Imagine navigating a vast ocean with only a single compass to guide your ship. The Advance Decline Line serves as that compass in the tumultuous sea of the stock market, providing a steady hand amidst the waves of volatility.

But why is this indicator considered essential in the realm of trading and investing? Understanding its significance can unlock a treasure trove of insights that may shape your approach to the market in ways you never imagined.

Importance of Advance Decline Line

The Advance Decline Line plays a crucial role in assessing market breadth by monitoring the number of advancing and declining stocks. As a key breadth indicator in financial markets, the AD Line provides investors with valuable insights into market sentiment and participation.

By tracking the performance of stocks across an index, the AD Line helps investors gauge the overall health of the market. Understanding the breadth of market movements is essential for conducting effective technical analysis and making informed investment decisions.

Historical Significance of AD Line

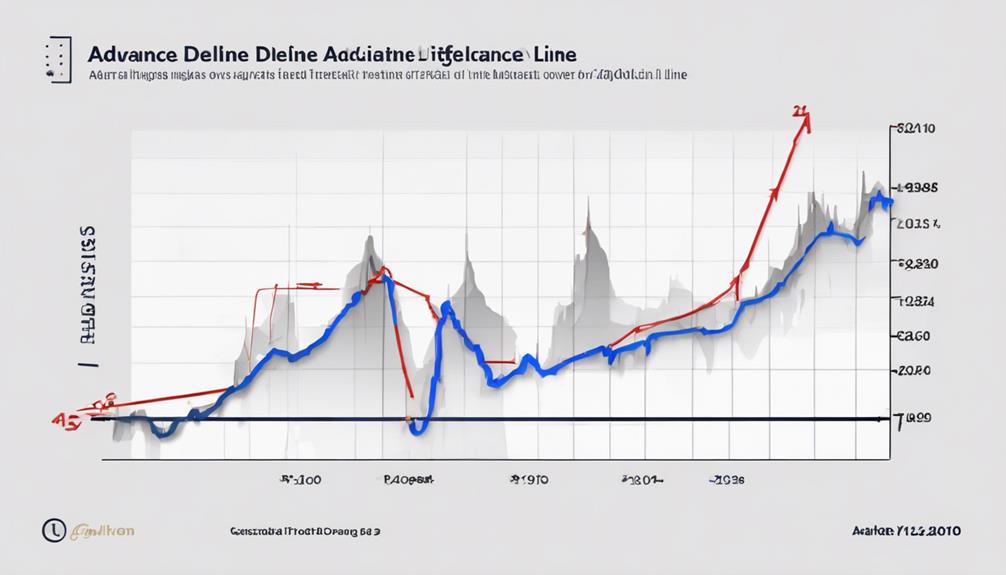

Pivoting from the discussion on the importance of the Advance Decline Line, historical analysis reveals compelling insights into the predictive power of AD Line movements in anticipating market shifts.

The AD line accurately forecasted the 2008 financial crisis and the dot-com bubble burst in 2000 by exhibiting bearish divergences before significant market downturns. This historical data underscores the AD line's predictive value in signaling potential stock market declines.

Traders can enhance their trading strategies by incorporating volume trends to confirm or negate bearish divergence signals in the AD line. Implementing risk mitigation strategies, such as reducing equity exposure and utilizing stop-loss orders, can be crucial when the AD line indicates declining market conditions.

Role in Market Analysis

Playing a crucial role in evaluating market breadth and sentiment, the Advance Decline Line tracks the number of advancing and declining stocks in an index. By analyzing this line, you can gain insights into overall market sentiment, potential trend reversals, and the strength of market rallies. It serves as a leading indicator for stock index performance, helping you make informed decisions in your market analysis.

Understanding the Advance Decline Line is key to identifying trends accurately and comprehensively assessing market conditions. Incorporating this indicator into your analysis allows you to gauge the health of the market and anticipate potential shifts in direction, giving you a strategic advantage in your trading decisions.

