Ever wondered how some traders seem to pinpoint precise price levels in the market?

The answer lies in the effective use of Fibonacci extensions. By incorporating these extensions derived from the powerful Fibonacci sequence, traders can unlock a whole new realm of price predictions and strategic decision-making.

The ability to forecast potential price targets beyond traditional retracement levels offers traders a strategic edge that can significantly impact their trading outcomes.

Explore further to uncover the intricacies of this strategy and its potential to revolutionize your trading approach.

The Power of Fibonacci Extensions

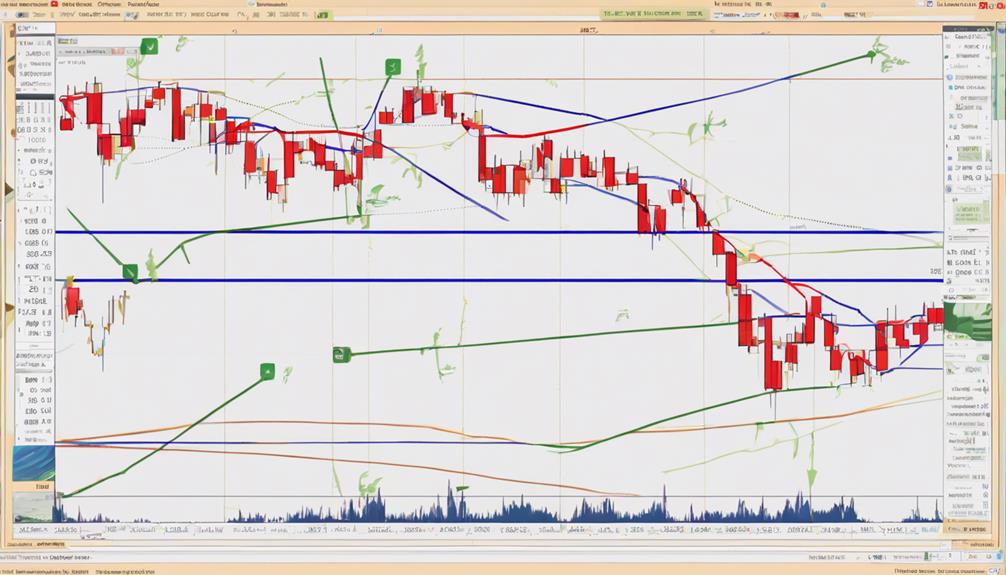

Utilizing Fibonacci extensions in trading empowers you with precise price targets beyond conventional levels, enabling the strategic placement of profit-taking orders. These extensions, based on Fibonacci ratios like 127.2%, 161.8%, and 261.8%, provide clear reference points for potential price movement, aiding in managing risk and enhancing your decision-making process.

By identifying support and resistance areas, Fibonacci extension levels guide you in making well-informed entry and exit decisions, optimizing your trading strategy. Incorporating Fibonacci extensions into your approach can significantly improve accuracy and assist in maximizing profit potential.

Understanding how to leverage these extensions effectively is crucial for fine-tuning your trading skills and achieving consistent results in the market.

Fibonacci Extensions in Trend Analysis

In trend analysis, Fibonacci extensions serve as valuable tools for traders seeking to pinpoint potential price targets beyond traditional Fibonacci retracement levels, aiding in strategic decision-making and risk management. These extensions are derived from key Fibonacci ratios like 127.2%, 161.8%, and 261.8%, providing traders with specific price levels to set profit targets.

By projecting price levels beyond the current trend, Fibonacci extensions help identify areas of potential support and resistance, crucial for making informed decisions on entry and exit points. Incorporating Fibonacci extensions in trend analysis enhances trading strategies by offering objective price targets, improving risk-reward ratios, and contributing to more effective risk management within trades.

Traders can leverage Fibonacci extensions to optimize their trading approach and capitalize on market trends efficiently.

