Mastering RSI with profitable trading strategies involves utilizing the Relative Strength Index (RSI) to interpret price movements effectively. By understanding RSI basics, traders can identify potential overbought and oversold conditions, aiding in strategic entry and exit decisions. Strategies like swing trading and intraday techniques leverage RSI signals for precise trading opportunities. In markets such as forex and crypto, customizing RSI settings enhances trading accuracy. Advanced tactics like trendline analysis, divergence patterns, and combining indicators like MACD and Bollinger Bands provide additional insights for successful trading. Each section in the guide offers in-depth strategies to maximize RSI's potential for profitable trading outcomes.

Understanding RSI Trading Basics

Understanding the foundational principles of RSI trading serves as a fundamental cornerstone for maneuvering the complexities of market dynamics and making informed trading decisions.

The Relative Strength Index (RSI) is a crucial technical indicator used by traders to gauge the speed and change of price movements within a specific timeframe. RSI values above 70 indicate that a market may be overbought, suggesting a potential reversal or correction in price. Conversely, values below 30 on the RSI indicate potential oversold conditions, implying a possible buying opportunity.

The RSI scale ranges from 0 to 100, with extreme levels signaling strong price momentum in the market. Traders leverage the RSI indicator to identify strategic entry and exit points based on overbought and oversold levels, allowing for strategic decision-making in response to market conditions.

RSI Strategy for Swing Trading

The RSI strategy for swing trading offers a structured approach to identifying potential entry points based on RSI signals over a specific timeframe. Implementing this strategy involves establishing clear stop-loss levels to manage risk effectively and considering various exit strategies to optimize trade outcomes.

RSI Swing Entry Points

Exploring the application of RSI swing entry points in swing trading strategies reveals a systematic approach to capturing short to medium-term price movements. Traders employing this strategy focus on identifying entry points when the RSI indicates overbought or oversold conditions, aiming to capitalize on potential trend reversals or continuation patterns.

Here are five key aspects to take into account when utilizing RSI swing entry points:

- Utilizing RSI overbought and oversold conditions for potential entry signals.

- Identifying price momentum shifts using RSI swing entry points.

- Looking for confirmation of trend reversals through RSI analysis.

- Using RSI swing entry points to aid in decision-making for profitable trades.

- Incorporating RSI signals into a thorough swing trading strategy.

Setting Stop Loss

In swing trading strategies utilizing RSI, implementing an effective Stop Loss is essential for risk management and capital protection. Setting a Stop Loss helps traders define the maximum loss they are willing to accept on a trade, based on their risk tolerance. It is typically placed below the swing low for long trades and above the swing high for short trades. Adjusting the Stop Loss level as the trade progresses in the desired direction is vital to protect profits. By incorporating a Stop Loss, traders can safeguard their capital and mitigate potential significant losses in swing trading with RSI.

| RSI Swing Trading Strategies | Stop Loss Implementation |

|---|---|

| Define maximum loss | Place Stop Loss strategically |

| Adjust as trade progresses | Protect profits |

| Safeguard capital | Mitigate potential losses |

Exit Strategy Considerations

Exit strategy considerations are vital components of swing trading with RSI, focusing on the best timing to lock in profits while managing risk effectively. When implementing an exit strategy in RSI swing trading, it is essential to take into account the following:

- Exit at Extreme Levels: Take into account exiting trades when RSI reaches extreme levels such as above 70 or below 30.

- Utilize Trailing Stops: Implement trailing stops to secure profits as the trade moves in your favor.

- Target Price Levels: Set target price levels based on RSI signals for effective exits.

- Risk Tolerance Alignment: Make sure that your exit strategy aligns with your risk tolerance and overall trading plan.

- Identify Trend Reversals: Exit on RSI divergence or when price action confirms a trend reversal to enhance profitability.

Intraday RSI Trading Techniques

Utilizing shorter RSI periods in intraday trading techniques allows traders to efficiently capture short-term price movements with precision and accuracy.

In intraday markets, traders often look for RSI-price action divergence to pinpoint potential trend reversals swiftly. However, it is essential to confirm these signals with other indicators before making trading decisions to reduce false signals and increase the probability of successful trades.

By incorporating RSI into intraday trading strategies, traders can effectively navigate short-term price fluctuations and capitalize on market opportunities.

Additionally, combining RSI with other technical tools such as moving averages or trendlines can further enhance the accuracy and effectiveness of intraday trading approaches.

