Decoding stock market trends using the OBV indicator involves analyzing volume changes to predict potential price movements. Introduced by Joseph Granville in 1963, OBV compares a security's closing price with the previous day's, illustrating the relationship between volume and price. Rising OBV suggests upward price movements, while falling OBV indicates potential downtrends, acting as a leading indicator for trend reversals. Identifying price-volume divergences is essential for predicting market trends. OBV can aid in confirming trend strength, pinpointing reversals, and identifying breakouts. Utilizing OBV in conjunction with other indicators enhances its effectiveness in making informed trading decisions. Understanding OBV is key to successfully maneuvering through the stock market.

Understanding OBV Indicator Basics

The foundation of comprehending the OBV indicator lies in grasping its fundamental principles and mechanics. As a leading technical indicator, OBV plays an essential role in analyzing volume changes to forecast potential price movements within the stock market. Introduced by Joseph Granville in 1963, OBV highlights the significance of volume in predicting price trends. By comparing a security's closing price with the previous closing price, OBV determines the level of buying or selling pressure in the market.

When OBV is on the rise, it signifies an increase in buying pressure, indicating potential upward price trends. Conversely, a decreasing OBV suggests mounting selling pressure, signaling potential downward price trends. This indicator is instrumental in confirming existing trends, identifying potential reversals, and illustrating the intricate relationship between volume and price movements in the market. Traders and investors often rely on OBV as a valuable tool for making informed decisions based on the dynamics of volume and its impact on price movements.

Calculating On-Balance Volume

The calculation of On-Balance Volume (OBV) involves comparing current and previous day closing prices to determine whether volume should be added or subtracted. Understanding how OBV is calculated is essential for interpreting trends and making informed decisions based on volume changes.

OBV Calculation Basics

In the domain of stock market analysis, understanding the calculation basics of On-Balance Volume (OBV) is fundamental for tracking volume changes and gaining insights into potential price movements.

OBV is computed by comparing a security's closing price with the previous day's closing price. If the current day's closing price exceeds the previous day's, the volume is added to the existing OBV. Conversely, if the current day's closing price is lower, the volume is subtracted. When the closing prices are identical, the OBV remains unchanged.

These calculations provide valuable information on volume changes, which can signal potential price movements in the market, making OBV an essential tool for investors and traders alike.

Interpreting OBV Trends

Utilizing On-Balance Volume (OBV) analysis provides investors with a strategic advantage in interpreting stock market trends through precise volume-based indicators. When interpreting OBV trends, traders focus on key aspects to understand market dynamics:

- OBV reflects buying or selling pressure based on volume changes.

- Rising OBV indicates potential price movements to the upside.

- Falling OBV suggests potential price movements to the downside.

- OBV serves as a leading indicator for trend reversals.

- Understanding OBV trends helps in making informed decisions by analyzing volume changes and their impact on price movements.

OBV Indicator Applications

Deciphering stock market trends accurately relies heavily on effectively applying the On-Balance Volume (OBV) indicator, which involves calculating volume changes in relation to price movements. By tracking volume changes, OBV provides valuable insights into buying and selling pressure, aiding in predicting potential price movements.

When the OBV line rises, it indicates increasing buying pressure, suggesting a potential upward price trend. Conversely, a downward movement in the OBV line reflects rising selling pressure, indicating a potential downward price trend.

Additionally, the Anchored On-Balance Volume (AOBV) variation offers adaptability by allowing selectable starting points, catering to various market conditions. Ultimately, understanding and utilizing the OBV indicator can help investors make informed decisions based on the dynamics of buying and selling pressure correlated with price movement.

