Exploring the intricacies of Elliott Wave Fractals unveils a realm of predictive analysis that has captured the interest of traders worldwide. The ability to anticipate market movements with precision through wave patterns offers a compelling advantage.

As we unravel the 7-point listicle, each aspect will shed light on the practical application of this theory. From basic principles to advanced strategies, the journey into mastering Elliott Wave Fractals promises a deeper understanding of market dynamics and potential trading opportunities.

Understanding Elliott Wave Fractals

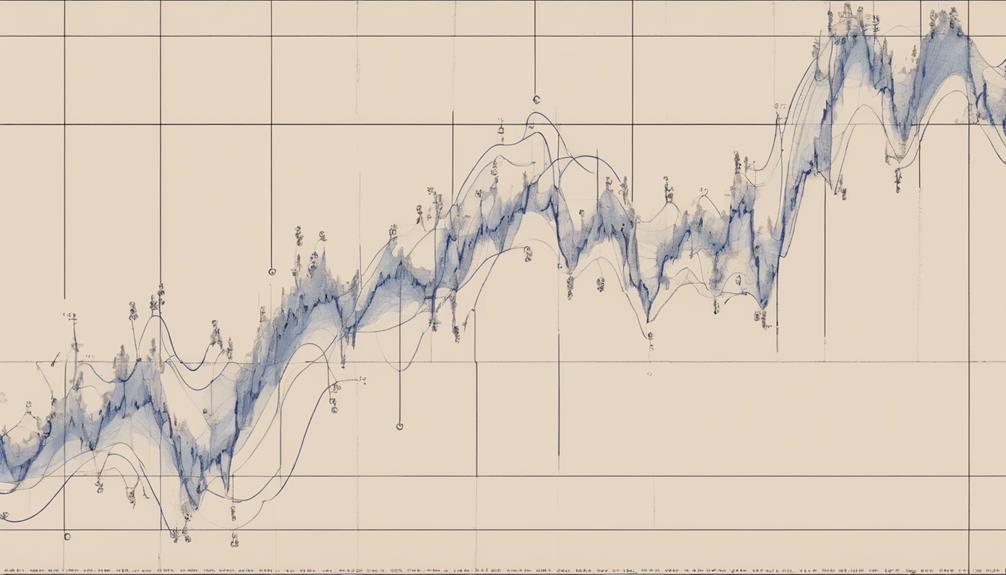

Within Elliott Wave Theory, a fundamental comprehension of Elliott Wave fractals is essential for deciphering the intricate patterns that underlie market movements. These fractals exhibit self-similar patterns, revealing the repetitive nature of wave structures at varying scales.

In Elliott Wave Theory, waves are categorized into motive waves and corrective waves, each adhering to Fibonacci ratios. By identifying these fractals, traders can discern smaller patterns within larger wave cycles, aiding in the prediction of market movements.

Moreover, understanding fractals helps traders grasp the hierarchical nature of wave structures, enabling them to anticipate the direction of future market trends more effectively. Mastery of Elliott Wave fractals allows traders to interpret market movements with greater precision, enhancing their ability to make informed trading decisions.

Identifying Wave Patterns

An essential aspect of market analysis in Elliott Wave Theory involves the precise identification of wave patterns through meticulous examination of market movements. Wave patterns, as outlined in the Elliott Wave Principle, consist of 5 waves moving in the direction of the trend, known as motive or impulse waves, followed by 3 waves moving against the trend, which form corrective patterns.

These patterns can be observed across various time frames, from minutes to years, providing valuable insights for traders. Correctly identifying these patterns enables traders to predict potential market movements and apply tools like Fibonacci Retracement to determine possible levels of support and resistance based on Fibonacci ratios derived from the sequence.

