Elliott Wave Theory's effectiveness in swing trading stems from its structured approach to market analysis and trend prediction. By incorporating wave patterns and Fibonacci retracements, traders can gain valuable insights into market dynamics, aiding in decision-making processes.

The theory's emphasis on impulse and corrective waves helps traders pinpoint potential entry and exit points, elevating their technical analysis skills. When integrated with other indicators, Elliott Wave Theory becomes a potent tool for navigating market fluctuations.

But what sets it apart from other strategies and why is it particularly suited for swing trading?

Elliott Wave Theory Fundamentals

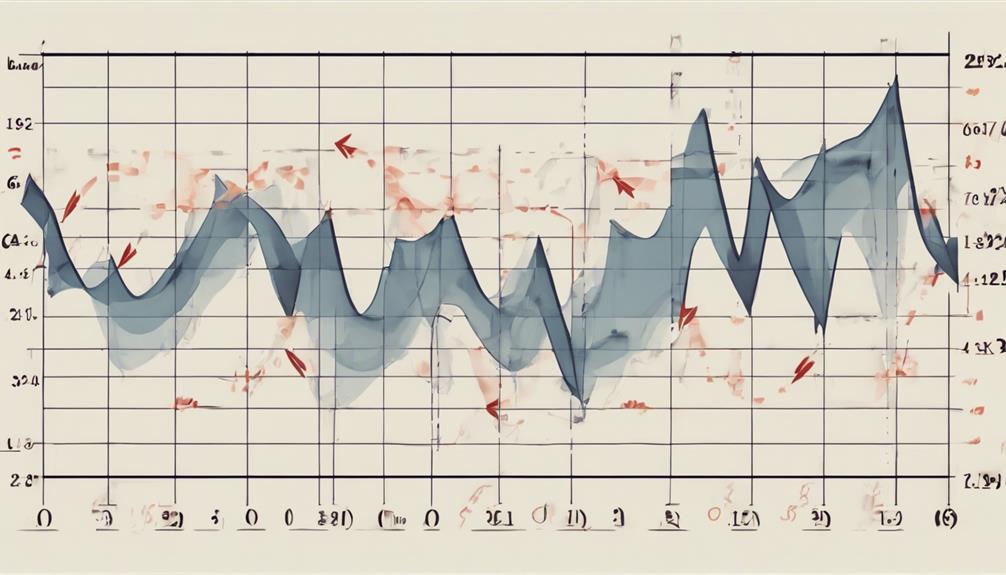

Analyzing the foundational principles of Elliott Wave Theory provides traders with a structured framework for interpreting market cycles and identifying potential trading opportunities. This theory categorizes market movements into impulse waves, which align with the trend, and corrective waves, which move against the trend.

By recognizing these wave patterns, traders can pinpoint potential turning points in the market, aiding in the identification of entry/exit points for trades. Elliott Wave Theory serves as a valuable tool in swing trading, where traders aim to capitalize on short- to medium-term price movements.

Through the application of this theory, traders can forecast price movements more effectively, enhancing their decision-making processes. Understanding the fundamentals of Elliott Wave Theory is crucial for traders looking to refine their swing trading strategies and navigate the complexities of market cycles.

Identifying Market Trends With Elliott Waves

Utilizing Elliott Wave Theory, traders can effectively identify market trends by observing distinct wave patterns that signify the direction and strength of price movements. This analytical tool is particularly valuable for swing traders aiming to capitalize on short to medium-term market fluctuations.

Key aspects of identifying market trends with Elliott Waves include:

- Elliott Wave Patterns: These patterns provide a systematic way to interpret market dynamics and forecast potential price movements.

- Strength of Trends: By analyzing the amplitude and structure of wave patterns, traders can gauge the strength of prevailing trends.

- Trend Reversals and Corrective Waves: Understanding corrective waves within the context of impulse waves helps traders anticipate potential trend reversals and corrections.

Forecasting Price Movements Effectively

Effectively forecasting price movements in swing trading requires a deep understanding of Elliott Wave Theory and its application in wave analysis. Traders utilize wave patterns to identify potential entry and exit points within their swing trading strategies.