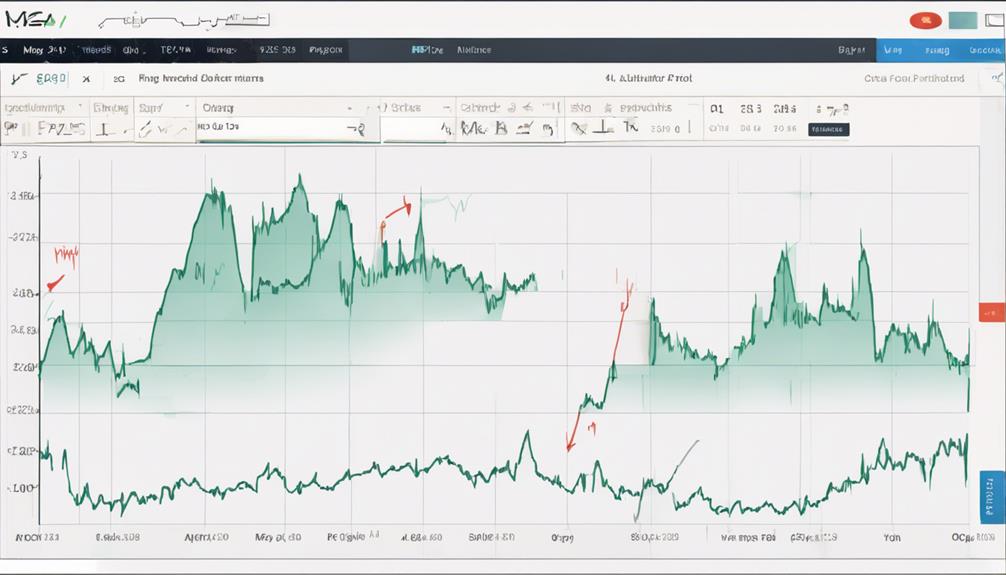

Interpreting OBV for Trend Analysis

Interpreting OBV data allows traders to gauge buying and selling pressures in the market to forecast potential price trends accurately. When analyzing the OBV line, several key points come into play:

- Rising OBV line indicates increasing buying pressure and potential upward price trend.

- Falling OBV line suggests rising selling pressure and potential downward price trend.

- OBV divergence signals potential price reversals and trend changes.

- OBV trend confirmation helps traders assess trend strength and direction.

- Analyzing OBV in conjunction with price trends provides insights into market dynamics.

Identifying Price-Volume Divergences

Identification of Price-Volume divergences plays a pivotal role in predicting potential market trends and making strategic trading decisions based on OBV analysis. Price-Volume divergences, as detected by the OBV indicator, occur when the OBV line moves counter to the price trend.

A key concept within this analysis is the bullish divergence, where the OBV suggests a potential price increase despite a downward price trend. Conversely, a bearish divergence in OBV indicates a potential price decrease despite an upward price trend.

Recognizing these divergences is essential for traders as it helps anticipate trend reversals and make informed decisions. By analyzing price-Volume divergences with OBV, traders gain a deeper understanding of market dynamics and potential price movements.

This analytical approach enables traders to interpret signals more effectively, enhancing their ability to navigate the stock market landscape with greater confidence and precision.

Using OBV for Breakout Confirmation

Breakout confirmation with OBV hinges on observing increasing OBV concurrent with price breakouts, a sign of potential trend strength continuation. This analysis allows traders to validate breakout signals through the correlation of volume and price movements, enhancing confidence in trend analysis.

Utilizing OBV for breakout confirmation can provide vital insights for making informed trading decisions based on volume-supported price movements.

OBV Breakout Signals

Utilizing OBV in conjunction with price movements provides traders with valuable insights into market trends and potential breakout confirmations. When analyzing OBV breakout signals, traders should consider the following:

- OBV breakout signals confirm price breakouts by analyzing volume trends.

- Increased OBV alongside price breakout indicates potential upward momentum.

- Falling OBV with price breakout could signal a false breakout or weakening trend.

- Traders use OBV breakout signals to validate price movements and make informed trading decisions.

- Combining OBV breakout signals with other technical indicators enhances trend confirmation accuracy.

Volume Confirmation Importance

Volume analysis plays a vital role in confirming the strength and sustainability of breakouts, especially when utilizing On-Balance Volume (OBV) as a tool for market trend assessment. Confirmation of a breakout through volume is essential as it provides insights into the underlying buying or selling pressure supporting the price movement.

When OBV rises during a breakout, it indicates increasing buying volume, supporting the continuation of the uptrend. Conversely, a falling OBV during a breakout suggests weakening buying interest, possibly signaling a false breakout.

Identifying Trend Reversals

When analyzing market trends and potential reversals, incorporating On-Balance Volume (OBV) as a confirmation tool can provide valuable insights into the underlying dynamics of price movements.

- Look for a rising OBV line to validate an upward price breakout.

- A falling OBV line can confirm a downward price breakout, indicating selling pressure.

- Confirm potential trend reversals by analyzing divergences between the OBV line and price trend.