Analyzing Wave Degree

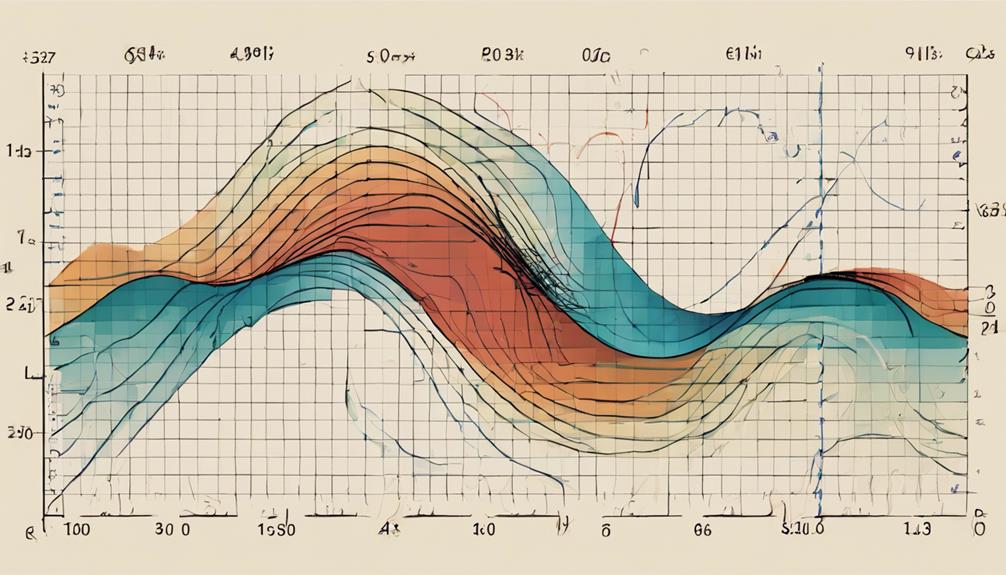

Analyzing wave degrees in Elliott Wave Theory provides a structured framework for evaluating market waves across various time frames, aiding in precise market analysis and prediction.

- Wave degrees, ranging from Grand Supercycle to Subminuette, represent different time frames, helping to identify the position of waves in the market progress.

- Each degree corresponds to a specific duration, from centuries for Grand Supercycle to minutes for Subminuette, allowing for a comprehensive view of market movements.

- Understanding wave degrees is essential for accurate wave analysis, as different degrees provide insight into the overall market trend.

- The hierarchical structure formed by the concept of wave degrees facilitates analyzing market waves at different scales, guiding trading decisions effectively.

Applying Fibonacci Ratios

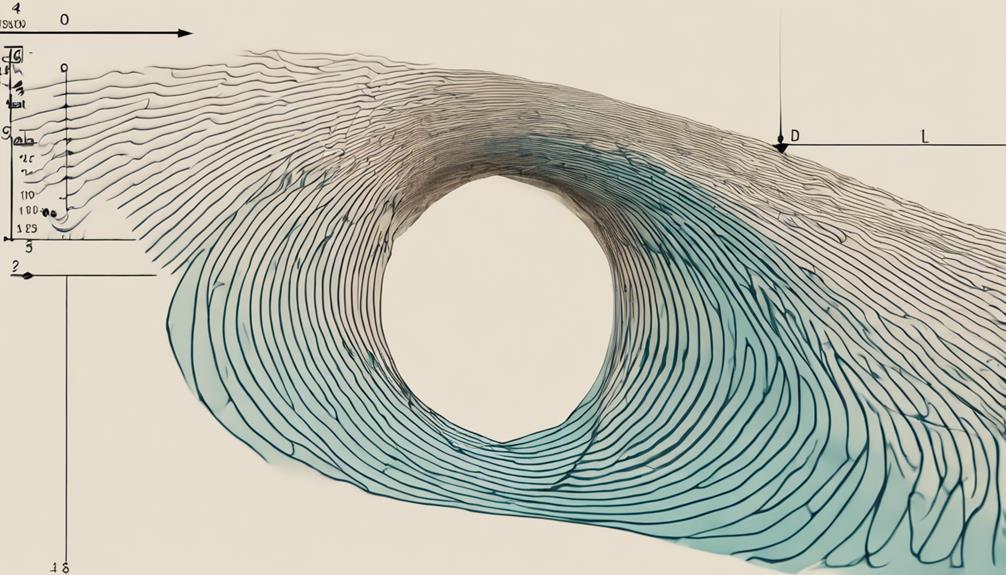

Utilizing Fibonacci ratios is a fundamental practice in predicting market reversal levels and identifying areas of support and resistance within Elliott Wave patterns. Traders often apply Fibonacci retracement levels, such as 0.618 and 1.618, to pinpoint potential reversal levels in the market. These levels help traders identify key areas where price may bounce or encounter resistance within the context of Elliott Wave patterns. Additionally, Fibonacci extensions are instrumental in projecting price targets for wave 3 and wave 5 in an impulse wave, aiding traders in setting profit targets.

Furthermore, Fibonacci ratios like 0.382 and 0.618 play a crucial role in determining the potential length of wave 2 within an Elliott Wave pattern. By integrating Fibonacci ratios with Elliott Wave analysis, traders can enhance their precision in identifying entry and exit points in the market. This strategic approach allows traders to make more informed decisions based on the confluence of Fibonacci levels and Elliott Wave patterns, improving the overall effectiveness of their trading strategies.