Fibonacci Extensions for Price Targets

When targeting price levels beyond traditional retracement levels, Fibonacci extensions offer traders specific profit-taking orders based on key ratios like 127.2%, 161.8%, and 261.8%. Derived from the Fibonacci sequence and ratios, these extensions provide potential support and resistance areas, aiding in managing risk-reward ratios effectively.

By projecting price levels beyond 100%, Fibonacci extensions help identify areas for potential price reversals or trend continuations. Integrating Fibonacci extensions into trading strategies enhances precision in setting profit targets and exit points, leveraging mathematical principles and historical price data.

Combining Fibonacci extensions with other technical indicators improves the effectiveness of trading decisions and overall strategy execution, offering traders a comprehensive approach to analyzing price movements and establishing profitable trades.

Enhancing Trading Strategies With Fibonacci Extensions

To optimize trading strategies effectively, incorporating Fibonacci extensions provides traders with enhanced precision in setting profit targets beyond traditional retracement levels. These extensions offer valuable insights into potential price targets, helping traders identify key support and resistance levels.

By aligning price targets with market trends, Fibonacci extensions assist in strategic decision-making for entry points and profit-taking levels. Additionally, integrating Fibonacci extensions with other technical indicators can improve the accuracy of trading signals and outcomes. This structured approach not only aids in maximizing profit potential but also enhances risk management by defining clear levels for stop-loss orders.

Maximizing Profits With Fibonacci Extensions

Maximize your trading profits with Fibonacci extensions, strategically setting specific price targets beyond traditional levels to optimize profit-taking orders. By incorporating Fibonacci ratios such as 127.2%, 161.8%, and 261.8%, you can enhance your profit-taking strategy for more precise exits.

Utilize Fibonacci extensions to establish strategic profit targets, improving your risk-reward ratios effectively. Managing trades becomes more efficient with clear price objectives provided by Fibonacci extension levels, aiding in profit optimization.

Including Fibonacci extensions in your trading strategies helps set realistic profit goals, ultimately enhancing your overall trading performance. Embrace these techniques to unlock the full potential of Fibonacci extensions for maximizing profits in your trades.

What Makes Fibonacci Extensions a Effective Trading Strategy for Profit Targets?

Fibonacci extensions profit targets can be an effective trading strategy due to their ability to identify potential price levels. Traders use these extensions to set profit targets based on the Fibonacci sequence, which can help maximize gains and minimize losses. This method is popular among investors for its proven track record in predicting price movements.

Frequently Asked Questions

Is Fibonacci a Good Trading Strategy?

Fibonacci can be a good trading strategy when used correctly. It aids in setting clear price targets, managing risk, and validating signals. By combining it with other indicators, you can optimize risk-reward ratios and make more informed decisions.

Why Does Fibonacci Work in Trading?

In trading, Fibonacci's like a compass guiding you through market waves. It works due to precise ratios mirroring natural systems. Aligning with psychology, it helps project targets accurately, anticipate movements, and spot crucial levels.

What Are the Benefits of Fibonacci Retracement?

Fibonacci retracement benefits you by pinpointing key levels for potential price reversals or continuations, aiding in entry and exit decisions. It's a widely used tool in technical analysis, offering clear reference points for setting stop-loss and profit targets.

What Is the Best Time Frame for Fibonacci Extension?

For Fibonacci extensions, choose a time frame aligned with your trading style. Intraday traders opt for 15 or 30-minute charts for precise entries. Swing traders prefer daily or weekly charts for capturing longer targets. Long-term investors utilize monthly or quarterly charts for strategic decisions.

Conclusion

In conclusion, incorporating Fibonacci extensions into your trading strategy is like adding a compass to your toolkit. These powerful levels act as guideposts, pointing you towards potential price targets and helping you navigate the complexities of the market.

By leveraging the mathematical beauty of the Fibonacci sequence, you can unlock a deeper understanding of market trends and make more informed decisions.

So, embrace the power of Fibonacci extensions and watch your profits soar to new heights.