- Make sure that volume supports price movements to validate breakout signals identified by OBV.

- Evaluate trend strength by observing OBV line movements during uptrends and downtrends.

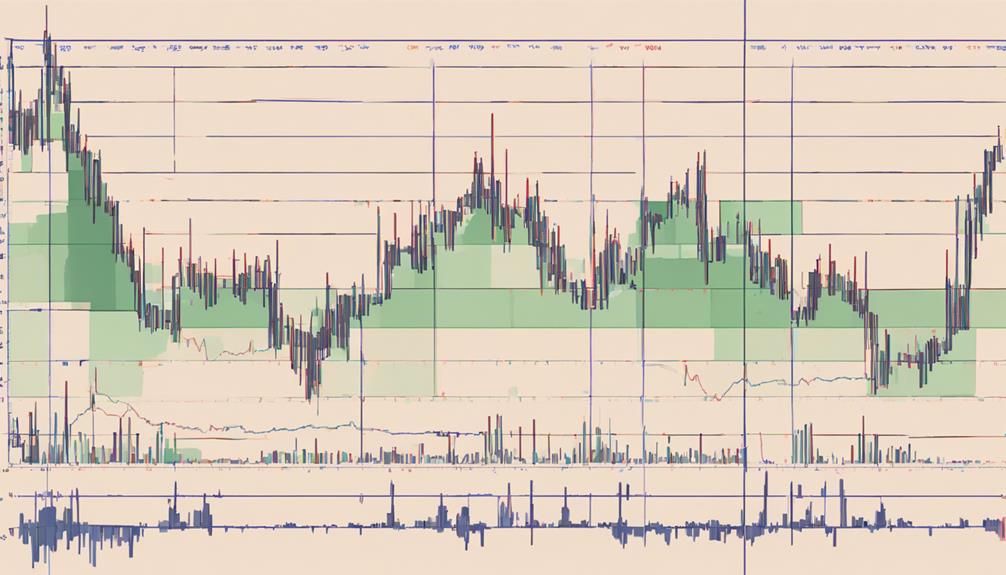

Applying OBV in Sideways Markets

In maneuvering through sideways markets, the application of On Balance Volume (OBV) can offer traders a valuable tool for identifying potential breakouts and trend continuations. By analyzing volume changes, OBV can help traders spot potential breakouts within range-bound markets.

In such conditions, where prices move within a horizontal range, OBV's ability to reflect volume-based signals can provide insights into trend continuations. Traders focusing on slower timeframes can leverage OBV to confirm ongoing trends and anticipate potential breakout points.

However, it's important to bear in mind that high volatility levels can impact the accuracy of OBV readings in sideways markets, making it essential for traders to take this factor into account when interpreting OBV signals. To enhance the effectiveness of OBV in identifying trading opportunities within range-bound markets, traders often combine OBV with other indicators to strengthen their analysis and decision-making process.

OBV Strategies for Trading Success

Traversing through the complexities of the stock market requires the implementation of strategic OBV approaches to enhance trading success and capitalize on market opportunities efficiently.

When crafting OBV strategies for trading success, consider the following key points:

- Utilize OBV to confirm trend strength and pinpoint potential reversals effectively.

- Leverage OBV divergence signals to anticipate price changes and make informed trading decisions ahead of the curve.

- Apply OBV in ranging markets to identify breakouts and continuation patterns for best trading opportunities in sideways movements.

- Combine OBV with other technical indicators to enhance signal accuracy and conduct thorough market analysis for well-informed decisions.

- Practice backtesting and demo trading with OBV to refine trading strategies, adapt to various market conditions, and improve overall trading performance over time.

Leveraging OBV in Forex Trading

Utilizing OBV as a key indicator in Forex trading provides valuable insights into price trend strength through volume analysis. The OBV indicator in Forex serves as a tool for traders to assess the relationship between volume and price movements. By tracking volume changes, OBV can help identify potential trend reversals or validate ongoing trends.

Traders leverage OBV in Forex to spot breakout opportunities and confirm the sustainability of price actions. When combined with other technical indicators, OBV enhances its utility in formulating effective Forex trading strategies. The OBV indicator is particularly useful in understanding market dynamics, as it offers a quantitative way to interpret changes in trading volume relative to price movements.