By comprehending wave degrees and wave counts, traders can anticipate trend reversals and price corrections, enabling them to make informed decisions in the market. Incorporating Fibonacci retracement levels alongside Elliott Wave Theory further enhances the accuracy of predicting price movements in swing trading scenarios.

This combined approach provides traders with a structured methodology to analyze and forecast future price movements based on historical data and wave patterns. By adhering to a systematic strategy that integrates wave analysis and Fibonacci retracement, traders can improve their forecasting abilities, ultimately leading to more successful outcomes in swing trading.

The meticulous application of these tools and techniques empowers traders to navigate the complexities of the market with greater precision and confidence.

Practical Applications in Swing Trading

In the realm of swing trading, practical applications of Elliott Wave Theory play a crucial role in guiding traders towards strategic decision-making based on wave patterns and market dynamics. By utilizing Elliott Wave Theory, swing traders can effectively pinpoint entry and exit points, allowing them to capitalize on market opportunities efficiently. Additionally, incorporating Fibonacci retracements in conjunction with Elliott Waves enhances technical analysis, providing a more comprehensive view of potential price movements.

- Identifying Entry and Exit Points: Elliott Wave Theory helps in identifying key levels where traders can enter or exit positions based on wave patterns and market trends.

- Forecasting Price Movements: By utilizing Elliott Wave Theory, swing traders can forecast price movements with greater precision, enabling them to make informed trading decisions.

- Understanding Market Dynamics: Elliott Wave Theory assists traders in comprehending market dynamics, anticipating trend reversals, and seizing profitable opportunities in the market.

Advantages of Elliott Wave Theory

Elliott Wave Theory stands out in the realm of swing trading by offering a structured approach to identifying and analyzing price patterns and trends with precision and accuracy. This analytical framework enables swing traders to anticipate potential price movements and market turning points more effectively.

Through wave analysis, Elliott Wave Theory provides insights into both impulse and corrective waves, facilitating strategic decision-making in trading. By incorporating Fibonacci ratios, this theory enhances swing trading strategies by pinpointing optimal entry and exit points with a higher degree of accuracy.

Moreover, the application of Elliott Wave Theory in swing trading assists traders in managing risk more efficiently. By recognizing wave patterns, traders can implement risk management techniques that maximize profit potential while minimizing potential losses.

What Makes Elliott Wave Theory Effective for Forex Trading in Swing Trading?

Elliott Wave Theory is effective for forex trading, especially in swing trading. By using forex trading tips with Elliott Wave, traders can analyze market trends and identify potential entry and exit points. This method helps traders capitalize on market movements and manage risk effectively in the forex market.

Frequently Asked Questions

What Is the Elliott Wave for Swing Trading?

The Elliott Wave Theory for swing trading involves analyzing market trends and potential reversals through structured wave patterns. Traders utilize this method to anticipate price changes, plan entry and exit points, and gain insight into market psychology and dynamics.

What Is the Significance of the Elliott Wave Theory?

Elliott Wave Theory holds significance in financial markets by providing a structured methodology to analyze price movements and anticipate market trends. Its focus on wave patterns aids in understanding market sentiment shifts and identifying potential trading opportunities.

What Are the 3 Golden Rules of Elliott Wave?

The three golden rules of Elliott Wave Theory encompass Wave 2 not surpassing 100% of Wave 1, Wave 3 being the longest impulse wave, and Wave 4 not overlapping with Wave 1. These rules are fundamental for accurate wave analysis and trend prediction.

Is the Elliott Wave Nonsense?

While Elliott Wave Theory has faced criticisms for subjectivity and varying wave counts, dismissing it as nonsense overlooks its historical significance and influence on technical analysis. Understanding its complexities can reveal valuable insights in market analysis.

Conclusion

In conclusion, Elliott Wave Theory offers swing traders a structured framework for analyzing market cycles and predicting trends with precision. By mastering wave patterns and utilizing Fibonacci retracements, traders can make well-informed decisions and identify optimal entry and exit points.

The theory's focus on impulse and corrective waves, when combined with other technical indicators, provides a powerful tool for navigating market fluctuations successfully. Embrace the wave of knowledge and ride the tide of market opportunities with Elliott Wave Theory.