Trading Strategies for Fractals

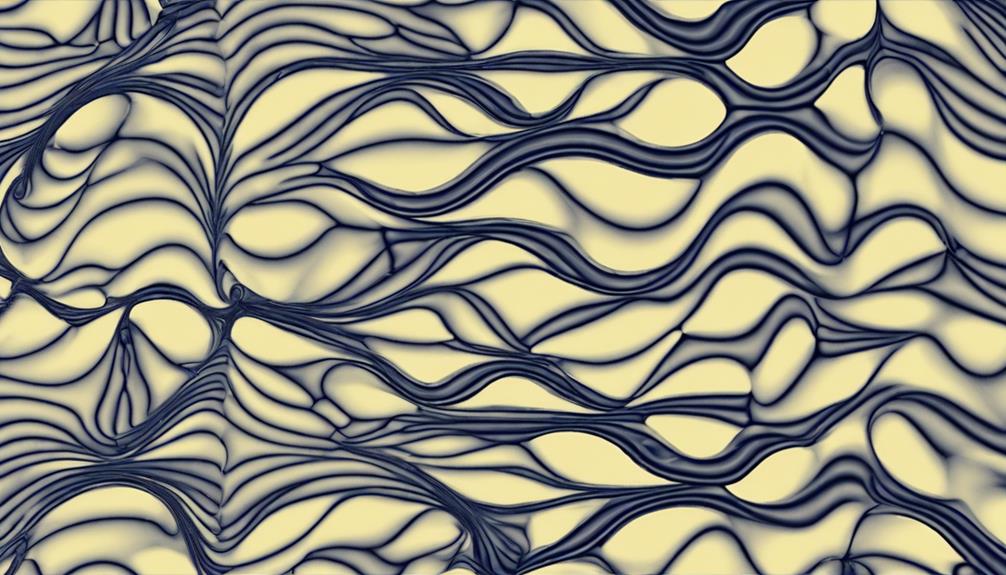

Fractals in Elliott Wave Theory provide traders with valuable insights into market dynamics by revealing repetitive patterns across various time scales. When it comes to trading strategies for fractals, there are several key points to consider:

- Identifying Support and Resistance Levels: Utilize fractals to pinpoint crucial support and resistance levels in the market based on the recurring patterns observed.

- Predicting Trend Reversals: Fractals can assist traders in anticipating potential trend reversals, allowing for timely adjustments to trading positions.

- Understanding Market Structure: By incorporating fractals into analysis, traders gain a deeper understanding of market structure, which can aid in making informed trading decisions.

- Enhancing Risk Management: Leveraging fractals within Elliott Wave analysis enhances risk management practices by providing clearer insights into potential price movements and market conditions.

Is Mastering Elliott Wave Fractals Essential for Understanding Elliott Wave Theory?

Mastering Elliott Wave Fractals is one of the best methods to understand Elliott Wave Theory. By learning to identify and analyze these repeating patterns, traders can gain a deeper understanding of market movements and make more informed trading decisions. Understanding fractals is essential for mastering Elliott Wave Theory.

Frequently Asked Questions

How Do You Master Elliott Wave?

Mastering Elliott Wave theory involves understanding wave patterns, distinguishing between impulse and corrective waves, and honing wave identification skills. It is crucial for informed trading decisions and can be enhanced through practice and community support.

What Are the Fibonacci Levels of the Elliott Wave?

The Fibonacci levels commonly used in Elliott Wave Theory are 0.236, 0.382, 0.500, 0.618, and 0.786. These ratios are pivotal in identifying potential reversal and extension points within Elliott Wave structures, aiding traders in setting profit targets and determining market entry and exit points.

What Is the Best Time Frame for Elliott Wave?

The best time frame for Elliott Wave analysis depends on the trader's goals. For longer-term trends, daily charts are preferred due to their reliability in identifying major trend changes. Intraday trading may benefit from shorter time frames like 1-hour or 4-hour charts.

What Is the Fractal Nature of the Elliott Wave?

The fractal nature of Elliott Waves encapsulates a self-similar structure where smaller wave patterns mimic larger ones, creating a hierarchy of repetitive formations. This intricate design aids traders in recognizing market trends and optimizing trading strategies.

Conclusion

In conclusion, mastering Elliott Wave Fractals is akin to navigating a complex maze of market movements, where each wave pattern and degree holds valuable information for traders.

Just as a skilled navigator uses a compass to guide their way through turbulent waters, understanding and applying Elliott Wave Theory with precision and discipline can lead to successful trading outcomes in the dynamic world of financial markets.