RSI Trading in the Crypto Market

Analyzing RSI in the crypto market is essential due to the high volatility levels witnessed in cryptocurrencies. Traders utilize RSI signals to pinpoint potential overbought or oversold conditions, aiding in strategic buying or selling decisions.

Understanding the timing of RSI signals can enhance traders' ability to navigate the unpredictable nature of cryptocurrency price movements effectively.

RSI in Crypto Volatility

Amidst the dynamic landscape of the cryptocurrency market, the Relative Strength Index (RSI) emerges as a pivotal tool for evaluating and maneuvering the inherent volatility of digital assets.

RSI is widely used in the crypto market to gauge volatility, identify overbought and oversold conditions, and anticipate potential trend reversals. Traders rely on RSI signals to make informed decisions on entry and exit points, leveraging market sentiment for profitable trading strategies.

The high volatility of the crypto market amplifies the importance of RSI in analyzing price movements and market dynamics. Tailoring RSI trading strategies specifically for cryptocurrencies can greatly enhance trading precision and profitability, offering traders a strategic advantage in navigating the crypto market landscape.

Timing RSI Signals

When trading in the cryptocurrency market, mastering the timing of Relative Strength Index (RSI) signals is paramount for strategic decision-making and maximizing profitability. RSI signals play a critical role in identifying overbought and oversold levels, guiding traders on when to enter or exit positions.

In the crypto market, RSI overbought levels above 70 often signal potential price corrections, prompting traders to contemplate selling positions. Conversely, RSI oversold levels below 30 indicate possible buying opportunities as prices may reverse upwards.

Additionally, monitoring RSI dynamics and utilizing RSI crossover signals at key levels can greatly enhance trading strategies, enabling traders to navigate the volatility of the crypto market with more confidence and precision.

Exploring RSI Indicator Applications

The utilization of the RSI indicator in trading strategies provides traders with a quantitative measure of price momentum and potential market conditions. Traders use the RSI as a momentum oscillator and one of the essential technical analysis tools to gauge market trends and identify potential buying opportunities.

Here are five key applications of the RSI indicator:

- RSI values above 70 indicate potential overbought conditions, signaling a possible reversal or correction in the price.

- Values below 30 on the RSI suggest oversold market conditions, indicating a potential buying opportunity for traders.

- The RSI's range from 0 to 100 offers insights into price extremes, helping traders make informed decisions.

- Traders can use the RSI to confirm the strength of a trend or identify potential trend reversals.

- By comparing price movements with RSI fluctuations, traders can assess market sentiment and make more accurate trading decisions.

Optimal Forex RSI Settings

In the domain of forex trading strategies, selecting the ideal RSI settings plays a vital role in enhancing trading precision and adaptability to market dynamics. The most suitable RSI settings in forex trading rely on the trader's preferences and the current market conditions.

Adjusting the RSI period to shorter values, such as 9, increases sensitivity to price movements, enabling traders to capture potential entry and exit points more promptly. Conversely, longer RSI periods like 21 offer smoother signals that are less reactive to short-term fluctuations, providing a more stable view of the market trend.

Experimenting with different RSI settings is essential for traders to fine-tune their strategies and align them with their individual trading styles. Ultimately, selecting the most appropriate RSI parameters is critical for effectively integrating this indicator into forex trading strategies, ensuring that traders receive accurate and timely signals to make informed decisions in the dynamic forex market.

Effective RSI Trading Methods

Effective RSI trading methods are essential for traders seeking to capitalize on market opportunities.

Understanding RSI basics for trading, utilizing RSI divergence strategies, and recognizing overbought and oversold conditions can enhance decision-making processes.

RSI Basics for Trading

Utilizing RSI as a momentum oscillator in trading requires a thorough understanding of its basics and effective methods. As an essential tool for traders, RSI helps in identifying potential buying or selling opportunities based on overbought and oversold conditions.

Key points to take into account when using RSI for trading include:

- RSI is a momentum oscillator measuring price change speed over a specified period.

- RSI values above 70 indicate overbought market conditions.

- Values below 30 suggest oversold market conditions.

- RSI ranges from 0 to 100, providing insights into the strength of price movements.

- Traders rely on RSI to implement various trading strategies effectively.