Advantages of Using OBV Indicator

The OBV indicator provides traders with a thorough method for tracking volume changes and spotting potential trend shifts early on.

By confirming price movements, it helps traders make more informed decisions based on the strength of the trend.

Utilizing OBV in conjunction with other analysis tools can offer a complete view of market dynamics, enhancing the accuracy of trading strategies.

OBV for Volume Tracking

Analyzing volume changes through On Balance Volume (OBV) provides traders with a strategic advantage in decoding stock market trends accurately. When using OBV for volume tracking, traders benefit from:

- Early Detection: Helps in identifying potential trend reversals early on.

- Confirmation of Breakouts: Effective in confirming price breakouts when volume supports the price movement.

- Trend Strength Evaluation: Provides valuable insights by evaluating trend strength through OBV line movements during uptrends and downtrends.

- Simplicity: Its simple calculation and interpretation make it suitable for traders of all experience levels.

- Accurate Predictions: Enables traders to predict price movements accurately based on volume shifts.

Early Trend Indication

With its ability to provide early indications of potential trend changes in the stock market, On Balance Volume (OBV) stands out as a valuable tool for traders seeking to anticipate market movements.

OBV helps traders identify buying or selling pressure before price movements occur, enabling them to make informed decisions about entering or exiting trades.

By analyzing OBV trends, traders can gain insight into the strength and direction of emerging trends, allowing for timely actions to capitalize on market opportunities.

This early trend indication capability of OBV can assist traders in predicting price breakouts and trend reversals, giving them a strategic advantage in maneuvering the dynamic stock market environment.

Confirming Price Movements

Upon examining volume changes in relation to price movements, On Balance Volume (OBV) serves as a reliable tool for confirming price movements in the stock market.

- Rising OBV with increasing price indicates strong buying pressure.

- Falling OBV with decreasing price suggests rising selling pressure.

- OBV is effective in confirming ongoing trends and identifying pivot points.

- It provides insights into market dynamics by tracking volume changes.

- Understanding the relationship between volume and price movements aids traders in making informed decisions.

Limitations of OBV for Trend Decoding

When considering the utility of On-Balance Volume (OBV) in decoding stock market trends, it is vital to acknowledge the significant limitations that can impede its accuracy. One of the primary challenges stems from the varying quality of volume data, which can impact the reliability of OBV in predicting trend reversals.

This inconsistency in volume data quality can lead to misleading signals, resulting in false interpretations of market trends. To mitigate this risk, it is advisable for traders to complement OBV with other technical analysis tools to validate signals and confirm trend movements. Relying solely on OBV for trend analysis may expose traders to the possibility of misinterpreting market dynamics, emphasizing the importance of understanding the limitations associated with this indicator.

Practical Tips for OBV Application

Utilizing On-Balance Volume (OBV) effectively requires implementing practical strategies that enhance trend analysis accuracy and trading decision-making. When applying OBV to stock market trends, consider the following practical tips:

- Identify Divergences: Look for discrepancies between the OBV line and price trends to anticipate potential reversals.

- Validate Breakouts: Verify that volume supports price movements indicated by OBV to confirm breakout signals.

- Evaluate Trend Strength: Analyze OBV line movements during both uptrends and downtrends to gauge the strength of the current trend.

- Combine with Other Tools: Enhance trading signals by integrating OBV with complementary technical analysis tools.

- Practice in Various Conditions: Test OBV in different market environments and timeframes to improve its effectiveness and reliability.

These strategies can help traders make informed decisions based on OBV analysis, enhancing their ability to interpret market trends accurately and with confidence.

Enhancing Trading Confidence With OBV

Analyzing On-Balance Volume (OBV) trends can greatly enhance traders' confidence in their market decisions by providing valuable insights into buying and selling pressure dynamics through volume analysis. By observing OBV trends, traders can identify potential price reversals by looking for divergences between the OBV line and price trends. These divergences serve as early warning signals, indicating shifts in market sentiment and possible upcoming price movements. Additionally, confirmation of price trends through OBV can greatly boost trading confidence, validating the strength of a trend before making trading decisions. In sideways markets, OBV can help traders pinpoint breakout opportunities, allowing them to capitalize on potential price movements. Moreover, combining OBV with other technical indicators can further enhance the accuracy of trade signals, providing a detailed view of market conditions for informed decision-making.

| Benefits of OBV for Trading Confidence |

|---|

| Identifying potential price reversals |

| Validating trend strength |

| Spotting breakout opportunities |

| Enhancing accuracy of trade signals |

Frequently Asked Questions

How to Use OBV for Trading?

