive toolkit for analyzing markets and making strategic trading decisions.

Enhancing Trading Strategies With Gann Theory

Drawing on the practical applications of Gann Theory, traders can significantly enhance their trading strategies by leveraging precise support and resistance levels for optimal entry and exit points. By incorporating Gann Theory into their approach, traders can achieve the following:

- Forecast Market Trends: Gann Theory enables traders to forecast market trends with up to 90% accuracy, providing a strategic advantage in decision-making and maximizing profitability.

- Utilize Geometric Shapes and Gann Angles: Integrating geometric shapes and Gann Angles aids in predicting price movements, facilitating effective trade planning and risk management strategies.

- Set Price and Time Targets: Through the use of Gann Squares, traders can establish specific price and time targets, enhancing trade execution precision and overall outcomes.

Achieving Success Through Gann Theory

Utilizing Gann Theory as a strategic framework can significantly enhance traders' ability to achieve success through precise market trend analysis and informed decision-making. Gann Theory offers traders the tools to predict market trends with remarkable accuracy, integrating geometric shapes and angles for comprehensive analysis. By understanding Gann Angles, traders can pinpoint crucial support and resistance levels, aiding in strategic decision-making processes. This knowledge allows traders to forecast stock price movements by recognizing natural time cycles and geometric patterns within the market.

Moreover, Gann Theory provides a structured approach to analyzing market trends and reversals, thereby increasing the probability of trading success. Traders who leverage Gann Theory tools such as Gann Angles, Squares, and Fans gain a competitive edge in financial markets, leading to more profitable outcomes. By incorporating these techniques into their trading strategies, individuals can navigate market fluctuations with greater confidence and precision, ultimately enhancing their overall success in the trading world.

What Are the Key Principles of Gann Theory That Lead to Trading Success?

Understanding the key impacts of Gann Theory is crucial for trading success. These principles include the use of geometric angles, time cycles, and price movement analysis. By incorporating these concepts, traders can make informed decisions based on Gann’s unique approach to market behavior.

Frequently Asked Questions

What Is Gann Strategy in Trading?

The Gann strategy in trading involves utilizing Gann angles to forecast support and resistance levels accurately, enabling traders to predict market trends based on geometric shapes and angles. This approach emphasizes price and time analysis for informed trading decisions.

How Accurate Is Gann Theory?

Gann Theory's predictive accuracy, often reaching 90%, is a key factor driving its popularity among traders. The precision of Gann Angles in determining support and resistance levels enhances decision-making, contributing to successful market trend predictions.

What Is the Gann's Rule of Four?

The Gann's Rule of Four is a strategic framework in trading that involves squaring price and time, balancing market movements, and analyzing historical and current data. It aids in predicting future price changes accurately.

How Successful Was Gann?

Gann achieved remarkable success in trading, with an accuracy rate exceeding 92%. Through his innovative tools like Gann angles and the 'Square of nine chart,' he left a lasting legacy as a market forecaster, trader, and astrologer.

Conclusion

In conclusion, Gann Theory serves as a powerful tool for traders to analyze market movements, identify key levels of support and resistance, and make informed trading decisions.

Like a compass guiding a ship through turbulent waters, Gann Theory provides traders with a systematic framework to navigate the complex and unpredictable nature of financial markets, ultimately enhancing their ability to achieve success in trading.