RSI Divergence Strategy

When implementing the RSI Divergence Strategy in trading, a crucial aspect to keep in mind is comparing price action with RSI to identify potential trend reversals effectively.

Bullish RSI Divergence is observed when the price forms lower lows while RSI forms higher lows, signaling a possible upward trend reversal.

Conversely, Bearish RSI Divergence occurs when the price establishes higher highs while RSI shows lower highs, indicating a potential downward trend reversal.

RSI Overbought and Oversold

RSI Overbought and Oversold levels are key indicators in technical analysis that provide valuable insights into potential market conditions and trading opportunities.

- RSI above 70 indicates overbought conditions, suggesting a potential price correction.

- RSI below 30 signifies oversold conditions, hinting at possible buying opportunities.

- RSI can help time entry and exit points effectively in trading.

- Understanding RSI levels is essential for interpreting market sentiment.

- RSI is a versatile tool applicable to various financial instruments for identifying market extremes.

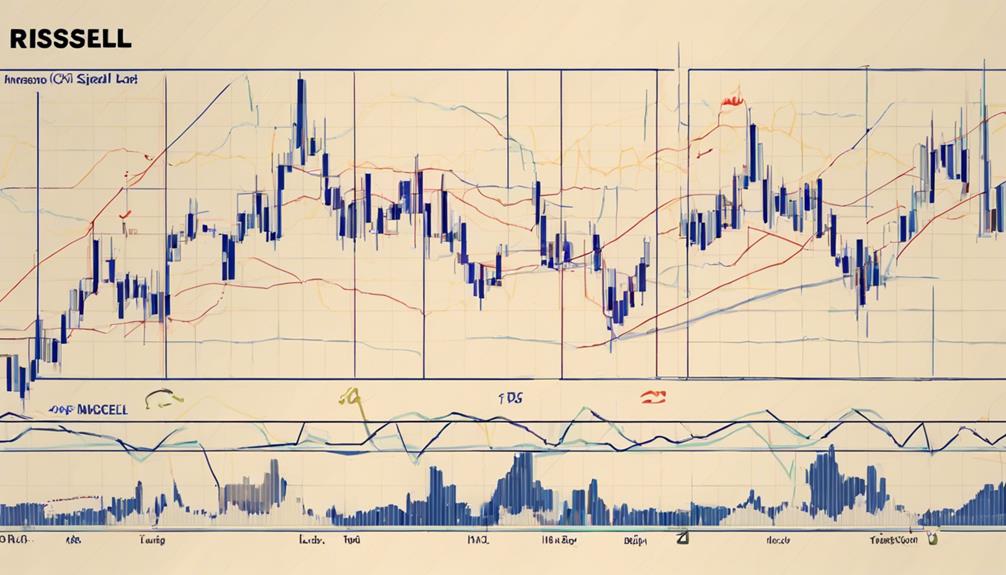

RSI Trendline Analysis

How can trendline analysis on the RSI indicator enhance the identification of support and resistance levels in trading strategies? RSI trendline analysis involves drawing trendlines on the RSI indicator to pinpoint important support and resistance levels. These trendlines offer insights into potential trend reversals and help traders confirm the prevailing market trends. By connecting swing highs or swing lows on the RSI, traders can establish trendlines that act as dynamic levels of support and resistance. Breakouts or bounces from these RSI trendlines can indicate significant momentum shifts, guiding traders in their decision-making process. This analytical approach provides an additional layer of information that complements traditional price action analysis, empowering traders to make more informed trading decisions.

| Benefits of RSI Trendline Analysis |

|---|

| Identifying Support & Resistance Levels |

| Confirming Trends & Reversals |

| Signaling Momentum Shifts |

Utilizing RSI for Day Trading

Day traders can leverage the Relative Strength Index (RSI) as a valuable tool for identifying market conditions and making timely trading decisions based on short-term price fluctuations. When utilizing RSI for day trading, traders can benefit from the following strategies:

- Identifying overbought and oversold conditions to determine potential entry and exit points.

- Utilizing RSI signals to make buy or sell decisions based on short-term price movements.

- Enhancing intraday trading strategies by applying shorter RSI periods for quick market analysis.

- Paying attention to RSI-price action divergence to anticipate possible trend reversals.

- Confirming trading decisions by incorporating other indicators alongside RSI for a more thorough analysis.