OBV trading signals provide insights into potential trend reversals and confirmation of price breakouts by analyzing divergences between OBV line and price trend.

OBV trend analysis evaluates trend strength through line movements during uptrends and downtrends.

Integrating OBV volume confirmation guarantees volume supports price movements.

Utilizing OBV in conjunction with other technical indicators can offer a thorough analysis for informed trading decisions based on both OBV signals and price action.

What Is the Best Timeframe for Obv?

Timeframe analysis is essential in determining the best timeframe for OBV. Different timeframes offer varying insights into OBV patterns and trend identification. Shorter timeframes like 5-minute charts suit day traders, while swing traders and investors often prefer daily or weekly charts. Scalpers may opt for very short timeframes like 1-minute charts.

Experimenting with various timeframes can help traders optimize OBV settings for their specific strategies and goals.

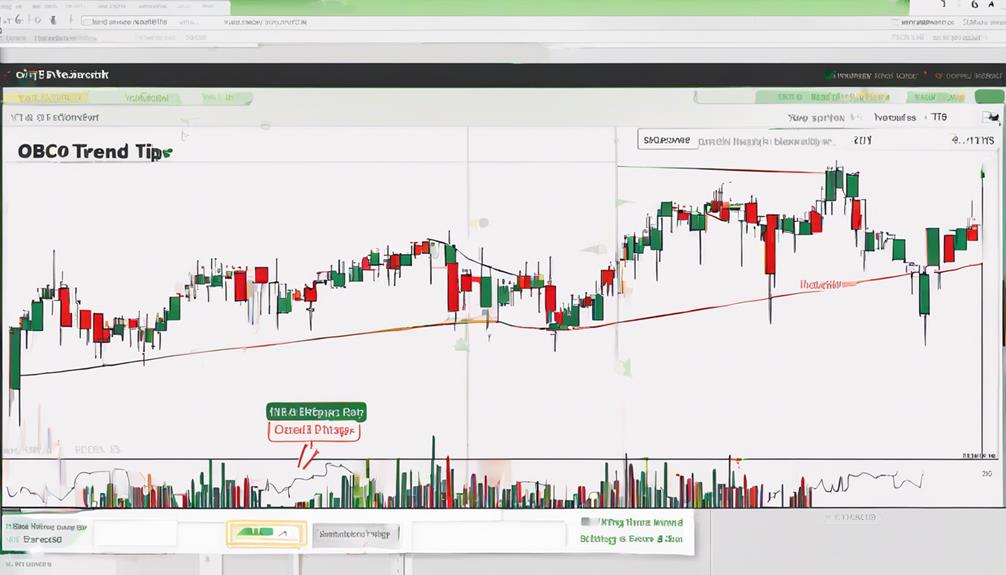

What Is the OBV Breakout Strategy?

The OBV Breakout Strategy is a trading method that leverages On Balance Volume (OBV) signals to identify potential breakouts in stock prices. Traders analyze OBV divergences to anticipate price movements and confirm trend strength.

This strategy focuses on spotting breakout patterns and trend reversals, aiding in effective trend confirmation. When used in conjunction with other technical indicators, the OBV Breakout Strategy can provide more reliable signals, making it a valuable tool for traders seeking to capitalize on momentum and trend changes in the stock market.

Is OBV Accurate?

When evaluating the OBV's precision, it is essential to take into account its dependability, effectiveness, and limitations. OBV can offer valuable insights into stock market trends, but its accuracy can be influenced by the quality of volume data.

Inaccurate volume information may result in misleading readings and false signals. To enhance OBV's reliability, traders should combine it with other technical analysis tools and thoroughly validate volume data sources.

Conclusion

To sum up, the On-Balance Volume (OBV) indicator serves as a valuable tool for decoding stock market trends. By analyzing volume alongside price movements, traders can gain insights into market strength and potential price reversals.

While OBV has its limitations, its advantages in confirming breakouts and identifying divergences make it a useful addition to any trading strategy.

As the saying goes, 'Volume speaks volumes,' and incorporating OBV can enhance trading confidence and decision-making.