AD Line as Indicator Strength

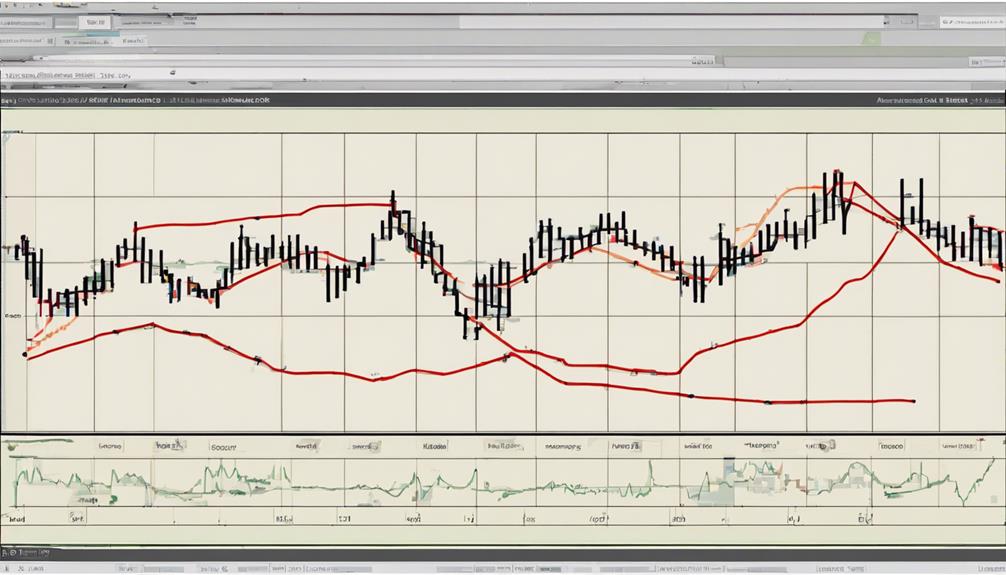

Considering its crucial role in market analysis, understanding the Advance Decline Line as an indicator of strength is essential for making informed trading decisions.

The AD Line is used to measure market breadth by tracking the difference between advancing and declining stocks, reflecting market sentiment and participation. A rising AD Line signifies broad market strength, supporting bullish market sentiment during rallies.

It helps investors assess the health of a market trend by showing the balance between advancing and declining stocks. Additionally, the AD Line is valuable for identifying trends and potential reversals, aiding traders in making strategic decisions.

Its ability to highlight market participation and sentiment makes it a key tool for those seeking to navigate market trends effectively.

What Is the Importance of Understanding the Functionality of the Advance Decline Line?

Understanding the advance decline line functionality is crucial for investors to gauge market strength. By tracking the number of advancing and declining stocks, it provides insight into overall market sentiment. This tool helps in identifying potential trend reversals and confirming the strength of a current trend.

What Are the Benefits of Using the Advance Decline Line?

Mastering the advance decline line can provide valuable insights into market trends and potential reversals. By analyzing the ratio of advancing to declining stocks, investors can gauge overall market breadth and potential strength. This can help in making informed decisions about market timing and identifying potential buying or selling opportunities.

Practical Applications of AD Line

To apply the Advance Decline Line effectively in trading decisions, understanding its practical applications is essential.

- Market Breadth and Trends: The AD line helps gauge market sentiment and participation, indicating the overall health of the market.

- Indicators and Decision-making: Used alongside other indicators, the AD line provides insights into market strength and weakness, aiding in informed decision-making.

- Stock Price Movements and Reversals: By analyzing stock price movements, the AD line assists in identifying potential market reversals.

- Historical Measure of Market Conditions: The cumulative AD line offers a historical perspective on market breadth and trend predictions based on the difference between advancing and declining issues over time.

Frequently Asked Questions

What Is the Use of Advance Decline Ratio?

In trading, the advance decline ratio is vital. It shows market sentiment by comparing advancing to declining stocks. A ratio above 1 signals positivity, while below 1 indicates negativity. Traders rely on this data for trend strength and reversals.

What Is the Advance to Decline Indicator?

The Advance to Decline (A/D) Indicator measures the net difference between advancing and declining stocks. It's crucial for assessing market breadth. Subtract declining from advancing stocks to calculate it. Rising A/D signals strength, falling suggests weakness.

What Is the Advance Decline Strategy?

To understand the Advance Decline Strategy, monitor the difference between advancing and declining stocks in an index. This technique aids in evaluating market breadth and sentiment, revealing trends and reversals. Enhance your trading acumen with this essential tool.

What Is Advance Decline Spread Issues?

When calculating Advance Decline Spread Issues, subtract declining stocks from advancing ones. A positive difference signals upbeat market sentiment. Traders use this data to assess market strength and predict potential reversals, making it a crucial tool for analysis.

Conclusion

As you navigate the complex world of trading, remember that the Advance Decline Line is more than just a tool – it's a compass guiding you through market fluctuations.

Like a lighthouse in a storm, the AD Line illuminates the path forward, revealing hidden trends and potential opportunities.

Embrace its power, harness its insights, and let it lead you towards success in the ever-changing seas of the stock market.