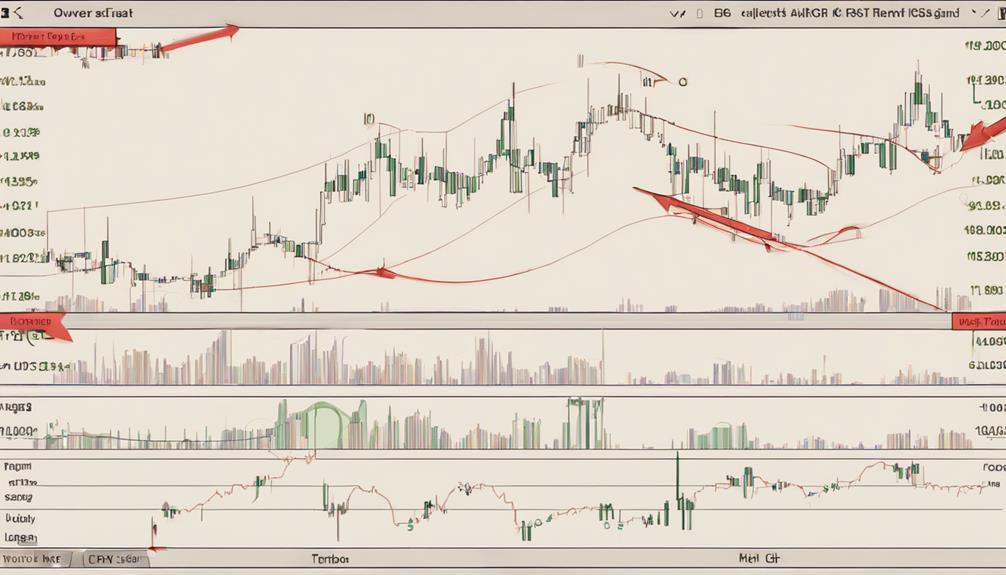

RSI Divergence Patterns

When analyzing market trends, traders can gain valuable insights by observing the divergence patterns in the Relative Strength Index (RSI). Bullish divergence occurs when the price makes lower lows while RSI makes higher lows, signaling a potential upward reversal.

On the other hand, bearish divergence occurs when the price forms higher highs while RSI forms lower highs, indicating a possible downward trend. RSI divergence patterns play an important role in helping traders anticipate trend changes by highlighting inconsistencies between price action and RSI readings.

By incorporating divergence analysis with RSI into their trading strategies, traders can make more informed decisions and receive early signals of potential market reversals. Recognizing and acting on these patterns can greatly enhance trading accuracy and profitability by identifying key turning points in the market.

Traders who master the skill of interpreting RSI divergence patterns are better positioned to capitalize on market opportunities and navigate changes in trend direction effectively.

RSI and Chart Pattern Recognition

Utilizing chart pattern recognition in conjunction with the Relative Strength Index (RSI) entails identifying formations such as head and shoulders, triangles, and double tops/bottoms. This integration allows traders to make more informed decisions by combining the strengths of both technical analysis tools.

Here are five key points to bear in mind when using RSI and chart pattern recognition:

- RSI can confirm chart patterns by indicating overbought/oversold conditions at pivotal levels of the patterns.

- Combining RSI signals with chart patterns enhances the accuracy of trade entries and exits, providing clearer entry and exit points.

- The RSI can help traders anticipate potential breakouts or breakdowns of chart patterns by signaling strength or weakness in the market.

- Recognizing chart patterns with the RSI adds a layer of validation to technical analysis, leading to more reliable trading decisions.

- Traders can use RSI in conjunction with chart patterns to validate potential trade setups and increase the probability of successful trades.

Enhancing Strategies With RSI and MACD

Incorporating MACD (Moving Average Convergence Divergence) alongside the Relative Strength Index (RSI) in trading strategies introduces a holistic approach that enhances trend analysis and signal confirmation. The RSI, a momentum oscillator, identifies overbought or oversold conditions, while MACD, as a trend-following indicator, confirms the strength and direction of a trend.

When RSI generates buy or sell signals, MACD can provide additional confirmation by showing the relationship between its two moving averages. The convergence or divergence of MACD and its signal line can further indicate potential trend changes, adding a layer of insight to RSI signals.

RSI Strategy With Bollinger Bands

The fusion of the RSI strategy with Bollinger Bands offers traders a thorough approach to analyzing market dynamics and enhancing trading signals. This powerful combination leverages the strengths of both indicators to provide a detailed view of the market, aiding traders in making well-informed decisions.

Here are five key aspects of the RSI strategy with Bollinger Bands:

- Combines two popular indicators for enhanced trading signals.

- Bollinger Bands help identify volatility and price levels, complementing RSI's overbought/oversold signals.

- RSI confirmation of Bollinger Bands signals strengthens entry or exit decisions.

- Looking for RSI divergence in conjunction with Bollinger Bands can indicate potential trend reversals.

- Traders utilize this strategy to confirm market movements and increase trade accuracy.

Combined Stochastic and RSI Tactics

The integrated relationship between Stochastic and RSI in trading strategies greatly enhances signal accuracy and decision-making processes. Stochastic identifies potential trend reversals, while RSI confirms overbought or oversold conditions, making them a powerful combination for traders. By combining these two indicators, trading efficiency is markedly improved as false signals are filtered out, leading to better-informed decisions. This holistic approach offers a thorough analysis of market trends, resulting in more robust trading strategies and increased profitability. To illustrate the effectiveness of combining Stochastic and RSI, the table below showcases key aspects of each indicator:

| Indicator | Key Features |

|---|---|

| RSI | Identifies overbought or oversold conditions |

| Stochastic | Signals potential trend reversals |

Advanced RSI Strategy Integration

Building upon the foundational understanding of Stochastic and RSI integration, exploring advanced strategies incorporating RSI with additional indicators elevates trading precision and decision-making capabilities.

Integrating RSI with MACD for confirmation signals enhances trading accuracy by providing complementary insights into momentum and trend strength. Advanced RSI strategies involve utilizing Fibonacci retracement levels to pinpoint potential price reversals with greater accuracy.

Implementing RSI in conjunction with Bollinger Bands aids traders in identifying volatility and potential trend changes, offering a holistic view of market conditions. Combining RSI with volume analysis offers valuable insights into the strength of price movements, helping traders make more informed decisions.

Incorporating divergence patterns with other indicators as part of advanced RSI strategy integration can provide traders with more precise entry and exit points, further enhancing the effectiveness of their trading strategies.

Frequently Asked Questions

What Is the Best Strategy for RSI Trading?

The best strategy for RSI trading involves considering the RSI levels for overbought and oversold conditions.

Selecting an appropriate time frame for analysis is crucial.

Identifying potential trend reversals is a key aspect of successful RSI trading.

Recognizing key candlestick patterns can provide valuable insights.

Interpreting divergence and convergence signals is essential for making informed trading decisions.

Implementing effective risk management practices is important to protect capital.

Evaluating the strategy's performance through thorough backtesting is necessary for refining and improving the approach.

What Is the 70 30 RSI Strategy?

The 70 30 RSI strategy utilizes RSI levels of 70 and 30 to signal potential trade opportunities. RSI above 70 indicates overbought conditions, hinting at a possible reversal, while RSI below 30 signifies oversold conditions, presenting buying chances.

This strategy aids in identifying trend reversals based on RSI levels, helping traders pinpoint entry points, manage risks, analyze different timeframes, and validate its effectiveness through backtesting results.

Do Professional Traders Use Rsi?

Institutional adoption of the Relative Strength Index (RSI) is prevalent among professional traders, as RSI provides valuable insights into market trends and sentiment.

Expert opinions emphasize the significance of incorporating RSI signals into trading strategies for effective risk management and maximizing profit potential.

Professional traders rely on RSI not only for its technical analysis capabilities but also for its role in enhancing trading psychology and decision-making processes.

What Is the RSI 50 Cross Strategy?

The RSI 50 Cross Strategy is a popular method for trend identification and signal confirmation in trading. When the RSI indicator crosses the 50 level, it signifies potential shifts in market direction.

Traders use this strategy to determine entry points, establish exit strategies, and manage risks effectively. Backtesting results and performance tracking are essential for evaluating the strategy's effectiveness and fine-tuning its application for profitable trading outcomes.

Conclusion

To sum up, mastering RSI with profitable trading strategies involves a thorough understanding of its basics and various techniques for different trading styles and markets.

While some may argue that relying solely on technical indicators like RSI may not always guarantee success in trading, it is essential to remember that combining multiple indicators and strategies can help mitigate risks and improve overall trading performance.

By integrating RSI with other indicators and strategies, traders can enhance their decision-making process and increase their chances of success in the market.